by Calculated Risk on 1/16/2020 08:57:00 AM

Thursday, January 16, 2020

Weekly Initial Unemployment Claims Decrease to 204,000

The DOL reported:

In the week ending January 11, the advance figure for seasonally adjusted initial claims was 204,000, a decrease of 10,000 from the previous week's unrevised level of 214,000. The 4-week moving average was 216,250, a decrease of 7,750 from the previous week's unrevised average of 224,000.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 216,250.

This was lower than the consensus forecast.

Wednesday, January 15, 2020

Thursday: Retail Sales, Unemployment Claims, Philly Fed Mfg, Builder Survey

by Calculated Risk on 1/15/2020 06:16:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 216,000 initial claims, up from 214,000 last week.

• Also at 8:30 AM, Retail sales for December is scheduled to be released. The consensus is for a 0.3% increase in retail sales.

• Also at 8:30 AM, the Philly Fed manufacturing survey for January. The consensus is for a reading of 3.4, up from 2.4.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 74, down from 76. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 10:00 AM, Speech by Fed Governor Michelle Bowman, The Outlook for Housing, At the Home Builders Association of Greater Kansas City: 2020 Economic Forecast Breakfast, Kansas City, Mo.

Fed's Beige Book: Economic Actvity Expanded "Modestly", Labor Market "Tight"

by Calculated Risk on 1/15/2020 02:03:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of New York based on information collected on or before January 6, 2020."

Economic activity generally continued to expand modestly in the final six weeks of 2019. The Dallas and Richmond Districts noted above-average growth, while Philadelphia, St. Louis, and Kansas City reported sub-par growth. Consumer spending grew at a modest to moderate pace, with a number of Districts noting some pickup from the prior reporting period. On balance, holiday sales were said to be solid, with several Districts noting the growing importance of online shopping. Vehicle sales generally expanded moderately, though a handful of Districts reported flat sales. Tourism was mixed, with growth reported in the eastern seaboard Districts but activity little changed in the Midwest and West. Manufacturing activity was essentially flat in most Districts, as in the previous report. Business in nonfinancial services was mixed but, on balance, growing modestly. Transportation activity was also mixed across Districts, with a majority reporting flat to weaker activity. Banks mostly characterized loan volume as steady to expanding moderately. Home sales trends varied widely across Districts but were flat overall, while residential rental markets strengthened. Some Districts pointed to low inventories as restraining home sales. New residential construction expanded modestly. Commercial real estate activity varied substantially across Districts. Agricultural conditions were little changed, as was activity in the energy sector. In many Districts, tariffs and trade uncertainty continued to weigh on some businesses. Expectations for the near-term outlook remained modestly favorable across the nation.

...

Employment was steady to rising modestly in most Districts, while labor markets remained tight throughout the nation. Most Districts cited widespread labor shortages as a factor constraining job growth, and, in a few cases, business expansion. A few Districts noted brisk demand for professional, technical, and managerial workers. A number of Districts reported job cuts or reduced hiring among manufacturers, and there were scattered reports of job cuts in the transportation and energy sectors. Wage growth was characterized as modest or moderate in most Districts—similar to the prior reporting period—and there were scattered reports of wage increases from year-end hikes in minimum wages. A few Districts also noted the use of benefits, incentives, training programs, and automation to reduce vacancies.

emphasis added

Small Business Optimism Index "Dips" in December

by Calculated Risk on 1/15/2020 11:15:00 AM

CR Note: This was released yesterday. Most of this survey is noise, but there is some information, especially on the labor market and the "Single Most Important Problem".

From the National Federation of Independent Business (NFIB): December 2019 Report: Small Business Optimism Dips in December

Small business optimism ended the year historically strong, with a reading of 102.7, down 2 points from November.

..

Net job creation had faded from February’s 0.52 workers per firm to September’s 0.10, but is back in strong territory. Finding qualified workers remains the top issue for 23 percent reporting this as their number one problem, 4 points below August’s record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 102.7 in December.

Note: Usually small business owners complain about taxes and regulations (currently 2nd and 3rd on the "Single Most Important Problem" list). However, during the recession, "poor sales" was the top problem. Now the difficulty of finding qualified workers is the top problem.

NY Fed: Manufacturing "Business activity grew to a small degree in New York State"

by Calculated Risk on 1/15/2020 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew to a small degree in New York State, according to firms responding to the January 2020 Empire State Manufacturing Survey. The headline general business conditions index was little changed at 4.8.This was slightly higher than the consensus forecast.

...

The index for number of employees held steady at 9.0, indicating that employment expanded for the fifth consecutive month. The average workweek index came in at 1.3, a sign that the average workweek was essentially unchanged

…

Indexes assessing the six-month outlook suggested that optimism about future conditions remained restrained.

emphasis added

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 1/15/2020 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 30.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 10, 2020. Last week’s results included an adjustment for the New Year’s Day holiday.

... The Refinance Index increased 43 percent from the previous week and was 109 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 16 percent from one week earlier. The unadjusted Purchase Index increased 51 percent compared with the previous week and was 8 percent higher than the same week one year ago.

...

“The mortgage market saw a strong start to 2020. Applications increased across the board, and the 30-year fixed mortgage rate hit its lowest level since September 2019,” said Joel Kan, Associate Vice President of Economic and Industry Forecasting. “Refinances increased for both conventional and government loans, as lower rates provided a larger incentive for borrowers to act. It remains to be seen if this strong refinancing pace is sustainable, but even with the robust activity the last two weeks, the level is still below what occurred last fall.”

Added Kan, “Homebuyers were active the first week of the year. Purchase activity was 8 percent higher than a year ago, and the purchase index increased to its highest level since October 2009. Low rates and the solid job market continue to encourage prospective buyers to enter the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to the lowest level since September 2019, 3.87 percent, from 3.91 percent, with points decreasing to 0.32 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

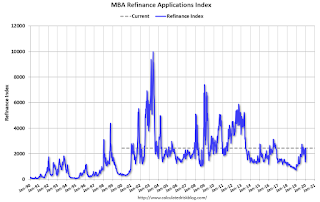

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 8% year-over-year.

Note: Holiday adjustments are difficult, and there are frequently large swings around holidays.

Tuesday, January 14, 2020

Wednesday: PPI, NY Fed Mfg Survey, Beige Book

by Calculated Risk on 1/14/2020 05:49:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Producer Price Index for December from the BLS. The consensus is for a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 4.0, up from 3.5.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Cleveland Fed: Key Measures Show Inflation Above 2% YoY in December, Core PCE below 2%

by Calculated Risk on 1/14/2020 11:30:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.1% annualized rate) in December. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for December here. Motor fuel increased at a 39.6% annualized rate in December.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.7% annualized rate) in December. The CPI less food and energy rose 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.9%, the trimmed-mean CPI rose 2.4%, and the CPI less food and energy rose 2.3%. Core PCE is for November and increased 1.6% year-over-year.

On a monthly basis, median CPI was at 2.1% annualized and trimmed-mean CPI was at 1.8% annualized.

Overall, these measures are mostly above the Fed's 2% target (Core PCE is below 2%).

Leading Index for Commercial Real Estate Increased in December

by Calculated Risk on 1/14/2020 09:01:00 AM

From Dodge Data Analytics: Dodge Momentum Index Moves Higher in December

The Dodge Momentum Index increased 1.5% in December to 156.2 (2000=100) from the revised November reading of 153.9. The Momentum Index, issued by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Both components of the Momentum Index rose over the month – the institutional component gained 2.3%, while the commercial component rose 0.9%.

For the full year, the Momentum Index averaged 141.9, a decline of 3.7% from 2018’s average. In 2019, the commercial component was 2.3% lower than the previous year, while the institutional component dropped 5.9%. Last year’s slip in the dollar value of projects entering planning suggests that construction spending for nonresidential buildings could see a setback in the year to come. However, the Momentum Index did end the year on a high note indicating that a decline in 2020 construction is likely to be modest in nature.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 156.2 in December, up from 153.9 in November.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". After declining late 2018, this index moved mostly sideways in the first half of 2019, and increased recently. So this suggests a pickup in Commercial Real Estate in 2020.

BLS: CPI increased 0.2% in December, Core CPI increased 0.1%

by Calculated Risk on 1/14/2020 08:33:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.2 percent in December on a seasonally adjusted basis after rising 0.3 percent in November, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 2.3 percent before seasonal adjustment.Core inflation was slightly lower than expectations in December. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

...

The index for all items less food and energy rose 0.1 percent in December after increasing 0.2 percent in November.

...

The all items index increased 2.3 percent for the 12 months ending December, the largest 12-month increase since the period ending October 2018. The index for all items less food and energy also rose 2.3 percent over the last 12 months, the same increase as the periods ending October and November.

emphasis added