by Calculated Risk on 9/19/2019 10:09:00 AM

Thursday, September 19, 2019

NAR: Existing-Home Sales Increased to 5.49 million in August

From the NAR: Existing-Home Sales Increase 1.3% in August

Existing-home sales inched up in August, marking two consecutive months of growth, according to the National Association of Realtors®. Three of the four major regions reported a rise in sales, while the West recorded a decline last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.3% from July to a seasonally adjusted annual rate of 5.49 million in August. Overall sales are up 2.6% from a year ago (5.35 million in August 2018).

...

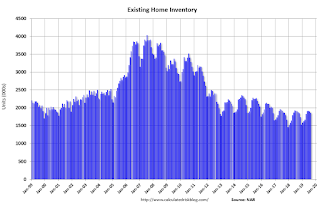

Total housing inventory at the end of August decreased to 1.86 million, down from 1.90 million existing-homes available for sale in July, and marking a 2.6% decrease from 1.91 million one year ago. Unsold inventory is at a 4.1-month supply at the current sales pace, down from 4.2 months in July and from the 4.3-month figure recorded in August 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in August (5.49 million SAAR) were up 1.3% from last month, and were 2.6% above the August 2018 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.86 million in August from 1.90 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.86 million in August from 1.90 million in July. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was down 2.6% year-over-year in August compared to August 2018.

Inventory was down 2.6% year-over-year in August compared to August 2018. Months of supply decreased to 4.1 months in August.

This was above the consensus forecast. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later …

Philly Fed Manufacturing shows Continued Expansion in September, At Slower Pace

by Calculated Risk on 9/19/2019 09:39:00 AM

From the Philly Fed: August 2019 Manufacturing Business Outlook Survey

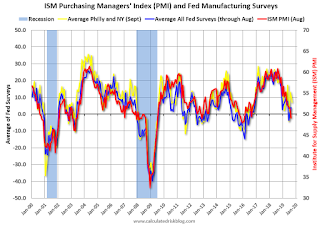

Manufacturing activity in the region continued to expand this month, according to results from the September Manufacturing Business Outlook Survey. The survey's broad indicators remained positive, although their movements were mixed: The indexes for general activity and new orders fell, while the indexes for shipments and employment increased. The survey’s price indexes increased notably this month. The survey’s future general activity index moderated but continues to suggest growth over the next six months.This was at the consensus forecast. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity fell 5 points this month to 12.0.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through September), and five Fed surveys are averaged (blue, through August) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

These early reports suggest the ISM manufacturing index will probably be weak again in September.

Weekly Initial Unemployment Claims increased to 208,000

by Calculated Risk on 9/19/2019 08:37:00 AM

The DOL reported:

In the week ending September 14, the advance figure for seasonally adjusted initial claims was 208,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 204,000 to 206,000. The 4-week moving average was 212,250, a decrease of 750 from the previous week's revised average. The previous week's average was revised up by 500 from 212,500 to 213,000.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 212,250.

This was lower than the consensus forecast.

Wednesday, September 18, 2019

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 9/18/2019 07:49:00 PM

Thursday:

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 204 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for September. The consensus is for a reading of 11.3, down from 16.8.

• At 10:00 AM, Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.38 million SAAR, down from 5.42 million in July. Housing economist Tom Lawler expects the NAR to report 5.42 million SAAR for August.

FOMC Projections and Press Conference

by Calculated Risk on 9/18/2019 02:12:00 PM

Statement here.

Fed Chair Powell press conference video here starting at 2:30 PM ET.

On the projections, growth was revised up slightly, and other projections were mostly unchanged.

Q1 real GDP growth was at 3.1% annualized, and Q2 at 2.0%. Currently most analysts are projecting around 1.5% to 2% in Q3. So the GDP projections for 2019 were revised up slightly.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Sept 2019 | 2.1 to 2.3 | 1.8 to 2.1 | 1.8 to 2.0 |

| Jun 2019 | 2.0 to 2.2 | 1.8 to 2.2 | 1.8 to 2.0 |

| Mar 2019 | 1.9 to 2.2 | 1.8 to 2.0 | 1.7 to 2.0 |

The unemployment rate was at 3.7% in August. So the unemployment rate projection for 2019 was unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Sept 2019 | 3.6 to 3.7 | 3.6 to 3.8 | 3.6 to 3.9 |

| Jun 2019 | 3.6 to 3.7 | 3.5 to 3.9 | 3.6 to 4.0 |

| Mar 2019 | 3.6 to 3.8 | 3.5 to 3.9 | 3.6 to 4.0 |

As of July 2019, PCE inflation was up 1.4% from July 2018 So PCE inflation projections were unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

PCE core inflation was up 1.6% in July year-over-year. So Core PCE inflation was unchanged.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Sept 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 |

| Jun 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.9 to 2.0 | 2.0 to 2.1 | 2.0 to 2.1 |

FOMC Statement: 25bp Decrease

by Calculated Risk on 9/18/2019 02:01:00 PM

Information received since the Federal Open Market Committee met in July indicates that the labor market remains strong and that economic activity has been rising at a moderate rate. Job gains have been solid, on average, in recent months, and the unemployment rate has remained low. Although household spending has been rising at a strong pace, business fixed investment and exports have weakened. On a 12-month basis, overall inflation and inflation for items other than food and energy are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. In light of the implications of global developments for the economic outlook as well as muted inflation pressures, the Committee decided to lower the target range for the federal funds rate to 1-3/4 to 2 percent. This action supports the Committee's view that sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain. As the Committee contemplates the future path of the target range for the federal funds rate, it will continue to monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2 percent objective.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair, John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Charles L. Evans; and Randal K. Quarles. Voting against the action were James Bullard, who preferred at this meeting to lower the target range for the federal funds rate to 1-1/2 to 1-3/4 percent; and Esther L. George and Eric S. Rosengren, who preferred to maintain the target range at 2 percent to 2-1/4 percent.

emphasis added

AIA: "Substantial Decline in Architecture Billings"

by Calculated Risk on 9/18/2019 12:45:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Substantial Decline in Architecture Billings

Demand for design services in August took a markedly downward swing compared to July’s already soft score, according to a new report released today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score of 47.2 in August showed a significant drop in architecture firm billings compared to the July score of 50.1. Any score below 50 indicates a decrease in billings. The design contracts score also declined to 47.9 in August, representing a rare dip for this indicator. Billings in the West stayed modestly positive while all other regions remained in negative territory.

“The sizeable drop in both design billings and new project activity, coming on the heels of six months of disappointing growth in billings, suggests that the design expansion that began in mid-2012 is beginning to face headwinds,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “Currently, the weakness is centered at firms specializing in commercial/industrial facilities as well as those located in the Midwest. However, there are fewer pockets of strength in design activity now, either by building sector or region than there have been in recent years.”

...

• Regional averages: West (51.2); Northeast (49.1); South (48.2); Midwest (46.4)

• Sector index breakdown: institutional (50.6); multi-family residential (50.5); commercial/industrial (46.9); mixed practice (46.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 47.2 in August, down from 50.1 in July. Anything below 50 indicates contraction in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 9 of the previous 12 months, suggesting some further increase in CRE investment in 2019 - but this is the weakest six month stretch since 2012, and might suggest some decline in CRE investment in 2020.

Comments on August Housing Starts

by Calculated Risk on 9/18/2019 10:37:00 AM

Earlier: Housing Starts increase to 1.364 Million Annual Rate in August, Highest in 12 Years

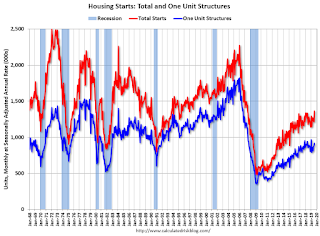

Total housing starts in August were above expectations, and starts for June and July were revised up combined. This was the highest level of starts in 12 years.

The housing starts report showed starts were up 12.3% in August compared to July, and starts were up 6.6% year-over-year compared to August 2018.

Single family starts were up 3.4% year-over-year, and multi-family starts were up 13.7% YoY. Much of the strength this month was in the volatile multi-family sector, still - overall - this was a strong report.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were up 6.6% in August compared to August 2018.

Year-to-date, starts are down 1.8% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year were the most difficult.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it seems likely starts will be up in 2019 compared to 2018.

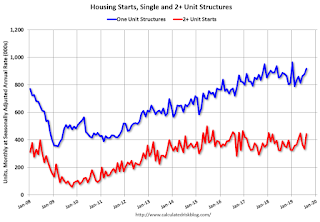

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - then completions caught up with starts.

As I've been noting for several years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Housing Starts increase to 1.364 Million Annual Rate in August, Highest in 12 Years

by Calculated Risk on 9/18/2019 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in August were at a seasonally adjusted annual rate of 1,364,000. This is 12.3 percent above the revised July estimate of 1,215,000 and is 6.6 percent above the August 2018 rate of 1,279,000. Single‐family housing starts in August were at a rate of 919,000; this is 4.4 percent above the revised July figure of 880,000. The August rate for units in buildings with five units or more was 424,000.

Building Permits:

Privately‐owned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,419,000. This is 7.7 percent above the revised July rate of 1,317,000 and is 12.0 percent above the August 2018 rate of 1,267,000. Single‐family authorizations in August were at a rate of 866,000; this is 4.5 percent above the revised July figure of 829,000. Authorizations of units in buildings with five units or more were at a rate of 509,000 in August.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in August compared to July. Multi-family starts were down 13.7% year-over-year in August.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last several years.

Single-family starts (blue) increased in August, and were up 3.4% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in August were above expectations, and starts for June and July were revised up combined. A strong report.

I'll have more later …

MBA: Mortgage Applications "Flat" in Latest Weekly Survey

by Calculated Risk on 9/18/2019 07:00:00 AM

From the MBA: Mortgage Applications Flat in Latest MBA Weekly Survey

Mortgage applications decreased 0.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 13, 2019. Last week’s results included an adjustment for the Labor Day holiday.

... The Refinance Index decreased 4 percent from the previous week and was 148 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index increased 16 percent compared with the previous week and was 15 percent higher than the same week one year ago.

...

“The jump in U.S. Treasury rates at the end of last week caused mortgage rates to increase across the board, with the 30-year fixed-rate mortgage climbing to 4.01 percent – the highest in seven weeks,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Refinancing activity dropped as a result, driven solely by conventional refinances.”

Added Kan, “The purchase index increased for the third straight week to the highest reading since July. Additionally, the average loan amount on purchase applications increased to its highest level since June. This is a likely a sign that the underlying demand for buying a home remains strong, despite some of the recent volatility we have seen.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.01 percent from 3.82 percent, with points decreasing to 0.37 from 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity. Now activity has declined a little as rates have increased.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year.