by Calculated Risk on 4/28/2019 07:04:00 PM

Sunday, April 28, 2019

Sunday Night Futures

Weekend:

• Schedule for Week of April 28, 2019

Monday:

• 8:30 AM ET, Personal Income and Outlays, March 2019. The consensus is for a 0.4% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.1%.

• 10:30 AM, Dallas Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were mixed over the last week with WTI futures at $62.87 per barrel and Brent at $71.63 per barrel. A year ago, WTI was at $68, and Brent was at $76 - so oil prices are down 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.89 per gallon. A year ago prices were at $2.80 per gallon, so gasoline prices are up 9 cents per gallon year-over-year.

April 2019: Unofficial Problem Bank list increased slightly to 73 Institutions

by Calculated Risk on 4/28/2019 11:05:00 AM

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for April 2019.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for April 2019. It was quiet during the month in terms of changes as the list increased by one institution to 73 banks. Aggregate assets increased to $52.1 billion from $51.6 billion a month earlier. A year ago, the list held 94 institutions with assets of $18.9 billion. The addition this month was CFSBANK, Charleroi, PA ($488 million).

Saturday, April 27, 2019

Schedule for Week of April 28, 2019

by Calculated Risk on 4/27/2019 08:11:00 AM

The key report scheduled for this week is the April employment report.

Other key reports include Case-Shiller house prices, ISM Manufacturing survey, Vehicle Sales and Personal Income and Outlays for March.

For manufacturing, the April Dallas manufacturing survey will be released.

The FOMC meets this week, and no change to policy is expected at this meeting.

8:30 AM ET: Personal Income and Outlays, March 2019. The consensus is for a 0.4% increase in personal income, and for a 0.7% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for April. This is the last of regional manufacturing surveys for April.

9:00 AM: S&P/Case-Shiller House Price Index for February.

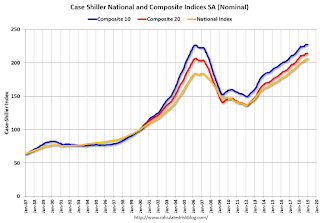

9:00 AM: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 3.2% year-over-year increase in the Comp 20 index for February.

9:45 AM: Chicago Purchasing Managers Index for April.

10:00 AM: Pending Home Sales Index for March. The consensus is for a 0.6% increase in the index.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

All day: Light vehicle sales for April. The consensus is for light vehicle sales to be 17.0 million SAAR in April, down from 17.5 million in March (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for April. The consensus is for light vehicle sales to be 17.0 million SAAR in April, down from 17.5 million in March (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the February sales rate.

8:15 AM: The ADP Employment Report for April. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in April, up from 129,000 added in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 55.0, down from 55.3 in March.

10:00 AM: ISM Manufacturing Index for April. The consensus is for the ISM to be at 55.0, down from 55.3 in March.Here is a long term graph of the ISM manufacturing index.

The PMI was at 55.3% in March, up from 54.2% in February. The employment index was at 57.5% and the new orders index was at 57.4%.

10:00 AM: Construction Spending for March. The consensus is for a 0.2% increase in construction spending.

2:00 PM: FOMC Meeting Announcement. No change to policy is expected at this meeting.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. Last week the DOL reported 230 thousand initial claims.

8:30 AM: Employment Report for April. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.

8:30 AM: Employment Report for April. The consensus is for 180,000 jobs added, and for the unemployment rate to be unchanged at 3.8%.There were 196,000 jobs added in March, and the unemployment rate was at 3.8%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In March the year-over-year change was 2.537 million jobs.

10:00 AM: the ISM non-Manufacturing Index for April. The consensus is for a reading of 57.2, up from 56.1.

Friday, April 26, 2019

For Fun: Jim the Realtor in 2009

by Calculated Risk on 4/26/2019 06:18:00 PM

Long time readers will remember the hilarious Jim the Realtor videos. Back, during the foreclosure crisis, Jim videoed a number of REO (Bank Real Estate Owned), and this one reminded him of Scarface.

Check out the backyard!

Freddie Mac: Mortgage Serious Delinquency Rate Decreased in March

by Calculated Risk on 4/26/2019 03:31:00 PM

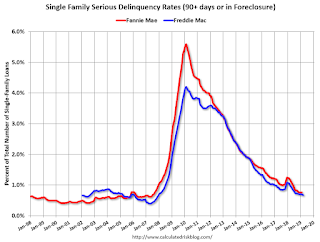

Freddie Mac reported that the Single-Family serious delinquency rate in March was 0.67%, down from 0.69% in February. Freddie's rate is down from 0.97% in March 2018.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

This is the lowest serious delinquency rate for Freddie Mac since December 2007.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

I expect the delinquency rate to decline to a cycle bottom in the 0.5% to 0.7% range - so this is close to a bottom.

Note: Fannie Mae will report for March soon.

Q1 Review: Ten Economic Questions for 2019

by Calculated Risk on 4/26/2019 01:07:00 PM

At the end of last year, I posted Ten Economic Questions for 2019. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2019 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q1 review (it is very early in the year). I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2019: Will housing inventory increase or decrease in 2019?

"I expect to see inventory up again year-over-year in December 2019. My reasons for expecting more inventory are 1) inventory is still historically low (inventory in November 2018 was the second lowest since 2000), 2) higher mortgage rates, and 3) further negative impact in certain areas from new tax law."According to the March NAR report on existing home sales, inventory was up 2.4% year-over-year in March, and the months-of-supply was at 3.9 months. It is very early, and the inventory build has slowed recently as mortgage rates declined, but I still expect some increase in inventory this year.

9) Question #9 for 2019: What will happen with house prices in 2019?

"If inventory increases further year-over-year as I expect by December 2019, it seems likely that price appreciation will slow to the low single digits - maybe around 3%."If is very early, but the CoreLogic data for February showed prices up 4.0% year-over-year. The January Case-Shiller data showed prices up 4.3% YoY - and slowing. Currently it appears price gains will slow in 2019.

8) Question #8 for 2019: How much will Residential Investment increase?

"Most analysts are looking for starts and new home sales to increase to slightly in 2019. For example, the NAHB is forecasting a slight increase in starts (to 1.269 million), and no change in home sales in 2019. And Fannie Mae is forecasting a slight increase in starts (to 1.265 million), and for new home sales to increase to 619 thousand in 2019.Through March, starts were down 9.7% year-over-year compared to the same period in 2018. New home sales were also up 1.7% year-over-year. It is early, but it appears starts will be down slightly this year, and new home sales will be up.

My sense is the weakness in late 2018 will continue into 2019, and starts will be down year-over-year, but not a huge decline. My guess is starts will decrease slightly in 2019 and new home sales will be close to 600 thousand."

7) Question #7 for 2019: How much will wages increase in 2019?

"As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3.5% in 2019 according to the CES."Through March 2019, nominal hourly wages were up 3.2% year-over-year. It is early, but it appears wages will increase faster in 2019 than in 2018.

6) Question #6 for 2019: Will the Fed raise rates in 2019, and if so, by how much?

"My current guess is just one hike in the 2nd half of the year."It now appears the Fed will be "patient" and not increase rates this year.

5) Question #5 for 2019: Will the core inflation rate rise in 2019? Will too much inflation be a concern in 2019?

The Fed is projecting core PCE inflation will increase to 2.0% to 2.1% by Q4 2019. There are risks for higher inflation with the labor market near full employment, however I do think there are structural reasons for low inflation (demographics, few employment agreements that lead to wage-price-spiral, etc).It is early, but inflation is currently close to the Fed's target. There is growing concern that inflation will soften in 2019, and that will be something to watch.

So, although I think core PCE inflation (year-over-year) will increase in 2019 and be around 2% by Q4 2019 (up from 1.9%), I think too much inflation will still not be a serious concern in 2019.

4) Question #4 for 2019: What will the unemployment rate be in December 2019?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the mid 3's by December 2019 from the current 3.7%. My guess is based on the participation rate being mostly unchanged in 2019, and for decent job growth in 2019, but less than in 2018 or 2017.The unemployment rate was at 3.8% in March, and it appears the unemployment rate will decline further in 2019.

3) Question #3 for 2019: Will job creation in 2019 be as strong as in 2018?

So my forecast is for gains of around 133,000 to 167,000 payroll jobs per month in 2019 (about 1.6 million to 2.0 million year-over-year) . This would be the fewest job gains since 2010, but another solid year for employment gains given current demographics.Through March 2019, the economy has added 541,000 thousand jobs, or 180,000 per month. This is slightly above my forecast, and - so far - it appears job growth will slow this year compared to 2018.

2) Question #2 for 2019: How much will the economy grow in 2019?

"Looking to 2019, fiscal policy will still be a positive for growth - although the boost will fade over the course of the year, and become a drag in 2020. And oil prices declined sharply in late 2018, and this will be a drag on economic growth in 2019. Auto sales are mostly moving sideways, and housing has been under pressure due to higher mortgage rates and the new tax plan.GDP growth was solid in Q1 at 3.2%, although the underlying details were weaker than the headline number. Last year I was forecasting a pickup in growth - and that happened - and this year I expect growth to slow over the course of the year.

These factors suggest growth will slow in 2019, probably to the low 2s -and maybe even a 1 handle."

1) Question #1 for 2019: Will Mr. Trump negatively impact the economy in 2019?

My forecasts are based on a limited negative impact from Mr. Trump - and I hope that remains the case. But he is a key downside risk for the economy.So far so good, but Mr. Trump's words and actions remain key risks for the economy.

The Fed will probably not raise rates this year, and it appears new home sales might be higher than I originally expected, but overall - and it is very early - it looks like 2019 is unfolding mostly as expected.

Q1 GDP: Investment

by Calculated Risk on 4/26/2019 08:54:00 AM

Investment was weak in Q1 (although private inventories increased). Also personal consumption expenditures (PCE) was weak (only increased at a 1.2% annual rate).

The first graph below shows the contribution to GDP from residential investment, equipment and software, and nonresidential structures (3 quarter trailing average). This is important to follow because residential investment tends to lead the economy, equipment and software is generally coincident, and nonresidential structure investment trails the economy.

In the graph, red is residential, green is equipment and software, and blue is investment in non-residential structures. So the usual pattern - both into and out of recessions is - red, green, blue.

The dashed gray line is the contribution from the change in private inventories.

Residential investment (RI) decreased in Q1 (-2.8% annual rate in Q1). Equipment investment increased slightly at a 0.2% annual rate, and investment in non-residential structures decreased at a 0.8% annual rate.

On a 3 quarter trailing average basis, RI (red) is down slightly, equipment (green) is slightly positive, and nonresidential structures (blue) is down slightly.

Recently RI has been soft, but the decrease is fairly small.

I'll post more on the components of non-residential investment once the supplemental data is released.

Residential Investment as a percent of GDP decreased in Q1, however RI has generally been increasing. RI as a percent of GDP is only just above the bottom of the previous recessions - and I expect RI to continue to increase further in this cycle.

The increase is now primarily coming from single family investment and home remodeling.

I'll break down Residential Investment into components after the GDP details are released.

Note: Residential investment (RI) includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories.

BEA: Real GDP increased at 3.2% Annualized Rate in Q1

by Calculated Risk on 4/26/2019 08:34:00 AM

From the BEA: Gross Domestic Product, First Quarter 2019 (Advance Estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the first quarter of 2019, according to the "advance" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2018, real GDP increased 2.2 percent....The advance Q1 GDP report, with 2.6% annualized growth, was above expectations.

The increase in real GDP in the first quarter reflected positive contributions from personal consumption expenditures (PCE), private inventory investment, exports, state and local government spending, and nonresidential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased. These contributions were partly offset by a decrease in residential investment.

The acceleration in real GDP growth in the first quarter reflected an upturn in state and local government spending, accelerations in private inventory investment and in exports, and a smaller decrease in residential investment. These movements were partly offset by decelerations in PCE and nonresidential fixed investment, and a downturn in federal government spending. Imports, which are a subtraction in the calculation of GDP, turned down.

emphasis added

Personal consumption expenditures (PCE) increased at 1.2% annualized rate in Q1, down from 3.2% in Q4. Residential investment (RI) decreased 2.8% in Q1. Equipment investment increased at a 0.2% annualized rate, and investment in non-residential structures decreased at a 0.8% pace.

I'll have more later ...

Thursday, April 25, 2019

Friday: Q1 GDP

by Calculated Risk on 4/25/2019 08:25:00 PM

From Goldman Sachs today on Q1 GDP:

We boosted our Q1 GDP forecast by two tenths to +2.6% (qoq ar) ahead of tomorrow’s advance release, reflecting the firm pace of durable inventory growth and the surprising rebound in commercial aircraft shipments in March.Friday:

emphasis added

• At 8:30 AM ET, Gross Domestic Product, 1st quarter 2019 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.2% in Q4.

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 97.1.

Merrill April Employment Report Forecast: 250K, 3.7%

by Calculated Risk on 4/25/2019 04:20:00 PM

A few brief excerpts from a Merrill Lynch research note:

We look for nonfarm payroll employment growth of 250k in the April Bureau of Labor Statistics (BLS) employment report, to be released on May 3rd. …

we think the strong job growth should put further downward pressure on the unemployment rate and look for it to decline to 3.7% from 3.8%. …

we look for wage growth to return back to the recent trend and forecast that average hourly earnings growth of 0.3% mom