by Calculated Risk on 9/03/2021 04:39:00 PM

Friday, September 03, 2021

CalculatedRisk Newsletter

I've started a newsletter focused solely on real estate. This newsletter is ad free.

• Expect House Prices to be up 20% YoY in July Report

• House Prices Increase Sharply in June

• Housing: Inventory is the Key Metric in 2021

• Forbearance, Delinquencies and Foreclosure: Will the end of the foreclosure moratorium, combined with the expiration of a large number of forbearance plans, lead to a surge in foreclosures and impact house prices, as happened following the housing bubble?

• How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?

• New Home Sales Increase to 708,000 Annual Rate in July

• Existing-Home Sales Increased to 5.99 million in July

• Housing Starts decreased to 1.534 Million Annual Rate in July

• Housing and Demographics: The Next Big Shift

This will usually be published several times a week, and will provide more in-depth analysis of the housing market.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

September 3rd COVID-19: Vaccination Rate has Increased, Over 1,500 Deaths Reported Today

by Calculated Risk on 9/03/2021 04:00:00 PM

NOTE: There will be no weekend updates on COVID.

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 52.9% | 52.0% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 175.5 | 172.6 | ≥2321 | |

| New Cases per Day3🚩 | 152,546 | 148,564 | ≤5,0002 | |

| Hospitalized3🚩 | 91,674 | 88,858 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,094 | 1,038 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 13 states and D.C. have between 50% and 59.9% fully vaccinated: Oregon at 58.4%, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.7%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.5%, Kentucky at 49.0%, Arizona at 48.9%, Ohio at 48.6%, Kansas at 48.6%, Nevada at 48.2%, Utah at 47.9%, Texas at 47.9% and Alaska at 47.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

AAR: August Rail Carloads and Intermodal Down Compared to 2019

by Calculated Risk on 9/03/2021 02:11:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Intermodal is navigating many of the same challenges that have plagued global supply chains for months, such as shutdowns at ports and manufacturing centers in Asia; port congestion; labor and capacity shortages at docks, warehouses, and drayage firms; container and chassis shortages; natural and man-made disasters (e.g., wildfires, hurricanes, and ships getting stuck in canals). Pressures are intensifying as retailers, many of whom already have much lower inventories than they’d like, are trying to stock up for the upcoming holiday season. At this point, no one knows if things will get worse before they get better, and if they do get worse, how much worse they will get.

emphasis added

Click on graph for larger image.

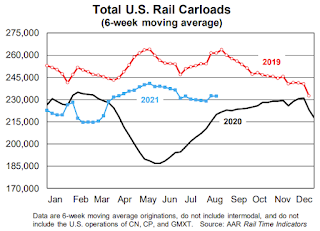

Click on graph for larger image.This graph from the Rail Time Indicators report shows the six week average of U.S. Carloads in 2019, 2020 and 2021:

Total originated carloads on U.S. railroads in August 2021 were 934,762, up 4.1% (36,815 carloads) over August 2020 and down 11.4% (120,262 carloads) from August 2019. The 4.1% year-over-year gain in August 2021 was the smallest year-over-year gain since March 2021. Total carloads averaged 233,691 per week in August 2021. Except for August 2020, that’s the lowest weekly average for total carloads for an August in our records that begin in 1988.

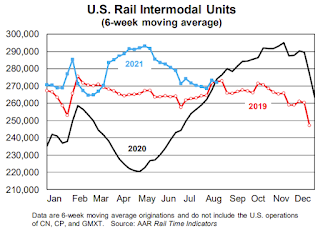

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):

The second graph shows the six week average (not monthly) of U.S. intermodal in 2019, 2020 and 2021: (using intermodal or shipping containers):U.S. intermodal originations, which are not included in carloads, were 3.3% lower in August 2021 than August 2020 and 0.4% lower than August 2019. That’s their first year-over-year decline in 13 months. Intermodal originations averaged 271,336 containers and trailers per week in August 2021, the third lowest of the eight months so far in 2021. In the 21 years from 2000 to 2020, August was a top-three intermodal month 16 times. That’s obviously won’t happen this year.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

by Calculated Risk on 9/03/2021 11:24:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of August 31st.

From Andy Walden at Black Knight: Forbearances Tick Down, With All Eyes on September Exits

The final week of August brought a 53,000 decline in the number of active forbearance plans, driven by a 23,000 reduction in plans among FHA/VA loans. Plan volumes also improved from the week prior among both GSE (-20,000) and portfolio/PLS (-10,000) loans.

According to Black Knight’s McDash Flash forbearance tracker, as of August 31, 1.71 million borrowers remain in COVID-19 related forbearance plans, including 1.8% of GSE, 5.6% of FHA/VA and 4.0% of portfolio held and privately securitized mortgages.

This puts plan volumes down nearly 9% (-168,000) from the same time last month as the market braces for the large wave of final plan expirations taking place in September. Of the 629,000 plans slated to be reviewed for extension/removal this month, nearly 400,000 are set to reach their final plan expirations based on current allowable forbearance term lengths.

Click on graph for larger image.

Significant volume declines could be seen in coming weeks as those plans reach their final expirations and exiting borrowers return to making mortgage payments in October.

emphasis added

Comments on August Employment Report

by Calculated Risk on 9/03/2021 09:21:00 AM

The headline jobs number in the August employment report was well below expectations, however employment for the previous two months was revised up significantly. The participation rate was unchanged and the unemployment rate decreased to 5.2%.

Earlier: August Employment Report: 235 Thousand Jobs, 5.2% Unemployment Rate

In August, the year-over-year employment change was 6.041 million jobs. This turned positive in April due to the sharp jobs losses in April 2020.

Permanent Job Losers

Click on graph for larger image.

Click on graph for larger image.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the report today. (ht Joe Weisenthal at Bloomberg).

In August, the number of permanent job losers decreased to 2.487 million from 2.930 million in July.

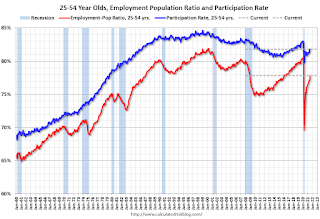

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.The prime working age will be key as the economy recovers.

The 25 to 54 participation rate was unchanged in August at 81.8% from 81.8% in July, and the 25 to 54 employment population ratio increased to 78.0% from 77.8% in July.

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"In August, the number of persons employed part time for economic reasons, at 4.5 million, was essentially unchanged. There were 4.4 million persons in this category in February 2020. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs."The number of persons working part time for economic reasons decreased in August to 4.469 million from 4.483 million in July. This is back close to pre-recession levels.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased to 8.8% from 9.2% in July. This is down from the record high in April 22.9% for this measure since 1994. This measure was at 7.0% in February 2020 (pre-pandemic).

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 3.179 million workers who have been unemployed for more than 26 weeks and still want a job, down from 3.425 million in July.

This does not include all the people that left the labor force. This will be a key measure to follow during the recovery.

Summary:

The headline monthly jobs number was well below expectations, however the previous two months were revised up by 134,000 combined. And the headline unemployment rate decreased to 5.2%.

August Employment Report: 235 Thousand Jobs, 5.2% Unemployment Rate

by Calculated Risk on 9/03/2021 08:41:00 AM

From the BLS:

Total nonfarm payroll employment rose by 235,000 in August, and the unemployment rate declined by 0.2 percentage point to 5.2 percent, the U.S. Bureau of Labor Statistics reported today. So far this year, monthly job growth has averaged 586,000. In August, notable job gains occurred in professional and business services, transportation and warehousing, private education, manufacturing, and other services. Employment in retail trade declined over the month.

...

The change in total nonfarm payroll employment for June was revised up by 24,000, from +938,000 to +962,000, and the change for July was revised up by 110,000, from +943,000 to +1,053,000. With these revisions, employment in June and July combined is 134,000 higher than previously reported.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the year-over-year change in total non-farm employment since 1968.

In August, the year-over-year change was 6.041 million jobs. This was up significantly year-over-year.

Total payrolls increased by 235 thousand in August. Private payrolls increased by 243 thousand.

Payrolls for June and July were revised up 134 thousand, combined.

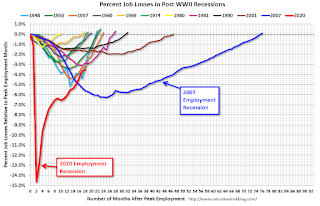

The second graph shows the job losses from the start of the employment recession, in percentage terms.

The second graph shows the job losses from the start of the employment recession, in percentage terms.The current employment recession was by far the worst recession since WWII in percentage terms, but currently is not as severe as the worst of the "Great Recession".

The third graph shows the employment population ratio and the participation rate.

The Labor Force Participation Rate was unchanged at 61.7% in August, from 61.7% in July. This is the percentage of the working age population in the labor force.

The Labor Force Participation Rate was unchanged at 61.7% in August, from 61.7% in July. This is the percentage of the working age population in the labor force. The Employment-Population ratio increased to 58.5% from 58.4% (black line).

I'll post the 25 to 54 age group employment-population ratio graph later.

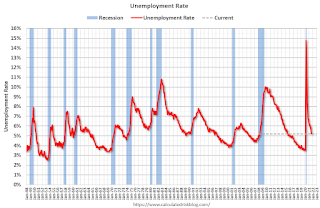

The fourth graph shows the unemployment rate.

The fourth graph shows the unemployment rate. The unemployment rate decreased in August to 5.2% from 5.4% in July.

This was well below consensus expectations, however June and July were revised up by 134,000 combined.

Thursday, September 02, 2021

Friday: Employment Report

by Calculated Risk on 9/02/2021 09:00:00 PM

My August Employment Preview

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payrolls rose 500k in August, below consensus of +725k. ... we expect the reopening of schools to boost job growth by around 150k in tomorrow’s report. ... We estimate a two-tenths drop in the unemployment rate to 5.2% ... reflecting a firm household employment gain and a stable participation rate.Friday:

emphasis added

• At 8:30 AM ET, Employment Report for August. The consensus is for 728 thousand jobs added, and for the unemployment rate to decrease to 5.2%.

• At 10:00 AM, ISM Services Index for August.

Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in June

by Calculated Risk on 9/02/2021 03:48:00 PM

New newsletter article: Real House Prices, Price-to-Rent Ratio and Price-to-Median Income in June

I've started a newsletter focused solely on real estate. This newsletter will be ad free.

You can subscribe at https://calculatedrisk.substack.com/ (Currently all content is available for free, but please subscribe).

September 2nd COVID-19: New Cases Still Increasing, Deaths Averaging Over 1,000 per Day

by Calculated Risk on 9/02/2021 03:01:00 PM

| COVID Metrics | ||||

|---|---|---|---|---|

| Today | Week Ago | Goal | ||

| Percent fully Vaccinated | 52.7% | 51.9% | ≥70.0%1 | |

| Fully Vaccinated (millions) | 175.0 | 172.2 | ≥2321 | |

| New Cases per Day3🚩 | 153,245 | 146,086 | ≤5,0002 | |

| Hospitalized3🚩 | 91,590 | 87,966 | ≤3,0002 | |

| Deaths per Day3🚩 | 1,046 | 1,009 | ≤502 | |

| 1 Minimum to achieve "herd immunity" (estimated between 70% and 85%). 2my goals to stop daily posts, 37 day average for Cases, Currently Hospitalized, and Deaths 🚩 Increasing 7 day average week-over-week for Cases, Hospitalized, and Deaths ✅ Goal met. | ||||

IMPORTANT: For "herd immunity" most experts believe we need 70% to 85% of the total population fully vaccinated (or already had COVID).

The following 14 states and D.C. have between 50% and 59.9% fully vaccinated: New Hampshire at 59.8%, Oregon, District of Columbia, Virginia, Colorado, Minnesota, California, Hawaii, Delaware, Pennsylvania, Wisconsin, Florida, Nebraska, Iowa, Illinois, and Michigan at 50.6%.

Next up (total population, fully vaccinated according to CDC) are South Dakota at 49.4%, Kentucky at 48.8%, Ohio at 48.5%, Kansas at 48.5%, Arizona at 48.1%, Nevada at 48.1%, Utah at 47.8%, Texas at 47.8% and Alaska at 47.4%.

Click on graph for larger image.

Click on graph for larger image.This graph shows the daily (columns) and 7 day average (line) of positive tests reported.

August Employment Preview

by Calculated Risk on 9/02/2021 02:09:00 PM

On Friday at 8:30 AM ET, the BLS will release the employment report for August. The consensus is for 728 thousand jobs added, and for the unemployment rate to decrease to 5.2%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 5.7 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 374,000 private sector jobs, well below the consensus estimate of 638,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in August to 49.0%, down from 52.9% last month. This would suggest a decline in manufacturing employment of around 25,000 jobs in August. ADP showed 6,000 manufacturing jobs added.

The ISM® Services employment index will be released tomorrow.

• Unemployment Claims: The weekly claims report showed a decrease in the number of initial unemployment claims during the reference week (include the 12th of the month) from 424,000 in July to 349,000 in August. This would usually suggest fewer layoffs in August than in July, although this might not be very useful right now. In general, weekly claims have been close to expectations in August.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers hasn't increased as sharply.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". While there has been a strong bounce back in total employment, from the shutdown in March and April 2020, permanent job losers hasn't increased as sharply.This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

This data is only available back to 1994, so there is only data for three recessions. In July, the number of permanent job losers decreased to 2.930 million from 3.187 million in June. These jobs will likely be the hardest to recover.

• IMPORTANT: The employment report will probably show another increase in state and local government education hiring. Usually in August, about 250 thousand educators are hired as the school year starts in some areas. This year, it seems likely more educators will be hired in August, and this could boost overall employment by a couple hundred thousand in the August report.

• Conclusion: The data suggests a weaker than expected report in August. However, there are some seasonal factors that will boost the BLS report (especially related to education).