by Calculated Risk on 6/19/2019 12:53:00 PM

Wednesday, June 19, 2019

Lawler: Early Read on Existing Home Sales in May

From housing economist Tom Lawler: Early Read on Existing Home Sales in May

I project that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.40 million in May, up 4.0% from April’s preliminary estimate and unchanged from last May’s seasonally adjusted pace.

CR Note: Existing home sales for May are scheduled to be released on Friday, June 21st. The consensus is the NAR will report sales of 5.29 million SAAR.

AIA: "Architecture billings remain flat" in May

by Calculated Risk on 6/19/2019 10:16:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture billings remain flat

Demand for design services in May remained essentially flat in comparison to the previous month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for May showed a small increase in design services at 50.2, which is slightly down from 50.5 in April. Any score above 50 indicates an increase in billings. Both the project inquiries index and the design contracts index softened in May but remained positive.

“The last four consecutive months, firm billings have either decreased or been flat, the longest period of that level of sustained softness since 2012,” said AIA Chief Economist Kermit Baker, PhD, Hon. AIA. “While both inquiries into new projects and the value of new design contracts remained positive, they both softened in May, another sign the amount of pending work in the pipeline at firms may be starting to stabilize.”

...

• Regional averages: Midwest (51.6); South (51.4); West (50.0); Northeast (47.5)

• Sector index breakdown: mixed practice (55.4); commercial/industrial (53.0); institutional (48.0); multi-family residential (46.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 50.2 in May, down from 50.5 in April. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 11 of the previous 12 months, suggesting a some further increase in CRE investment in 2019 - but this is the weakest four month stretch since 2012.

MBA: Mortgage Applications Decreased in Latest Weekly Survey

by Calculated Risk on 6/19/2019 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 14, 2019.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 4 percent higher than the same week one year ago.

...

“After seeing a six-week streak, mortgage rates for 30-year loans increased slightly, which led to a pullback in overall refinance activity,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Borrowers were sensitive to rising rates, but the refinance share of applications was still at its highest level since January 2018, and refinance activity was at its second highest level this year. Government refinances actually increased last week, led by a 17 percent in VA refinance applications, while conventional refinance applications decreased 7 percent.”

Added Kan, “Purchase applications decreased more than 3 percent last week, but were still up almost 4 percent from last year. Strong demand from

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) increased to 4.14 percent from 4.12 percent, with points increasing to 0.38 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 4% year-over-year.

Tuesday, June 18, 2019

Wednesday: FOMC Announcement

by Calculated Risk on 6/18/2019 08:26:00 PM

Here is my FOMC preview. The consensus is that there will no change in policy at the FOMC meeting this week, but that the Fed might take a more dovish tone.

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• During the day, The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

• At 2:00 PM, FOMC Meeting Announcement. No change to policy is expected at this meeting.

• At 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

Phoenix Real Estate in May: Sales up 4% YoY, Active Inventory up 3% YoY

by Calculated Risk on 6/18/2019 02:44:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report"):

1) Overall sales increased to 10,341 in May, up from 9,913 in May 2018. Sales were up 8.9% from April 2019 (last month), and up 4.3% from May 2018.

2) Active inventory was at 16,260, up from 15,795 in May 2018. That is up 2.9% year-over-year. This is the seventh consecutive month with a YoY increase in active inventory.

The last seven months - with a YoY increase - followed twenty-four consecutive months with a YoY decrease in inventory in Phoenix.

Months of supply decreased from 2.43 in April to 2.07 in May. This is low.

Comments on May Housing Starts

by Calculated Risk on 6/18/2019 10:35:00 AM

Earlier: Housing Starts at 1.269 Million Annual Rate in May

Total housing starts in May were above expectations, and starts for March and April were revised up.

The housing starts report showed starts were down 0.9% in May compared to April, and starts were down 4.7% year-over-year compared to May 2018.

Single family starts were down 12.5% year-over-year, and multi-family starts were up 13.8%.

This first graph shows the month to month comparison for total starts between 2018 (blue) and 2019 (red).

Starts were down 4.7% in May compared to May 2018.

Year-to-date, starts are down 5.3% compared to the same period in 2018.

Last year, in 2018, starts were strong early in the year, and then fell off in the 2nd half - so the early comparisons this year are the most difficult.

My guess was starts would be down slightly year-over-year in 2019 compared to 2018, but nothing like the YoY declines we saw in February and March. Now it looks like starts might be up slightly in 2019 compared to 2018.

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but turned down, and has moved sideways recently. Completions (red line) had lagged behind - however completions and starts are at about the same level now.

As I've been noting for a few years, the significant growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect some further increases in single family starts and completions.

Housing Starts at 1.269 Million Annual Rate in May

by Calculated Risk on 6/18/2019 08:39:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately‐owned housing starts in May were at a seasonally adjusted annual rate of 1,269,000. This is 0.9 percent below the revised April estimate of 1,281,000 and is 4.7 percent below the May 2018 rate of 1,332,000. Single‐family housing starts in May were at a rate of 820,000; this is 6.4 percent below the revised April figure of 876,000. The May rate for units in buildings with five units or more was 436,000.

Building Permits:

Privately‐owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,294,000. This is 0.3 percent above the revised April rate of 1,290,000, but is 0.5 percent below the May 2018 rate of 1,301,000. Single‐family authorizations in May were at a rate of 815,000; this is 3.7 percent above the revised April figure of 786,000. Authorizations of units in buildings with five units or more were at a rate of 442,000 in May.

emphasis added

Click on graph for larger image.

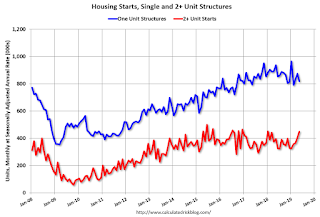

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) were up in May compared to April. Multi-family starts were up 14% year-over-year in May.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) decreased in May, and were down 12% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then eventual recovery (but still historically low).

Total housing starts in May were above expectations, and starts for March and April were revised up.

I'll have more later …

Monday, June 17, 2019

Tuesday: Housing Starts

by Calculated Risk on 6/17/2019 07:16:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Stay Flat, But Risks Will Increase From Here

Mortgage rates were only modestly higher today. Most lenders were still quoting the same rates compared to Friday with the only difference being slightly higher upfront costs. This means the rate at the top of the average mortgage quote is still within striking distance of the lowest levels since September 2017. [Most Prevalent Rates 30YR FIXED - 3.875% - 4.0%]Tuesday:

emphasis added

• At 8:30 AM ET: Housing Starts for May. The consensus is for 1.240 million SAAR, up from 1.235 million SAAR in April.

CAR on California: "Lower interest rates perk up May home sales"

by Calculated Risk on 6/17/2019 12:20:00 PM

The CAR reported: Lower interest rates perk up May home sales as median price reaches another high

California’s median home price edged higher to another peak for the second straight month as lower interest rates helped bolster home sales in May, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.Here is some inventory data from the NAR and CAR (ht Tom Lawler). Note that the YoY increase has been slowing in both California and Nationally.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 406,960 units in May, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2019 if sales maintained the May pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

May’s sales figure was up 2.6 percent from the 396,780 level in April and down 0.6 percent from home sales in May 2018 of 409,270. Sales rose above the 400,000 benchmark for the first time since July 2018 and reached the highest level in 11 months, while the year-to-year sales dip was the smallest in 13 months.

“The lowest interest rates in nearly a year and a half, no doubt, have elevated housing demand as monthly mortgage payments have become more manageable to home buyers in general,” said C.A.R. President Jared Martin. “The state’s housing market remains soft, however, as home sales continue to lag behind last year’s level for more than a year now.”

...

Active listings, which have been decelerating since December 2018, continued to climb from the prior year, increasing 7.4 percent from a year ago. It was the 14th consecutive year-over-year increase but also the first single-digit gain since last June.

The Unsold Inventory Index (UII), which is a ratio of inventory over sales, was lower than April’s level, suggesting that the typical seasonal pattern of rising home sales are beginning to play out this year. The Unsold Inventory Index was 3.2 months in May, down from 3.4 months in April but up from 3.0 months in May 2018. The index measures the number of months it would take to sell the supply of homes on the market at the current sales rate. The jump in the UII from a year ago can be attributed to the mild sales decline and the sharp increase in active listings.

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | -5.1 | 8.3% |

| Jun-18 | -0.5% | 8.1% |

| Jul-18 | 0.0% | 11.9% |

| Aug-18 | 2.1% | 17.2% |

| Sep-18 | 1.1% | 20.4% |

| Oct-18 | 2.8% | 28% |

| Nov-18 | 4.2% | 31% |

| Dec-18 | 4.8% | 30.6% |

| Jan-19 | 4.6% | 27% |

| Feb-19 | 3.2% | 19.2% |

| Mar-19 | 2.4% | 13.4% |

| Apr-19 | 1.7% | 10.8% |

| May-19 | NA | 7.4% |

FOMC Preview

by Calculated Risk on 6/17/2019 11:25:00 AM

The consensus is that there will no change in policy at the FOMC meeting this week, but that the Fed might take a more dovish tone (and possibly even remove the word "patience") - and possibly hint at a rate cut later this year (perhaps as insurance).

Note that Goldman Sachs chief economist Jan Hatzius wrote today: "A Skeptical View of Insurance Cuts". Hatzius thinks the Fed will remain data dependent (any rate cut will be based on the data), and not cut rates as "insurance".

There might some revisions in the economic projections, especially for inflation.

Here are the March FOMC projections.

Q1 real GDP growth was at 3.1% annualized, and most analysts are projecting around 2% in Q2. So the GDP projections will probably be little changed.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2019 | 2020 | 2021 |

| Mar 2019 | 1.9 to 2.2 | 1.8 to 2.0 | 1.7 to 2.0 |

| Dec 2018 | 2.3 to 2.5 | 1.8 to 2.0 | 1.5 to 2.0 |

The unemployment rate was at 3.6% in May. The unemployment rate projection for 2019 will probably be unchanged or revised down slightly.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2019 | 2020 | 2021 |

| Mar 2019 | 3.6 to 3.8 | 3.6 to 3.9 | 3.7 to 4.1 |

| Dec 2018 | 3.5 to 3.7 | 3.5 to 3.8 | 3.6 to 3.9 |

As of April 2019, PCE inflation was up 1.5% from April 2018. This was below the projected range for 2019 and PCE inflation might be revised down for 2019.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2019 | 2020 | 2021 |

| Mar 2019 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

| Dec 2018 | 1.8 to 2.1 | 2.0 to 2.1 | 2.0 to 2.1 |

PCE core inflation was up 1.6% in April year-over-year. So the projection for core PCE for 2019 will probably be revised down.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2019 | 2020 | 2021 |

| Mar 2019 | 1.9 to 2.0 | 2.0 to 2.1 | 2.0 to 2.1 |

| Dec 2018 | 2.0 to 2.1 | 2.0 to 2.1 | 2.0 to 2.1 |

In general, GDP and the unemployment rate have been at or better than the March projections, however inflation has been softer than the March projections.