by Calculated Risk on 4/16/2020 03:18:00 PM

Thursday, April 16, 2020

CAR on California March Housing: Sales down 6.1% YoY

The CAR reported: California’s housing market begins to feel effects of coronavirus as March home sales drop, C.A.R. reports

California home sales fell from both the previous month and year in March as the coronavirus pandemic began taking a toll on the housing market, especially in the last two weeks of the month as the state’s stay-at-home order was put in place, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.CR Note: This is just the beginning of the sales decline. Existing home sales are reported when the transaction closes, so this was mostly for contracts signed in January and February. The CAR didn't include inventory, but it appears inventory is down sharply too (no one wants strangers walking through their homes right now).

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 373,070 units in March, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2020 if sales maintained the March pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

March’s sales total was down 11.5 percent from the 421,670 level in February and was down 6.1 percent from a year ago. The month-to-month drop was the first double-digit loss in more than nine years and the largest since August 2007. Additionally, the year-over-year decline was the first in nine months and the largest decrease since March 2019.

“The relatively moderate sales decrease that occurred in March is only a prelude to what we’ll see in April and May because sales were still modestly strong during the first two weeks of March before stay-in-place orders were implemented throughout the state,” said 2020 C.A.R. President Jeanne Radsick, a second-generation REALTOR® from Bakersfield, Calif. “However, pending sales, which is a better reflection of the current market conditions and consumer concerns about the coronavirus, dropped nearly 25 percent and suggest the decline could extend beyond the next couple of months, depending on the duration of the pandemic and the lockdown.”

...

California’s supply of available housing decreased in March from the prior month as the COVID-19 pandemic continued to disrupt the economy and the housing market. Potential home sellers are holding off listing their properties on the market as uncertainty about the future economic/market conditions remains. C.A.R.’s Unsold Inventory Index dropped to 2.7 months in March, down from 3.6 months both in February and March 2019. It was the lowest inventory level in three months. The index indicates the number of months it would take to sell the supply of homes on the market at the current rate of sales.

emphasis added

Lawler: Redfin Selected Housing Market Data

by Calculated Risk on 4/16/2020 11:59:00 AM

From housing economist Tom Lawler:

Redfin Corporation, a real estate brokerage company in the United States and Canada, has recently (and temporarily) been publishing more timely data on selected housing data that it covers. Here is an excerpt from its website.

“Each week, we are temporarily releasing a new daily dataset to keep everyone up-to-date on the latest developments in the housing market.Here is a table showing YOY % changes in selected housing data compiled by Redfin.

All data here is computed daily as either a rolling 7-day or 28-day window. The local data is grouped by Redfin market, which may not align perfectly with metro area definitions (CBSAs). All of this data is subject to revisions weekly and should be viewed with caution.”

| Period | Pending Sales | YOY % Change Active Listings | New Listings |

|---|---|---|---|

| 3/28-4/3/2020 | -49.35% | -19.40% | -43.60% |

| 3/21-3/27/2020 | -33.81% | -17.40% | -28.30% |

| 3/14-3/20/2020 | -19.91% | -16.10% | -10.70% |

| 3/7-3/13/2020 | -7.31% | -15.90% | -3.50% |

| 2/29-3/6/2020 | 1.46% | -16.30% | 2.20% |

Redfin data on closed home sales is not quite as timely, but for the 28-day period ending 3/27/2020 Redfin’s closed home sales were up 1.5% from the comparable period of 2019.

I have not done any work to assess how Redfin’s data track other measures of housing activity.

Comments on March Housing Starts

by Calculated Risk on 4/16/2020 11:50:00 AM

This was partially pre-crisis. Although housing starts will decline significantly during the crisis, residential construction is considered essential, and starts will not decline as sharply as some other sectors.

Earlier: Housing Starts decreased to 1.216 Million Annual Rate in March

Total housing starts in March were below expectations and revisions to prior months were negative.

The housing starts report showed starts were down 22.3% in March compared to February, but starts were still up 1.4% year-over-year compared to March 2019.

Single family starts were up 2.8% year-over-year, and multi-family starts were down 1.6% YoY.

This first graph shows the month to month comparison for total starts between 2019 (blue) and 2020 (red).

Starts were up 1.4% in March compared to March 2019.

Last year, in 2019, starts picked up in the 2nd half of the year, so the comparisons are easy early in the year.

Starts will be down YoY over the next several months due to impact from COVID-19.

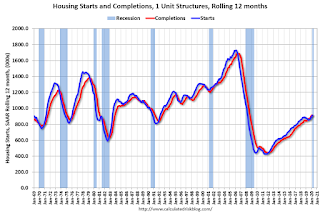

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts- although starts had picked up a little again lately.

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions once the crisis ends.

Philly Fed "Manufacturing firms reported continued weakening" in April

by Calculated Risk on 4/16/2020 09:07:00 AM

From the Philly Fed: Manufacturing firms reported continued weakening

Manufacturing firms reported continued weakening in regional manufacturing activity this month, according to results from the Manufacturing Business Outlook Survey. The survey’s current indicators for general activity, new orders, and shipments once again fell sharply this month to long-term low readings, coinciding with ongoing developments related to the coronavirus pandemic. The indexes for employment and the average workweek, which had both remained positive last month, fell into negative territory this month. The firms expect the current letup in manufacturing activity to last less than six months, as the broadest indicator of future activity strengthened further from last month’s reading; furthermore, the firms continue to expect overall growth in new orders, shipments, and employment over the next six months.This was well below the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current activity declined strikingly for the second consecutive month from -12.7 in March to -56.6 this month, falling below its nadir during the Great Recession. This is the current activity index’s lowest reading since July 1980. … The firms reported widespread decreases in manufacturing employment this month, as the current employment index fell 51 points to -46.7, its lowest reading since March 2009. The average workweek index fell 55 points to -54.5, its lowest reading ever.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

These early reports suggest the ISM manufacturing index will decline significantly in April, likely to new lows.

Housing Starts decreased to 1.216 Million Annual Rate in March

by Calculated Risk on 4/16/2020 08:47:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in March were at a seasonally adjusted annual rate of 1,216,000. This is 22.3 percent below the revised February estimate of 1,564,000, but is 1.4 percent above the March 2019 rate of 1,199,000. Single‐family housing starts in March were at a rate of 856,000; this is 17.5 percent below the revised February figure of 1,037,000. The March rate for units in buildings with five units or more was 347,000.

Building Permits:

Privately‐owned housing units authorized by building permits in March were at a seasonally adjusted annual rate of 1,353,000. This is 6.8 percent below the revised February rate of 1,452,000, but is 5.0 percent above the March 2019 rate of 1,288,000. Single‐family authorizations in March were at a rate of 884,000; this is 12.0 percent below the revised February figure of 1,005,000. Authorizations of units in buildings with five units or more were at a rate of 423,000 in March.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were down in March compared to February. Multi-family starts were down 1.6% year-over-year in March.

Multi-family is volatile month-to-month, and had been mostly moving sideways the last several years.

Single-family starts (blue) decreased in March, and were up 2.8% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in March were below expectations and revisions were negative.

Residential construction is considered an essential business, and might hold up better than some other sectors of the economy - but will still be negatively impacted by COVID-19.

I'll have more later …

Weekly Initial Unemployment Claims decrease to 5,245,000

by Calculated Risk on 4/16/2020 08:35:00 AM

The DOL reported:

In the week ending April 11, the advance figure for seasonally adjusted initial claims was 5,245,000, a decrease of 1,370,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 6,606,000 to 6,615,000. The 4-week moving average was 5,508,500, an increase of 1,240,750 from the previous week's revised average. The previous week's average was revised up by 2,250 from 4,265,500 to 4,267,750.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 5,508,500.

This was lower than the consensus forecast.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week while increasing sharply).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.Continued claims have already increased to a new record high of 11,976,000 (SA) and will increase further over the next few weeks - and likely stay at that high level until the crisis abates.

Wednesday, April 15, 2020

Thursday: Housing Starts, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 4/15/2020 07:40:00 PM

CR Note: The number of weekly claims will be huge again. Also, the March housing starts report will likely show weakness due to COVID-19.

The Philly Fed manufacturing survey is for April, and will probably be very weak.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for a 6.500 million initial claims, down from 6.606 million the previous week.

• Also at 8:30 AM, Housing Starts for March. The consensus is for 1.307 million SAAR, down from 1.599 million SAAR in February.

• Also at 8:30 AM, the Philly Fed manufacturing survey for April. The consensus is for a reading of -30.0, down from -12.7.

April 15 Update: US COVID-19 Test Results: More Needed

by Calculated Risk on 4/15/2020 05:08:00 PM

Test-and-trace is a key criterion in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Note: The Financial Times reports that Germany is doing more than 50,000 tests per day (with about one-fourth of the US population). That would be 200,000 in the US. I rounded up to 300,000 per day since the US is so behind on testing. But there are recommendations that Germany needs 200,000 tests per day to do test-and-trace. (800,000 adjusted for population).

This is just test results reported daily.

There were 161,135 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 18.7% (red line). The US probably needs enough tests to push the percentage below 5% (probably much lower based on testing in New Zealand).

All experts agree: We need many more tests!

Fed's Beige Book: "Economic activity contracted sharply and abruptly"

by Calculated Risk on 4/15/2020 02:04:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Boston based on information collected on or before April 6, 2020."

Economic activity contracted sharply and abruptly across all regions in the United States as a result of the COVID-19 pandemic. The hardest-hit industries—because of social distancing measures and mandated closures—were leisure and hospitality, and retail aside from essential goods. Most Districts reported declines in manufacturing, but cited significant variation across industries. Producers of food and medical products reported strong demand but faced both production delays, due to infection-prevention measures, and supply chain disruptions. Some other manufacturing industries, such as autos, mostly shut down. The energy sector, suffering from low prices, reduced investment and output. Districts reporting on loan demand said it was high, both from companies accessing credit lines and from households refinancing mortgages. All Districts reported highly uncertain outlooks among business contacts, with most expecting conditions to worsen in the next several months.A few excerpts from the regional reports on real estate:

...

Employment declined in all Districts, steeply in many cases, as the COVID-19 pandemic affected firms in many sectors. Employment cuts were most severe in the retail and leisure and hospitality sectors, where most Districts reported widespread mandatory closures and steep falloffs in demand. Many Districts said severe job cuts were widespread, including the manufacturing and energy sectors. Contacts in several Districts noted they were cutting employment via temporary layoffs and furloughs that they hoped to reverse once business activity resumes. The near-term outlook was for more job cuts in coming months.

emphasis added

Boston: Real estate activity in the region paused in March.

Atlanta: Housing activity softened, and commercial real estate decelerated.

San Francisco: The residential real estate market was mixed, but grew slightly overall.

NMHC: Rent Payment Tracker Finds Rent Payment Rate at 93 Percent of Prior Month

by Calculated Risk on 4/15/2020 11:25:00 AM

From the NMHC: Rent Payment Tracker Finds Rent Payment Rate at 93 Percent of Prior Month

The National Multifamily Housing Council (NMHC) found that 84 percent of apartment households made a full or partial rent payment by April 12 in its second survey of 11.5 million units of professionally managed apartment units across the country, up 15 percentage points from April 5.CR Note: I've noted before that a key goal of disaster relief is to fill the economic hole caused by the disaster. There has been a sudden stop in economic activity, however the financial world continues. Some people are advocating suspending paying bills, such as rents, mortgages, insurance, credit card, bond payments, and other bills during the crisis. This is a terrible idea. We don’t want to add a financial crisis, on top of an economic crisis, on top of a healthcare crisis. If we have a financial crisis too, it will be much hard to eventually reopen the economy. So it is good news that most people are still paying their rents (and many more will probably catch up once they receive Federal benefits). The Federal government needs to keep filling the economic hole.

NMHC’s Rent Payment Tracker numbers also examined historical numbers and found that 90 percent of renters made full or partial payments from April 1-12, 2019, and 91 percent of renters in March 1-12, 2020. The latest tracker numbers reflect a payment rate of 93 percent compared to the same time last month. These data encompass a wide variety of market-rate rental properties, which can vary by size, type and average rental price.

“We are pleased to see that it appears that the vast majority of apartment residents who can pay their rent are doing so to help ensure that their properties can continue to operate safely and so apartment owners can help residents who legitimately need help,” said Doug Bibby, President of NMHC. “Unfortunately, unemployment levels are continuing to rise and delays have been reported in getting assistance to residents, which could affect May’s rent levels. It is our hope that, as residents begin receiving the direct payments and the enhanced unemployment benefits the federal government passed, we will continue to see improvements in rent payments.”

…

"History offers us no frame of reference for the truly unprecedented economic situation we find ourselves in,” said Bibby. "With apartment firms stepping up to support their residents by waiving late fees, creating flexible payment plans and offering other creative solutions for residents impacted by COVID-19, we expected more renters to pay later in the month than has historically been the case. The increase in this week’s number over last week’s, however, shows that apartment residents are continuing to pay rent despite the financial challenges facing them.”

emphasis added