by Calculated Risk on 8/06/2020 08:58:00 PM

Thursday, August 06, 2020

Friday: Employment Report

My July Employment Preview

Goldman July Payrolls Preview

Friday:

• At 8:30 AM ET, Employment Report for July. The consensus is for 1.58 million jobs added, and for the unemployment rate to decrease to 10.7%.

August 6 COVID-19 Test Results

by Calculated Risk on 8/06/2020 05:41:00 PM

Note: There are some states having reporting problems.

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 731,700 test results reported over the last 24 hours.

There were 54,184 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.4% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

Goldman July Payrolls Preview

by Calculated Risk on 8/06/2020 04:47:00 PM

A few brief excerpts from a note by Goldman Sachs economist Spencer Hill:

We estimate nonfarm payroll growth slowed to +1.0mn in July after +4.8mn in June (consensus is +1.5mn). ... we believe education seasonality could boost July payroll growth by as much as 500-750k

…

We estimate the unemployment rate declined by 0.4pp to 10.7%

emphasis added

July Employment Preview

by Calculated Risk on 8/06/2020 11:41:00 AM

On Friday at 8:30 AM ET, the BLS will release the employment report for July. The consensus is for an increase of 1.58 million non-farm payroll jobs (+1.47 million private sector), and for the unemployment rate to decrease to 10.5%.

The usual indicators are somewhat useless again this month due to the ongoing pandemic. Some states are opening up, while others have closed bars, indoor restaurants, and some other businesses. In states with rising cases, economic activity appears to have flattened or declined in July.

The ADP employment report showed a gain of 167,000 private sector jobs, far below the consensus estimate of 1.5 million jobs.

The ISM manufacturing employment index increased in July to 44.3% from 42.1% in June, but still well below 50. This would suggest around 50,000 manufacturing jobs lost in July - although ADP showed 10,000 manufacturing jobs added.

The ISM Services employment index increased in July to 42.1% from 43.1% in June, and is still well below 50. This would suggest around 140,000 service jobs lost in July. Combined, the ISM surveys suggest around 190,000 private sector jobs lost in July.

The weekly claims report shows a high number of initial claims during the BLS reference week, although the number of continuing claims dropped significant from the June reference to the July reference week (suggesting people going back to work).

There are other indicators that analysts are looking at - like Homebase hours worked and the experimental Household Pulse Survey. The Homebase data suggests employment was mostly flat, and the Pulse Survey might suggest a significant decline in employment.

IMPORTANT: The employment report will probably show a large increase in state and local government education hiring. This is because of a quirk in the seasonal adjustment due to educators being let go earlier than usual this year due to the pandemic, see: State and Local Government Education Employment will Increase Sharply in July, Seasonally Adjusted

Also, the Decennial Census hired around 27,000 temporary workers that will show up in government hires.

• Conclusion: There is a wide range of estimates for the July report. I expect to see a large number of government jobs added (mostly due to a statistical quirk - but also due to temporary Decennial Census hiring). I'll take the over on government jobs added, but the under on private sector jobs (consensus is 1.47 million private sector - and possibly even a negative private sector number).

No matter what the July report shows, there will be millions and millions of people unemployed, and the course of the economy will be determined by the course of the virus.

NY Fed Q2 Report: "Total Household Debt Decreased in Q2 2020, Marking First Decline Since 2014"

by Calculated Risk on 8/06/2020 11:10:00 AM

From the NY Fed: Total Household Debt Decreased in Q2 2020, Marking First Decline Since 2014

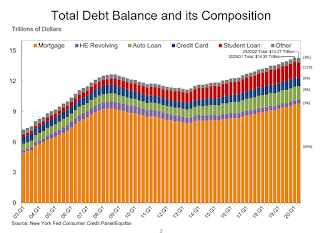

The Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt decreased by $34 billion (0.2%) to $14.27 trillion in second quarter of 2020. This marks the first decline since the second quarter of 2014 and is the largest decline since the second quarter of 2013. The Report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data. This latest report reflects consumer credit data as of June 30, 2020.

Mortgage balances—the largest component of household debt—rose by $63 billion in the second quarter to $9.78 trillion. Mortgage originations, which include mortgage refinances, reached $846 billion, the highest volume seen since the refinance boom in 2013. Origination credit scores for mortgages increased notably in the second quarter of 2020.

Reflecting the sharp decline in overall consumer spending due to the COVID-19 pandemic and related social distancing orders, credit card balances fell sharply by $76 billion in the second quarter. This was the steepest decline in card balances seen in the history of the data. Auto and student loan balances were roughly flat in the second quarter. In total, non-housing balances (including credit card, auto loan, student loan, and other debts) saw the largest drop in the history of this report, with an $86 billion decline.

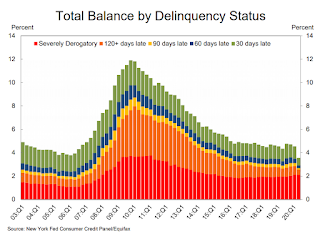

Aggregate delinquency rates dropped markedly in the second quarter, reflecting increased uptake of forbearances, which were provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. Note that accounts in forbearance are typically marked as current on consumer credit reports.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt decreased in Q2. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Aggregate household debt balances declined by $34 billion in the second quarter of 2020, a 0.2% drop, and now stand at $14.27 trillion. The drop was the first decline since the second quarter of 2014 and the largest decline since the second quarter of 2013. Balances are $1.59 trillion higher, in nominal terms, than the previous peak (2008Q3) of $12.68 trillion and 27.9% above the 2013Q2 trough.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased sharply in Q2. From the NY Fed:

Aggregate delinquency rates dropped markedly in the second quarter, reflecting an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit files from the reporting of skipped or deferred payments. Note the difference that accounts in forbearance might be categorized as delinquent on the lender’s book, but typically as current on the credit reports. As of June 30, 3.6% of outstanding debt was in some stage of delinquency, a 1.0 percentage point decrease from the fourth quarter of 2019. Of the $512 billion of debt that is delinquent, $372 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders books but upon which they continue to attempt collection).There is much more in the report.

The uptake in forbearances is notably visible in the delinquency rate transitions for mortgages. The share of mortgages in early delinquency that transitioned ‘to current’ spiked to 61.1% reflecting that many of those became forborne, while there was a decline in the share of mortgages in early delinquency whose status worsened during the second quarter of 2020. There were only 24,000 new foreclosure starts; given that homeowners with federally backed mortgages are currently protected from foreclosure through a moratorium in the CARES Act.

Las Vegas Real Estate in July: Sales up 4% YoY, Inventory down 35% YoY

by Calculated Risk on 8/06/2020 10:11:00 AM

This report is for closed sales in July; sales are counted at the close of escrow, so the contracts for these homes were mostly signed in May and June.

The Las Vegas Realtors reported Southern Nevada home prices remain in record territory despite pandemic; LVR housing statistics for July 2020

LVR reported a total of 4,025 existing local homes, condos and townhomes were sold during July. Compared to the same time last year, July sales were up 5.3% for homes, but down 3.3% for condos and townhomes. Sales were up significantly from the previous month.1) Overall sales were up 3.7% year-over-year to 4,025 in July 2020 from 3,883 in July 2019.

...

By the end of July, LVR reported 4,806 single-family homes listed for sale without any sort of offer. That’s down 38.4% from one year ago. For condos and townhomes, the 1,581 properties listed without offers in July represented a 15.2% drop from one year ago.

…

Despite the coronavirus crisis, the number of so-called distressed sales in July remained near historically low levels. The association reported that short sales and foreclosures combined accounted for just 1.2% of all existing local property sales in July. That compares to 2.0% of all sales one year ago, 2.9% two years ago and 6.4% three years ago.

emphasis added

2) Active inventory (single-family and condos) is down from a year ago, from a total of 9,752 in July 2019 to 6,387 in July 2020. Note: Total inventory was down 34.5% year-over-year. And months of inventory is still low.

3) Low level of distressed sales.

Weekly Initial Unemployment Claims decrease to 1,186,000

by Calculated Risk on 8/06/2020 08:38:00 AM

The DOL reported:

In the week ending August 1, the advance figure for seasonally adjusted initial claims was 1,186,000, a decrease of 249,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 1,434,000 to 1,435,000. The 4-week moving average was 1,337,750, a decrease of 31,000 from the previous week's revised average. The previous week's average was revised up by 250 from 1,368,500 to 1,368,750.The previous week was revised up.

emphasis added

This does not include the 655,707 initial claims for Pandemic Unemployment Assistance (PUA).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 1,337,750.

Initial weekly claims was below the consensus forecast of 1.415 million initial claims, however the previous week was revised up slightly.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims decreased to 16,107,000 (SA) from 16,951,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 12,956,478 receiving Pandemic Unemployment Assistance (PUA). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

Wednesday, August 05, 2020

Thursday: Unemployment Claims, NY Fed Q2 Quarterly Report on Household Debt and Credit

by Calculated Risk on 8/05/2020 08:46:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 1.415 million initial claims, down from 1.434 million the previous week.

• At 11:00 AM, NY Fed: Q2 Quarterly Report on Household Debt and Credit

August 5 COVID-19 Test Results

by Calculated Risk on 8/05/2020 06:26:00 PM

The number of tests per day has been declining. It is not clear if this is a testing problem or a reporting problem.

The US is now mostly reporting over 700,000 tests per day. Based on the experience of other countries, the percent positive needs to be well under 5% to really push down new infections, so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 664,219 test results reported over the last 24 hours.

There were 51,825 positive tests.

See the graph on US Daily Deaths here.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 7.5% (red line).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The Changing Mix of Light Vehicle Sales

by Calculated Risk on 8/05/2020 01:37:00 PM

The relatively low gasoline prices made me take another look at the mix of vehicles being sold.

This graph shows the percent of light vehicle sales between passenger cars and trucks / SUVs through July 2020.

Over time the mix has changed toward more and more towards light trucks and SUVs.

Only when oil prices are high, does the trend slow or reverse.

The percent of light trucks and SUVs was at 76% in July 2020.