by Calculated Risk on 9/23/2021 09:38:00 PM

Thursday, September 23, 2021

Friday: New Home Sales

Friday:

• At 10:00 AM ET, New Home Sales for August from the Census Bureau. The consensus is for 714 thousand SAAR, up from 708 thousand in July.

• Also at 10:00 AM, Opening Remarks, Fed Chair Jerome Powell, At Fed Listens: Perspectives on the Pandemic Recovery

September 23rd COVID-19: 55% of Americans Fully Vaccinated

by Calculated Risk on 9/23/2021 09:36:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 55.0% | 54.2% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 182.6 | 180.1 | ≥2321 | |

| New Cases per Day3 | 121,532 | 146,684 | ≤5,0002 | |

| Hospitalized3 | 81,373 | 90,243 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,556 | 1,545 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 20 states and D.C. have between 50% and 59.9% fully vaccinated: Virginia at 59.8%, District of Columbia, Colorado, California, Minnesota, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, Kentucky, Arizona, Kansas, Texas, Nevada, and Utah at 50.0%.

Next up (total population, fully vaccinated according to CDC) are Ohio at 49.8%, Alaska at 49.7%, North Carolina 49.0% and Montana at 48.1%.

Click on graph for larger image.

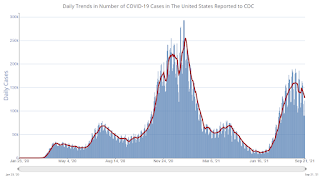

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Existing Home Sales: Some Regional Differences Appear

by Calculated Risk on 9/23/2021 04:26:00 PM

In the Newsletter I have Existing Home Sales: Some Regional Differences Appear

Excerpt:

For the last year, most housing markets moved together with rapidly falling inventory and sharply increasing house prices. However, in August, about half of these markets saw a month-over-month (MoM) increase in inventory - and the other half saw a decrease - so we might be seeing some regional divergence.

Hotels: Occupancy Rate Down 11.6% Compared to Same Week in 2019

by Calculated Risk on 9/23/2021 01:38:00 PM

Note: The year-over-year occupancy comparisons are easy, since occupancy declined sharply at the onset of the pandemic.

U.S. hotel occupancy reached a four-week high, according to STR‘s latest data through September 18.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

September 12-18, 2021 (percentage change from comparable week in 2019*):

• Occupancy: 63.0% (-11.6%)

• verage daily rate (ADR): $131.04 (-2.6%)

• Revenue per available room (RevPAR): $82.50 (-13.9%)

The gain in occupancy was helped by weekly group demand eclipsing 1 million for the first time since the earliest days of the pandemic. More group demand created a lowering effect on ADR, as group rooms for upper-tier classes are typically priced lower than transient rooms.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

Fed's Flow of Funds: Household Net Worth Increased $5.9 Trillion in Q2

by Calculated Risk on 9/23/2021 12:28:00 PM

The Federal Reserve released the Q2 2021 Flow of Funds report today: Financial Accounts of the United States.

The net worth of households and nonprofits rose to $141.7 trillion during the second quarter of 2021. The value of directly and indirectly held corporate equities increased $3.5 trillion and the value of real estate increased $1.2 trillion.

...

Household debt increased 7.9 percent at an annual rate in the second quarter of 2021. Consumer credit grew at an annual rate of 8.6 percent, while mortgage debt (excluding charge-offs) grew at an annual rate of 8 percent.

Click on graph for larger image.

Click on graph for larger image.The first graph shows Households and Nonprofit net worth as a percent of GDP.

This graph shows homeowner percent equity since 1952.

This graph shows homeowner percent equity since 1952. Household percent equity (as measured by the Fed) collapsed when house prices fell sharply in 2007 and 2008.

In Q2 2021, household percent equity (of household real estate) was at 67.7% - up from 67.3% in Q1. This is the highest percent equity since the 1980s.

Note: about 30.3% of owner occupied households had no mortgage debt as of April 2010. So the approximately 50+ million households with mortgages have less than 67.7% equity - and about 1.2 million homeowners still have negative equity.

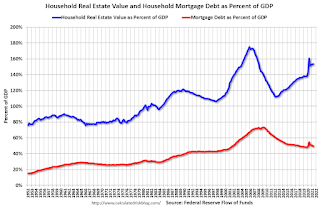

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.

The third graph shows household real estate assets and mortgage debt as a percent of GDP. Note this graph was impacted by the sharp decline in Q2 2020 GDP.Mortgage debt increased by $222 billion in Q2. This is the largest quarterly increase in mortgage debt since 2006.

Mortgage debt is up $573 billion from the peak during the housing bubble, but, as a percent of GDP is at 49.6% - down from Q1 - and down from a peak of 73.3% of GDP during the housing bubble.

The value of real estate, as a percent of GDP, increased in Q2, and is well above the average of the last 30 years.

CoreLogic: 1.2 Million Homes with Negative Equity in Q2 2021

by Calculated Risk on 9/23/2021 09:33:00 AM

From CoreLogic: Homeowners Gained $2.9 Trillion in Equity in Q2 2021, CoreLogic Reports

CoreLogic® ... today released the Homeowner Equity Report for the second quarter of 2021. The report shows U.S. homeowners with mortgages (which account for roughly 63% of all properties) have seen their equity increase by 29.3% year over year, representing a collective equity gain of over $2.9 trillion, and an average gain of $51,500 per borrower, since the second quarter of 2020.

...

“The growth in homeowner equity provides a strong financial cushion for tens of millions Americans. For those most impacted by the pandemic, equity gains will help play a critical role in staving off foreclosure,” said Frank Martell, president and CEO of CoreLogic. “Based on projected increases in economic activity and home values over the next year, we expect to see further gains in equity and a corresponding drop in negative equity, forbearance rates and foreclosure.”

...

Negative equity, also referred to as underwater or upside down mortgages, applies to borrowers who owe more on their mortgages than their homes are currently worth. As of the second quarter of 2021, negative equity share, and the quarter-over-quarter and year-over-year changes, were as follows:

• Quarterly change: From the first quarter of 2021 to the second quarter of 2021, the total number of mortgaged homes in negative equity decreased by 12% to 1.2 million homes, or 2.3% of all mortgaged properties.

• Annual change: In the second quarter of 2020, 1.8 million homes, or 3.3% of all mortgaged properties, were in negative equity. This number decreased by 30%, or 520,000 properties, in the second quarter of 2021.

• The national aggregate value of negative equity was approximately $268 billion at the end of the second quarter of 2021. This is down quarter over quarter by approximately $5.2 billion, or 1.9%, from $273.2 billion in the first quarter of 2021, and down year over year by approximately $18.9 billion, or 6.6%, from $286.8 billion in the second quarter of 2020.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoreLogic compares Q2 to Q1 2021 equity distribution by LTV. There are a few properties with LTV over 125%. But most homeowners have a significant amount of equity. This is a very different picture than at the start of the housing bust when many homeowners had little equity.

On a year-over-year basis, the number of homeowners with negative equity has declined from 1.8 million to 1.2 million.

Weekly Initial Unemployment Claims increase to 351,000

by Calculated Risk on 9/23/2021 08:41:00 AM

The DOL reported:

In the week ending September 18, the advance figure for seasonally adjusted initial claims was 351,000, an increase of 16,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 332,000 to 335,000. The 4-week moving average was 335,750, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 750 from 335,750 to 336,500.The following graph shows the 4-week moving average of weekly claims since 1971.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 335,750.

The previous week was revised up.

Regular state continued claims increased to 2,845,000 (SA) from 2,714,000 (SA) the previous week.

Note (released with a 2 week delay): There were an additional 4,896,125 receiving Pandemic Unemployment Assistance (PUA) that decreased from 5,487,233 the previous week (there are questions about these numbers). This was a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance. And threre were an additional 3,644,555 receiving Pandemic Emergency Unemployment Compensation (PEUC) down from 3,805,795.

Weekly claims were higher than the consensus forecast.

Wednesday, September 22, 2021

Thursday: Unemployment Claims, Q2 Flow of Funds

by Calculated Risk on 9/22/2021 09:00:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 320 thousand initial claims, down from 332 thousand last week.

• Also at 8:30 AM, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 11:00 AM, the Kansas City Fed manufacturing survey for September.

• At 12:00 PM, Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

September 22nd COVID-19: 7-Day Average New Cases Off 20% from Recent High

by Calculated Risk on 9/22/2021 06:14:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 54.9% | 54.1% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 182.4 | 179.7 | ≥2321 | |

| New Cases per Day3 | 127,655 | 147,804 | ≤5,0002 | |

| Hospitalized3 | 82,870 | 91,282 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,513 | 1,470 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 19 states and D.C. have between 50% and 59.9% fully vaccinated: Virginia at 59.8%, District of Columbia, Colorado, California, Minnesota, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, Michigan, South Dakota, Kentucky, Arizona, Kansas and Texas, and Nevada at 50.1%.

Next up (total population, fully vaccinated according to CDC) are Utah at 49.9%, Ohio at 49.7%, Alaska at 49.5%, North Carolina 48.9% and Montana at 48.0%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

Black Knight: National Mortgage Delinquency Rate Decreased in August

by Calculated Risk on 9/22/2021 04:34:00 PM

Note: At the beginning of the pandemic, the delinquency rate increased sharply (see table below). Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight: With Moratoria Lifted, Foreclosure Starts Edge Higher, But Still 80% Below Pre-Pandemic Levels; Delinquency Rate Falls to 4% For First Time Since Early 2020

• The national delinquency rate on first lien mortgages fell to 4.00% in August, the lowest it’s been since pandemic-related impacts caused mortgage delinquencies to spike in early 2020According to Black Knight's First Look report, the percent of loans delinquent decreased 3.5% in August compared to July, and decreased 42% year-over-year.

• Serious delinquencies – including those in active forbearance – fell by 108,000 from July and, though down by more than 1 million from last August, are still roughly 930,000 above pre-pandemic levels

• August’s 7,100 foreclosure starts represented the largest such volume in eight months after foreclosure moratoria on federally backed loans were lifted at the end of July

• Despite the increase – which was driven primarily by restarting the process on loans that had been in foreclosure prior to the moratoria – start volumes remain 80% below August 2019 levels

• Though the number of loans in active foreclosure saw the first monthly rise of 2021 (+2,000), volumes remain near record lows and are still down 44% (-97,000) from pre-pandemic levels

• Prepayment activity rose by nearly 9% in the month with interest rates – which have held below 3% in recent months – continuing to spur both refinance and purchase activity

emphasis added

The percent of loans in the foreclosure process increased 1.7% in August and were down 24% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.00% in August, down from 4.14% in July.

The percent of loans in the foreclosure process increased in August to 0.27%, from 0.26% in July.

The number of delinquent properties, but not in foreclosure, is down 1,557,000 properties year-over-year, and the number of properties in the foreclosure process is down 45,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2021 | July 2021 | Aug 2020 | Aug 2019 | |

| Delinquent | 4.00% | 4.14% | 6.88% | 3.45% |

| In Foreclosure | 0.27% | 0.26% | 0.35% | 0.48% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,122,000 | 2,206,000 | 3,679,000 | 1,818,000 |

| Number of properties in foreclosure pre-sale inventory: | 142,000 | 140,000 | 187,000 | 253,000 |

| Total Properties | 2,264,000 | 2,346,000 | 3,867,000 | 2,066,000 |