by Calculated Risk on 7/21/2018 08:11:00 AM

Saturday, July 21, 2018

Schedule for Week of July 22, 2018

The key economic reports this week are the advance estimate of Q2 GDP, and June New and Existing Home Sales.

For manufacturing, the Richmond and Kansas City Fed manufacturing surveys will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for June. This is a composite index of other data.

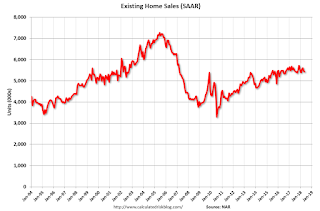

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, up from 5.43 million in May.

10:00 AM: Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for 5.45 million SAAR, up from 5.43 million in May.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.35 million SAAR for June and that inventory will be down 4.1% year-over-year.

9:00 AM: FHFA House Price Index for May 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for July.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: New Home Sales for June from the Census Bureau.

10:00 AM: New Home Sales for June from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the sales rate for last month.

The consensus is for 669 thousand SAAR, down from 689 thousand in May.

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 217 thousand initial claims, up from 207 thousand the previous week.

8:30 AM: Durable Goods Orders for June from the Census Bureau. The consensus is for a 3.2% increase in durable goods orders.

10:00 AM: the Q2 2018 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for July.

8:30 AM: Gross Domestic Product, 2nd quarter 2018 (Advance estimate). The consensus is that real GDP increased 4.2% annualized in Q2, up from 2.0% in Q1.

10:00 AM: University of Michigan's Consumer sentiment index (Final for July). The consensus is for a reading of 97.2, up from 97.1.

Friday, July 20, 2018

Oil Rigs: "A brutal week for rig counts"

by Calculated Risk on 7/20/2018 03:28:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 20, 2018:

• A brutal week for rig counts

• Total oil rigs fell, -5 to 858

• Horizontal oil rig counts came in -7 to 762

...

• A year ago, operators were adding rigs at $50 WTI; now they are withdrawing rigs at $70 WTI.

• All this begs the underlying economics of shale production after 500 horizontal oil rigs have been added in this cycle.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

State Unemployment since 1976

by Calculated Risk on 7/20/2018 01:29:00 PM

Earlier I posted the BLS release for state unemployment rates in June. I've been posting a graph showing the number of states with unemployment rates above certain levels since 2006.

Since all of the state series began in 1976, below is a graph showing state unemployment rates since 1976.

Only one state has never had an unemployment rate below 6% (Alaska with a minimum is 6.3% in 1999). So Dark Blue on the graph below never reaches zero.

For interest, note the impact of Hurricane Katrina in 2005 when the unemployment rate for Louisiana increased sharply from 5.4% to 11.3% in one month, and the unemployment rate for Mississippi increased from 6.9% to 9.8%.

This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 1976.

At the worst of the great recession, there were 11 states with an unemployment rate at or above 11% (red).

At the worst of the early '80s recession, there were 18 states with an employment rate at or above 11%.

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

BLS: Unemployment Rates Lower in 9 states in June, Oregon at New Low

by Calculated Risk on 7/20/2018 10:08:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in June in 9 states, higher in 3 states, and stable in 38 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Ten states had jobless rate decreases from a year earlier and 40 states and the District had little or no change. The national unemployment rate rose by 0.2 percentage point from May to 4.0 percent but was 0.3 point lower than in June 2017.

...

Hawaii had the lowest unemployment rate in June, 2.1 percent. The rate in Oregon (4.0 percent) set a new series low. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.1 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Has Housing Market Activity Peaked?

by Calculated Risk on 7/20/2018 08:43:00 AM

Following the release of housing starts this week, Sharon Nunn wrote in the WSJ: Housing Market Stumbles at the Beginning of Summer. She quoted Ian Shepherdson, chief economist at Pantheon Macroeconomics as telling clients: “Housing market activity – sales and construction – likely has peaked for this cycle."

If correct, that would be significant for the economy.

First, I think it is likely that existing home sales will move more sideways going forward. However it is important to remember that new home sales are more important for jobs and the economy than existing home sales. Since existing sales are existing stock, the only direct contribution to GDP is the broker's commission. There is usually some additional spending with an existing home purchase - new furniture, etc. - but overall the economic impact is small compared to a new home sale.

Also I think the growth in multi-family starts is behind us, and that multi-family starts peaked in June 2015. See: Comments on June Housing Starts

For the economy, what we should be focused on are single family starts and new home sales. As I noted in Investment and Recessions "New Home Sales appears to be an excellent leading indicator, and currently new home sales (and housing starts) are up solidly year-over-year, and this suggests there is no recession in sight."

If new home sales and single family starts have peaked that would be a significant warning sign. Although housing is under pressure from policy (negative impact from tax, immigration and trade policies), I do not think housing has peaked, and I think new home sales and single family starts will increase further over the next couple of years.

Thursday, July 19, 2018

Technical Note: Temporary Census Hiring and the Monthly Employment Report

by Calculated Risk on 7/19/2018 04:05:00 PM

Most of the temporary hiring for the 2020 Census will happen in March, April and May of 2020. But some minor hiring will happen starting later this year.

Here is the historical data on temporary Census hiring since 1990.

For the monthly CES employment report, the BLS collects the data from Census, and adds the number of temporary workers to the total number of jobs reported for the month. The temporary Census data is not seasonally adjusted.

As an example, for May 2010, the BLS reported:

Total nonfarm payroll employment grew by 431,000 in May, reflecting the hiring of 411,000 temporary employees to work on Census 2010, the U.S. Bureau of Labor Statistics reported today.Those are real jobs, but they are not part of the business cycle - and they are very temporary, and they do not reflect the underlying trend of hiring.

So, for the May 2010 report, I reported: May Employment Report: 20K Jobs ex-Census, 9.7% Unemployment Rate. Some sites reported job gains of 431 thousand, and others reported private hiring only - but my view is the most helpful approach is to just remove the Census hiring from the headline number.

So starting in a few months, I'll once again report the employment number ex-Census.

Another interesting question is: How does Census hiring impact the unemployment rate (from the CPS)? I think the answer is very little.

I think these workers come mostly from three groups:

1) Those already employed taking a part time job,

2) People not in the workforce picking up a little temporary income (like retirees or students who would otherwise not be in the workforce), and

3) the unemployed taking a part time job.

People taking a second job will show up in the number of people working multiple jobs ("Multiple Jobholders Level" in the CPS, something to watch). For retirees and students, they will probably leave the workforce once the temporary job is over.

But only the unemployed taking a part time job will lower the unemployment rate, and I think that will be a small part of the temporary Census 2020 hiring.

Hotels: Occupancy Rate decreased Year-over-Year

by Calculated Risk on 7/19/2018 03:12:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 14 July

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 8-14 July 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 9-15 July 2017, the industry recorded the following:

• Occupancy: -1.6% to 76.1%

• Average daily rate (ADR): +1.2% to US$132.14

• Revenue per available room (RevPAR): -0.4% to US$100.56

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the occupancy rate will be solid through the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

California Bay Area Home Sales Decline 13 Percent YoY in June

by Calculated Risk on 7/19/2018 12:19:00 PM

Here are some Bay Area stats from Pacific Union chief economist Selma Hepp: Are Bay Area Housing Markets Getting the Jitters? June’s Median Price Growth Doesn’t Suggest So.

• Bay Area home sales dropped by 13 percent year over year in June.

• Sales in Sonoma and Napa counties slowed by more than 20 percent, while activity in San Francisco, Marin, and Alameda counties declined by about 10 percent.

• Sales of homes priced at less than $1 million fell at the fastest rate seen in two years, down by 28 percent, driven by 50 percent drops in San Mateo and Santa Clara counties.

• Sales of homes priced above $1 million continued to grow; however, June’s increase was the smallest seen in a year.

• Inventory dropped by 2 percent, but the decline was the smallest seen over the last year.

Earlier: Philly Fed Manufacturing Survey "Continued to expand" in July

by Calculated Risk on 7/19/2018 10:12:00 AM

From the Philly Fed: July 2018 Manufacturing Business Outlook Survey

Regional manufacturing activity continued to expand in July, according to results from this month’s Manufacturing Business Outlook Survey. All the broad indicators remained positive, with the general activity and new orders indexes improving this month. The survey’s price indexes suggest widespread increases for purchased inputs, and more firms reported price increases for their own manufactured goods. Expectations for the next six months continued to moderate but remain positive overall.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased 6 points this month. Over 44 percent of the manufacturers reported increases in overall activity this month, while 19 percent reported decreases. The new orders index rebounded 14 points after falling 23 points in June. ... The firms continued to report overall higher employment, but increases were not as widespread this month. Over 24 percent of the responding firms reported increases in employment this month, down from 34 percent last month. The current employment index fell 14 points to 16.8. The current average workweek index declined 11 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

This suggests the ISM manufacturing index will show solid expansion again in July.

Weekly Initial Unemployment Claims decreased to 207,000

by Calculated Risk on 7/19/2018 08:33:00 AM

The DOL reported:

In the week ending July 14, the advance figure for seasonally adjusted initial claims was 207,000, a decrease of 8,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 220,500, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 223,000 to 223,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,500.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.