by Calculated Risk on 12/31/2021 05:15:00 PM

Friday, December 31, 2021

"Highest Mortgage Rates in a Month, But Just Barely"

From Matthew Graham at MortgageNewsDaily: Highest Rates in a Month, But Just Barely

Mortgage rates began the week in decent shape, but moved higher somewhat abruptly yesterday. Context is important though. The smallest increment of adjustment for mortgages is typically 0.125%, and we haven't seen a move that big since early November. In fact, the overall range in 30yr fixed rates hasn't even been 0.125% during that time!

In other words, we're only able to say "highest rates in a month" because they finally trickled to just slightly higher levels. On that note, we might as well prepare for the next technicality. Specifically, if things get just a bit worse, we'll soon be able to say "highest rates in 9 months," even though they won't be too terribly different from today's.

Click on graph for larger image.

Click on graph for larger image.This is a graph from Mortgage News Daily (MND) showing 30-year fixed rates from three sources (MND, MBA, Freddie Mac) since 2010.

Question #7 for 2022: How about housing starts and new home sales in 2022?

by Calculated Risk on 12/31/2021 12:23:00 PM

Today, in the Real Estate Newsletter: Question #7 for 2022: How much will Residential investment change in 2022? How about housing starts and new home sales in 2022?

A brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I’ll post those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

...

Most analysts are looking for new home sales to increase in 2022. For example, the NAHB expects new home sales to increase to 840 thousand in 2022, and Fannie Mae expects 897 thousand, and the MBA is forecasting 922 thousand in 2022.

And for housing starts, Fannie Mae is forecasting starts will be mostly unchanged at 1.6 million, and the NAHB is forecasting a decline to 1.55 million.

My guess is starts will be down low-to-mid single digits year-over-year in 2022. New home sales could pick up solidly if existing home inventory stays low, supply issues are resolved, and mortgage rates stay low, but my guess is new home sales will be mostly unchanged year-over-year.

Lawler: More on the CoreLogic Home Investor Activity Report

by Calculated Risk on 12/31/2021 08:33:00 AM

From housing economist Tom Lawler:

Below is a table showing quarterly home sales based on CoreLogic’s property records database for “non-investors” and for “investors” based on size of investors. For fun I also included the YOY % change in the S&P/Case-Shiller National Home Price Index., As a reminder, here is how CoreLogic defines an investor purchase:

Using CoreLogic’s public records data, we define an investor as an entity (individual or corporate) who retained three or more properties simultaneously within the past 10 years or has a corporate or non-individual identifier on the deed. Examples include LLCs, CORPs, and INCs, to name a few.”CoreLogic’s “size” categories fir investors are as follows: small 3-10 properties, mid-sized 11-99 properties, and large 100+ properties.

Click on table for larger image.

Click on table for larger image.What is striking is that investor home purchases by investors in all three size categories exploded upward beginning in the second quarter.

Note that while total home purchases in the third quarter of this year were up 7.5% from the third quarter of 2019, non-investor home purchases were DOWN 5.2%.

I’ll have even more on this topic later. WRT the above chart, however, here are some questions to consider:

Did investor purchases surge BECAUSE home prices were accelerating? Or was the surge in investor purchases behind the surge in home prices? Or … was it a combination of both?

Thursday, December 30, 2021

COVID December 30, 2021: Record Cases; Focus on Hospitalizations and Deaths

by Calculated Risk on 12/30/2021 09:21:00 PM

There will be no COVID updates until January 3rd. Have a safe New Year.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 62.0% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 205.8 | --- | ≥2321 | |

| New Cases per Day3🚩 | 316,277 | 176,457 | ≤5,0002 | |

| Hospitalized3🚩 | 67,324 | 61,699 | ≤3,0002 | |

| Deaths per Day3 | 1,100 | 1,216 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of hospitalizations reported.

The second graph shows the daily (columns) and 7-day average (line) of new cases reported.

The second graph shows the daily (columns) and 7-day average (line) of new cases reported.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in November

by Calculated Risk on 12/30/2021 04:18:00 PM

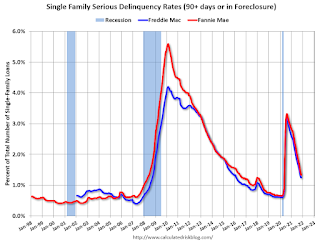

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 1.46% in November, from 1.33% in October. The serious delinquency rate is down from 2.96% in November 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 3.61% are seriously delinquent (down from 4.02% in October).

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Freddie Mac reported earlier.

Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

by Calculated Risk on 12/30/2021 03:12:00 PM

Today, in the Real Estate Newsletter: Question #8 for 2022: Housing Credit: Will we see easier mortgage lending in 2022?

A brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I’ll post those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

...

For Q3 2021, the Net Equity Extraction was $147 billion, or 3.24% of Disposable Personal Income (DPI). The last two quarters have shown a sharp increase in equity extraction compared to recent years, but the level is nothing like the amount of equity extraction during the housing bubble as a percent of DPI. During the housing bubble we saw several quarters with MEW above 8% of DPI.

...

Mortgage equity withdrawal will probably decline in 2022, since fewer homeowners will refinance their mortgages. However, there is some concern about banks easing lending standards, and the rapid increase in non-QM loans.

This will be something to watch in 2022, but overall lending is still solid (unlike during the housing bubble).

Question #9 for 2022: What will happen with house prices in 2022?

by Calculated Risk on 12/30/2021 10:16:00 AM

Today, in the Real Estate Newsletter: Question #9 for 2022: What will happen with house prices in 2022?

A brief excerpt:

Earlier I posted some questions on my blog for next year: Ten Economic Questions for 2022. Some of these questions concern real estate (inventory, house prices, housing credit, housing starts, new home sales), and I’ll post those in the newsletter (others like GDP and employment will be on my blog).There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

I'm adding some thoughts, and maybe some predictions for each question.

...

If inventory doesn’t increase in 2022, house prices will continue to increase at a double-digit pace. There are several possible reasons for an increase in inventory in 2022. Here are a few:

1. A sharp increase in mortgage rates.

2. Economic problems overseas that spillover into the US.

3. Unregulated areas of finance causing economic problems.

4.Affordability (a combination of higher mortgage rates and higher prices).

A sharp increase in mortgage rates is possible, especially if inflation stays elevated and the pandemic subsides (each wave of the pandemic has pushed down interest rates). And at some point, affordability will start to matter, but in general - with low mortgage rates - houses are still somewhat affordable (see the bottom of this post on affordability).

Weekly Initial Unemployment Claims Decrease to 198,000

by Calculated Risk on 12/30/2021 08:34:00 AM

The DOL reported:

In the week ending December 25, the advance figure for seasonally adjusted initial claims was 198,000, a decrease of 8,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 205,000 to 206,000. The 4-week moving average was 199,250, a decrease of 7,250 from the previous week's revised average. This is the lowest level for this average since October 25, 1969 when it was 199,250. The previous week's average was revised up by 250 from 206,250 to 206,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 206,000.

The previous week was revised up.

Regular state continued claims decreased to 1,716,000 (SA) from 1,856,000 (SA) the previous week.

Weekly claims were below the consensus forecast.

Wednesday, December 29, 2021

Thursday: Unemployment Claims, Chicago PMI

by Calculated Risk on 12/29/2021 08:18:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. Initial claims were 205 thousand last week.

• At 9:45 AM: Chicago Purchasing Managers Index for December.

And on COVID (focus on hospitalizations and deaths):

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 61.9% | --- | ≥70.0%1 | |

| Fully Vaccinated (millions) | 205.6 | --- | ≥2321 | |

| New Cases per Day3🚩 | 277,241 | 162,133 | ≤5,0002 | |

| Hospitalized3🚩 | 64,756 | 61,570 | ≤3,0002 | |

| Deaths per Day3 | 1,085 | 1,227 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37-day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7-day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7-day average (line) of positive tests reported.

Las Vegas Visitor Authority for November: Visitor Traffic Down 11.3% Compared to 2019

by Calculated Risk on 12/29/2021 02:16:00 PM

From the Las Vegas Visitor Authority: November 2021 Las Vegas Visitor Statistics

With traditional seasonal decreases after seeing annual peaks in October, November visitation exceeded 3.1M visitors (down ‐8.2% MoM and down ‐11.3% vs. Nov 2019.)

Overall hotel occupancy reached 77.6% for the month (‐4.0 pts MoM) as weekends saw continued strong levels at 90.7% (+0.3 pts MoM) while midweek occupancy ebbed MoM to 71.9% from 77.5% in October.

November room rates approached $156, surpassing Nov 2019 levels by 15.5%, while RevPAR reached $121, up 1.7% vs. Nov 2019.

Click on graph for larger image.

Click on graph for larger image. Thist graph shows visitor traffic for 2019 (blue), 2020 (orange) and 2021 (red).

Visitor traffic was down 11.3% compared to the same month in 2019.