by Calculated Risk on 9/16/2019 07:38:00 PM

Monday, September 16, 2019

Tuesday: Industrial Production, Homebuilder Survey

From Matthew Graham at Mortgage News Daily: Rates Recover Modestly, But Uncertainty Remains

[M]ortgage rates won't care in the slightest when and if the Fed cuts rates this Wednesday. The Fed's outlook on future rate cuts and on its policy stance in general will be of far more interest. Until we're through Fed day, volatility potential remains high. That said, the bond market was at least willing to respond to the weekend's Saudi oil news in an expected way (i.e. rates moved slightly lower as geopolitical risks flared). This suggests the bond market is approaching this week with a more open mind than last week (where traders pushed rates higher regardless of any argument to the contrary). [Most Prevalent Rates 30YR FIXED - 3.875%]Tuesday:

emphasis added

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for August. The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.5%.

• At 10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 66, unchanged from 66 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

Phoenix Real Estate in August: Sales up 8.6% YoY, Active Inventory Down 16.6% YoY

by Calculated Risk on 9/16/2019 04:48:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales increased to 8,726 in August, down from 9,192 in July, but up from 8,036 in August 2018. Sales were down 5.1% from July 2019 (last month), and up 8.6% from August 2018.

2) Active inventory was at 13,350, down from 16,035 in August 2018. That is down 16.6% year-over-year.

3) Months of supply in to 2.00 months in August from 1.96 months in July. This is low.

This is another market with increasing sales and falling inventory. With the decline in mortgage rates in August, we will probably see a further pickup in coming months.

Update: Predicting the Next Recession

by Calculated Risk on 9/16/2019 01:34:00 PM

CR September 2019 Update: In 2013, I wrote a post "Predicting the Next Recession". I repeated the post in January 2015 (and in the summer of 2015, in January 2016, in August 2016, in April 2017, in April 2018, and in October 2018) because of all the recession calls. In late 2015, the recession callers were out in force - arguing the problems in China, combined with the impact on oil producers of lower oil prices (and defaults by energy companies) - would lead to a global recession and drag the US into recession. I didn't think so - and I was correct.

Once again the recession callers are out in force. This time it is the global slowdown, the trade war, the jump in oil prices due to the attack on Saudi production facilities, and the Fed Funds rate being too tight (with an inverted yield curve).

I've added a few updates in italics by year. Most of the text is from January 2013.

A few thoughts on the "next recession" ... Forecasters generally have a terrible record at predicting recessions. There are many reasons for this poor performance. In 1987, economist Victor Zarnowitz wrote in "The Record and Improvability of Economic Forecasting" that there was too much reliance on trends, and he also noted that predictive failure was also due to forecasters' incentives. Zarnowitz wrote: "predicting a general downturn is always unpopular and predicting it prematurely—ahead of others—may prove quite costly to the forecaster and his customers".

Incentives motivate Wall Street economic forecasters to always be optimistic about the future (just like stock analysts). Of course, for the media and bloggers, there is an incentive to always be bearish, because bad news drives traffic (hence the prevalence of yellow journalism).

In addition to paying attention to incentives, we also have to be careful not to rely "heavily on the persistence of trends". One of the reasons I focus on residential investment (especially housing starts and new home sales) is residential investment is very cyclical and is frequently the best leading indicator for the economy. UCLA's Ed Leamer went so far as to argue that: "Housing IS the Business Cycle". Usually residential investment leads the economy both into and out of recessions. The most recent recovery was an exception, but it was fairly easy to predict a sluggish recovery without a contribution from housing.

Since I started this blog in January 2005, I've been pretty lucky on calling the business cycle. I argued no recession in 2005 and 2006, then at the beginning of 2007 I predicted a recession would start that year (made it by one month with the Great Recession starting in December 2007). And in 2009, I argued the economy had bottomed and we'd see sluggish growth.

Finally, over the last 18 months, a number of forecasters (mostly online) have argued a recession was imminent. I responded that I wasn't even on "recession watch", primarily because I thought residential investment was bottoming.

[CR 2015 Update: this was written two years ago - I'm not sure if those calling for a recession then have acknowledged their incorrect forecasts and / or changed theirs views (like ECRI and various bloggers). Clearly they were wrong.]

[CR April 2017 Update: Now it has been over four years! And yes, ECRI has admitted their recession calls were incorrect. Not sure about the rest of the recession callers.]

[CR September 2019 Update: Now it has been six and a half years!]

Now one of my blogging goals is to see if I can get lucky again and call the next recession correctly. Right now I'm pretty optimistic (see: The Future's so Bright ...) and I expect a pickup in growth over the next few years (2013 will be sluggish with all the austerity).

The next recession will probably be caused by one of the following (from least likely to most likely):

3) An exogenous event such as a pandemic, significant military conflict, disruption of energy supplies for any reason, a major natural disaster (meteor strike, super volcano, etc), and a number of other low probability reasons. All of these events are possible, but they are unpredictable, and the probabilities are low that they will happen in the next few years or even decades.

[CR 2019 Update: the risk of a oil supply shock has risen - and possibly even a military conflict - but I don't think oil prices will rise enough to take the economy into recession.]

2) Significant policy error. This might involve premature or too rapid fiscal or monetary tightening (like the US in 1937 or eurozone in 2012). Two examples: not reaching a fiscal agreement and going off the "fiscal cliff" probably would have led to a recession, and Congress refusing to "pay the bills" would have been a policy error that would have taken the economy into recession. Both are off the table now, but there remains some risk of future policy errors.

Note: Usually the optimal path for reducing the deficit means avoiding a recession since a recession pushes up the deficit as revenues decline and automatic spending (unemployment insurance, etc) increases. So usually one of the goals for fiscal policymakers is to avoid taking the economy into recession. Too much austerity too quickly is self defeating.

[CR 2019 Update: We are seeing policy mistakes from the Trump administration on taxes, immigrations, and trade. See: When the Story Change, Be Alert. I'm watching for the impact of these policy mistakes.]

1) Most of the post-WWII recessions were caused by the Fed tightening monetary policy to slow inflation. I think this is the most likely cause of the next recession. Usually, when inflation starts to become a concern, the Fed tries to engineer a "soft landing", and frequently the result is a recession. Since inflation is not an immediate concern, the Fed will probably stay accommodative for a few more years.

So right now I expect further growth for the next few years (all the austerity in 2013 concerns me, especially over the next couple of quarters as people adjust to higher payroll taxes, but I think we will avoid contraction). [CR 2015 Update: We avoided contraction in 2013!] I think the most likely cause of the next recession will be Fed tightening to combat inflation sometime in the future - and residential investment (housing starts, new home sales) will probably turn down well in advance of the recession. In other words, I expect the next recession to be a more normal economic downturn - and I don't expect a recession for a few years.

[CR 2019 Update: This was written in 2013 - and my prediction for no "recession for a few years" was correct. I'm still not on recession watch, and I don't expect a recession in the immediate future (not in the next 12 months). ]

Hotels: Some Analyis of Short Term Rentals; Occupancy Rate Decreased Year-over-year

by Calculated Risk on 9/16/2019 10:14:00 AM

First, some analysis from HotelNewsNow on the impact of short term rentals on hotels: The effects of maturing short-term rentals on US hotels

From HotelNewsNow.com: STR: US hotel results for week ending 7 September

The U.S. hotel industry reported negative year-over-year results in the three key performance metrics during the week of 1-7 September 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 2-8 September 2018, the industry recorded the following:

• Occupancy: -1.1% to 61.0%

• Average daily rate (ADR): -1.0% to US$121.37

• Revenue per available room (RevPAR): -2.1% at US$73.97

Reflective of the anticipation of Hurricane Dorian’s landfall, Miami/Hialeah, Florida, reported the steepest decline in RevPAR (-27.0% to US$60.47), due primarily to the largest drop in occupancy (-20.8% to 47.6%). The market registered the second-largest decrease in ADR (-7.9% to US$127.12).

Orlando, Florida, experienced the only other double-digit decline in occupancy (-14.8% to 51.9%) and the third-largest decrease in RevPAR (-13.7% to US$51.13).

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018 (record year), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

Occupancy has been solid in 2019, and close to-date compared to the previous 4 years.

However occupancy will be lower this year than in 2018 (the record year).

Seasonally, the 4-week average of the occupancy rate will now move sideways until the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

NY Fed: Manufacturing "Business activity was little changed in New York State"

by Calculated Risk on 9/16/2019 08:34:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity was little changed in New York State, according to firms responding to the September 2019 Empire State Manufacturing Survey. The headline general business conditions index edged down three points to 2.0. New orders were marginally higher than last month, and shipments grew modestly. Delivery times were steady, and inventories increased. Employment levels expanded, while the average workweek held steady.This was lower than the consensus forecast.

...

After spending three months in negative territory, the index for number of employees rose to 9.7, pointing to an increase in employment levels, while the average workweek index came in at 1.7, indicating little change in hours worked.

…

Indexes assessing the six-month outlook suggested that optimism about future conditions waned. The index for future business conditions fell twelve points to 13.7.

emphasis added

Sunday, September 15, 2019

Sunday Night Futures

by Calculated Risk on 9/15/2019 07:43:00 PM

Weekend:

• Schedule for Week of September 15, 2019

• FOMC Preview

Monday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 4.9, up from 4.8.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 11 and DOW futures are down 88 (fair value).

Note: Oil futures are up about 10% following the attack on the Saudi oil facilities. Oil prices were up over the last week with WTI futures at $60.84 per barrel and Brent at $67.85 barrel. A year ago, WTI was at $69, and Brent was at $78 - so oil prices are down about 15% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.55 per gallon. A year ago prices were at $2.85 per gallon, so gasoline prices are down 30 cents year-over-year.

FOMC Preview

by Calculated Risk on 9/15/2019 09:55:00 AM

The consensus is the FOMC will cut the Fed Funds rate 25 bps to a range of 1.75% to 2.0% at the meeting this week. A 50 bps cut is not impossible, but seems unlikely at this meeting.

A key will be if the FOMC signals another rate cut in October. The hints could be in the press conference, or in the dot plot.

Revisions to the economic projections will probably be minor, and the statement will probably be mostly unchanged from July.

Here are the June FOMC projections.

Q1 real GDP growth was at 3.1% annualized, and Q2 at 2.0%. Currently most analysts are projecting around 1.5% to 2% in Q3. So the GDP projections will probably be little changed.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Jun 2019 | 2.0 to 2.2 | 1.8 to 2.0 | 1.8 to 2.0 |

| Mar 2019 | 1.9 to 2.2 | 1.8 to 2.0 | 1.7 to 2.0 |

The unemployment rate was at 3.7% in August. The unemployment rate projection for Q4 2019 will probably be little changed.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Jun 2019 | 3.6 to 3.7 | 3.6 to 3.9 | 3.7 to 4.1 |

| Mar 2019 | 3.6 to 3.8 | 3.5 to 3.9 | 3.6 to 4.0 |

As of July 2019, PCE inflation was up 1.4% from July 2018. This was below the projected range for 2019 however it appears inflation has picked up a little recently - and this projection will probably be mostly unchanged.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Jun 2019 | 1.5 to 1.6 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

PCE core inflation was up 1.6% in July year-over-year. The projection for core PCE for 2019 will probably be mostly unchanged.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Jun 2019 | 1.7 to 1.8 | 1.9 to 2.0 | 2.0 to 2.1 |

| Mar 2019 | 1.9 to 2.0 | 2.0 to 2.1 | 2.0 to 2.1 |

In general the economy has been tracking the June projections.

Saturday, September 14, 2019

Schedule for Week of September 15, 2019

by Calculated Risk on 9/14/2019 08:11:00 AM

The key economic reports this week are August Housing Starts and Existing Home Sales.

For manufacturing, August Industrial Production, and the September New York and Philly Fed surveys, will be released this week.

The FOMC is expected to cut the Fed Funds rate 25bps on Wednesday, and the Fed's Q2 Flow of Funds report will be released on Friday.

8:30 AM ET: The New York Fed Empire State manufacturing survey for September. The consensus is for a reading of 4.9, up from 4.8.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.

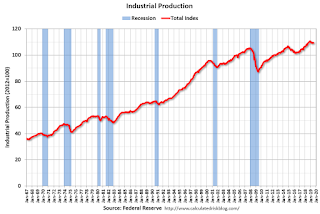

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for August.This graph shows industrial production since 1967.

The consensus is for a 0.1% increase in Industrial Production, and for Capacity Utilization to be unchanged at 77.5%.

10:00 AM: The September NAHB homebuilder survey. The consensus is for a reading of 66, unchanged from 66 in August. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Housing Starts for August.

8:30 AM: Housing Starts for August. This graph shows single and total housing starts since 1968.

The consensus is for 1.250 million SAAR, up from 1.191 million SAAR.

During the day: The AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

2:00 PM: FOMC Meeting Announcement. The Fed is expected to lower the Fed Funds rate 25bps at this meeting..

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 214 thousand initial claims, up from 204 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for September. The consensus is for a reading of 11.3, down from 16.8.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.38 million SAAR, down from 5.42 million in July.

10:00 AM: Existing Home Sales for August from the National Association of Realtors (NAR). The consensus is for 5.38 million SAAR, down from 5.42 million in July.The graph shows existing home sales from 1994 through the report last month.

10:00 AM: State Employment and Unemployment (Monthly) for August 2019

12:00 PM: Q2 Flow of Funds Accounts of the United States from the Federal Reserve.

Friday, September 13, 2019

"Mortgage Rates' Week Goes From Bad to Worse"

by Calculated Risk on 9/13/2019 05:21:00 PM

From Matthew Graham at MortgageNewsDaily: Mortgage Rates' Week Goes From Bad to Worse

Mortgage rates were already having their worst week since 2016 as of yesterday afternoon. Rather than help to heal some of the damage, today's bond market momentum only made things worse. Whether we're looking at 10yr Treasury yields a broad indicator of longer-term rates or average mortgage lender offerings, this week now ranks among the top 3 in the past decade in terms of the overall move higher. At this point, we'd have to go back to the trauma of 2013's 'taper tantrum' to see anything bigger. [Today's Most Prevalent Rates 30YR FIXED - 3.875%]

Click on graph for larger image.

Click on graph for larger image.This graph from Mortgage News Daily shows mortgage rates since 2014.

This graph is interactive at the Mortgage News Daily site, and you could view mortgage rates back to the mid-1980s - click here for graph.

Q3 GDP Forecasts: Around 1.5% to 2.0%

by Calculated Risk on 9/13/2019 01:01:00 PM

From Merrill Lynch:

3Q and 2Q GDP tracking remain at 2.0% qoq saar. [Sept 13 estimate]From Goldman Sachs:

emphasis added

Following this morning’s data, we boosted our Q3 GDP tracking estimate by one tenth to +2.0% (qoq ar). [Sept 13 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 1.6% for 2019:Q3 and 1.1% for 2019:Q4. [Sept 13 estimate].And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2019 is 1.8 percent on September 13, down from 1.9 percent on September 11. [Sept 13 estimate]CR Note: These early estimates suggest real GDP growth will be around 1.5% to 2.0% annualized in Q3.