by Calculated Risk on 8/13/2018 10:37:00 AM

Monday, August 13, 2018

Goldman: "Price pressures seem to be everywhere except the inflation statistics"

A few brief excerpts from a Goldman Sachs research note: Bottlenecks and Price Pressures: Pushing on a String... or Pushing Through?

Company commentary and business surveys increasingly highlight bottlenecks and price pressures, as well as a growing shortage of workers in the trucking, healthcare, and construction industries. Yet despite tight labor markets and rising input costs, core PCE inflation has yet to exceed 2 percent on a sustained basis. To paraphrase Robert Solow, price pressures seem to be everywhere except the inflation statistics.CR Note: I'm not worried about a period of inflation like in the 1970s. There are many differences between today and periods of high inflation. Demographics are different (the baby boomers were entering the labor force in the '70s), workers have much less bargaining power now, and in the '70s, many labor and material contracts were tied to CPI (that is far less common today).

…

Barring a sizeable rebound in capital formation or labor-force participation, capacity constraints are likely to become increasingly binding as the expansion continues. While the Fed may view further declines in the unemployment rate with some ambivalence, the implications of broadening labor shortages and product-market bottlenecks are more clear-cut, representing a textbook form of overheating that the Committee has historically taken great pains to avoid.

Housing Inventory Tracking

by Calculated Risk on 8/13/2018 09:06:00 AM

Update: This update includes inventory in Las Vegas and Sacramento through July.

Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

The graph below shows the YoY change for non-contingent inventory in Las Vegas and Sacramento (through July), and Houston, Phoenix (through June) and total existing home inventory as reported by the NAR (through June 2018).

This shows the YoY change in inventory for Houston, Las Vegas, Phoenix, and Sacramento. The black line is the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 20% year-over-year in July (inventory was still very low), and has increased YoY for ten consecutive months.

Also note that inventory was up slightly YoY in Las Vegas in July (red), the first YoY increase in Las Vegas since May 2015..

Inventory, on a national basis, was up 0.5% year-over-year (YoY) in June, the first YoY increase since June 2015.

Houston is a special case, and inventory was up for several years due to lower oil prices, but declined YoY recently as oil prices increased.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory will be up YoY at the end of 2018 (but still be low).

This is not comparable to late 2005 when inventory increased sharply signaling the end of the housing bubble, but it does appear that inventory is bottoming nationally.

Sunday, August 12, 2018

Sunday Night Futures

by Calculated Risk on 8/12/2018 07:48:00 PM

Weekend:

• Schedule for Week of Aug 12, 2018

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $67.87 per barrel and Brent at $73.00 per barrel. A year ago, WTI was at $49, and Brent was at $51 - so oil prices are up about 40% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.85 per gallon. A year ago prices were at $2.35 per gallon - so gasoline prices are up 50 cents per gallon year-over-year.

Summer Teen Employment

by Calculated Risk on 8/12/2018 01:01:00 PM

Here is a look at the change in teen employment over time.

The graph below shows the participation rate and employment-population ratio for those 16 to 19 years old.

The graph is Not Seasonally Adjusted (NSA), to show the seasonal hiring of teenagers during the summer.

A few observations:

1) Although teen employment has recovered some since the great recession, overall teen employment has been trending down. This is probably because more people are staying in school (a long term positive for the economy).

2) A smaller percentage of teenagers are seeking summer employment. The seasonal spikes are smaller than in previous decades. So a smaller percentage of teenagers are joining the labor force during the summer as compared to previous years. This could be because of fewer employment opportunities, or because teenagers are pursuing other activities during the summer.

3) The decline in teenager participation is one of the reasons the overall participation rate has declined (of course, the retiring baby boomers is the main reason the overall participation rate is generally declining).

Saturday, August 11, 2018

Schedule for Week of August 12, 2018

by Calculated Risk on 8/11/2018 08:11:00 AM

The key economic reports this week are July Housing Starts and Retail Sales.

For manufacturing, July industrial production, and the August New York and Philly Fed surveys, will be released this week.

No major economic releases scheduled.

6:00 AM: NFIB Small Business Optimism Index for July.

11:00 AM: NY Fed: Q2 Quarterly Report on Household Debt and Credit

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: Retail sales for July will be released. The consensus is for a 0.1% increase in retail sales.

8:30 AM ET: Retail sales for July will be released. The consensus is for a 0.1% increase in retail sales.This graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993. Retail and Food service sales, ex-gasoline, increased by 5.2% on a YoY basis in June.

8:30 AM ET: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 20.0, down from 22.6.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 78.2%.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 69, up from 68. Any number above 50 indicates that more builders view sales conditions as good than poor.

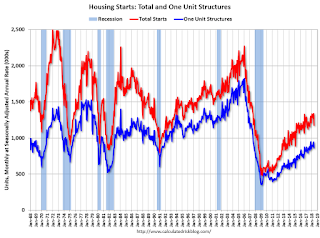

8:30 AM: Housing Starts for July.

8:30 AM: Housing Starts for July. This graph shows single and total housing starts since 1968.

The consensus is for 1.271 million SAAR, up from 1.173 million SAAR.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 215 thousand initial claims, up from 213 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 22.3, down from 25.7.

10:00 AM: State Employment and Unemployment (Monthly) for July 2018

10:00 AM: University of Michigan's Consumer sentiment index (Preliminary for August).

Friday, August 10, 2018

Q3 GDP Forecasts

by Calculated Risk on 8/10/2018 04:57:00 PM

It's early in the quarter, but here are a few forecasts:

From Merrill Lynch:

We continue to track 4.1% for 2Q GDP. Growth should ebb to a still-robust 3.4% in 3Q. [Aug 10 estimate].And from the Altanta Fed: GDPNow

emphasis added

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2018 is 4.3 percent on August 9, down from 4.4 percent on August 3. [Aug 9 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast for 2018:Q3 stands at 2.6%. [Aug 10 estimate]CR Note: Since it is early, the range of estimates is wide. These estimates suggest real annualized GDP in the 2.6% to 4.3% range in Q3.

Sacramento Housing in July: Sales Down 2.2% YoY, Active Inventory up 20% YoY

by Calculated Risk on 8/10/2018 02:13:00 PM

From SacRealtor.org: Sales, median sales price drop, inventory creeps upward

July closed with 1,598 sales, a 9.6% decrease from the 1,767 sales of June. Compared to July last year (1,634), the figure is a 2.2% decrease. Of the 1,598 sales this month, 214 (13.4%) used cash financing, 975 (61%) used conventional, 291 (18.2%) used FHA, 81 (5.1%) used VA and 37 (2.3%) used Other types of financing.CR Note: Inventory is still low, but up significantly year-over-year in Sacramento.

Active Listing Inventory increased 8.1% from 2,660 to 2,875 units [inventory is up 20.0% YoY from 2,395 in July 2017]. The Months of Inventory increased from 1.5 to 1.8 Months. This figure represents the amount of time (in months) it would take for the current rate of sales to deplete the total active listing inventory.

The Average DOM (days on market) increased from 21 to 22 from June to July and the Median DOM increased from 10 to 12. “Days on market” represents the days between the initial listing of the home as “active” and the day it goes “pending.” Of the 1,598 sales this month, 77.3% (1,235) were on the market for 30 days or less and 93.3% (1,491) were on the market for 60 days or less.

emphasis added

Key Measures Show Inflation increased YoY in July

by Calculated Risk on 8/10/2018 11:11:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.7% annualized rate) in July. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.3% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for July here.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (2.1% annualized rate) in July. The CPI less food and energy rose 0.2% (3.0% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.8%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 2.4%. Core PCE is for June and increased 1.9% year-over-year.

On a monthly basis, median CPI was at 2.7% annualized, trimmed-mean CPI was at 2.3% annualized, and core CPI was at 3.0% annualized.

Using these measures, inflation increased year-over-year in July. Overall, these measures are mostly above the Fed's 2% target (Core PCE is close).

Early Look at 2019 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 8/10/2018 09:00:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 3.2 percent over the last 12 months to an index level of 246.155 (1982-84=100). For the month, the index was unchanged prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2017, the Q3 average of CPI-W was 239.668.

Last year was the highest Q3 average, so we have to compare Q3 this year to last year.

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 3.2% year-over-year in July, and although this is very early - we need the data for August and September - my current guess is COLA will probably be close to 3% this year, the largest annual increase since 2012.

Contribution and Benefit Base

The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2017 yet, but wages probably increased again in 2017. If wages increased the average of the last three years, then the contribution base next year will increase to around $132,000 in 2019, from the current $128,400.

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).

BLS: CPI increased 0.2% in July, Core CPI increased 0.2%

by Calculated Risk on 8/10/2018 08:32:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.2 percent in July on a seasonally adjusted basis after rising 0.1 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.9 percent before seasonal adjustment.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast.

The index for shelter rose 0.3 percent in July and accounted for nearly 60 percent of the seasonally adjusted monthly increase in the all items index. The food index rose slightly in July, with major grocery store food group indexes mixed. The energy index fell 0.5 percent, as all the major component indexes declined.

The index for all items less food and energy rose 0.2 percent in July, the same increase as in May and June. … The all items index rose 2.9 percent for the 12 months ending July, the same increase as for the period ending June. The index for all items less food and energy rose 2.4 percent for the 12 months ending July; this was the largest 12-month increase since the period ending September 2008.

emphasis added