by Calculated Risk on 1/15/2019 06:50:00 PM

Tuesday, January 15, 2019

Wednesday: Retail Sales (Postponed), Homebuilder Survey, Beige Book

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, POSTPONED Retail sales for December is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

• At 10:00 AM, The January NAHB homebuilder survey. The consensus is for a reading of 57, up from 54. Any number above 50 indicates that more builders view sales conditions as good than poor.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

NAHB: Builder Confidence decreases for the 55+ Housing Market in Q3

by Calculated Risk on 1/15/2019 04:06:00 PM

I haven't posted this in some time. This is a quarterly index that was released last year by the the National Association of Home Builders (NAHB). This index is similar to the overall housing market index (HMI). The NAHB started this index in Q4 2008 (during the housing bust), so the readings were initially very low

From the NAHB: Builder Confidence in the 55+ Housing Market Drops in the Third Quarter

Builder confidence in the single-family 55+ housing market dropped seven points to 60 in the third quarter, according to the National Association of Home Builders' (NAHB) 55+ Housing Market Index (HMI) ... Although the index declined, it is still in positive territory as a reading above 50 means that more builders view conditions as good than poor.

“Although various headwinds are starting to have an impact on the 55+ housing market, there are many parts of the country where the market is still doing well,” said Chuck Ellison, chairman of NAHB's 55+ Housing Industry Council and Vice President-Land of Miller & Smith in McLean, Va. “In some places it is becoming a challenge for builders to provide housing at prices their customers can afford.”

...

“The decline in the single-family 55+ HMI is consistent with the recent weakness in new and existing home sales,” said NAHB Chief Economist Robert Dietz. “The high readings seen in the previous three quarters are not sustainable with high construction costs and rising interest rates.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the NAHB 55+ Single Family HMI through Q3 2018. Any reading above 50 indicates that more builders view conditions as good than as poor. The index decreased to 60 in Q3 down from 67 in Q2.

There are two key drivers in addition to the improved economy: 1) there is a large cohort that recently moved into the 55+ group, and 2) the homeownership rate typically increases for people in the 55 to 70 year old age group. So demographics should be favorable for the 55+ market.

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 1/15/2019 11:56:00 AM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is expanding solidly now.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

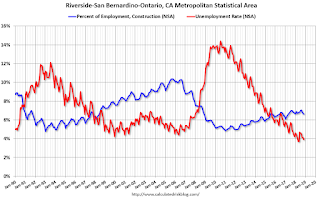

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, and is down to 3.9% (down from 14.4% in 2010). And construction employment is up from the lows (as a percent of total employment), but still well below the bubble years.

So the unemployment rate has fallen to a record low, and the economy isn't as heavily depending on construction. Overall the Inland Empire economy is in much better shape today.

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..Clearly the Inland Empire is more dependent on construction than most areas. Construction has picked up as a percent of total employment, but the economy in California and the U.S. is not as dependent on construction as during the bubble years.

NY Fed: Manufacturing "Business activity grew slightly in New York State"

by Calculated Risk on 1/15/2019 08:38:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity grew slightly in New York State, according to firms responding to the January 2019 Empire State Manufacturing Survey. The headline general business conditions index fell eight points to 3.9, its lowest level in well over a year. New orders increased at a slower pace than in recent months, while shipments continued to climb significantly.This was well below the consensus forecast, and the weakest reading since May 2017.

…

The index for number of employees fell ten points but remained positive at 7.4, indicating a modest increase in employment levels, while the average workweek index held steady at 6.8.

…

Firms were less optimistic about the six-month outlook than in recent months. The index for future business conditions fell thirteen points to 17.8, and the indexes for future new orders and shipments also declined.

emphasis added

Monday, January 14, 2019

Mortgages Rates: 30 Year Fixed at 4.5%

by Calculated Risk on 1/14/2019 06:26:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Unchanged to Start the Week

Mortgage rates held their ground today, keeping them in line with long-term lows achieved over the past 2 weeks. To be fair, it was the previous week that offered the biggest benefits, but last week was no slouch. Factoring out the first few days of January, it would have been the best week for mortgage rates since April 2018. [30YR FIXED - 4.5%]Tuesday:

emphasis added

• At 8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.2% increase in core PPI.

• At 8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 12.0, up from 10.9.

Fed: Q3 2018 Household Debt Service Ratio at Series Low

by Calculated Risk on 1/14/2019 12:41:00 PM

The Fed's Household Debt Service ratio through Q3 2018 was released last week: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio decreased in Q3, and is at a new series low. Note: The financial obligation ratio (FOR) also decreased in Q3.

The DSR for mortgages (blue) is also at a series low. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) had been increasing, but has decreased recently.

This data suggests aggregate household cash flow has improved significantly since the great recession.

Housing Inventory Tracking

by Calculated Risk on 1/14/2019 08:44:00 AM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 4.2% year-over-year (YoY) in November, this was the fourth consecutive month with a YoY increase, following over three years of YoY declines.

The graph below shows the YoY change for non-contingent inventory in Houston and Las Vegas (through December), and Phoenix and Sacramento (through November) and total existing home inventory as reported by the NAR (through November). (I'll be adding more areas).

The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory was up 82% YoY in Las Vegas in December (red), the sixth consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up 13% year-over-year in Houston in December. With falling oil prices - along with higher mortgage rates - inventory will probably increase in Houston.

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect further increase in inventory in 2019.

Also note that inventory in Seattle was up 272% year-over-year in December, and Denver up 45% YoY (not graphed)!

Sunday, January 13, 2019

Sunday Night Futures

by Calculated Risk on 1/13/2019 06:59:00 PM

Weekend:

• Schedule for Week of January 13, 2019

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 10 and DOW futures are down 92 (fair value).

Oil prices were up over the last week with WTI futures at $51.91 per barrel and Brent at $60.87 per barrel. A year ago, WTI was at $64, and Brent was at $70 - so oil prices are down about 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.24 per gallon. A year ago prices were at $2.52 per gallon, so gasoline prices are down 28 cents per gallon year-over-year.

Update: "Scariest jobs chart ever"

by Calculated Risk on 1/13/2019 02:16:00 PM

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions.

Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary!

I retired the graph in May 2014 when employment finally exceeded the pre-recession peak.

I keep getting asked if I could post an update to the graph, and here it is through the December 2018 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 8.6% above the previous peak.

Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession).

Saturday, January 12, 2019

Schedule for Week of January 13th

by Calculated Risk on 1/12/2019 08:11:00 AM

Special Note on Government Shutdown: If the Government shutdown continues, then some additional releases will be delayed. For example, this coming week, the retail sales and housing starts reports will not be released if the government remains shutdown. (see bottom for key releases already delayed).

The key reports this week are December housing starts and retail sales.

For manufacturing, the December Industrial Production report and the January NY and Philly Fed manufacturing surveys will be released.

No major economic releases scheduled.

8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.1% decrease in PPI, and a 0.2% increase in core PPI.

8:30 AM: The New York Fed Empire State manufacturing survey for January. The consensus is for a reading of 12.0, up from 10.9.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.2% increase in retail sales.

8:30 AM: Retail sales for December is scheduled to be released. The consensus is for a 0.2% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 3.6% on a YoY basis.

10:00 AM: The January NAHB homebuilder survey. The consensus is for a reading of 57, up from 54. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM: Housing Starts for December.

8:30 AM: Housing Starts for December. This graph shows single and total housing starts since 1968.

The consensus is for 1.256 million SAAR, unchanged from 1.256 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 216 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for January. The consensus is for a reading of 10.0, up from 9.4.

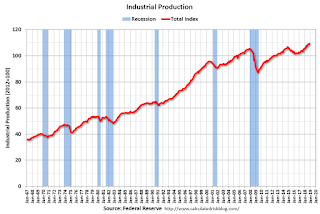

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for December.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to be unchanged at 78.5%.

10:00 AM: University of Michigan's Consumer sentiment index (Final for January). The consensus is for a reading of 97.0.

10:00 AM: State Employment and Unemployment (Monthly) for December 2018

New Home Sales (Census) for November from the Census Bureau. The consensus was for 560 thousand SAAR, up from 544 thousand in October.

Construction Spending (Census) for November. The consensus was for a 0.3% increase in construction spending.

Light vehicle sales (BEA) for December. The consensus was for light vehicle sales to be 17.2 million SAAR in December, down from 17.4 million in November (Seasonally Adjusted Annual Rate).

Trade Balance report (Census) for November from the Census Bureau. The consensus was the trade deficit would be $53.9 billion. The U.S. trade deficit was at $55.5 billion in October.