by Calculated Risk on 12/20/2018 11:04:00 AM

Thursday, December 20, 2018

Black Knight: National Mortgage Delinquency Rate Increased Slightly in November

From Black Knight: Black Knight’s First Look: November Prepayment Activity Hits 10-Year Low as Refinances Fall and Housing Turnover Sees Seasonal Decline

• Prepayment activity fell 14 percent month-over-month and 29 percent year-over-year to its lowest level since November 2008According to Black Knight's First Look report for November, the percent of loans delinquent increased 1.8% in November compared to October, and decreased 18.5% year-over-year.

• Historically, prepayments were driven primarily by refinance activity but, more recently, the primary driver has become housing sales

• The last time the prepayment rate was this low – in the heat of the financial crisis – interest rates were above 6 percent and purchase lending had fallen by more than 50 percent in a 24-month span

• Delinquencies saw a slight seasonal increase in November, but remain 19 percent below last year’s level

• Serious delinquencies (90 or more days past due) also increased slightly for the month; now stand at 510,00

• Foreclosure starts fell by 11 percent month-over-month, with an estimated 45,200 starts in November

• A slight uptick in foreclosure inventory was offset by a month-over-month increase in the number of outstanding mortgages, resulting in a net decline in the national foreclosure rate

The percent of loans in the foreclosure process decreased 0.2% in November and were down 22.0% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.71% in November, up from 3.64% in October.

The percent of loans in the foreclosure process decreased slightly in November to 0.52% from 0.52% in October.

The number of delinquent properties, but not in foreclosure, is down 399,000 properties year-over-year, and the number of properties in the foreclosure process is down 69,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Nov 2018 | Oct 2018 | Nov 2017 | Nov 2016 | |

| Delinquent | 3.71% | 3.64% | 4.55% | 4.46% |

| In Foreclosure | 0.52% | 0.52% | 0.66% | 0.98% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,925,000 | 1,884,000 | 2,324,000 | 2,263,000 |

| Number of properties in foreclosure pre-sale inventory: | 268,000 | 267,000 | 337,000 | 498,000 |

| Total Properties | 2,193,000 | 2,152,000 | 2,661,000 | 2,761,000 |

Philly Fed Mfg "Indicators Remained Muted" in December

by Calculated Risk on 12/20/2018 08:53:00 AM

From the Philly Fed: December 2018 Manufacturing Business Outlook Survey

Manufacturing activity in the region continued to grow but remained subdued, according to results from the December Manufacturing Business Outlook Survey. The survey’s broad indicators were positive, but their movements were mixed this month: The general activity and shipments indicators fell from their readings last month, while the indicators for new orders and employment increased. The firms remained generally optimistic about future growth.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity decreased from 12.9 in November to 9.4 this month, its lowest reading since August 2016 … The firms continued to report overall higher employment. Over 24 percent of the responding firms reported increases in employment this month, while 6 percent of the firms reported decreases in employment. The current employment index remained positive and edged 2 points higher to 18.3. The current workweek index fell 6 points to 0.5, its lowest reading in 26 months.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through December), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through November (right axis).

This suggests the ISM manufacturing index will show expansion again in December, but will likely be lower than in November.

Weekly Initial Unemployment Claims increased to 214,000

by Calculated Risk on 12/20/2018 08:36:00 AM

The DOL reported:

In the week ending December 15, the advance figure for seasonally adjusted initial claims was 214,000, an increase of 8,000 from the previous week's unrevised level of 206,000. The 4-week moving average was 222,000, a decrease of 2,750 from the previous week's unrevised average of 224,750.The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 222,000.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, December 19, 2018

Thursday: Unemployment Claims, Philly Fed Mfg Survey

by Calculated Risk on 12/19/2018 07:07:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 221 thousand initial claims, up from 206 thousand the previous week.

• At 8:30 AM, the Philly Fed manufacturing survey for December. The consensus is for a reading of 17.5, up from 12.9.

Merrill and Goldman comments on Fed Rate Hike

by Calculated Risk on 12/19/2018 05:27:00 PM

Some brief excerpts from research notes by economists at Merrill Lynch and Goldman Sachs …

From Merrill Lynch:

The Fed hiked rates while signaling a lower path, as we expected. ... We think Fed Chair Powell delivered a clear message: when the Fed has reached the neutral target range, there is a need for greater caution and policy to become ever more data dependent. This means that the threshold to bring rates into restrictive territory - above the neutral rate - is high. The Fed would need to see convincing data including a further decline in the unemployment rate, above target inflation with inflation expectations shifting higher and cooperative financial markets.From Goldman:

We are changing our call for the Fed. We now expect the Fed to hike just two more times in 2019 with no additional hikes in 2020. This would leave the terminal rate of the cycle to be 2.75 - 3.0% and shaves 50bp off our previous path of the Fed. The market has already shifted and is not even pricing in a full hike in 2019 with cuts in 2020. In our view, the Fed is too optimistic about the terminal rate but the market is too pessimistic. In addition, consistent with our forecast for fewer Fed hikes, we lower our US interest rate forecasts across the curve, with the 10yr ending at 3%.

The FOMC raised the funds rate target range to 2¼% -2½%, as widely expected. The median dot in the Summary of Economic Projections now shows a 2-1 baseline for rate hikes in 2019-2020, compared to 3-1 in September, but the average dot declined significantly, a dovish surprise suggesting broad endorsement of the new baseline. Changes to the post-meeting statement were generally dovish as well. While the growth characterization was more upbeat than we had expected, the policy guidance was a bit more dovish than we had expected.

FOMC Projections

by Calculated Risk on 12/19/2018 03:47:00 PM

Statement here.

Powell press conference video here.

On the projections, growth was revised down slightly, and inflation was softer.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.0 to 3.1 | 2.3 to 2.5 | 1.8 to 2.0 |

| Sep 2018 | 3.0 to 3.2 | 2.4 to 2.7 | 1.8 to 2.1 |

| Jun 2018 | 2.7 to 3.0 | 2.2 to 2.6 | 1.8 to 2.0 |

The unemployment rate was at 3.7% in November. So the unemployment rate projection for 2018 was unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Dec 2018 | 3.7 | 3.5 to 3.7 | 3.5 to 3.8 |

| Sep 2018 | 3.7 | 3.4 to 3.6 | 3.4 to 3.8 |

| Jun 2018 | 3.6 to 3.7 | 3.4 to 3.5 | 3.4 to 3.7 |

As of October, PCE inflation was up 2.0% from October 2017. PCE inflation projections were revised down for 2018, 2019, and 2020.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 1.8 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 2.0 to 2.1 | 2.0 to 2.1 | 2.1 to 2.2 |

| Jun 2018 | 2.0 to 2.1 | 2.0 to 2.2 | 2.1 to 2.2 |

PCE core inflation was up 1.8% in October year-over-year. Core PCE inflation was revised down slightly for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Dec 2018 | 1.8 to 1.9 | 2.0 to 2.1 | 2.0 to 2.1 |

| Sep 2018 | 1.9 to 2.0 | 2.0 to 2.1 | 2.1 to 2.2 |

| Jun 2018 | 1.9 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 12/19/2018 03:40:00 PM

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a strong rate. Job gains have been strong, on average, in recent months, and the unemployment rate has remained low. Household spending has continued to grow strongly, while growth of business fixed investment has moderated from its rapid pace earlier in the year. On a 12-month basis, both overall inflation and inflation for items other than food and energy remain near 2 percent. Indicators of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee judges that some further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term. The Committee judges that risks to the economic outlook are roughly balanced, but will continue to monitor global economic and financial developments and assess their implications for the economic outlook.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 2-1/4 to 2‑1/2 percent.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments

Voting for the FOMC monetary policy action were: Jerome H. Powell, Chairman; John C. Williams, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Michelle W. Bowman; Lael Brainard; Richard H. Clarida; Mary C. Daly; Loretta J. Mester; and Randal K. Quarles

emphasis added

AIA: "Run of positive billings continues at architecture firms"

by Calculated Risk on 12/19/2018 12:15:00 PM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Run of positive billings continues at architecture firms

Architecture firm billings growth expanded in November by a healthy margin, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for November was 54.7 compared to 50.4 in October. With the strongest billings growth figure since January and continued strength in new project inquiries and design contracts, billings are closing the year on a strong note.

“Despite some concerns about a potential economic downturn, architecture firms continue to report strong billings, inquiries, and new design contracts,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “For the coming year, concerns about the economy among architecture firm leaders tend to be balanced by their concerns about a lack of qualified employee prospects.”

...

• Regional averages: Northeast (56.8), Midwest (53.1), South (50.5), West (49.0)

• Sector index breakdown: commercial/industrial (53.8), mixed practice (53.8), multi-family residential (51.2), institutional (50.8)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 54.7 in November, up from 50.4 in October. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index has been positive for 14 consecutive months, suggesting a further increase in CRE investment in 2019.

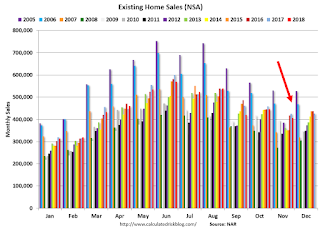

Comments on November Existing Home Sales

by Calculated Risk on 12/19/2018 11:19:00 AM

Earlier: NAR: Existing-Home Sales Increased to 5.32 million in November

Two key points:

1) The key for the housing - and the overall economy - is new home sales, single family housing starts and overall residential investment. Overall this is a reasonable level for existing home sales, and the recent weakness is no surprise given the increase in mortgage rates.

2) Inventory is still low, but was up 4.2% year-over-year (YoY) in November. This was the fourth consecutive month with a year-over-year increase in inventory, and the largest YoY increase since late 2014.

The current slight YoY increase in inventory is nothing like what happened in 2005 and 2006. In 2005 (see red arrow), inventory kept increasing all year, and that was a sign the bubble was ending.

Although I expected inventory to increase YoY in 2018, I also expected inventory to follow the normal seasonal pattern (not keep increasing all year).

Also inventory levels remains low, and could increase much more and still be at normal levels. No worries.

Sales NSA in November (406,000, red column) were below sales in November 2017 (425,000, NSA), but were the third highest since the housing bubble (behind 2016 and 2017).

Sales NSA through November (first eleven months) are down about 2.3% from the same period in 2017.

This is a small YoY decline in sales to-date - it is likely that higher mortgage rates are impacting sales, and it is possible there has been an impact from the changes to the tax law (decreasing property taxes write-off, etc).

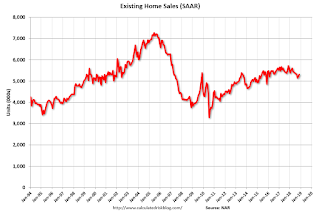

NAR: Existing-Home Sales Increased to 5.32 million in November

by Calculated Risk on 12/19/2018 10:08:00 AM

From the NAR: Existing-Home Sales Increase for Second Consecutive Month

Existing-home sales increased in November, according to the National Association of Realtors®, marking two consecutive months of increases. Three of four major U.S. regions saw gains in sales activity last month.

Total existing-home sales, completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 1.9 percent from October to a seasonally adjusted rate of 5.32 million in November. Sales are now down 7.0 percent from a year ago (5.72 million in November 2017).

...

Total housing inventory at the end of November decreased to 1.74 million, down from 1.85 million existing homes available for sale in October. This represents an increase from 1.67 million a year ago, however. Unsold inventory is at a 3.9-month supply at the current sales pace, down from 4.3 last month and up from 3.5 months a year ago.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in November (5.32 million SAAR) were up 1.9% from last month, but were 7.0% below the November 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory decreased to 1.74 million in November from 1.85 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory decreased to 1.74 million in November from 1.85 million in October. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory was up 4.2% year-over-year in November compared to November 2017.

Inventory was up 4.2% year-over-year in November compared to November 2017. Months of supply was at 3.9 months in October.

For existing home sales, a key number is inventory - and inventory is still low, but appears to have bottomed. I'll have more later ...