by Calculated Risk on 9/25/2018 09:12:00 AM

Tuesday, September 25, 2018

Case-Shiller: National House Price Index increased 6.0% year-over-year in July

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: Home Price Gains Slow According to the S&P CoreLogic Case-Shiller Index

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 6.0% annual gain in July, down from 6.2% in the previous month. The 10-City Composite annual increase came in at 5.5%, down from 6.0% in the previous month. The 20-City Composite posted a 5.9% year-over-year gain, down from 6.4% in the previous month.

Las Vegas, Seattle and San Francisco continued to report the highest year-over-year gains among the 20 cities. In July, Las Vegas led the way with a 13.7% year-over-year price increase, followed by Seattle with a 12.1% increase and San Francisco with a 10.8% increase. Five of the 20 cities reported greater price increases in the year ending July 2018 versus the year ending June 2018.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in July. The 10-City and 20-City Composites reported increases of 0.2% and 0.3%, respectively. After seasonal adjustment, the National Index recorded a 0.2% month-over-month increase in July. The 10-City Composite remained flat and the 20-City Composite posted a 0.1% month-over-month increase. Eighteen of 20 cities reported increases in June before seasonal adjustment, while 13 of 20 cities reported increases after seasonal adjustment.

“Rising homes prices are beginning to catch up with housing,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Year-over-year gains and monthly seasonally adjusted increases both slowed in July for the S&P Corelogic Case-Shiller National Index and the 10 and 20-City Composite indices. The slowing is widespread: 15 of 20 cities saw smaller monthly increases in July 2018 than in July 2017. Sales of existing single family homes have dropped each month for the last six months and are now at the level of July 2016. Housing starts rose in August due to strong gains in multifamily construction. The index of housing affordability has worsened substantially since the start of the year.

“Since home prices bottomed in 2012, 12 of the 20 cities tracked by the S&P Corelogic Case-Shiller indices have reached new highs before adjusting for inflation. The eight that remain underwater include the four cities which led the home price boom: Las Vegas, Miami, Phoenix and Tampa. All are enjoying rising prices, especially Las Vegas which currently has the largest year-over-year increases of all 20 cities. The other cities where prices are still not over their earlier peaks are Washington DC, Chicago, New York and Atlanta."

emphasis added

The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 0.9% from the bubble peak, and unchanged in July (SA).

The Composite 20 index is 2.4% above the bubble peak, and up 0.1% (SA) in July.

The National index is 9.9% above the bubble peak (SA), and up 0.2% (SA) in July. The National index is up 48.6% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.5% compared to July 2017. The Composite 20 SA is up 5.9% year-over-year.

The National index SA is up 6.0% year-over-year.

Note: According to the data, prices increased in 13 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, September 24, 2018

Tuesday: Case-Shiller House Prices

by Calculated Risk on 9/24/2018 06:25:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Treading Water Near Long-Term Highs

Mortgage rates are having a bleak September, having risen at least an eighth of a percentage point in all cases and by a quarter of a point in many cases. Depending on the lender and scenario, conventional 30yr fixed rates of 5.0% aren't out of the question although 4.875% remains far more prevalent for borrowers with lots of equity/down-payment and top-tier credit. Either way, that's as high as mortgage rates have been since 2011 for most lenders. [30YR FIXED - 4.75-4.875%]Tuesday:

emphasis added

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for July. The consensus is for a 6.3% year-over-year increase in the Comp 20 index for July.

• At 9:00 AM, FHFA House Price Index for July 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM, Richmond Fed Survey of Manufacturing Activity for September.

Housing Inventory Tracking

by Calculated Risk on 9/24/2018 02:36:00 PM

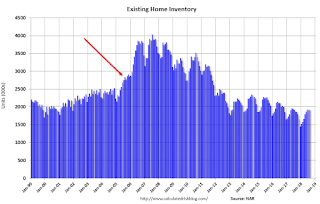

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Inventory, on a national basis, was up 2.7% year-over-year (YoY) in July, this the first YoY increase since early 2015.

The graph below shows the YoY change for non-contingent inventory in Houston, Las Vegas, Sacramento, and Phoenix (through August) and total existing home inventory as reported by the NAR (also through August).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 22% year-over-year in August (inventory was still very low), and has increased YoY for eleven consecutive months.

Also note that inventory was up 20% YoY in Las Vegas in August (red), the second consecutive month with a YoY increase.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased. Inventory was up slightly in Houston in August (but the YoY change might be distorted by Hurricane Harvey last year).

Inventory is a key for the housing market, and I am watching inventory for the impact of the new tax law and higher mortgage rates on housing. I expect national inventory will be up YoY at the end of 2018 (but still be low).

Although I expect inventory to increase YoY in 2018, I expect inventory to follow the normal seasonal pattern (not keep increasing all year).

So this is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble.

Also inventory is still very low. Consider Sacramento and Las Vegas - two cities with large YoY increases in inventory - the recent increases pushed inventory in Sacramento to 1.9 months supply. And in Las Vegas, the recent increases pushed up the months-of-supply in Las Vegas to 1.8 months.

Black Knight: National Mortgage Delinquency Rate Decreased in August

by Calculated Risk on 9/24/2018 12:21:00 PM

From Black Knight: Black Knight’s First Look: Strong Summer of Improvement for Mortgage Delinquencies; Industry Bracing for Impact from Hurricane Florence

• Mortgage delinquencies fell again in August and are now down 5.7 percent over the past two monthsAccording to Black Knight's First Look report for August, the percent of loans delinquent decreased 2.4% in August compared to July, and decreased 10.4% year-over-year.

• This marks the strongest such decline during July-August on record, since before 2000

• Foreclosure starts also eased in August and are now more than 12 percent below last year’s level

• Delinquencies resulting from 2017’s hurricanes continue to decline – just 25,100 remain in the mainland U.S.

• Some 391,000 homeowners with mortgages were located in Hurricane Florence’s evacuation area, with an estimated 283,000 in the 18 North Carolina counties declared disaster areas so far by FEMA

The percent of loans in the foreclosure process decreased 4.4% in August and were down 28.2% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.52% in August, down from 3.61% in July.

The percent of loans in the foreclosure process decreased in August to 0.54% (from 0.57% in July).

The number of delinquent properties, but not in foreclosure, is down 185,000 properties year-over-year, and the number of properties in the foreclosure process is down 105,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Aug 2018 | July 2018 | Aug 2017 | Aug 2016 | |

| Delinquent | 3.52% | 3.61% | 3.93% | 4.24% |

| In Foreclosure | 0.54% | 0.57% | 0.76% | 1.04% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,818,000 | 1,861,000 | 2,003,000 | 2,151,000 |

| Number of properties in foreclosure pre-sale inventory: | 280,000 | 293,000 | 385,000 | 527,000 |

| Total Properties | 2,099,000 | 2,154,000 | 2,388,000 | 2,678,000 |

Dallas Fed: "Texas Manufacturing Expansion Continues amid Increased Uncertainty"

by Calculated Risk on 9/24/2018 10:37:00 AM

From the Dallas Fed: Texas Manufacturing Expansion Continues amid Increased Uncertainty

Texas factory activity continued to expand in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped six points to 23.3, indicating output growth continued but at a slower pace than last month.So far the regional surveys for September have indicated solid growth.

Other indexes of manufacturing activity also suggested slower expansion in September. The new orders index fell nine points to 14.7, its lowest reading in six months. Similarly, the growth rate of orders index slipped to 11.5, also a six-month low. The capacity utilization index retreated slightly to 21.6, while the shipments index fell five points to 20.8.

Perceptions of broader business conditions remained positive this month, although outlooks were less optimistic and uncertainty increased further. The general business activity index edged down but remained highly elevated at 28.1. The company outlook index held above average but retreated nine points to 18.2, its lowest reading in more than a year. The relatively new index measuring uncertainty regarding companies’ outlooks moved up four points to a new high of 19.9.

Labor market measures suggest employment levels and work hours rose at a slower pace in September. The employment index remained positive but dropped 11 points to 17.7. One-quarter of firms noted net hiring, compared with 7 percent noting net layoffs. The hours worked index moved down to 12.7.

emphasis added

Chicago Fed "Index Points to Steady Economic Growth in August"

by Calculated Risk on 9/24/2018 08:37:00 AM

From the Chicago Fed: Index Points to Steady Economic Growth in August

The Chicago Fed National Activity Index (CFNAI) was unchanged at +0.18 in August. Three of the four broad categories of indicators that make up the index increased from July, and two of the four categories made positive contributions to the index in August. The index’s three-month moving average, CFNAI-MA3, rose to +0.24 in August from +0.02 in July.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was slightly above the historical trend in August (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, September 23, 2018

Sunday Night Futures

by Calculated Risk on 9/23/2018 07:22:00 PM

Weekend:

• Schedule for Week of September 23, 2018

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are down 8 and DOW futures are down 80 (fair value).

Oil prices were up over the last week with WTI futures at $71.48 per barrel and Brent at $79.73 per barrel. A year ago, WTI was at $52, and Brent was at $59 - so oil prices are up about 30% to 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.84 per gallon. A year ago prices were at $2.55 per gallon (jumped last year due to hurricane Harvey) - so gasoline prices are up 29 cents per gallon year-over-year.

FOMC Preview

by Calculated Risk on 9/23/2018 08:11:00 AM

The consensus is that the Fed will increase the Fed Funds Rate 25bps at the meeting this week, and the tone will remain upbeat.

Assuming the expected happens, the focus will be on the wording of the statement, the projections, and Fed Chair Jerome Powell's press conference to try to determine how many rate hikes to expect in 2018 (probably four) and in 2019.

Here are the June FOMC projections.

Current projections for Q3 GDP are in mid-3% range. GDP increased at a 2.2% real annual rate in Q1, and 4.2% in Q2. This puts GDP, so far in 2018, above the expected range, and GDP projections might be revised up.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Change in Real GDP1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.7 to 3.0 | 2.2 to 2.6 | 1.8 to 2.0 |

| Mar 2018 | 2.6 to 3.0 | 2.2 to 2.6 | 1.8 to 2.1 |

The unemployment rate was at 3.9% in August. So the unemployment rate projection for 2018 will probably be mostly unchanged.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Unemployment Rate2 | 2018 | 2019 | 2020 |

| Jun 2018 | 3.6 to 3.7 | 3.4 to 3.5 | 3.4 to 3.7 |

| Mar 2018 | 3.6 to 3.8 | 3.4 to 3.7 | 3.5 to 3.8 |

As of July, PCE inflation was up 2.3% from July 2017. So PCE inflation might be revised up for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| PCE Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 2.0 to 2.1 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

PCE core inflation was up 2.0% in July year-over-year. Core PCE inflation might also be revised up for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | |||

|---|---|---|---|

| Core Inflation1 | 2018 | 2019 | 2020 |

| Jun 2018 | 1.9 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

| Mar 2018 | 1.8 to 2.0 | 2.0 to 2.2 | 2.1 to 2.2 |

In general the data has been somewhat firmer than the FOMC's June projections, so it seems likely the FOMC will be on track for four rate hikes in 2018.

Saturday, September 22, 2018

Schedule for Week of September 23, 2018

by Calculated Risk on 9/22/2018 08:11:00 AM

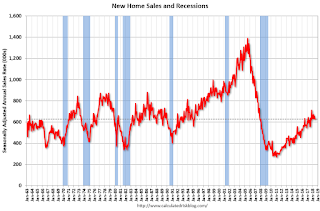

The key reports this week are August New Home sales, and the third estimate of Q2 GDP.

Other key indicators include Personal Income and Outlays for August and Case-Shiller house prices for July.

For manufacturing, the Dallas, Richmond, and Kansas City Fed manufacturing surveys will be released this week.

Also, the FOMC meets this week, and is expected to raise the Fed Funds rate 25bps.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the most recent report (the Composite 20 was started in January 2000).

The consensus is for a 6.3% year-over-year increase in the Comp 20 index for July.

9:00 AM: FHFA House Price Index for July 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for August from the Census Bureau.

10:00 AM: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 630 thousand SAAR, up from 627 thousand in July.

2:00 PM: FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

2:00 PM: FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

2:30 PM: Fed Chair Jerome Powell holds a press briefing following the FOMC announcement.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 210 thousand initial claims, up from 201 thousand the previous week.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Third estimate). The consensus is that real GDP increased 4.3% annualized in Q2, up from the second estimate of 4.2%.

Early: Reis Q3 2018 Apartment Survey of rents and vacancy rates.

10:00 AM: Pending Home Sales Index for August. The consensus is 0.2% increase in the index.

11:00 AM: the Kansas City Fed manufacturing survey for September. This is the last of the regional surveys for September.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.4% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 62.0, down from 63.6 in August.

10:00 AM: University of Michigan's Consumer sentiment index (Final for September). The consensus is for a reading of 100.8.

Friday, September 21, 2018

Oil Rigs Decline Slightly

by Calculated Risk on 9/21/2018 07:15:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on September 21, 2018:

• Oil rigs declined, -1 to 866

• Horizontal oil rigs fell, -3 to 766

...

• Horizontal oil rigs are essentially unchanged in the last 14 weeks

• The Permian added 3 rigs, the Cana Woodford was hammered with a loss of 6 rigs

• The breakeven oil price to add horizontal oil rigs is now $70 WTI, about the same as WTI.

• The model suggests horizontal oil rig counts will decline again next week.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.