by Calculated Risk on 8/15/2018 07:00:00 AM

Wednesday, August 15, 2018

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 10, 2018.

... The Refinance Index remained unchanged from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 4 percent compared with the previous week and was 3 percent lower than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.81 percent from 4.84 percent, with points decreasing to 0.43 from 0.45 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

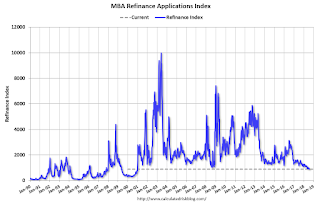

Click on graph for larger image.The first graph shows the refinance index since 1990.

This was unchanged from last week at the lowest level since December 2000.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

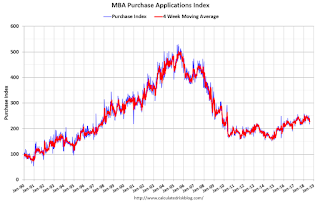

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is down 3% year-over-year.

Tuesday, August 14, 2018

Wednesday: Retail Sales, Industrial Production, Homebuilder Confidence, NY Fed Mfg

by Calculated Risk on 8/14/2018 06:03:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for July will be released. The consensus is for a 0.1% increase in retail sales. Retail and Food service sales, ex-gasoline, increased by 5.2% on a YoY basis in June.

• At 8:30 AM, The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 20.0, down from 22.6.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 69, up from 68. Any number above 50 indicates that more builders view sales conditions as good than poor.

California Bay Area Home Sales Decline 3 Percent YoY in July, Inventory up 2% YoY

by Calculated Risk on 8/14/2018 01:31:00 PM

Here are some Bay Area stats from Pacific Union chief economist Selma Hepp: Finally More Bay Area Housing Inventory After 16 Months of Declines

• The Bay Area's decline in home sales (single-family and condominiums) improved in July, with only a 3 percent less activity year over year after a 13 percent decline in June.

• Inventory finally improved, up by 2 percent, after 16 consecutive months of year-over-year declines.

• Inventory above $1 million increased by 17 percent, mostly driven by more homes for sale in Santa Clara and San Mateo counties.

• Only Sonoma and Napa counties gained inventory below $1 million, up by 17 percent and by 5 percent respectively

• In contrast, San Francisco still lost inventory across all price ranges in July, declining by 14 percent. Contra Costa County saw inventory drop by 5 percent from July 2017.

NY Fed Q2 Report: "Total Household Debt Rises for 16th Straight Quarter"

by Calculated Risk on 8/14/2018 11:09:00 AM

From the NY Fed: Total Household Debt Rises for 16th Straight Quarter

he Federal Reserve Bank of New York’s Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $82 billion (0.6%) to $13.29 trillion in the second quarter of 2018. It was the 16th consecutive quarter with an increase, and the total is now $618 billion higher than the previous peak of $12.68 trillion, from the third quarter of 2008. Further, overall household debt is now 19.2% above the post-financial-crisis trough reached during the second quarter of 2013. The Report is based on data from the New York Fed’s Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data.

Mortgage balances—the largest component of household debt—rose by $60 billion during the second quarter, to $9.00 trillion. Balances on home equity lines of credit (HELOC) continued their downward trend, declining by $4 billion, to $432 billion. The median credit score of newly originating mortgage borrowers was roughly unchanged, at 760.

"Aggregate household debt grew for the 16th consecutive quarter in the second quarter of 2018," said Wilbert van der Klaauw, senior vice president at the New York Fed, "While overall delinquency rates have remained stable at relatively low levels, transition rates into delinquency have fallen noticeably for student debt over the past year, reflecting an improved labor market and increased participation in various income-driven repayment plans."

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Aggregate household debt balances increased in the second quarter of 2018 for the 16th consecutive quarter, and are now $618 billion higher than the previous (2008Q3) peak of $12.68 trillion. As of June 30, 2018, total household indebtedness was $13.29 trillion, an $82 billion (0.6%) increase from the first quarter of 2018. Overall household debt is now 19.2% above the 2013 Q2 trough.

Mortgage balances, the largest component of household debt, increased slightly during the second quarter. Mortgage balances shown on consumer credit reports on June 30 stood at $9.0 trillion, an increase of $60 billion from the first quarter of 2018. Balances on home equity lines of credit (HELOC), on a declining trend since 2009, saw a $4 billion drop in the second quarter and are now at $432 billion. Non-housing balances saw a $26 billion increase in the second quarter, with auto loans and credit cards increasing by $9 billion and $14 billion respectively.

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate decreased in Q2. From the NY Fed:

Aggregate delinquency rates improved in the second quarter of 2018. As of June 30, 4.5% of outstanding debt was in some stage of delinquency, a very small improvement from the last quarter. Of the $598 billion of debt that is delinquent, $403 billion is seriously delinquent (at least 90 days late or “severely derogatory”). The flow into 90+ day delinquency for credit card balances has been rising for the last year and remained elevated during the second quarter, while the flow into 90+ day delinquency for auto loan balances has been slowly trending upward since 2012.There is much more in the report.

About 225,000 consumers had a bankruptcy notation added to their credit reports in 2018Q2, about the same number observed in the same quarter of last year. New bankruptcy notations have been at historically low levels since 2016.

Small Business Optimism Index increased in July

by Calculated Risk on 8/14/2018 08:32:00 AM

From the National Federation of Independent Business (NFIB): July 2018 Report: Small Business Optimism Index

The Small Business Optimism Index marked its second highest level in the survey’s 45-year history at 107.9, rising to within 0.1 point of the July 1983 record-high of 108.

..

Fifty-nine percent reported hiring or trying to hire (down four points), but 52 percent (88 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill. Twenty-three percent of owners cited the difficulty of finding qualified workers as their single most important business problem (up two points), one point below the 45-year record high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 107.9 in July.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, August 13, 2018

Tuesday: Q2 Quarterly Report on Household Debt and Credit

by Calculated Risk on 8/13/2018 06:51:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hold Steady at 3-Week Lows

Mortgage rates stayed steady at the lowest levels in more than 3 weeks as financial markets are still accounting for additional risks relating to Turkey. Simply put, Turkey is in the midst of a debt/currency/banking crisis and investors are worried about some sort of domino effect among banks that are heavily invested in Turkish banks. All this is worth a bit of "safe-haven" demand for US Treasuries, which offer essentially risk-free returns and a liquid place to park money temporarily. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 6:00 AM ET,: NFIB Small Business Optimism Index for July.

• At 11:00 AM,: NY Fed: Q2 Quarterly Report on Household Debt and Credit

Long Beach Port Traffic "Dips" in July

by Calculated Risk on 8/13/2018 04:08:00 PM

From the Port of Long Beach: July Container Volumes Dip in Long Beach

The Port of Long Beach saw a decline in container volumes in July compared to the same month a year ago, which hit a historic high that has since been surpassed.This is the lowest level for exports in almost a year (imports are seasonal, so this is the lowest level for imports since April). The decline in exports could be related to shippers trying to beat the tariffs in June. I'll post a graph once the Port of Los Angeles reports July traffic.

The drop, 4.4 percent, was attributed to shipping alliances’ decisions in July to shift vessel deployment and port calls. Port officials also raised concerns that escalating tariffs could slow trade activity — thus far the busiest in the Port’s 107-year history — during the remainder of the year.

...

For the calendar year, the Port of Long Beach is on pace for its busiest year ever, topping 2017. Through July, volumes are 11.3 percent or almost half a million TEUs over the same period in 2017, totaling 4.6 million TEUs. June 2018 volume at the Port was the highest in its history, at 752,188 TEUs.

Goldman: "Price pressures seem to be everywhere except the inflation statistics"

by Calculated Risk on 8/13/2018 10:37:00 AM

A few brief excerpts from a Goldman Sachs research note: Bottlenecks and Price Pressures: Pushing on a String... or Pushing Through?

Company commentary and business surveys increasingly highlight bottlenecks and price pressures, as well as a growing shortage of workers in the trucking, healthcare, and construction industries. Yet despite tight labor markets and rising input costs, core PCE inflation has yet to exceed 2 percent on a sustained basis. To paraphrase Robert Solow, price pressures seem to be everywhere except the inflation statistics.CR Note: I'm not worried about a period of inflation like in the 1970s. There are many differences between today and periods of high inflation. Demographics are different (the baby boomers were entering the labor force in the '70s), workers have much less bargaining power now, and in the '70s, many labor and material contracts were tied to CPI (that is far less common today).

…

Barring a sizeable rebound in capital formation or labor-force participation, capacity constraints are likely to become increasingly binding as the expansion continues. While the Fed may view further declines in the unemployment rate with some ambivalence, the implications of broadening labor shortages and product-market bottlenecks are more clear-cut, representing a textbook form of overheating that the Committee has historically taken great pains to avoid.

Housing Inventory Tracking

by Calculated Risk on 8/13/2018 09:06:00 AM

Update: This update includes inventory in Las Vegas and Sacramento through July.

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the YoY change for non-contingent inventory in Las Vegas and Sacramento (through July), and Houston, Phoenix (through June) and total existing home inventory as reported by the NAR (through June 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 20% year-over-year in July (inventory was still very low), and has increased YoY for ten consecutive months.

Also note that inventory was up slightly YoY in Las Vegas in July (red), the first YoY increase in Las Vegas since May 2015..

Inventory, on a national basis, was up 0.5% year-over-year (YoY) in June, the first YoY increase since June 2015.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory will be up YoY at the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally.

Sunday, August 12, 2018

Sunday Night Futures

by Calculated Risk on 8/12/2018 07:48:00 PM

Weekend:

• Schedule for Week of Aug 12, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $67.87 per barrel and Brent at $73.00 per barrel. A year ago, WTI was at $49, and Brent was at $51 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.85 per gallon. A year ago prices were at $2.35 per gallon - so gasoline prices are up 50 cents per gallon year-over-year.