by Calculated Risk on 2/22/2019 02:01:00 PM

Friday, February 22, 2019

Q4 GDP Forecasts: High-1s, Low-2s, 2018 Annual GDP around 2.8%

The BEA has announced that the Q4 advanced GDP report will be combined with the 2nd estimate of GDP, and will be released on Feb 28th.

From Merrill Lynch:

Weak retail sales data and inventory build caused a 0.8pp decline in our 4Q GDP tracking estimate to 1.5% from 2.3% [Feb 14 estimate]From the NY Fed Nowcasting Report

emphasis added

The New York Fed Staff Nowcast stands at 2.3% for 2018:Q4 and 1.2% for 2019:Q1. [Feb 22 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2018 is 1.4 percent on February 21, down from 1.5 percent on February 14. [Feb 21 estimate]CR Note: These estimates suggest GDP in the high 1s for Q4.

Using the middle of these three forecasts (about 1.8% real GDP growth in Q4), that would put 2018 annual GDP growth at around 2.8%. This would be the best year since 2015, but lower than many forecasts.

Fannie and Freddie: Combined REO inventory declined in Q4, Down 21% Year-over-year

by Calculated Risk on 2/22/2019 01:48:00 PM

Fannie and Freddie reported results for Q4 2018. Here is some information on Real Estate Owned (REOs).

Freddie Mac reported the number of REO declined to 7,100 at the end of Q4 2018 compared to 8,299 at the end of Q4 2017.

For Freddie, this is down 91% from the 74,897 peak number of REOs in Q3 2010.

Fannie Mae reported the number of REO declined to 20,156 at the end of Q4 2018 compared to 26,311 at the end of Q4 2017.

For Fannie, this is down 88% from the 166,787 peak number of REOs in Q3 2010.

Here is a graph of Fannie and Freddie Real Estate Owned (REO).

REO inventory decreased in 2018, and combined inventory is down 21% year-over-year.

This is close to normal levels of REOs.

MBA: The Unemployment Rate and Mortgage Delinquency Rate

by Calculated Risk on 2/22/2019 09:52:00 AM

An interesting chart from the Mortgage Bankers Association’s (MBA):

Last week, MBA Research released fourth quarter of 2018 results of its National Delinquency Survey (NDS). The delinquency rate for mortgage loans on one‐to‐four‐unit residential properties was 4.06 percent – down 41 basis points from the previous quarter, 111 basis points from the fourth quarter of 2017 and at its lowest level since the first quarter of 2000.

In this week’s chart, we show the relationship between the unemployment rate, supplied by the U.S. Bureau of Labor Statistics (BLS), and the mortgage delinquency rate for all loans over a 30‐year period.

Nine years ago (the first quarter of 2010) during the aftermath of the Great Recession, the unemployment rate reached 9.83 percent, and the mortgage delinquency rate was at its peak of 10.06 percent. Fast forward to last year’s fourth quarter, the unemployment rate was 3.80 percent and nearing 50‐year lows, and the mortgage delinquency rate (4.06 percent) was at an 18‐year low.

Click on graph for larger image.

Click on graph for larger image.The close tracking between unemployment and mortgage delinquency rates from the period 1988‐2008 appears less pronounced than from 2008‐2018. For example, the unemployment rate reached 7.63 percent in the third quarter of 1992, while the mortgage delinquency rate was relatively low in comparison, at 4.58 percent. Possible factors influencing this change include differences in mortgage product mix and criteria, borrower behavior and recession severity.CR Note: The mortgage delinquency rate is currently near all time lows for this series.

Thursday, February 21, 2019

Hotels: Occupancy Rate Increased Year-over-year

by Calculated Risk on 2/21/2019 05:34:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 16 February

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 10-16 February 2019, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 11-17 February 2018, the industry recorded the following:

• Occupancy: +0.7% to 63.5%

• Average daily rate (ADR): +2.7% to US$131.99

• Revenue per available room (RevPAR): +3.4% to US$83.88

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2019, dash light blue is 2018, blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

A decent start for 2019.

Seasonally, the occupancy rate will increase over the next month or so into the Spring travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Comments on January Existing Home Sales

by Calculated Risk on 2/21/2019 12:41:00 PM

Earlier: NAR: Existing-Home Sales Decreased to 4.94 million in January

A few key points:

1) The key for housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Unfortunately this key data has been delayed due to the government shutdown. However, overall, this is still a somewhat reasonable level for existing home sales, and the weakness at the end of 2018 and early 2019 was no surprise given the increase in mortgage rates.

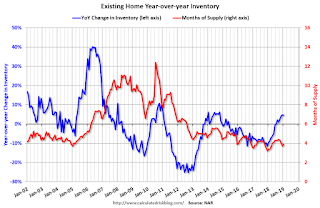

2) Inventory is still low, but was up 4.6% year-over-year (YoY) in January. This was the sixth consecutive month with a year-over-year increase in inventory, although the YoY increase was slightly smaller in January than in December.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in January . The consensus was for sales of 5.05 million SAAR, Lawler estimated the NAR would report 4.92 million SAAR in January, and the NAR actually reported 4.94 million SAAR.

The current YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending. This winter (light blue arrow), inventory is following the normal seasonal pattern.

Although I expected inventory to increase YoY in 2019, I also expected inventory to once again follow the normal seasonal pattern.

Also inventory levels remain somewhat low, and could increase more and still be at normal levels. No worries.

Sales NSA in January (285,000, red column) were below sales in January 2018 (313,000, NSA), and sales were the lowest for January since 2015.

NAR: Existing-Home Sales Decreased to 4.94 million in January

by Calculated Risk on 2/21/2019 10:12:00 AM

From the NAR: Existing-Home Sales Drop 1.2 Percent in January

Existing-home sales experienced a minor drop for the third consecutive month in January, according to the National Association of Realtors®. Of the four major U.S. regions, only the Northeast saw an uptick in sales activity last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 1.2 percent from December to a seasonally adjusted annual rate of 4.94 million in January. Sales are now down 8.5 percent from a year ago (5.40 million in January 2018).

...

Total housing inventory at the end of January increased to 1.59 million, up from 1.53 million existing homes available for sale in December, and represents an increase from 1.52 million a year ago. Unsold inventory is at a 3.9-month supply at the current sales pace, up from 3.7 months in December and from 3.4 months in January 2018.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (4.94 million SAAR) were down 1.2% from last month, and were 8.5% below the January 2018 sales rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.59 million in January from 1.53 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.59 million in January from 1.53 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 4.6% year-over-year in January compared to January 2018.

Inventory was up 4.6% year-over-year in January compared to January 2018. Months of supply was at 3.9 months in January.

For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...

Philly Fed Mfg "Weakened" in February

by Calculated Risk on 2/21/2019 09:11:00 AM

From the Philly Fed: February 2019 Manufacturing Business Outlook Survey

Manufacturing conditions in the region weakened this month, according to firms responding to the February Manufacturing Business Outlook Survey. The indicators for general activity, new orders, and shipments fell into negative territory, but the indicator for employment remained positive. Input prices also moderated notably this month. The survey’s indexes for future conditions were mostly steady, with firms remaining generally optimistic about growth over the next six months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The index for current manufacturing activity in the region decreased from a reading of 17.0 in January to -4.1 this month. This is the index’s first negative reading since May 2016. Both the new orders and shipments indexes also fell this month. The current new orders index decreased nearly 24 points to -2.4, and the current shipments index decreased 17 points to -5.3.

The firms continued to add to their payrolls this month. The current employment index improved from a reading of 9.6 in January to 14.5 this month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through February), and five Fed surveys are averaged (blue, through January) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through January (right axis).

This suggests the ISM manufacturing index will show expansion again in February, but at a level than in January.

Weekly Initial Unemployment Claims decreased to 216,000

by Calculated Risk on 2/21/2019 08:38:00 AM

The DOL reported:

In the week ending February 16, the advance figure for seasonally adjusted initial claims was 216,000, a decrease of 23,000 from the previous week's unrevised level of 239,000. The 4-week moving average was 235,750, an increase of 4,000 from the previous week's unrevised average of 231,750. This is the highest level for this average since January 20, 2018 when it was 237,500.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 235,750.

This was lower than the consensus forecast.

Wednesday, February 20, 2019

Thursday: Existing Home Sales, Unemployment Claims, Philly Fed Mfg, Durable Goods

by Calculated Risk on 2/20/2019 09:04:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 239 thousand the previous week.

• Also at 8:30 AM, Durable Goods Orders for January from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

• Also at 8:30 AM, the Philly Fed manufacturing survey for February. The consensus is for a reading of 14.5, down from 17.0.

• At 10:00 AM, Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 5.05 million SAAR, up from 4.99 million. See: Existing Home Sales for January: Take the Under

Existing Home Sales for January: Take the Under

by Calculated Risk on 2/20/2019 05:23:00 PM

The NAR is scheduled to release Existing Home Sales for January at 10:00 AM on Thursday, February 21st.

The consensus is for 5.05 million SAAR, up from 4.99 million in December. Housing economist Tom Lawler estimates the NAR will reports sales of 4.92 million SAAR for January and that inventory will be up 6.6% year-over-year. Based on Lawler's estimate, I expect existing home sales to be below the consensus for January.

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for almost 9 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

Last month, in December 2018, the consensus was for sales of 5.24 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated the NAR would report 4.97 million, and the NAR reported 4.99 million (as usual Lawler was closer than the consensus).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

Over the last eight plus years, the consensus average miss was 144 thousand, and Lawler's average miss was 67 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | 5.43 |

| Jun-18 | 5.45 | 5.35 | 5.38 |

| Jul-18 | 5.43 | 5.40 | 5.34 |

| Aug-18 | 5.36 | 5.36 | 5.34 |

| Sep-18 | 5.30 | 5.20 | 5.15 |

| Oct-18 | 5.20 | 5.31 | 5.22 |

| Nov-18 | 5.19 | 5.23 | 5.32 |

| Dec-18 | 5.24 | 4.97 | 4.99 |

| Jan-19 | 5.05 | 4.92 | --- |

| 1NAR initially reported before revisions. | |||