by Calculated Risk on 1/11/2021 09:23:00 PM

Monday, January 11, 2021

Tuesday: Job Openings

From Matthew Graham at Mortgage News Daily: Rates Rising at Fastest Pace in Months

Mortgage rates are coming off a rough week--the roughest, in fact, since June 2020 by some measures. That's the last time rates rose this quickly for market-driven reasons. There were a few instances of bigger moves in Aug/Sept as the new refinance fee was announced, delayed, and ultimately implemented. Either way, things aren't great right now, relatively speaking.Tuesday:

The "relative" qualification is important considering this abrupt move higher has yet to threaten to take the average top tier 30yr fixed quote above 3%--far from it, in fact. Most lenders can still offer 2.875% or better on refis and 2.625% or better on purchases. This assumes an ideal scenario with 20%+ equity, strong credit, etc.

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for December.

• At 10:00 AM, Job Openings and Labor Turnover Survey for November from the BLS.

January 11 COVID-19 Test Results; Record 7-Day Cases and Deaths

by Calculated Risk on 1/11/2021 07:18:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,897,059 test results reported over the last 24 hours.

There were 193,857 positive tests.

Almost 31,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 10.2% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

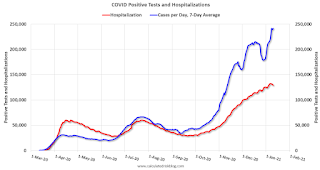

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record 7-Day Cases

• Record 7-Day Deaths

MBA Survey: "Share of Mortgage Loans in Forbearance Decreases to 5.46%"

by Calculated Risk on 1/11/2021 04:00:00 PM

Note: This is as of January 3rd.

From the MBA: Share of Mortgage Loans in Forbearance Decreases to 5.46%

The Mortgage Bankers Association’s (MBA) latest Forbearance and Call Volume Survey revealed that the total number of loans now in forbearance decreased from 5.53% of servicers’ portfolio volume in the prior week to 5.46% as of January 3, 2021. According to MBA’s estimate, 2.7 million homeowners are in forbearance plans.

...

"The share of loans in forbearance slightly declined for each investor category entering the new year, remaining within the narrow range observed for the last two months,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “The data show that those homeowners who remain in forbearance are more likely to be in distress, with fewer continuing to make any payments and fewer exiting forbearance each month. Those borrowers who do exit are also more likely to require a modification to their ongoing repayment plans.”

Fratantoni continued, “Surging COVID-19 cases caused economic activity to stall in December, with a monthly job loss for the first time since April, and with those jobs mostly concentrated in the leisure and hospitality sector. We expect that this slowdown will prevent any rapid improvement in the forbearance numbers over the next few months.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of portfolio in forbearance by investor type over time. Most of the increase was in late March and early April, and has generally been trending down.

The MBA notes: "Total weekly forbearance requests as a percent of servicing portfolio volume (#) increased relative to the prior week from 0.06% to 0.07%."

Sacramento Housing in December: Sales increase 23% YoY, Active Inventory down 44% YoY

by Calculated Risk on 1/11/2021 03:06:00 PM

Note that December sales are for contracts typically signed in October and November.

From SacRealtor.org: December sales volume up 23% annually, inventory at .5 months

December ended with 1,528 sales, up 1.1% from the 1,511 sales in November. Compared to one year ago (1,244), the current figure is up 22.8%.

...

The Active Listing Inventory decreased 23.4% from November to December, from 959 units to 735 units.

Compared with December 2019 (1,315), inventory is down 44.1%. The Months of Inventory dropped from .6 Months to .5 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. The chart below reflects the Months of Inventory in each price range.

...

The Median DOM (days on market) remained at 7 and the Average DOM remained at 16. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,528 sales this month, 87% (1,329) were on the market for 30 days or less and 95.8% (1,463) were on the market for 60 days or less.

emphasis added

Housing Inventory Weekly Update: Starting the Year at Record Lows

by Calculated Risk on 1/11/2021 12:59:00 PM

One of the key questions for 2021 is: Will inventory increase as the pandemic subsides, or will inventory decrease further in 2021?

Tracking inventory will be very important this year, and I'll be using some weekly sources.

This inventory graph is courtesy of Altos Research.

Mike Simonsen discusses this data regularly on Youtube.

Seattle Real Estate in December: Sales up 31% YoY, Inventory UP 39% YoY

by Calculated Risk on 1/11/2021 10:55:00 AM

Note: Inventory is down sharply in the Northwest almost everywhere except Seattle. And inventory is low in Seattle too, but was even lower a year ago.

The Northwest Multiple Listing Service reported “Extraordinary market conditions” sustain strong home sales

around Washington state during holidays

“Insatiable buyer demand” is keeping inventory scarce as house hunters try to outmaneuver and outbid each other, according to reports from Northwest Multiple Listing Service (NWMLS). Its statistical summary for December showed strong activity throughout the holiday season with double-digit increases in new listings, pending sales, closed sales, and prices.The press release is for the Northwest MLS area. There were 9,008 closed sales in December 2020, up 27.0% from 7,093 sales in December 2019.

...

“As more people are working from home, they are also purchasing properties further afield from Seattle,” observed James Young, director of the Washington Center for Real Estate Research at the University of Washington. He singled out Chelan, Clallam, Grays Harbor, Kittitas, and Mason as counties that had year-over-year price growth of 20% or more. The MLS report also shows Pacific and Whatcom counties with 20% or higher price gains.

“The velocity of the December market is a harbinger of the 2021 market as tight listing inventory, low interest rates, and high buyer demand continue to drive momentum,” remarked NWMLS director John Deely, executive vice president, operations at Coldwell Banker Bain. “Every market serviced by NWMLS was trending below December 2019 for total active inventory,” he noted. “In King County, despite a nearly 62% increase in new listings compared to a year ago, the insatiable buyer demand quickly absorbed available properties,” he added.

emphasis added

In King County, sales were up 28% year-over-year, and active inventory was down 14% year-over-year.

In Seattle, sales were up 30.7% year-over-year, and inventory was up 39.5% year-over-year.. This puts the months-of-supply in Seattle at just 1.2 months.

Seven High Frequency Indicators for the Economy

by Calculated Risk on 1/11/2021 08:17:00 AM

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

The TSA is providing daily travel numbers.

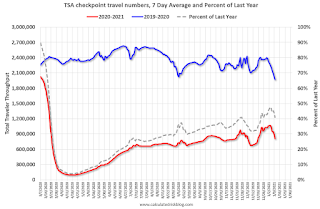

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019-2020 (Blue) and 2020-2021 (Red).

The dashed line is the percent of last year for the seven day average.

This data is as of January 10th.

The seven day average is down 59.0% from last year (41.0% of last year). (Dashed line)

There has been a slow increase from the bottom, with ups and downs due to the Thanksgiving and Christmas holidays.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through January 9, 2020.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays. Note that dining is generally lower in the northern states - Illinois, Pennsylvania, and New York. Note that California dining is off sharply with the orders to close.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Blue is 2020 and red is 2021. Data is from BoxOfficeMojo through January 7th.

This data shows domestic box office for each week (red) and the maximum and minimum for the previous four years. Blue is 2020 and red is 2021. Data is from BoxOfficeMojo through January 7th.Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $9 million last week (compared to usually around $200 million per week at this time of year).

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

This data is through January 2nd. Hotel occupancy is currently down 17.2% year-over-year. Seasonally we'd expect business travel would start to pick up in the new year, but there will probably not be much pickup early this year.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.At one point, gasoline supplied was off almost 50% YoY.

As of January 1st, gasoline supplied was off about 14.8% (about 85.2% of the same week in 2019).

Note: People driving instead of flying might have boosted gasoline consumption over the summer.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through January 9th for the United States and several selected cities.

This data is through January 9th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 45% of the January level. It is at 34% in Chicago, and 53% in Houston - and mostly trending up over the last couple of week.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is daily data since early 2020.

This graph is from Todd W Schneider. This is daily data since early 2020.This data is through Friday, January 8th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Sunday, January 10, 2021

Sunday Night Futures

by Calculated Risk on 1/10/2021 08:44:00 PM

Weekend:

• Schedule for Week of January 10, 2021

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures S&P 500 are down 11 and DOW futures are down 80 (fair value).

Oil prices were up over the last week with WTI futures at $52.26 per barrel and Brent at $55.81 barrel. A year ago, WTI was at $59, and Brent was at $67 - so WTI oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.32 per gallon. A year ago prices were at $2.59 per gallon, so gasoline prices are down $0.27 per gallon year-over-year.

January 10 COVID-19 Test Results; Record 7-Day Cases and Deaths

by Calculated Risk on 1/10/2021 07:10:00 PM

The US is now averaging close to 2 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be under 5% (probably close to 1%), so the US has far too many daily cases - and percent positive - to do effective test-and-trace.

There were 1,935,115 test results reported over the last 24 hours.

There were 222,918 positive tests.

Almost 29,000 US deaths have been reported so far in January. See the graph on US Daily Deaths here.

Click on graph for larger image.

Click on graph for larger image.This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 11.5% (red line is 7 day average). The percent positive is calculated by dividing positive results by total tests (including pending).

And check out COVID Act Now to see how each state is doing. (updated link to new site)

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.• Record 7-Day Cases

• Record 7-Day Deaths

By Request: Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 1/10/2021 11:25:00 AM

Note: I usually post this monthly, but I hesitated recently due to the COVID-19 pandemic. But I've received a number of requests lately - the recent numbers are ugly.

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr. Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Trump is in Orange (47 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 824,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 387,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,970,000 under President Clinton (light blue), by 14,714,000 under President Reagan (dark red), 9,039,000 under President Carter (dashed green), 1,511,000 under President G.H.W. Bush (light purple), and 11,849,000 under President Obama (dark blue).

During the 47 months of Trump's term, the economy has lost 2,102,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 277,000 jobs).

During the 47 months of Trump's term, the economy has lost 901,000 public sector jobs.

After 47 months of Trump's presidency, the economy has lost 3,003,000 jobs, about 12.8 million behind the projection.