by Calculated Risk on 10/17/2020 05:55:00 PM

Saturday, October 17, 2020

October 17 COVID-19 Test Results

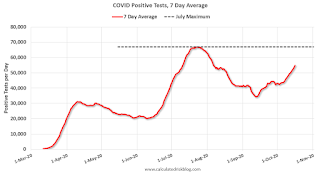

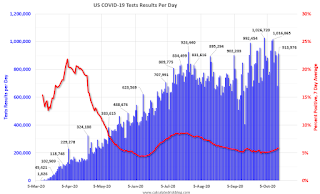

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,003,502 test results reported over the last 24 hours.

There were 59,642 positive tests.

Over 12,000 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 5.9% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high cases before the end of October.

Schedule for Week of October 18, 2020

by Calculated Risk on 10/17/2020 08:11:00 AM

The key economic reports this week are September Housing Starts and Existing Home sales.

8:00 AM: Discussion, Fed Chair Jerome Powell, Cross-Border Payments and Digital Currencies, At the International Monetary Fund Annual Meeting - Panel on Cross-Border Payments

10:00 AM: The October NAHB homebuilder survey. The consensus is for a reading of 83, unchanged from 83 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

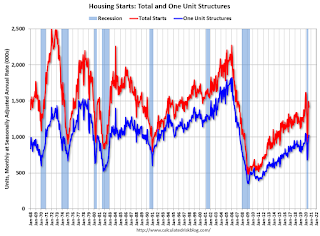

8:30 AM: Housing Starts for September.

8:30 AM: Housing Starts for September. This graph shows single and total housing starts since 1968.

The consensus is for 1.450 million SAAR, up from 1.416 million SAAR.

10:00 AM: State Employment and Unemployment (Monthly) for September 2020

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 860 thousand from 898 thousand last week.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 6.25 million SAAR, up from 6.00 million in August.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 6.25 million SAAR, up from 6.00 million in August.The graph shows existing home sales from 1994 through the report last month.

11:00 AM: the Kansas City Fed manufacturing survey for October.

No major economic releases scheduled.

Friday, October 16, 2020

Sacramento Housing in September: Sales increase 22% YoY, Active Inventory down 49% YoY

by Calculated Risk on 10/16/2020 09:55:00 PM

Note that September sales are for contracts typically signed in July and August.

From SacRealtor.org: September 2020 Statistics – Sacramento Housing Market – Single Family Homes

September wrapped up with 1,695 sales, up 8.7% from the 1,560 sales in August. Compared to one year ago (1,383), the current figure is up 21.7%.1) Overall sales increased to 1,695 in September, up 21.7% from 1,383 in September 2019. Sales were up 8.7% from August 2020 (previous month).

...

The Active Listing Inventory increased 1.5% from August to September, from 1,238 units to 1,257 units. Compared with September 2019 (2,457), inventory is down 48.8%. The Months of Inventory decreased from .8 Months to .7 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory. The chart below reflects the Months of Inventory in each price range.

...

The Median DOM (days on market) dropped from 7 to 6 and the Average DOM dropped from 21 to 18. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,695 sales this month, 84% (1,424) were on the market for 30 days or less and 92.4% (1,566) were on the market for 60 days or less.

emphasis added

2) Active inventory was at 1,238 down from 2,457 in September 2019. That is down 48.8% year-over-year. This is the seventeenth consecutive month with a YoY decline in inventory.

Existing home sales for September will be released next week.

October 16 COVID-19 Test Results

by Calculated Risk on 10/16/2020 06:46:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,046,412 test results reported over the last 24 hours.

There were 68,124 positive tests.

Almost 11,300 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.5% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high cases before the end of October.

Q3 GDP Forecasts

by Calculated Risk on 10/16/2020 12:40:00 PM

From Merrill Lynch:

We are tracking 33% qoq saar for 3Q GDP growth. [Oct 16 estimate]From Goldman Sachs:

emphasis added

We boosted our Q3 consumption growth estimate due to the stronger-than-expected September retail sales report. However, this morning’s utilities and goods production data were softer than our previous assumptions. On net, we left our Q3 GDP tracking estimate unchanged at +35% (qoq ar). [Oct 16 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 13.8% for 2020:Q3 and 3.6% for 2020:Q4. [Oct 16 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2020 is 35.2 percent on October 16, unchanged from October 9 after rounding. After this week’s data releases by the U.S. Bureau of Labor Statistics, the U.S. Department of the Treasury's Bureau of the Fiscal Service, the Federal Reserve Board of Governors, and the U.S. Census Bureau, a decrease in the nowcast of third-quarter real gross private domestic investment growth from 48.4 percent to 47.0 percent was offset by an increase in the nowcast of third-quarter real personal consumption expenditures growth from 37.0 percent to 37.3 percent. [Oct 16 estimate]It is important to note that GDP is reported at a seasonally adjusted annual rate (SAAR). A 35% annualized increase in Q3 GDP, is about 7.8% QoQ, and would leave real GDP down about 3.3% from Q4 2019.

The following graph illustrates this decline.

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent decline in real GDP from the previous peak (currently the previous peak was in Q4 2019).

This graph is through Q2 2020, and real GDP is currently off 10.2% from the previous peak. For comparison, at the depth of the Great Recession, real GDP was down 4.0% from the previous peak.

The black arrow shows what a 35% annualized increase in real GDP would look like in Q3.

Even with a 35% annualized increase (about 7.8% QoQ), real GDP will be down about 3.3% from Q4 2019; a slightly smaller decline in real GDP than at the depth of the Great Recession.

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Increased Slightly Following Large Decline Last Week

by Calculated Risk on 10/16/2020 10:50:00 AM

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of October 13th.

From Forbearance Volumes Increase Slightly Following Largest Weeklyl Drop

Following last week’s largest weekly decline in COVID-19-related forbearances since the pandemic began, the market saw a slight uptick of 19k loans in forbearance this week.

New data released today from Black Knight’s McDash Flash Forbearance Tracker shows that though volumes increased week-over-week, there is still reason to be optimistic about the state of U.S. mortgages in forbearance.

We are seeing the national forbearance rate hold steady at 5.6% week-over-week, with just under 3 million homeowners remaining in active forbearance. This number is down from a peak of 4.76 million in late May.

Click on graph for larger image.

All in, there are currently 708k fewer loans in forbearance now than the same time last month, which is a 19% decline. Of the remaining 2,988,000 current forbearance cases, 78% have had their terms extended with their servicer.

Industrial Production Decreased 0.6 Percent in September; 7.1% Below Pre-Crisis Level

by Calculated Risk on 10/16/2020 09:22:00 AM

From the Fed: Industrial Production and Capacity Utilization

Industrial production fell 0.6 percent in September, its first decline after four consecutive months of gains. The index increased at an annual rate of 39.8 percent for the third quarter as a whole. Although production has recovered more than half of its February to April decline, the September reading was still 7.1 percent below its pre-pandemic February level. Manufacturing output decreased 0.3 percent in September and was 6.4 percent below February's level. The output of utilities dropped 5.6 percent, as demand for air conditioning fell by more than usual in September. Mining production increased 1.7 percent in September; even so, it was 14.8 percent below a year earlier. At 101.5 percent of its 2012 average, total industrial production was 7.3 percent lower in September than it was a year earlier. Capacity utilization for the industrial sector decreased 0.5 percentage point in September to 71.5 percent, a rate that is 8.3 percentage points below its long-run (1972–2019) average but 7.3 percentage points above its low in April.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up from the record low set in April, but still well below the level in February 2020.

Capacity utilization at 71.5% is 8.3% below the average from 1972 to 2017.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production decreased in September to 101.5. This is 7.1% below the February 2020 level.

The change in industrial production was well below consensus expectations, however industrial production in July and August were revised up.

Retail Sales increased 1.9% in September

by Calculated Risk on 10/16/2020 08:37:00 AM

On a monthly basis, retail sales increased 1.9 percent from August to September (seasonally adjusted), and sales were up 5.4 percent from September 2019.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for September 2020, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $549.3 billion, an increase of 1.9 percent from the previous month, and 5.4 percent above September 2019.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 1.9% in September.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 6.8% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 6.8% on a YoY basis.The increase in September was above expectations, and sales in July and August were revised up, combined.

Thursday, October 15, 2020

Friday: Retail Sales, Industrial Production

by Calculated Risk on 10/15/2020 09:00:00 PM

Friday:

• At 8:30 AM ET, Retail sales for September will be released. The consensus is for a 0.7% increase in retail sales.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for September. The consensus is for a 0.6% increase in Industrial Production, and for Capacity Utilization to increase to 71.9%.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for October).

October 15 COVID-19 Test Results

by Calculated Risk on 10/15/2020 06:49:00 PM

The US is now mostly reporting 700 thousand to 1 million tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 913,976 test results reported over the last 24 hours.

There were 63,172 positive tests.

Over 10,400 Americans deaths from COVID have been reported in October. See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 6.9% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The dashed line is the July high.

Note that there were very few tests available in March and April, and many cases were missed (the percent positive was very high - see first graph). By June, the percent positive had dropped below 5%.

Everyone needs to be vigilant or we might see record high cases this Fall and Winter.