by Calculated Risk on 4/22/2020 06:53:00 PM

Wednesday, April 22, 2020

Thursday: Unemployment Claims, New Home Sales

CR Note: The number of weekly claims will be huge again, but probably lower than the previous weeks. Also, the March New Home Sales report will likely show weakness due to COVID-19.

The Kansas City Fed manufacturing survey is for April, and will probably be very weak.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 4.150 million initial claims, down from 5.245 million the previous week.

• At 10:00 AM, New Home Sales for March from the Census Bureau. The consensus is for 645 thousand SAAR, down from 765 thousand in February.

• At 11:00 AM, the Kansas City Fed manufacturing survey for April.

April 22 Update: US COVID-19 Test Results

by Calculated Risk on 4/22/2020 05:40:00 PM

NOTE: California reported over 165,000 tests. Perhaps they were clearing a backlog, but a majority of the tests were negative - pushing down the percent positive rate. I'd take today's numbers with a grain of salt.

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 311,381 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 9% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

NMHC: "April Apartment Market Conditions Showed Weakness Amid COVID-19 Outbreak"

by Calculated Risk on 4/22/2020 02:24:00 PM

The National Multifamily Housing Council (NMHC) released their April report: April Apartment Market Conditions Showed Weakness Amid COVID-19 Outbreak

Apartment market conditions weakened in the National Multifamily Housing Council’s (NMHC) Quarterly Survey of Apartment Market Conditions for April 2020, as the industry confronts the ongoing COVID-19 pandemic. The Market Tightness (12), Sales Volume (6), Equity Financing (13), and Debt Financing (20) indexes all came in well below the breakeven level (50).

“Residents across the country are currently under directives to stay at home and practice social distancing in order to contain the spread of COVID-19. As a result, much of the nation’s economic activity has been put on hold,” noted NMHC Chief Economist Mark Obrinsky. “With upwards of 20 million Americans now out of work, it is not surprising that 82 percent of respondents reported looser market conditions this quarter, and that just 5 percent observed a tighter market.”

“In the market for apartment sales, many respondents appear to have adopted the ‘wait-and-see’ attitude, noting that COVID-19 has created too much uncertainty around asset pricing for much of any transactions to occur. There are some buyers out looking for deals at the moment, but few sellers are willing to adjust prices downward. Only 1 percent of respondents reported higher sales volume, the lowest on record since 2008.”

...

The Market Tightness Index decreased from 48 to 12, indicating looser market conditions. The vast majority (82 percent) of respondents reported looser market conditions than three months prior, compared to 5 percent who reported tighter conditions. A small portion (12 percent) of respondents felt that conditions were no different from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading below 50 indicates looser conditions from the previous quarter. This indicates market conditions were looser in April due to COVID.

Philly Fed: State Coincident Indexes Decreased in 34 states in March

by Calculated Risk on 4/22/2020 11:37:00 AM

From the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for March 2020. Over the past three months, the indexes increased in 18 states, decreased in 29, and remained stable in three, for a three-month diffusion index of -22. In the past month, the indexes increased in 12 states, decreased in 34 states, and remained stable in four, for a one-month diffusion index of -44.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the great recession, and all or mostly green during most of the recent expansion.

The map is mostly red on a three month basis, and will turn red everywhere soon.

Note: The BLS reported some issues with some state Unemployment data for March, and that is probably why some states are still green (and this 3 month change).

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In March, 14 states had increasing activity including states with minor increases. (The few positive states are probably due to the issues the BLS has identified - all states will see declining activity in April).

FHFA: House Prices up 5.7% YoY in February

by Calculated Risk on 4/22/2020 09:18:00 AM

From the FHFA: FHFA House Price Index Up 0.7 Percent in February; Up 5.7 Percent from Last Year

U.S. house prices rose in February, up 0.7 percent from the previous month, according to the Federal Housing Finance Agency (FHFA) House Price Index (HPI). House prices rose 5.7 percent from February 2019 to February 2020. The previously reported 0.3 percent increase for January 2020 was revised upward to 0.5 percent.This is pre-crisis.

For the nine census divisions, seasonally adjusted monthly house price changes from January 2020 to February 2020 were all positive, ranging from 0.3 percent in the West South Central division to +1.2 percent in the Middle Atlantic division. The 12-month changes were all positive, ranging from +4.2 percent in the West South Central division to +8.1 percent in the Mountain division.

“U.S. house prices posted a strong increase in February," according to Dr. Lynn Fisher, Deputy Director of the Division of Research and Statistics at FHFA. “The growth in home prices coincides with other data showing robust housing market activity in early 2020 preceding the current crisis. House prices had positive monthly gains in every census division. Transactions still do not reflect much, if any, influence from the COVID-19 outbreak as of February."

emphasis added

AIA: Architecture Billings Index Decreased Sharply in March

by Calculated Risk on 4/22/2020 08:51:00 AM

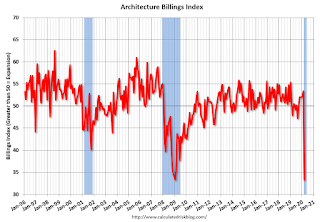

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index points to major downturn in commercial construction

Reflecting the deteriorating conditions in the overall economy, demand for design services from architecture firms recorded a record fall, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 33.3 for March reflects a decrease in design services provided by U.S. architecture firms (any score below 50 indicates a decrease in billings). During March, both the new project inquiries and design contracts scores dropped dramatically, posting scores of 23.8 and 27.1 respectively.

“Though most architecture firms have made quick transitions to remote operations, the complete shutdown of business activity is severely impacting architects,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “The dramatic pullback in new and ongoing design projects reflects just how quickly and fundamentally business conditions have changed across the country and around the world in the last month as a result of the COVID-19 pandemic.”

...

• Regional averages: West (45.3); South (44.2); Midwest (44.2); Northeast (38.4)

• Sector index breakdown: institutional (46.9); multi-family residential (43.3); commercial/industrial (41.9); mixed practice (40.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 33.3 in March, down from 53.4 in February. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

This was the largest one month decline on record for this index. This also matches the lowest level for this index during the Great Recession.

MBA: Mortgage Applications Decreased, Purchase Applications down 31% YoY

by Calculated Risk on 4/22/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 17, 2020.

... The Refinance Index decreased 1 percent from the previous week and was 225 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 3 percent compared with the previous week and was 31 percent lower than the same week one year ago.

...

“Mortgage applications were essentially unchanged last week, as a slight drop in refinance activity was offset by a 2 percent increase in purchase applications. California and Washington, two states hit hard by COVID-19, saw another week of rising activity – partly driving the overall increase. Despite the weekly gain, the purchase index remained close to its lowest level since 2015, and was over 30 percent lower than a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The pandemic-related economic stoppage has caused some buyers and sellers to delay their decisions until there are signs of a turnaround. This has resulted in reduced buyer traffic, less inventory, and March existing-homes sales falling to their slowest annual pace in nearly a year.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) remained unchanged at 3.45 percent, with points remaining unchanged at 0.29 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

Note the Fed has stepped up buying of MBS last month and that helped with liquidity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is down 31% year-over-year.

Purchase activity has fallen sharply.

Note: Red is a four-week average (blue is weekly).

Tuesday, April 21, 2020

Wednesday: Mortgage Purchase Index, Architecture Billings

by Calculated Risk on 4/21/2020 07:45:00 PM

CR Note: The mortgage purchase application survey will give us further hints about the housing market.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:00 AM, FHFA House Price Index for February 2019. This was originally a GSE only repeat sales, however there is also an expanded index.

• During the day: The AIA's Architecture Billings Index for March (a leading indicator for commercial real estate).

April 21 Update: US COVID-19 Test Results

by Calculated Risk on 4/21/2020 04:59:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 151,627 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 18% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

A few Comments on Weekly and Continued Unemployment Claims

by Calculated Risk on 4/21/2020 02:16:00 PM

We will probably see a decline in initial weekly unemployment claims this week. The consensus is initial claims will decrease to 4.145 million, from 5.245 million last week. That is still a huge number of initial claims.

The extremely high level of claims will probably continue for several weeks. But it will be important to track Continued Claims too - since many of these people won't be returning to work for some time.

Here is a graph of continued claims since 1967.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

Continued claims have already increased to a new record high of 11,976,000 (SA) and will increase further over the next few weeks.

During the Great Recession, initial weekly claims were a helpful measure of the recovery. Although weekly claims will likely remain elevated for some time, they will decline significantly from the recent levels.

This time it will be more important to track continued claims as a measure of the eventual recovery - - since continued claims are likely to stay at a high level until the crisis abates.