by Calculated Risk on 2/27/2021 11:45:00 AM

Saturday, February 27, 2021

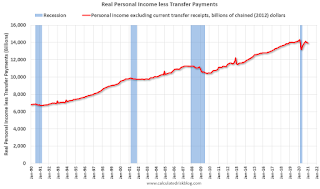

Real Personal Income less Transfer Payments

Government transfer payments increased sharply in January compared to December, and were $2.5 trillion (on SAAR basis) above the February 2020 level. Most of the increase in transfer payments - compared to the level prior to the crisis - is from unemployment insurance and "other" (includes direct payments).

This table shows the amount of unemployment insurance and "Other" transfer payments since February 2020 (pre-crisis level). The increase in "Other" was mostly due to other parts of the relief acts (including direct payments).

| Selected Transfer Payments Billions of dollars, SAAR | ||

|---|---|---|

| Other | Unemployment Insurance | |

| Feb-20 | $506 | $28 |

| Mar-20 | $515 | $74 |

| Apr-20 | $3,379 | $493 |

| May-20 | $1,360 | $1,356 |

| Jun-20 | $758 | $1,405 |

| Jul-20 | $760 | $1,331 |

| Aug-20 | $692 | $636 |

| Sep-20 | $936 | $359 |

| Oct-20 | $731 | $305 |

| Nov-20 | $619 | $281 |

| Dec-20 | $655 | $308 |

| Jan-21 | $2,337 | $571 |

A key measure of the health of the economy (Used by NBER in recession dating) is Real Personal Income less Transfer payments.

Click on graph for larger image.

Click on graph for larger image.This graph shows real personal income less transfer payments since 1990.

This measure of economic activity decreased 0.5% in January, compared to December, and was down 2.8% compared to February 2020 (previous peak).

Another way to look at this data is as a percent of the previous peak.

Another way to look at this data is as a percent of the previous peak.Real personal income less transfer payments was off 8.1% in April. This was a larger decline than the worst of the great recession.

Currently personal income less transfer payments are still off 2.8% (dashed line).

Schedule for Week of February 28, 2021

by Calculated Risk on 2/27/2021 08:11:00 AM

The key report scheduled for this week is the February employment report.

Other key reports scheduled for this week are the trade deficit and February vehicle sales.

Fed Chair Powell speaks on the U.S. economy on Thursday.

10:00 AM: ISM Manufacturing Index for January. The consensus is for the ISM to be at 58.9, up from 58.7 in January.

10:00 AM: Construction Spending for December. The consensus is for a 0.7% increase in construction spending.

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 16.4 million SAAR in February, down from 16.6 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 16.4 million SAAR in February, down from 16.6 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

10:00 AM: Corelogic House Price index for January.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for February. This report is for private payrolls only (no government). The consensus is for 168,000 payroll jobs added in February, down from 174,000 added in January.

10:00 AM: the ISM Services Index for February.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a increase to 760 thousand from 730 thousand last week.

12:05 PM: Discussion with Fed Chair Jerome Powell, Conversation on the U.S. Economy, At The Wall Street Journal Jobs Summit (via livestream)

8:30 AM: Employment Report for February. The consensus is for 148,000 jobs added, and for the unemployment rate to increase to 6.4%.

8:30 AM: Employment Report for February. The consensus is for 148,000 jobs added, and for the unemployment rate to increase to 6.4%.There were 49,000 jobs added in January, and the unemployment rate was at 6.3%.

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, and the worst in terms of the unemployment rate.

8:30 AM: Trade Balance report for January from the Census Bureau.

8:30 AM: Trade Balance report for January from the Census Bureau. This graph shows the U.S. trade deficit, with and without petroleum, through the most recent report. The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The consensus is the trade deficit to be $67.5 billion. The U.S. trade deficit was at $66.6 billion in December.

Friday, February 26, 2021

February 26 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/26/2021 07:56:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Feb 26th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 70.5 million doses have been given. In the last week, an average of 1.45 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.45 million tests per day over the last week. The percent positive over the last 7 days was 4.7%.

There were 1,793,570 test results reported over the last 24 hours.

There were 74,429 positive tests.

Over 68,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in January

by Calculated Risk on 2/26/2021 04:33:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 2.80% in January, from 2.87% in December. The serious delinquency rate is up from 0.66% in January 2020.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble, and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (2% of portfolio), 5.87% are seriously delinquent (down from 5.88% in December). For loans made in 2005 through 2008 (2% of portfolio), 9.98% are seriously delinquent (unchanged from 9.98%), For recent loans, originated in 2009 through 2018 (96% of portfolio), 2.32% are seriously delinquent (down from 2.39%). So Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance are counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once they are employed.

Note: Freddie Mac reported earlier.

NY Times Upshot: "Where Have All the Houses Gone?"

by Calculated Risk on 2/26/2021 12:51:00 PM

This is an excellent article by Emily Badger and Quoctrung Bui in the NY Times: Where Have All the Houses Gone? The authors discuss many of the issues we've discussed on why housing inventory is so low (pandemic, people renting homes, baby boomers aging in place, etc).

A brief excerpt on the conversion of single family homes to rental properties:

“Right now it’s a screaming good deal to have two properties: When my mortgage rate is 2.7 percent, why not have two of them?” said Michael Simonsen, the C.E.O. of Altos Research. “It took a long time, I think, to realize that that’s what was going on.”In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors. Most of these rental conversions were at the lower end, and that limited the supply for first time buyers.

Over the past decade, he points out, the number of single-family homes in the rental market grew by more than seven million. And the vast majority of those are owned by individuals, not big institutional investors. Other opportunities to make revenue off investment properties have also boomed with the rise of companies like Airbnb.

Q1 GDP Forecasts

by Calculated Risk on 2/26/2021 11:20:00 AM

From Merrrill Lynch:

Our 1Q GDP tracking estimate held at 5.5% [Feb 26 estimate]From Goldman Sachs:

emphasis added

We left our Q1 GDP tracking estimate unchanged at +6.0% (qoq ar). [Feb 25 estimate]From the NY Fed Nowcasting Report

he New York Fed Staff Nowcast stands at 8.7% for 2021:Q1. [Feb 26 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2021 is 8.8 percent on February 26, down from 9.6 percent on February 25. [Feb 26 estimate]

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 2/26/2021 10:18:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of February 23rd.

From Black Knight

"The number of mortgages in active forbearance rose for the second week in a row, climbing by by 21K (+0.08) since last Tuesday, pushing the total back up above 2.7M after falling below that threshold for the first time since last April earlier this month. This week’s rise continues the trend of mid-month increases we’ve grown accustomed to seeing since the recovery began.

Despite the weekly increase, the monthly rate of decline held steady at -2%, continuing the trend of very slow but steady improvement in the number of outstanding forbearance cases. Remember: monthly declines have been averaging less than 2% since early December.

According our McDash Flash daily mortgage performance data set, as of February 23, 2.7M homeowners – 5.1% of all mortgage-holders – remain in active forbearance. This includes 9.3% of FHA/VA, 3.2% of GSE and 5.2% of portfolio/private mortgages"

"Once again, portfolio held and privately securitized loans saw the largest increase in plans (+16K / +2.4%), followed FHA/VA loans, which saw active forbearance plans rise by 7K (+0.6%). As was the case last week, GSE loans were the only cohort to see any sort of decline (-2K; -0.2%).

Some 160K forbearance plans are set to hit scheduled expiration points at the end of February."

emphasis added

The number of loans in forbearance has declined slightly over the last few months.

Personal Income increased 10.0% in January, Spending increased 2.4%

by Calculated Risk on 2/26/2021 08:41:00 AM

The BEA released the Personal Income and Outlays report for January:

Personal income increased $1,954.7 billion (10.0 percent) in January according to estimates released today by the Bureau of Economic Analysis. Disposable personal income (DPI) increased $1,963.2 billion (11.4 percent) and personal consumption expenditures (PCE) increased $340.9 billion (2.4 percent).The January PCE price index increased 1.5 percent year-over-year and the January PCE price index, excluding food and energy, increased 1.5 percent year-over-year.

Real DPI increased 11.0 percent in January and Real PCE increased 2.0 percent; goods increased 5.1 percent and services increased 0.5 percent. The PCE price index increased 0.3 percent. Excluding food and energy, the PCE price index also increased 0.3 percent

emphasis added

The following graph shows real Personal Consumption Expenditures (PCE) through January 2021 (2012 dollars). Note that the y-axis doesn't start at zero to better show the change.

Click on graph for larger image.

Click on graph for larger image.The dashed red lines are the quarterly levels for real PCE.

Personal income was at expectations, and the increase in PCE was slightly below expectations.

Thursday, February 25, 2021

Friday: Personal Income and Outlays

by Calculated Risk on 2/25/2021 09:00:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Are Now Well Over 3 Percent

Most any mortgage lender added another eighth of a percent to their 30yr fixed rate offerings. Over the course of the past week, most lenders are .25-.375% higher. And compared to the beginning of last week, many lenders are a full HALF POINT higher. In other words, what had been 2.75% is now 3.25%. What had been 2.875% is now 3.375%.Friday:

• At 8:30 AM ET, Personal Income and Outlays for January. The consensus is for a 10.0% increase in personal income, and for a 2.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• At 9:45 AM, Chicago Purchasing Managers Index for February. The consensus is for a reading of 61.0, down from 63.8 in January.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for February). The consensus is for a reading of 76.2.

February 25 COVID-19 Test Results and Vaccinations

by Calculated Risk on 2/25/2021 06:47:00 PM

SPECIAL NOTE: The Covid Tracking Project will end daily updates on March 7th.

From Bloomberg on vaccinations as of Feb 25th.

"In the U.S., more Americans have now received at least one dose than have tested positive for the virus since the pandemic began. So far, 68.3 million doses have been given. In the last week, an average of 1.31 million doses per day were administered."Here is the CDC COVID Data Tracker. This site has data on vaccinations, cases and more.

The US is averaged 1.45 million tests per day over the last week. The percent positive over the last 7 days was 4.7%.

There were 1,837,743 test results reported over the last 24 hours.

There were 75,565 positive tests.

Over 66,000 US deaths have been reported in February. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

And check out COVID Act Now to see how each state is doing. (updated link to new site)

Click on graph for larger image.

Click on graph for larger image.This graph shows the 7 day average of positive tests reported and daily hospitalizations.