by Calculated Risk on 4/08/2020 07:48:00 PM

Wednesday, April 08, 2020

Thursday: Unemployment Claims, PPI

CR Note: The focus this week will be on weekly unemployment claims, and the consensus is probably low. Once weekly claims decline from these stratospheric levels, the focus will shift to continued claims.

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for a 5.000 million initial claims, down from 6.648 million the previous week.

• Also at 8:30 AM, The Producer Price Index for March from the BLS. The consensus is for a 0.3% decrease in PPI, and a 0.1% increase in core PPI.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Preliminary for April).

April 8 Update: US COVID-19 Test Results

by Calculated Risk on 4/08/2020 05:11:00 PM

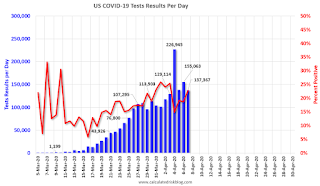

Note: the large increase last Saturday in test results reported was due to California working through the backlog of pending tests.

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I'm no longer including pending tests. So this is just test results reported daily.

There were 129,137 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 22% (red line). The US needs enough tests to push the percentage below 5% (probably much lower).

Test. Test. Test. Protect healthcare workers first!

LA area Port Traffic Down Year-over-year in March

by Calculated Risk on 4/08/2020 02:26:00 PM

Note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.1% in March compared to the rolling 12 months ending in February. Outbound traffic was down 0.7% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Because of the timing of the New Year, we would have expected traffic to decline in February without an impact from COVID-19, but bounce back in March (didn't happen this year).

In general imports both imports and exports have turned down recently - and will probably be negatively impacted by COVID-19 over the next several months.

FOMC Minutes: Zero Rates until "weathered recent events"

by Calculated Risk on 4/08/2020 02:07:00 PM

From the Fed: Minutes of the Federal Open Market Committee, March 15, 2020. A few excerpts:

All participants viewed the near-term U.S. economic outlook as having deteriorated sharply in recent weeks and as having become profoundly uncertain. Many participants had repeatedly downgraded their outlook of late in response to the rapidly evolving situation. All saw U.S. economic activity as likely to decline in the coming quarter and viewed downside risks to the economic outlook as having increased significantly. Participants noted that the timing of the resumption of growth in the U.S. economy depended on the containment measures put in place, as well as the success of those measures, and on the responses of other policies, including fiscal policy.

...

Participants all agreed that the effects of the pandemic would weigh on economic activity in the near term and that the duration of this period of weakness was uncertain. They further concurred that the unpredictable effects of the coronavirus outbreak were a source of major downside risks to the economic outlook.

In their consideration of monetary policy at this meeting, most participants judged that it would be appropriate to lower the target range for the federal funds rate by 100 basis points, to 0 to 1/4 percent. In discussing the reasons for such a decision, these participants pointed to a likely decline in economic activity in the near term related to the effects of the coronavirus outbreak and the extremely large degree of uncertainty regarding how long and severe such a decline in activity would be. In light of the sharply increased downside risks to the economic outlook posed by the global coronavirus outbreak, these participants noted that risk-management considerations pointed toward a forceful monetary policy response, with the majority favoring a 100 basis point cut that would bring the target range to its effective lower bound (ELB). With regard to monetary policy beyond this meeting, these participants judged that it would be appropriate to maintain the target range for the federal funds rate at 0 to 1/4 percent until policymakers were confident that the economy had weathered recent events and was on track to achieve the Committee's maximum employment and price stability goals.

emphasis added

Houston Real Estate in March: Sales up 6.9% YoY, Inventory Up 2.6% YoY

by Calculated Risk on 4/08/2020 12:58:00 PM

This is mostly prior to the collapse in oil prices and the impact of COVID-19. Closed sales in March are for contracts that were mostly signed in January and February.

From the HAR: Strong sales momentum through mid-March helps offset COVID-19’s market impact later in the month

As COVID-19 ravages the physical and business health of the nation, its impact on the Houston real estate market only began to set in during the last week of March, and therefore caused little disruption to the month’s overall performance. The full effect of the pandemic is expected to become more apparent when the April housing numbers are tallied. ...Sales in Houston set a record in 2019 and were off to a strong start in 2020. The impact of COVID-19, and the sharp decline in oil prices, will hit sales in Houston in the coming months.

According to the latest monthly Market Update from the Houston Association of Realtors (HAR), 7,566 single-family homes sold in March compared to 6,995 a year earlier, accounting for an 8.2 percent increase and the ninth consecutive month of positive sales. ... Sales of all property types totaled 8,965, up 6.9 percent from March 2019.

“What’s about to happen to Houston real estate reminds me of Hurricane Harvey in that we are bracing for impact, but don’t yet know what the full extent on the market will be,” said HAR Chairman John Nugent with RE/MAX Space Center. “There are consumers out there for whom finding a home is critical, however, HAR has urged all Realtor members to conduct as much business as possible online, using technology such as virtual open houses, virtual tours and electronic signature documents, in the interest of protecting everyone’s health. What’s most important during this pandemic is for everyone to be responsible community stewards and heed the warnings of health experts and local officials,” added Nugent.

...

Total active listings, or the total number of available properties, rose 2.6 percent to 40,932.. … Single-family homes inventory recorded a 3.5-months supply in March, down from a 3.8-months supply a year earlier.

emphasis added

Weather Adjusted Employment Losses in March

by Calculated Risk on 4/08/2020 09:42:00 AM

Even before the negative impact from COVID-19, the employment report in March was going to be disappointing. This is because the better than normal weather boosted employment gains in both January and February, and there was going to be payback in March. The question is: how much?

The San Francisco Fed estimates Weather-Adjusted Change in Total Nonfarm Employment (monthly change, seasonally adjusted). They use local area weather to estimate the impact on employment. For March, the BLS reported 701 thousand jobs lost, the San Francisco Fed estimates that weather adjusted employment losses were 617 thousand.

This suggests weather payback (from previous months), would have reduced March employment by over 80 thousand - and the March report would have been disappointing even without the pandemic.

Given the current circumstances, this is mostly irrelevant. However, if someone points to the gains in January and February, and claims that employment growth was picking up before COVID-19 - without adjusting for the weather - that would be inaccurate.

MBA: Mortgage Applications Decreased, Purchase Applications down 33% YoY

by Calculated Risk on 4/08/2020 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 17.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 3, 2020.

... The Refinance Index decreased 19 percent from the previous week and was 144 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 12 percent from one week earlier. The unadjusted Purchase Index decreased 12 percent compared with the previous week and was 33 percent lower than the same week one year ago.

...

“Mortgage applications fell last week, as economic weakness and the surge in unemployment continues to weigh heavily on the housing market. Purchase activity declined again, with the index dropping to its lowest level since 2015 and now down 33 percent compared to a year ago,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “With much less liquidity and tighter credit in the jumbo market, average loan sizes declined, and mortgage rates for jumbo loans increased to a high last seen in January.”

Added Kan, “Refinance applications dropped 19 percent, reversing a 25 percent increase the week before. Given the ongoing rate volatility, along with the persistent lack of liquidity in certain sectors of the MBS market, we expect to see continued weekly swings in refinance activity.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) increased to 3.49 percent from 3.47 percent, with points decreasing to 0.28 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

Note the Fed has stepped up buying of MBS last month and that helped with liquidity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is DOWN 33% year-over-year.

It appears purchase activity is falling sharply.

Note: Red is a four-week average (blue is weekly).

Tuesday, April 07, 2020

Wednesday: FOMC Minutes, MBA Mortgage Purchase Applications

by Calculated Risk on 4/07/2020 07:10:00 PM

CR Note: The mortgage purchase application survey will give us a hint about the housing market, and the FOMC minutes are for the key meeting of March 15th ('whatever it takes' meeting).

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 2:00 PM: FOMC Minutes, Meeting of March 15, 2020

April 7 Update: US COVID-19 Test Results

by Calculated Risk on 4/07/2020 05:56:00 PM

Note: the large increase Saturday in test results reported was due to California working through the backlog of pending tests.

Test-and-trace is a key criteria in starting to reopen the country. My current guess is test-and-trace will require around 300,000 tests per day at first since the US is far behind the curve. Some scientists believe we need around 800,000 tests per day.

Notes: Data for the previous couple of days is updated and revised, so graphs might change.

Also, I'm no longer including pending tests. So this is just test results reported daily.

There were 137,367 test results reported over the last 24 hours.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 23% (red line). The US needs enough tests to push the percentage below 5% (probably much lower).

Test. Test. Test. Protect healthcare workers first!

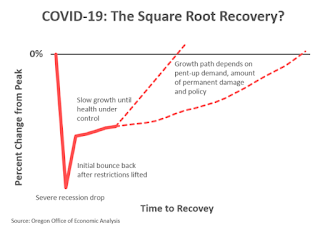

The "Square Root Recovery"

by Calculated Risk on 4/07/2020 01:05:00 PM

This is an interesting way to look at the eventual recovery, from Josh Lehner at the Oregon Office of Economic Analysis: COVID-19: The Square Root Recovery?

The thinking is as follows.

The sudden stop of the economy sends us into a severe recession overnight. Once the health situation improves some, the curve flattens and caseloads peak, the restrictions begin to be lifted. This results in some initial bounce back in economic activity, although far from 100%. We may be able to got out to eat, or get a haircut again, or the like. These firms will staff back up to meet this demand, but is the rebound 1/3 of the losses? 1/2 the losses? We don’t know that answer today. ...

This initial bounce back likely takes the economy from near-depression level readings up to something resembling a severe or bad recession. From there the economy sees slow or moderate rates of growth until the health situation is under control.

Click on graph for larger image.

Click on graph for larger image.This graph is from Josh Lehner.

Finally, just to be clear, none of this is designed to be pitting the economy against public health. Research shows they are clearly connected and in past episodes, the economy is stronger in places that improve public health the most. As Bill Conerly said the other week, if you tell me the health outcomes, I can tell you the path of the economy. That remains true today.