by Calculated Risk on 10/28/2020 06:58:00 PM

Wednesday, October 28, 2020

October 28 COVID-19 Test Results

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 875,738 test results reported over the last 24 hours.

There were 78,661 positive tests.

Almost 20,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9.0% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average for the USA.

Freddie Mac: Mortgage Serious Delinquency Rate decreased in September

by Calculated Risk on 10/28/2020 05:09:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in September was 3.04%, down from 3.17% in August. Freddie's rate is up from 0.61% in August 2019.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Mortgages in forbearance are being counted as delinquent in this monthly report, but they will not be reported to the credit bureaus.

This is very different from the increase in delinquencies following the housing bubble. Lending standards have been fairly solid over the last decade, and most of these homeowners have equity in their homes - and they will be able to restructure their loans once (if) they are employed.

Note: Fannie Mae will report for September soon.

October Vehicle Sales Forecast: Unchanged Year-over-year

by Calculated Risk on 10/28/2020 11:32:00 AM

From Wards: U.S. Light Vehicle Sales & Inventory Forecast, October 2020 (pay content)

This graph shows actual sales from the BEA (Blue), and Wards forecast for October (Red).

Sales have bounced back from the April low, and will likely be unchanged year-over-year in October.

The Wards forecast of 16.8 million SAAR, would be up about 3% from September.

This would put sales in 2020, through October, down about 17% compared to the same period in 2019.

Zillow Case-Shiller House Price Forecast: "Annual growth in September as reported by Case-Shiller is expected to accelerate"

by Calculated Risk on 10/28/2020 08:29:00 AM

The Case-Shiller house price indexes for August were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Matthew Speakman at Zillow: August Case-Shiller Results and September Forecast: No Signs of Cooling

The remarkable surge in home prices continued into August as prices showed no signs of cooling down heading into the fall.

...

By some measures, home prices are rising at a faster pace than they ever have – an incredible feat considering the market is rising from an already elevated level. The supply of for-sale homes, already extremely tight, has only become more constrained in recent months, and historically low mortgage rates continue to encourage many buyers to enter the market. This heightened competition for the few homes on the market has placed consistent, firm pressure on home prices for months now, and there are few signs that this will relent any time soon. While the path of the overall economy is likely to be most directly dictated by coronavirus-related and political developments in the coming months, recent trends suggest that the housing market – which has basically withstood every pandemic-related challenge to this point – will continue its strong momentum in the months to come.

Annual growth in September as reported by Case-Shiller is expected to accelerate in all three main indices. S&P Dow Jones Indices is expected to release data for the September S&P CoreLogic Case-Shiller Indices on Tuesday, November 24.

emphasis added

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 6.6% in September, up from 5.7% in August.

The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be at 6.6% in September, up from 5.7% in August. The Zillow forecast is for the 20-City index to be up 6.2% YoY in September from 5.2% in August, and for the 10-City index to increase to be up 5.7% YoY compared to 4.7% YoY in August.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 10/28/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 23, 2020.

... The Refinance Index increased 3 percent from the previous week and was 80 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 0.2 percent from one week earlier. The unadjusted Purchase Index decreased 0.3 percent compared with the previous week and was 24 percent higher than the same week one year ago.

“Mortgage applications to buy a home were flat compared to the prior week, but overall activity remains strong this fall. Applications jumped 24 percent compared to last year, and the average loan size reached another record high at $372,600. These results highlight just how strong the upper end of the market is right now, with outsized growth rates in the higher loan size categories. Furthermore, housing inventory shortages have pushed national home prices considerably higher on an annual basis,” said Joel Kan, MBA’s Associative Vice President of Economic and Industry Forecasting. “Refinance activity has been somewhat volatile over the past few months but did increase almost 3 percent last week. With the 30-year fixed rate at MBA’s all-time survey low of 3.00 percent, conventional refinances rose 5 percent. However, the government refinance index decreased for the first time in a month, driven by a slowdown in VA refinance activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to 3.00 percent from 3.02 percent, with points decreasing to 0.35 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 24% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

Tuesday, October 27, 2020

October 27 COVID-19 Test Results

by Calculated Risk on 10/27/2020 06:58:00 PM

The US is now averaging close to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 892,015 test results reported over the last 24 hours.

There were 73,096 positive tests.

Almost 19,500 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 8.2% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

This is a new record 7-day average for the USA.

Richmond Fed: "Fifth District manufacturing activity strengthened in October"

by Calculated Risk on 10/27/2020 01:52:00 PM

Earlier from the Richmond Fed: Fifth District manufacturing activity strengthened in October

Fifth District manufacturing activity strengthened in October, according to the most recent survey from the Richmond Fed. The composite index rose from 21 in September to 29 in October, its highest reading on record, buoyed by increases in the shipments and new orders indexes, while the third component—the employment index—was unchanged. Firms reported improving business conditions and growing backlogs of orders, overall. Manufacturers were optimistic that conditions would continue to improve in the coming months.This was the last of the regional Fed surveys for October.

Survey results indicated that many manufacturers continued to increase employment and wages in October.

emphasis added

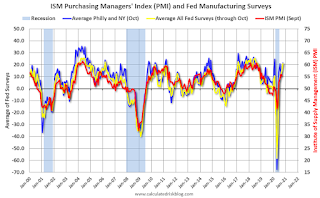

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

The ISM manufacturing index for October will be released on Monday, November 2nd. Based on these regional surveys, the ISM manufacturing index will likely increase in October from the September level.

Note that these are diffusion indexes, so readings above 0 (or 50 for the ISM) means activity is increasing (it does not mean that activity is back to pre-crisis levels).

Note: October Employment Report Will Show a Decrease of 147,000 Temporary Census Workers

by Calculated Risk on 10/27/2020 11:20:00 AM

The Census Bureau released an update today on 2020 Census Paid Temporary Workers

As of the September reference week, there were 246,801 decennial Census temporary workers. As of the October reference week, October 11th - 17th, there were 99,490 temp workers.

That is a decrease of 147,311 temporary jobs.

In August, the employment report showed a gain of 238,000 temporary 2020 Census workers, boosting the headline number.

In September, the employment report showed a decrease of 41,000 temporary 2020 Census workers, reducing the headline number.

The October employment report will show a 147,311 decrease in temporary Census employment.

HVS: Q3 2020 Homeownership and Vacancy Rates

by Calculated Risk on 10/27/2020 11:06:00 AM

The Census Bureau released the Residential Vacancies and Homeownership report for Q3 2020.

It is likely the results of this survey were significantly distorted by the pandemic. See note from Census below.

This report is frequently mentioned by analysts and the media to track household formation, the homeownership rate, and the homeowner and rental vacancy rates. However, there are serious questions about the accuracy of this survey.

This survey might show the trend, but I wouldn't rely on the absolute numbers. The Census Bureau is investigating the differences between the HVS, ACS and decennial Census, and analysts probably shouldn't use the HVS to estimate the excess vacant supply or household formation, or rely on the homeownership rate, except as a guide to the trend.

National vacancy rates in the third quarter 2020 were 6.4 percent for rental housing and 0.9 percent for homeowner housing. The rental vacancy rate of 6.4 percent was 0.4 percentage points lower than the rate in the third quarter 2019 (6.8 percent) and 0.7 percentage points higher than the rate in the second quarter 2020 (5.7 percent). The homeowner vacancy rate of 0.9 percent was 0.5 percentage points lower than the rate in the third quarter 2019 (1.4 percent) and virtually unchanged from the rate in the second quarter 2020 (0.9 percent).

The homeownership rate of 67.4 percent was 2.6 percentage points higher than the rate in the third quarter 2019 (64.8 percent) and not statistically different from the rate in the second quarter 2020 (67.9 percent). "

Click on graph for larger image.

Click on graph for larger image.The Red dots are the decennial Census homeownership rates for April 1st 1990, 2000 and 2010. The HVS homeownership rate decreased to 67.4% in Q3, from 67.9% in Q2.

I'd put more weight on the decennial Census numbers. It is likely the results in Q2 and Q3 were distorted by the pandemic.

The HVS homeowner vacancy was unchanged at 0.9%.

The HVS homeowner vacancy was unchanged at 0.9%. Once again - this probably shows the general trend, but I wouldn't rely on the absolute numbers.

From Census:

Due to the coronavirus pandemic (COVID-19), data collection operations for the CPS/HVS were affected during the third quarter of 2020, as in-person interviews were only allowed for portions of the sample in July (41 percent), August (53 percent), and September (100 percent). The remaining interviews were conducted over the telephone. If the Field Representative was unable to get contact information on the sample unit, the unit was made a Type A noninterview (no one home, refusal, etc). We are unable to determine the extent to which this data collection change affected our estimates.

The rental vacancy rate increased to 6.4% in Q3.

The rental vacancy rate increased to 6.4% in Q3.The quarterly HVS is the most timely survey on households, but there are many questions about the accuracy of this survey.

Case-Shiller: National House Price Index increased 5.7% year-over-year in August

by Calculated Risk on 10/27/2020 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3 month average of June, July and August prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P CoreLogic Case-Shiller Index Shows Annual Home Price Gains Increased to 5.7% in August

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.7% annual gain in August, up from 4.8% in the previous month. The 10-City Composite annual increase came in at 4.7%, up from 3.5% in the previous month. The 20-City Composite posted a 5.2% year-over-year gain, up from 4.1% in the previous month.

Phoenix, Seattle and San Diego reported the highest year-over-year gains among the 19 cities (excluding Detroit) in August. Phoenix led the way with a 9.9% year-over-year price increase, followed by Seattle with an 8.5% increase and San Diego with a 7.6% increase. All 19 cities reported higher price increases in the year ending August 2020 versus the year ending July 2020.

...

The National Index posted a 1.1% month-over-month increase, while the 10-City and 20-City Composites both posted increases of 1.1% before seasonal adjustment in August. After seasonal adjustment, the National Index posted a month-over-month increase of 1.0%, while the 10-City and 20- City Composites both posted increases of 0.5%. In August, all 19 cities (excluding Detroit) reported increases before seasonal adjustment, while 17 of the 19 cities reported increases after seasonal adjustment.

“Housing prices were strong in August,” says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices. “The National Composite Index gained 5.7% relative to its level a year ago, well ahead of July’s 4.8% increase. The 10- and 20-City Composites (up 4.7% and 5.2%, respectively) also rose at an accelerating pace in August. The strength of the housing market was consistent nationally – all 19 cities for which we have August data rose, and all 19 gained more in the 12 months ended in August than they had done in the 12 months ended in July.

“A trend of accelerating increases in the National Composite Index began in August 2019 but was interrupted in May and June, as COVID-related restrictions produced modestly-decelerating price gains. We speculated last month that the accelerating trend might have resumed, and August’s results easily bear that interpretation. The last time that the National Composite matched August’s 5.7% growth rate was 25 months ago, in July 2018. If future reports continue in this vein, we may soon be able to conclude that the COVID-related deceleration is behind us.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 5.2% from the bubble peak, and up 0.5% in August (SA) from July.

The Composite 20 index is 9.5% above the bubble peak, and up 0.5% (SA) in August.

The National index is 20.1% above the bubble peak (SA), and up 1.0% (SA) in August. The National index is up 62% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.7% compared to August 2019. The Composite 20 SA is up 5.2% year-over-year.

The National index SA is up 5.7% year-over-year.

Note: According to the data, prices increased in 18 cities month-over-month seasonally adjusted.

Price increases were above expectations. I'll have more later.