by Calculated Risk on 11/11/2019 02:59:00 PM

Monday, November 11, 2019

Las Vegas: Convention Attendance and Visitor Traffic up Slightly in 2019 Through September

During the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to new record highs.

However, in 2018, visitor traffic declined 0.2% compared to 2017, but was still 7.5% above the pre-recession peak.

Convention attendance declined 2.2% in 2018 from the record high in 2017. Here is the data from the Las Vegas Convention and Visitors Authority.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). 2019 is estimated based on data through September 2019.

Convention attendance was up 3.3% in 2019 compared to the same period in 2018.

Visitor traffic was up 0.6% in 2019 compared to the first nine months of 2018.

Historically, declines in Las Vegas visitor traffic have been associated with economic weakness, so the slight declines over the last two years was concerning.

U.S. Heavy Truck Sales up 3% Year-over-year in October

by Calculated Risk on 11/11/2019 11:53:00 AM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the October 2019 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 180 thousand in May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 479 thousand SAAR in June 2015.

Heavy truck sales declined again - mostly due to the weakness in the oil sector - and bottomed at 366 thousand SAAR in October 2016.

Click on graph for larger image.

Following the low in 2016, heavy truck sales increased to a new all time high in September 2019 (revised).

Heavy truck sales were at 536 thousand SAAR in October, down from 575 thousand SAAR in September, but up from 521 thousand SAAR in October 2018.

LA area Port Traffic Down Year-over-year in October

by Calculated Risk on 11/11/2019 09:06:00 AM

Special note: The expansion to the Panama Canal was completed in 2016 (As I noted a few years ago), and some of the traffic that used the ports of Los Angeles and Long Beach is probably going through the canal. This might be impacting TEUs on the West Coast.

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was down 1.4% in October compared to the rolling 12 months ending in September. Outbound traffic was down 0.7% compared to the rolling 12 months ending the previous month.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

In general imports have been increasing (although down this year), and exports have mostly moved sideways over the last 8 years - and also have moved down recently.

Sunday, November 10, 2019

Sunday Night Futures

by Calculated Risk on 11/10/2019 06:55:00 PM

Thank you to all the veterans! Especially to my 97 years young father who flew a Corsair off the USS Bennington in the Pacific during WWII, and also served in Korea and Vietnam. And thanks to Uncle Jack (who passed away early this year) and Uncle Kenny. Thank you all.

Weekend:

• Schedule for Week of November 10, 2019

• Update on Yield Curve

Monday:

• Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $57.13 per barrel and Brent at $62.40 barrel. A year ago, WTI was at $60, and Brent was at $69 - so oil prices are down about 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.62 per gallon. A year ago prices were at $2.67 per gallon, so gasoline prices are down sligthly year-over-year.

Update on Yield Curve

by Calculated Risk on 11/10/2019 12:04:00 PM

Back in August I wrote: Don't Freak Out about the Yield Curve

I noted that I wasn't even on recession watch!

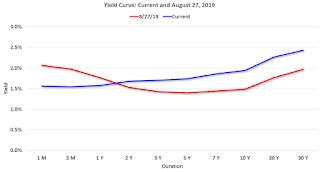

First, here is a graph of the current yield curve, and the yield curve back on August 27, 2019.

The current yield curve (blue) is upward sloping (longer duration notes and bonds yield more than short term bills and notes).

In August, the yield curve was inverted (red).

However - as I noted in August - the Fed was cutting rates this year.

Source: Daily Treasury Yield Curve Rates

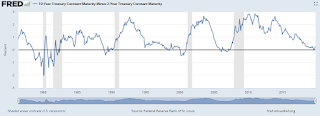

And here is an updated graph of 10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity from FRED.

In mid-1998 the spread between the 10 year and the 2 year went slightly negative, and a recession didn't start until 2001 - over 2 1/2 years later. Of course the Fed cut rates in 1998 - just like the current situation.

Saturday, November 09, 2019

Schedule for Week of November 10, 2019

by Calculated Risk on 11/09/2019 08:11:00 AM

The key economic reports this week are October CPI and Retail Sales.

For manufacturing, October industrial production, and the November New York Fed survey, will be released this week.

Fed Chair Jerome Powell will provide testimony to Congress on the Economic Outlook, on Wednesday and Thursday.

Veterans Day Holiday: Most banks will be closed in observance of Veterans Day. The stock market will be open. No economic releases are scheduled.

6:00 AM: NFIB Small Business Optimism Index for October.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: The Consumer Price Index for October from the BLS. The consensus is for a 0.3% increase in CPI, and a 0.2% increase in core CPI.

11:00 AM: NY Fed: Q3 Quarterly Report on Household Debt and Credit

11:00 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the Joint Economic Committee, U.S. Congress

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215,000 initial claims, up from 211,000 last week.

8:30 AM: The Producer Price Index for October from the BLS. The consensus is for a 0.3% increase in PPI, and a 0.2% increase in core PPI.

10:00 AM: Testimony, Fed Chair Jerome Powell, The Economic Outlook, Before the House Budget Committee, Washington, D.C.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.2% increase in retail sales.

8:30 AM ET: Retail sales for October will be released. The consensus is for a 0.2% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 4.7% on a YoY basis.

8:30 AM: The New York Fed Empire State manufacturing survey for November. The consensus is for a reading of 5.0, up from 4.0.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for October.This graph shows industrial production since 1967.

The consensus is for a 0.4% decrease in Industrial Production, and for Capacity Utilization to decrease to 77.2%.

Friday, November 08, 2019

AAR: October Rail Carloads down 8.4% YoY, Intermodal Down 7.8% YoY

by Calculated Risk on 11/08/2019 12:42:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

A combination of a weak domestic manufacturing sector, feeble economic growth abroad that’s limiting exports, continued trade spats that are disrupting global supply chains, and general economic uncertainty are creating strong headwinds for U.S. rail volumes.

In October 2019, total U.S. rail carloads were down 8.4% from October 2018, their ninth straight decline. ... Intermodal won no prizes in October either: it was down 7.8%, its biggest percentage decline since January 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows the year-over-year changes in U.S. Carloads.

Total carloads originated by U.S. railroads in October 2019 were down 8.4%, or 112,703 carloads, from October 2018. That’s the ninth straight yearover- year decline and the biggest percentage decline since March 2019. For the first ten months of 2019, total carloads were down 4.3%, or 497,121 carloads, from the same period last year. Year-to-date carloads were slightly lower in 2016, but other than that, 2019’s year-to-date total is the lowest since sometime prior to 1988, when our data begin.

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):

The second graph is the year-over-year change for intermodal traffic (using intermodal or shipping containers):U.S. intermodal originations in October 2019 were 7.8% lower than in October 2018, their ninth straight monthly decline — something that hasn’t happened since 2009 during the Great Recession. Year-to-date intermodal volume through October was down 4.5%, or 553,863 containers and trailers, from 2018.

Early Q4 GDP Forecasts: 0.7% to 2.1%

by Calculated Risk on 11/08/2019 11:19:00 AM

From Goldman Sachs:

[O]ur Q4 GDP tracking estimate declined by one-tenth to +2.1% (qoq ar), and we increased our past-quarter GDP tracking estimate for Q3 by one-tenth to +2.1% (qoq ar, compared to +1.9% as originally reported). [November 4 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 0.7% for 2019:Q4. News from this week's data releases decreased the nowcast for 2019:Q4 by 0.1 percentage point. [Nov 8 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2019 is 1.0 percent on November 5, down from 1.1 percent on November 1. [Nov 5 estimate]CR Note: These very early estimates suggest real GDP growth will be between 0.7% and 2.1% annualized in Q4.

Hotels: Occupancy Rate Decreased Year-over-year

by Calculated Risk on 11/08/2019 09:34:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 2 November

The U.S. hotel industry reported nearly flat year-over-year results in the three key performance metrics during the week of 27 October through 2 November 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 28 October through 3 November 2018, the industry recorded the following:

• Occupancy: -0.3% to 62.7%

• Average daily rate (ADR): +0.6% to US$126.04

• Revenue per available room (RevPAR): +0.3% to US$79.05

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will decline into the winter.

Data Source: STR, Courtesy of HotelNewsNow.com

Thursday, November 07, 2019

Seattle Real Estate in October: Sales up 7.6% YoY, Inventory down 9.3% YoY

by Calculated Risk on 11/07/2019 05:11:00 PM

The Northwest Multiple Listing Service reported Sparse supply spurring more competition among motivated home buyers in Western Washington

"People are moving here, home prices will continue to increase, inventory shortages will occur. That's our future," remarked Dick Beeson, principal managing broker at RE/MAX Northwest in Gig Harbor, upon viewing the October statistics from Northwest Multiple Listing Service.The press release is for the Northwest. In King County, sales were up 5.3% year-over-year, and active inventory was down 23.5% year-over-year.

Active listings of homes and condos totaled 14,379, the lowest level since April. Compared to a year ago, last month's selection declined more than 21% and was down 10% from September, according to the new report from Northwest MLS. The year-over-year and month-to-month volume of new listings also declined last month. On a positive note, MLS figures show system-wide gains in October's pending sales (up nearly 5.6%), closed sales (up 4.1%) and prices (up nearly 7.7%) compared to a year ago.

emphasis added

In Seattle, sales were up 7.6% year-over-year, and inventory was down 9.3% year-over-year.. The year-over-year increase in inventory has ended, and the months of supply is still low in Seattle (2.1 months). In many areas it appears the inventory build that started last year is over.