by Calculated Risk on 7/19/2018 04:05:00 PM

Thursday, July 19, 2018

Technical Note: Temporary Census Hiring and the Monthly Employment Report

Most of the temporary hiring for the 2020 Census will happen in March, April and May of 2020. But some minor hiring will happen starting later this year.

Here is the historical data on temporary Census hiring since 1990.

For the monthly CES employment report, the BLS collects the data from Census, and adds the number of temporary workers to the total number of jobs reported for the month. The temporary Census data is not seasonally adjusted.

As an example, for May 2010, the BLS reported:

Total nonfarm payroll employment grew by 431,000 in May, reflecting the hiring of 411,000 temporary employees to work on Census 2010, the U.S. Bureau of Labor Statistics reported today.Those are real jobs, but they are not part of the business cycle - and they are very temporary, and they do not reflect the underlying trend of hiring.

So, for the May 2010 report, I reported: May Employment Report: 20K Jobs ex-Census, 9.7% Unemployment Rate. Some sites reported job gains of 431 thousand, and others reported private hiring only - but my view is the most helpful approach is to just remove the Census hiring from the headline number.

So starting in a few months, I'll once again report the employment number ex-Census.

Another interesting question is: How does Census hiring impact the unemployment rate (from the CPS)? I think the answer is very little.

I think these workers come mostly from three groups:

1) Those already employed taking a part time job,

2) People not in the workforce picking up a little temporary income (like retirees or students who would otherwise not be in the workforce), and

3) the unemployed taking a part time job.

People taking a second job will show up in the number of people working multiple jobs ("Multiple Jobholders Level" in the CPS, something to watch). For retirees and students, they will probably leave the workforce once the temporary job is over.

But only the unemployed taking a part time job will lower the unemployment rate, and I think that will be a small part of the temporary Census 2020 hiring.

Hotels: Occupancy Rate decreased Year-over-Year

by Calculated Risk on 7/19/2018 03:12:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 14 July

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 8-14 July 2018, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 9-15 July 2017, the industry recorded the following:

• Occupancy: -1.6% to 76.1%

• Average daily rate (ADR): +1.2% to US$132.14

• Revenue per available room (RevPAR): -0.4% to US$100.56

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year probably since the Great Depression for hotels).

The occupancy rate, to date, is slightly ahead of the record year in 2017. Note: 2017 finished strong due to the impact of the hurricanes.

On a seasonal basis, the occupancy rate will be solid through the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

California Bay Area Home Sales Decline 13 Percent YoY in June

by Calculated Risk on 7/19/2018 12:19:00 PM

Here are some Bay Area stats from Pacific Union chief economist Selma Hepp: Are Bay Area Housing Markets Getting the Jitters? June’s Median Price Growth Doesn’t Suggest So.

• Bay Area home sales dropped by 13 percent year over year in June.

• Sales in Sonoma and Napa counties slowed by more than 20 percent, while activity in San Francisco, Marin, and Alameda counties declined by about 10 percent.

• Sales of homes priced at less than $1 million fell at the fastest rate seen in two years, down by 28 percent, driven by 50 percent drops in San Mateo and Santa Clara counties.

• Sales of homes priced above $1 million continued to grow; however, June’s increase was the smallest seen in a year.

• Inventory dropped by 2 percent, but the decline was the smallest seen over the last year.

Earlier: Philly Fed Manufacturing Survey "Continued to expand" in July

by Calculated Risk on 7/19/2018 10:12:00 AM

From the Philly Fed: July 2018 Manufacturing Business Outlook Survey

Regional manufacturing activity continued to expand in July, according to results from this month’s Manufacturing Business Outlook Survey. All the broad indicators remained positive, with the general activity and new orders indexes improving this month. The survey’s price indexes suggest widespread increases for purchased inputs, and more firms reported price increases for their own manufactured goods. Expectations for the next six months continued to moderate but remain positive overall.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity increased 6 points this month. Over 44 percent of the manufacturers reported increases in overall activity this month, while 19 percent reported decreases. The new orders index rebounded 14 points after falling 23 points in June. ... The firms continued to report overall higher employment, but increases were not as widespread this month. Over 24 percent of the responding firms reported increases in employment this month, down from 34 percent last month. The current employment index fell 14 points to 16.8. The current average workweek index declined 11 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through July), and five Fed surveys are averaged (blue, through June) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through June (right axis).

This suggests the ISM manufacturing index will show solid expansion again in July.

Weekly Initial Unemployment Claims decreased to 207,000

by Calculated Risk on 7/19/2018 08:33:00 AM

The DOL reported:

In the week ending July 14, the advance figure for seasonally adjusted initial claims was 207,000, a decrease of 8,000 from the previous week's revised level. This is the lowest level for initial claims since December 6, 1969 when it was 202,000. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 220,500, a decrease of 2,750 from the previous week's revised average. The previous week's average was revised up by 250 from 223,000 to 223,250.The previous week was revised up.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 220,500.

This was lower than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, July 18, 2018

Thursday: Unemployment Claims, Philly Fed Mfg

by Calculated Risk on 7/18/2018 08:31:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, up from 214 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for July. The consensus is for a reading of 22.0, up from 19.9.

Phoenix Real Estate in June: Sales down 3%, Active Inventory down 10% YoY

by Calculated Risk on 7/18/2018 03:49:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report", table below):

1) Overall sales in June were down 3.3% year-over-year.

2) Active inventory is down 10.4% year-over-year. This is the smallest YoY decrease this year. In some cities, it appears the inventory decline might be ending, but not yet in Phoenix.

This is the twentieth consecutive month with a YoY decrease in inventory.

| June Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Sales | YoY Change | Active Inventory | YoY Change | |

| Jun-13 | 8,228 | --- | 15,752 | --- |

| Jun-14 | 7,219 | -12.3% | 24,462 | 55.3% |

| Jun-15 | 8,674 | 20.2% | 19,596 | -19.9% |

| Jun-16 | 8,861 | 2.2% | 20,138 | 2.8% |

| Jun-17 | 9,391 | 6.0% | 17,682 | -12.2% |

| Jun-18 | 9,079 | -3.3% | 15,851 | -10.4% |

Fed's Beige Book: Economic Growth "moderate or modest", "concern about tariffs", "Shrinking Margins"

by Calculated Risk on 7/18/2018 02:07:00 PM

Concern about tariffs. Shrinking margins. Slow growth in existing home sales.

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Boston based on information collected on or before July 9, 2018. "

Economic activity continued to expand across the United States, with 10 of the 12 Federal Reserve Districts reporting moderate or modest growth. The outliers were the Dallas District, which reported strong growth driven in part by the energy sector, and the St. Louis District where growth was described as slight. Manufacturers in all Districts expressed concern about tariffs and in many Districts reported higher prices and supply disruptions that they attributed to the new trade policies. All Districts reported that labor markets were tight and many said that the inability to find workers constrained growth. Consumer spending was up in all Districts with particular strength in Dallas and Richmond. Contacts reported higher input prices and shrinking margins. Six Districts specifically mentioned trucking capacity as an issue and attributed it to a shortage of commercial drivers. Contacts in several Districts reported slow growth in existing home sales but were not overly concerned about rising interest rates. Commercial real estate was largely unchanged.

...

Employment continued to rise at a modest to moderate pace in most Districts. Labor markets were described as tight, with most Districts reporting firms had difficulty finding qualified labor. ... On balance, wage increases were modest to moderate, with some differences across sectors; a couple of Districts cited a pickup in the pace of wage growth.

emphasis added

Comments on June Housing Starts

by Calculated Risk on 7/18/2018 11:55:00 AM

Earlier: Housing Starts decreased to 1.173 Million Annual Rate in June

Housing starts in June were disappointing, and starts for April and May were revised down. However this was just one month, and most of the decline was in multi-family starts that are volatile month-to-month.

The housing starts report released this morning showed starts were down 12.3% in June compared to May, and starts were down 4.2% year-over-year compared to June 2017.

Both multi-family and single family starts were down year-over-year.

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were down 4.2% in June compared to June 2017.

Through six months, starts are up 7.8% year-to-date compared to the same period in 2017. That is still a solid increase.

Single family starts were down 0.2% year-over-year, and down 9.1% compared to May 2018.

Multi-family starts were down 15.3% year-over-year, and down 20.2% compared to May 2018 (multi-family is volatile month-to-month).

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but has turned down recently. Completions (red line) had lagged behind - however completions have passed starts (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significantly growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the relatively low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a couple more years, or more, of increasing single family starts and completions.

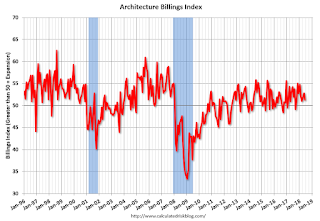

AIA: "June architecture firm billings stay positive"

by Calculated Risk on 7/18/2018 10:09:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: June architecture firm billings stay positive

Architecture firm billings slowed in June but remained positive for the ninth consecutive month, according to a new report today from The American Institute of Architects (AIA).

AIA’s Architecture Billings Index (ABI) score for June was 51.3 compared to 52.8 in May; it remains positive since any score over 50 represents billings growth. As a result, June’s ABI shows that demand for architecture firm services continues to improve across all sectors.

“Architects continue to see increases in demand for their services this summer, with new project work coming in at a healthy pace,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “However, business conditions are beginning to vary across the country. While essentially remaining flat in the Northeast and Midwest, billings jumped in the South while dropping in the West.”

...

• Regional averages: West (46.9), Midwest (49.8), South (57.4), Northeast (50.2)

• Sector index breakdown: multi-family residential (54.6), institutional (51.6), commercial/industrial (53.4), mixed practice (49.3)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 51.3 in June, down from 52.8 in May. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018 and early 2019.