by Calculated Risk on 1/23/2021 08:11:00 AM

Saturday, January 23, 2021

Schedule for Week of January 24, 2021

The key reports scheduled for this week are the advance estimate of Q4 GDP and December New Home sales. Other key indicators include December Personal Income and Outlays and November Case-Shiller house prices.

For manufacturing, the Dallas, Richmond and Kansas City Fed manufacturing surveys will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

8:30 AM ET: Chicago Fed National Activity Index for December. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for January.

9:00 AM: FHFA House Price Index for November. This was originally a GSE only repeat sales, however there is also an expanded index.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.

9:00 AM ET: S&P/Case-Shiller House Price Index for November.This graph shows the Year over year change in the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 8.1% year-over-year increase in the Comp 20 index.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for January.

10:00 AM: State Employment and Unemployment (Monthly) for December 2020

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for December. The consensus is for a 0.9% increase in durable goods.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: Gross Domestic Product, 4th quarter 2020 (Advance estimate). The consensus is that real GDP increased 4.3% annualized in Q4.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for an decrease to 880 thousand from 900 thousand last week.

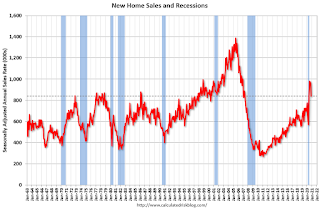

10:00 AM: New Home Sales for December from the Census Bureau.

10:00 AM: New Home Sales for December from the Census Bureau. This graph shows New Home Sales since 1963.

The dashed line is the sales rate for last month.

The consensus is for 860 thousand SAAR, up from 841 thousand in November.

11:00 AM: the Kansas City Fed manufacturing survey for January. This is the last of regional manufacturing surveys for January.

8:30 AM ET: Personal Income and Outlays for December. The consensus is for a 0.1% increase in personal income, and for a 0.4% decrease in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for January. The consensus is for a reading of 48.5, up from 48.2 in December.

10:00 AM: Pending Home Sales Index for December. The consensus is for a 0.6% decrease in the index.

10:00 AM: University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 79.2.

Friday, January 22, 2021

January 22 COVID-19 Test Results and Vaccinations

by Calculated Risk on 1/22/2021 07:18:00 PM

"Vaccinations in the U.S. began Dec. 14 with health-care workers, and so far 19.8 million shots have been given, according to a state-by-state tally by Bloomberg and data from the Centers for Disease Control and Prevention. In the last week, an average of 982,739 doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

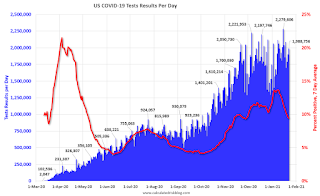

It is possible the 7-day average cases has peaked. Stay safe! I'm looking forward to not posting this data in a few months.

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,988,756 test results reported over the last 24 hours.

There were 188,983 positive tests.

Almost 68,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.5% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

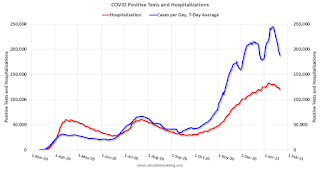

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly

by Calculated Risk on 1/22/2021 03:30:00 PM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of January 19th.

From Black Knight: Active Forbearance Plans Increase Slightly as Imporvement Continues to Plateau

The trend of mid-month increases in active forbearance plans we’ve been reporting on for some time continues in 2021, with the population of homeowners in such plans rising by 17,000 this week.

According to the latest weekly snapshot of our McDash Flash daily mortgage performance data, 2.74 million homeowners were in active forbearance as of January 19. The population has been vacillating between 2.71 and 2.83 million since early November, when the country began seeing new coronavirus case spikes and resulting shutdowns.

...

Click on graph for larger image.

Removal rates have also slowed noticeably following the six-month point of forbearance plans. This suggests that those borrowers who remain in forbearance were likely more heavily impacted by the economic downturn and thus are less likely to leave such plans before the full allowable 12-month period runs down.

...

Though we are a far cry from the peaks we saw last summer as far as the total number of active forbearance plans, the rate of improvement continues to be relatively slow. We’re seeing fewer new plan starts, with that number holding steady at the three-week average and down 30 percent from the same week in December. At the same time, plan removals remain weak, with this week recording the second lowest weekly removal volume observed to date since we began monitoring the situation in April.

emphasis added

Comments on December Existing Home Sales

by Calculated Risk on 1/22/2021 01:22:00 PM

Earlier: NAR: Existing-Home Sales Increased to 6.76 million in December

A few key points:

1) This was the highest sales rate for December since 2004, and the 2nd highest sales for December on record. Some of the increase over the last several months was probably related to pent up demand from the shutdowns in March and April. Other reasons include record low mortgage rates, a move away from multi-family rentals, strong second home buying (to escape the high-density cities) and favorable demographics.

2) Inventory is very low, and was down 23% year-over-year (YoY) in December. This is the lowest level of inventory for December since at least the early 1990s. Months-of-supply is at a record low. Inventory will be important to watch in 2021, see: Some thoughts on Housing Inventory

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales by month for 2019 and 2020.

Note that existing home sales picked up somewhat in the second half of 2019 as interest rates declined.

Even with weak sales in April, May, and June, annual sales in 2020 were at 5,640,000, up 5.6% from 5,340,000 in 2019. This was the highest annual sales rate since 2006 (6,477,000).

The second graph shows existing home sales Not Seasonally Adjusted (NSA) by month (Red dashes are 2020), and the minimum and maximum for 2005 through 2019.

The second graph shows existing home sales Not Seasonally Adjusted (NSA) by month (Red dashes are 2020), and the minimum and maximum for 2005 through 2019.Sales NSA in December (537,000) were 23.7% above sales last year in December (434,000). This was the highest sales for December (NSA) since 2004.

Q4 GDP Forecasts

by Calculated Risk on 1/22/2021 11:37:00 AM

The BEA will release the preliminary estimate for Q4 GDP this coming Thursday, January 28th. The consensus estimate is for a 4.3% annualized increase in GDP.

From Merrrill Lynch:

We expect the first estimate of 4Q GDP growth to come in at a robust 4.5% qoq saar, supported by continued strength in residential and equipment investment. Consumption likely slowed but remained positive. [Jan 22 estimate] emphasis addedFrom Goldman Sachs:

We left our Q4 GDP tracking estimate unchanged at +4.0% (qoq ar). [Jan 21 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.6% for 2020:Q4 and 6.6% for 2021:Q1. [Jan 22 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 7.5 percent on January 21, up from 7.4 percent on January 15. [Jan 21 estimate]

NAR: Existing-Home Sales Increased to 6.76 million in December

by Calculated Risk on 1/22/2021 10:13:00 AM

From the NAR: Existing-Home Sales Rise 0.7% in December, Annual Sales See Highest Level Since 2006

Existing-home sales rose in December, with home sales in 2020 reaching their highest level since 2006, according to the National Association of Realtors®. Activity in the major regions was mixed on a month-over-month basis, but each of the four areas recorded double-digit year-over-year growth in December.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 0.7% from November to a seasonally-adjusted annual rate of 6.76 million in December. Sales in total rose year-over-year, up 22.2% from a year ago (5.53 million in December 2019).

...

Total housing inventory at the end of December totaled 1.07 million units, down 16.4% from November and down 23% from one year ago (1.39 million). Unsold inventory sits at an all-time low 1.9-month supply at the current sales pace, down from 2.3 months in November and down from the 3.0-month figure recorded in December 2019. NAR first began tracking the single-family home supply in 1982.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December (6.76 million SAAR) were up 0.7% from last month, and were 22.2% above the December 2019 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.07 million in December from 1.28 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.07 million in December from 1.28 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 23% year-over-year in December compared to December 2019.

Inventory was down 23% year-over-year in December compared to December 2019. Months of supply decreased to 1.9 months in December (an all time low).

This was above the consensus forecast. I'll have more later.

Black Knight: National Mortgage Delinquency Rate Decreased in December

by Calculated Risk on 1/22/2021 08:00:00 AM

Note: Loans in forbearance are counted as delinquent in this survey, but those loans are not reported as delinquent to the credit bureaus.

From Black Knight: Black Knight’s First Look: 2020 Ends With 1.7 Million More Seriously Delinquent Homeowners Than at Start of Year; Foreclosures at Record Low

• The year ended with 1.54 million more delinquent and 1.7 million more seriously delinquent mortgages than at the start of 2020, a looming reminder of the challenges facing the market in 2021According to Black Knight's First Look report, the percent of loans delinquent decreased 3.9% in December compared to November, and increased 79% year-over-year.

• Despite the year-over-year increase, the national delinquency rate saw modest improvement in December, falling by 3.9% from November to 6.08%, the lowest level since April 2020

• Serious delinquencies (loans 90 or more days past due) also improved, falling to 2.15 million from 2.19 million the month prior

• Even after months of improvement, 90-day default activity rose by more than 250% (+2.6 million) overall in 2020

• Foreclosure starts fell by 67% from the year prior and the year’s 40,000 foreclosure sales (completions) represented an annual decline of more than 70%

• Starts and sales have hit record lows as moratoriums and forbearance plans protect distressed homeowners from facing foreclosure in the wake of the pandemic

• Prepayment activity rose by 12% percent in December, ending the year 112% higher than the same month in 2019 and highlighting a still-strong refinance market entering 2021

emphasis added

The percent of loans in the foreclosure process increased 1.3% in December and were down 28% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 6.08% in December, down from 6.33% in November.

The percent of loans in the foreclosure process increased slightly in December to 0.33%, from 0.33% in November.

The number of delinquent properties, but not in foreclosure, is up 1,448,000 properties year-over-year, and the number of properties in the foreclosure process is down 67,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Dec 2020 | Nov 2020 | Dec 2019 | Dec 2018 | |

| Delinquent | 6.08% | 6.33% | 3.40% | 3.88% |

| In Foreclosure | 0.33% | 0.33% | 0.46% | 0.52% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 3,251,000 | 3,381,000 | 1,803,000 | 2,013,000 |

| Number of properties in foreclosure pre-sale inventory: | 178,000 | 176,000 | 245,000 | 271,000 |

| Total Properties | 3,429,000 | 3,557,000 | 2,047,000 | 2,283,000 |

Thursday, January 21, 2021

Friday: Existing Home Sales

by Calculated Risk on 1/21/2021 09:18:00 PM

Friday:

• At 10:00 AM ET, Existing Home Sales for December from the National Association of Realtors (NAR). The consensus is for 6.55 million SAAR, down from 6.69 million.

Housing economist Tom Lawler estimates the NAR will report sales of 6.62 million SAAR for December.

January 21 COVID-19 Test Results and Vaccinations

by Calculated Risk on 1/21/2021 07:28:00 PM

"Vaccinations in the U.S. began Dec. 14 with health-care workers, and so far 18.4 million shots have been given, according to a state-by-state tally by Bloomberg and data from the Centers for Disease Control and Prevention. In the last week, an average of 939,973 doses per day were administered."Also check out the graphs at COVID-19 Vaccine Projections The site has several interactive graphs related to US COVID vaccinations including a breakdown of how many have had one shot, and how many have had both shots.

It is possible the 7-day average cases has peaked. Stay safe! I'm looking forward to not posting this data in a few months.

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,919,138 test results reported over the last 24 hours.

There were 184,864 positive tests.

Almost 64,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.6% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.It is possible cases and hospitalizations have peaked, but are still at a very high level.

Hotels: Occupancy Rate Declined 31.8% Year-over-year

by Calculated Risk on 1/21/2021 01:07:00 PM

U.S. weekly hotel occupancy climbed back to the 40% mark, according to STR‘s latest data through 16 January.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

10-16 January 2021 (percentage change from comparable week in 2020):

• Occupancy: 40.1% (-31.8%)

• Average daily rate (ADR): US$89.39 (-31.9%)

• evenue per available room (RevPAR): US$35.85 (-53.6%)

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels prior to 2020).

Seasonally we'd expect that business travel would start to pick up in the new year, but there will probably not be much pickup early in 2021.

Note: Y-axis doesn't start at zero to better show the seasonal change.