by Calculated Risk on 11/28/2018 12:04:00 PM

Wednesday, November 28, 2018

Fed Chair Powell: The Federal Reserve's Framework for Monitoring Financial Stability

From Fed Chair Powell: The Federal Reserve's Framework for Monitoring Financial Stability

Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth. My FOMC colleagues and I, as well as many private-sector economists, are forecasting continued solid growth, low unemployment, and inflation near 2 percent.CR note: This seems pretty consistent with prior comments.

A few Comments on October New Home Sales

by Calculated Risk on 11/28/2018 11:01:00 AM

New home sales for October were reported at 544,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, however the three previous months were revised up significantly. Although weak, this was only a little below the initial report for September of 553,000 (now revised up to 597,000).

Sales in October were down 12.0% year-over-year compared to October 2017. The largest declines were in the Northeast, possibly due to a combination of higher interest rates and changes in the tax law.

On Inventory: Months of inventory is now above the top of the normal range, however the number of units completed and under construction is still somewhat low. Inventory will be something to watch very closely.

Earlier: New Home Sales decrease to 544,000 Annual Rate in October.

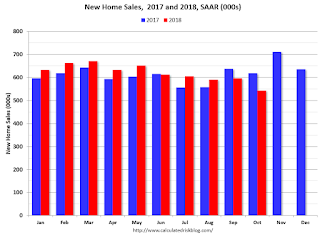

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are only up 2.8% through October compared to the same period in 2017.

And the comparison in November will be very difficult (Sales in November 2017 were strong). And sales might finish the year down from 2017,.

This is below my forecast for 2018 for an increase of about 6% over 2017. As I noted early this year, there were downside risks to that forecast, primarily higher mortgage rates, but also higher costs (labor and material), the impact of the new tax law, and other possible policy errors.

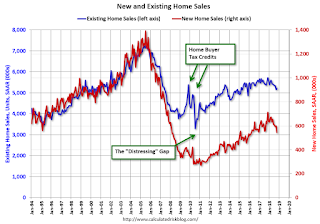

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I still expect this gap to slowly close. However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

New Home Sales decrease to 544,000 Annual Rate in October

by Calculated Risk on 11/28/2018 10:14:00 AM

The Census Bureau reports New Home Sales in October were at a seasonally adjusted annual rate (SAAR) of 544 thousand.

The previous three months were revised up significantly.

"Sales of new single‐family houses in October 2018 were at a seasonally adjusted annual rate of 544,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 8.9 percent below the revised September rate of 597,000 and is 12.0 percent below the October 2017 estimate of 618,000. "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in October to 7.4 months from 6.5 months in September.

The months of supply increased in October to 7.4 months from 6.5 months in September. The all time record was 12.1 months of supply in January 2009.

This is above the normal range (less than 6 months supply is normal).

"The seasonally‐adjusted estimate of new houses for sale at the end of October was 336,000. This represents a supply of 7.4 months at the current sales rate."

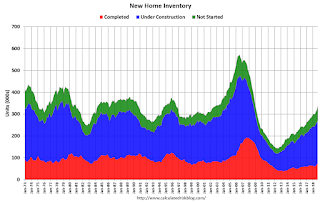

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still somewhat low, and the combined total of completed and under construction is a little low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In October 2018 (red column), 42 thousand new homes were sold (NSA). Last year, 49 thousand homes were sold in October.

The all time high for September was 105 thousand in 2005, and the all time low for October was 23 thousand in 2010.

This was well below expectations of 575,000 sales SAAR, however the previous months were revised up significantly. I'll have more later today.

Q3 GDP Unrevised at 3.5% Annual Rate

by Calculated Risk on 11/28/2018 08:34:00 AM

From the BEA: Gross Domestic Product, Third Quarter 2018 (Second Estimate); Corporate Profits, Third Quarter 2018 (Preliminary Estimate)

Real gross domestic product (GDP) increased at an annual rate of 3.5 percent in the third quarter of 2018, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 4.2 percent.PCE growth was revised down from 4.0% to 3.6%. Residential investment was revised up from -4.0% to -2.6%. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was also 3.5 percent. With this second estimate for the third quarter, the general picture of economic growth remains the same; upward revisions to nonresidential fixed investment and private inventory investment were offset by downward revisions to personal consumption expenditures (PCE) and state and local government spending.

emphasis added

Here is a Comparison of Second and Advance Estimates.

MBA: Mortgage Applications Increased in Latest Weekly Survey

by Calculated Risk on 11/28/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 23, 2018. This week’s results include an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index decreased 28 percent compared with the previous week and was 2 percent higher than the same week one year ago.

...

“After several weeks of market volatility, 30-year fixed mortgage rates decreased four basis points to 5.12 percent last week. Homebuyers responded, with purchase applications 1.7 percent higher than a year ago, and after adjusting for the Thanksgiving holiday, they increased almost 9 percent from the previous week,” said Mike Fratantoni, MBA’s Chief Economist. “The rise in purchase activity was led by conventional purchase applications, which surged almost 12 percent, while government purchases were essentially unchanged over the week. This also pushed the average loan size for purchase applications higher, which likely meant there were fewer first-time homebuyers in the market last week.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 5.12 percent from 5.16 percent, with points decreasing to 0.46 from 0.48 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

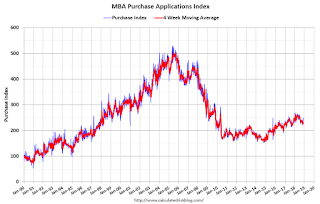

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 2% year-over-year.

Tuesday, November 27, 2018

Wednesday: New Home Sales, GDP, Fed Chair Powell, Richmond Fed Mfg Survey

by Calculated Risk on 11/27/2018 06:59:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 3nd quarter 2018 (Second estimate). The consensus is that real GDP increased 3.5% annualized in Q3, unchanged from the advance estimate of GDP.

• At 10:00 AM, New Home Sales for October from the Census Bureau. The consensus is for 575 thousand SAAR, up from 553 thousand in September.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for November. This is the last of the regional Fed manufacturing surveys for November.

• At 12:00 PM, Speech by Fed Chair Jerome Powell, The Federal Reserve's Framework for Monitoring Financial Stability, At The Economic Club of New York Signature Luncheon, New York, New York

Real House Prices and Price-to-Rent Ratio in September

by Calculated Risk on 11/27/2018 03:33:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in September

It has been over eleven years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 10.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 8.5% below the bubble peak (and historically there has been an upward slope to real house prices). The composite 20, in real terms, is still 12.4% below the bubble peak.

The year-over-year increase in prices has slowed to 5.5% nationally, and will probably slow more as inventory picks up.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $286,000 today adjusted for inflation (43%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA)and the Case-Shiller Composite 20 Index (SA) are both at new all times highs (above the bubble peak).

Real House Prices

In real terms, the National index is back to January 2005 levels, and the Composite 20 index is back to June 2004.

In real terms, house prices are at 2004/2005 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to February 2004 levels, and the Composite 20 index is back to November 2003 levels.

In real terms, prices are back to late 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 11/27/2018 01:30:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

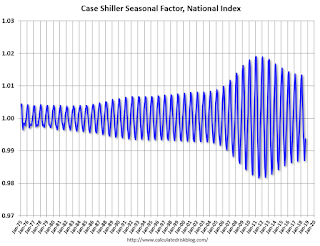

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through September 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Black Knight: National Mortgage Delinquency Rate Decreased in October

by Calculated Risk on 11/27/2018 11:18:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Rebound Strongly in October; Number of Seriously Past-Due Loans Falls Below 500,000 for First Time Since 2006

• After rising sharply in September, mortgage delinquencies fell by 8.2 percent in October and are now down by nearly 18 percent from the same time last yearAccording to Black Knight's First Look report for October, the percent of loans delinquent decreased 8.2% in October compared to September, and decreased 17.9% year-over-year.

• Serious delinquencies – loans 90 or more days past due – fell by 14,000 from last month and 90,000 from last October to hit a more than 12-year low

• Improvements in hurricane-related delinquencies associated with Harvey and Irma – which spiked in late 2017 – are contributing to the strong year-over-year improvements

• Despite foreclosure starts seeing a monthly increase from September’s nearly 18-year low, the number of loans in active foreclosure fell slightly from September and has decreased by 24 percent from last year

• Prepayment activity – now driven primarily by housing turnover – climbed 14 percent, but remains 29 percent below last year’s level

The percent of loans in the foreclosure process decreased 0.5% in October and were down 24.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.64% in October, down from 3.97% in September.

The percent of loans in the foreclosure process decreased slightly in October to 0.52% from 0.52% in September.

The number of delinquent properties, but not in foreclosure, is down 378,000 properties year-over-year, and the number of properties in the foreclosure process is down 81,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2018 | Sept 2018 | Oct 2017 | Oct 2016 | |

| Delinquent | 3.64% | 3.97% | 4.44% | 4.35% |

| In Foreclosure | 0.52% | 0.52% | 0.68% | 0.99% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,884,000 | 2,049,000 | 2,262,000 | 2,202,000 |

| Number of properties in foreclosure pre-sale inventory: | 267,000 | 268,000 | 348,000 | 504,000 |

| Total Properties | 2,152,000 | 2,317,000 | 2,610,000 | 2,706,000 |

Case-Shiller: National House Price Index increased 5.5% year-over-year in September

by Calculated Risk on 11/27/2018 09:10:00 AM

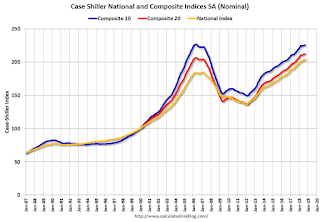

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Annual Home Price Gains Slow According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.5% annual gain in September, down from 5.7% in the previous month. The 10City Composite annual increase came in at 4.8%, down from 5.2% in the previous month. The 20-City Composite posted a 5.1% year-over-year gain, down from 5.5% in the previous month.

Las Vegas, San Francisco and Seattle reported the highest year-over-year gains among the 20 cities. In September, Las Vegas led the way with a 13.5% year-over-year price increase, followed by San Francisco with a 9.9% increase and Seattle with an 8.4% increase. Four of the 20 cities reported greater price increases in the year ending September 2018 versus the year ending August 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.1% in September. The 10-City and 20-City Composites did not report any gains for the month. After seasonal adjustment, the National Index recorded a 0.4% month-over-month increase in September. The 10-City Composite and the 20-City Composite both posted 0.3% month-over-month increases. In September, nine of 20 cities reported increases before seasonal adjustment, while 18 of 20 cities reported increases after seasonal adjustment.

“Home prices plus data on house sales and construction confirm the slowdown in housing,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The S&P CoreLogic Case-Shiller National Index showed a 5.5% year-over-year gain, weaker for the second month in a row as 16 of 20 cities showed smaller annual price gains. On a monthly basis, nine cities saw prices decline in September compared to August. In Seattle, where prices were rising at doubledigit annual rates a few months ago, prices dropped last month. The few places reporting larger gains including some of the cities which had the biggest gains and largest losses 10 years ago: Las Vegas, Phoenix and Tampa.

“Sales of both new and existing single family homes peaked one year ago in November 2017. Sales of existing homes are down 9.3% from that peak. Housing starts are down 8.7% from November of last year. The National Association of Home Builders sentiment index dropped seven points to 60, its lowest level in two years. One factor contributing to the weaker housing market is the recent increase in mortgage rates. Currently the national average for a 30-year fixed rate loan is 4.9%, a full percentage point higher than a year ago.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off slightly from the bubble peak, and up 0.3% in September (SA).

The Composite 20 index is 2.8% above the bubble peak, and up 0.3% (SA) in September.

The National index is 10.8% above the bubble peak (SA), and up 0.4% (SA) in September. The National index is up 49.8% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.8% compared to September 2017. The Composite 20 SA is up 5.2% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in 18 of 20 cities month-over-month seasonally adjusted.

I'll have more later.