by Calculated Risk on 7/10/2018 02:19:00 PM

Tuesday, July 10, 2018

Q2 Review: Ten Economic Questions for 2018

At the end of last year, I posted Ten Economic Questions for 2018. I followed up with a brief post on each question. The goal was to provide an overview of what I expected in 2018 (I don't have a crystal ball, but I think it helps to outline what I think will happen - and understand - and change my mind, when the outlook is wrong).

By request, here is a quick Q2 review. I've linked to my posts from the beginning of the year, with a brief excerpt and a few comments:

10) Question #10 for 2018: Will the New Tax Law impact Home Sales, Inventory, and Price Growth in Certain States?

My sense is the low end of the housing market will be fine. The Mortgage Interest Deduction (MID) will be capped at interest on a mortgage up to $750,000 instead of $1,000,000, so the lower priced markets will not be hit by the reduction in the MID. There might be some additional taxes for these buyers due to the limits on SALT and property taxes, but this should be minor.It is early, and there isn't any clear evidence of an impact from the new tax law, although some areas (like California) are now seeing a year-over-year increase in inventory - and that could be a leading indicator that price growth will slow.

I also expect the high end of the market to be fine. The high end is already doing well even with the MID capped at $1 million. For these buyers, the bigger impact will be the SALT and property tax limitations, but there will be offsets for these buyers due to the lower rates - and these buyers will likely benefit from the corporate tax cuts. Many of these buyers will also benefit from the changes to the Alternative Minimum Tax (AMT).

It is the upper-mid-range in the certain markets that will probably slow. This might be in the $750,000 to $1.5 million price range. These potential buyers probably don't benefit from the AMT or corporate changes, but they will likely be hit by the SALT and property tax limits.

9) Question #9 for 2018: Will housing inventory increase or decrease in 2018?

I was wrong on inventory last year (and the previous year), but right now my guess is active inventory will increase in 2018 (inventory will decline seasonally in December and January, but I expect to see inventory up again year-over-year in December 2018). My reasons for expecting more inventory are 1) inventory is historically low (lowest for November since 2000), 2) and the recent changes to the tax law.According to the May NAR report on existing home sales, inventory was down 6.1% year-over-year in May, and the months-of-supply was at 4.1 months. This was the smallest year-over-year decline since October 2016, and inventory in some areas is now up year-over-year (For example, in May, inventory in California was up 8.3% year-over-year). It still seems likely that inventory will be up year-over-year in December.

8) Question #8 for 2018: What will happen with house prices in 2018?

Inventories will probably remain low in 2018, although I expect inventories to increase on a year-over-year basis by December of 2018. Low inventories, and a decent economy suggests further price increases in 2018.If is early, but the CoreLogic data released last week showed prices up 7.1% year-over-year in May. The CoreLogic year-over-year increase was higher than last year, and there is no evidence of price increases slowing yet.

Perhaps higher mortgage rates will slow price appreciation. If we look back at the "taper tantrum" in 2013, price appreciation slowed somewhat over the next year - but that was from a high level. In June 2013, the Case-Shiller National index was up 9.3% year-over-year. By June 2014, the index was up 6.3% year-over-year.

If inventory increases year-over-year as I expect by December 2018, it seems likely that price appreciation will slow to the low-to-mid single digits.

7) Question #7 for 2018: How much will Residential Investment increase?

Most analysts are looking for starts to increase to around 1.25 to 1.3 million in 2018, and for new home sales of around 650 thousand.Through May, starts were up about 10% year-over-year compared to the same period in 2017, and on pace for about 1.32 million this year. New home sales were also up about 8% year-over-year and on pace for about 660 thousand in 2018.

I also think there will be further growth in 2018. My guess is starts will increase to just over 1.25 million in 2018 and new home sales will be just over 650 thousand.

6) Question #6 for 2018: How much will wages increase in 2018?

As the labor market continues to tighten, we should see more wage pressure as companies have to compete for employees. I expect to see some further increases in both the Average hourly earning from the CES, and in the Atlanta Fed Wage Tracker. Perhaps nominal wages will increase close to 3% in 2018 according to the CES.Through June 2018, nominal hourly wages were up 2.7% year-over-year. This is about the same as last year, and it is too early to tell if wages will increase at a faster rate in 2017.

5) Question #5 for 2018: Will the Fed raise rates in 2018, and if so, by how much?

My current guess is the Fed will hike three times in 2018.The Fed has already hiked twice in 2018, and it now appears there will be four hikes this year.

As an aside, many new Fed Chairs have faced a crisis early in their term. A few examples, Paul Volcker took office in August 1979, and inflation hit almost 12% (up from 7.9% the year before), and the economy went into recession as Volcker raised rates. Alan Greenspan took office in August 1987, and the stock market crashed almost 34% within a couple months of Greenspan taking office (including over 20% in one day!). And Ben Bernanke took office in February 2006, just as house prices peaked - and he was challenged by the housing bust, great recession and financial crisis.

Hopefully Jerome Powell will see smoother sailing.

4) Question #4 for 2018: Will the core inflation rate rise in 2018? Will too much inflation be a concern in 2018?

The Fed is projecting core PCE inflation will increase to 1.7% to 1.9% by Q4 2018. However there are risks for higher inflation with the labor market near full employment, and new tax law providing some fiscal stimulus.As of May, inflation has moved up to the Fed's target.

I do think there are structural reasons for low inflation, but currently I think PCE core inflation (year-over-year) will increase in 2018 and be closer to 2% by Q4 2018 (up from 1.4%), but too much inflation will still not be a serious concern in 2018.

3) Question #3 for 2018: What will the unemployment rate be in December 2018?

Depending on the estimate for the participation rate and job growth (next question), it appears the unemployment rate will decline into the high 3's by December 2018 from the current 4.1%. My guess is based on the participation rate declining about 0.2 percentage points in 2018, and for decent job growth in 2018, but less than in 2017.The unemployment rate was at 4.0% in June.

2) Question #2 for 2018: Will job creation slow further in 2018?

So my forecast is for gains of around 150,000 to 167,000 payroll jobs per month in 2018 (about 1.8 million to 2.0 million year-over-year) . Lower than in 2017, but another solid year for employment gains given current demographics.Through June 2018, the economy has added 1,287,000 thousand jobs, or 215,000 per month. This is above my forecast, and it appears the economy will add more jobs in 2018 than in 2017 although still below gains for the years 2013 through 2016.

1) Question #1 for 2018: How much will the economy grow in 2018?

It is possible that there will be a pickup in growth in 2018 due to a combination of factors.GDP growth was at 2.0% in Q1, and most estimates suggest growth around 3.8% in Q2 (and slowing in Q3). It looks like GDP growth will be in the high 2% range this year, and 3% is possible.

The new tax policy should boost the economy a little in 2018, and there will probably be some further economic boost from oil sector investment in 2018 since oil prices have increased recently. Also the housing recovery is ongoing, however auto sales are mostly moving sideways.

And demographics are improving (the prime working age population is growing about 0.5% per year, compared to declining a few years ago).

All these factors combined will probably push GDP growth into the mid-to-high 2% range in 2018. And a 3% handle is possible if there is some pickup in productivity.

Currently it looks like 2018 is unfolding about as expected, although, employment gains will probably be higher than I originally expected.

BLS: Job Openings Decreased in May

by Calculated Risk on 7/10/2018 10:10:00 AM

Notes: In May there were 6.638 million job openings, and, according to the May Employment report, there were 6.065 million unemployed. So, for the second consecutive month, there were more job openings than people unemployed. Also note that the number of job openings has exceeded the number of hires since January 2015.

From the BLS: Job Openings and Labor Turnover Summary

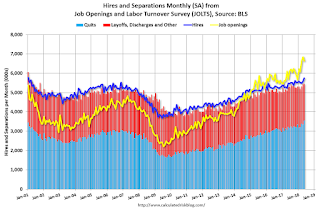

The number of job openings edged down to 6.6 million on the last business day of May, the U.S. Bureau of Labor Statistics reported today. Over the month, hires and separations were little changed at 5.8 million and 5.5 million, respectively. Within separations, the quits rate and the layoffs and discharges rate were little changed at 2.4 percent and 1.1 percent, respectively. ...The following graph shows job openings (yellow line), hires (dark blue), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

The number of quits increased in May to 3.6 million (+212,000). The quits rate was 2.4 percent. The number of quits rose for total private (+204,000) and was little changed for government.

emphasis added

This series started in December 2000.

Note: The difference between JOLTS hires and separations is similar to the CES (payroll survey) net jobs headline numbers. This report is for May, the most recent employment report was for June.

Click on graph for larger image.

Click on graph for larger image.Note that hires (dark blue) and total separations (red and light blue columns stacked) are pretty close each month. This is a measure of labor market turnover. When the blue line is above the two stacked columns, the economy is adding net jobs - when it is below the columns, the economy is losing jobs.

Jobs openings decreased in May to 6.638 million from 6.840 million in April.

The number of job openings (yellow) are up 16.7% year-over-year.

Quits are up 10.4% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

Job openings are at a high level, and quits are increasing year-over-year. This was a strong report.

Small Business Optimism Index decreased in June

by Calculated Risk on 7/10/2018 08:35:00 AM

From the National Federation of Independent Business (NFIB): June 2018 Report: Small Business Optimism Index

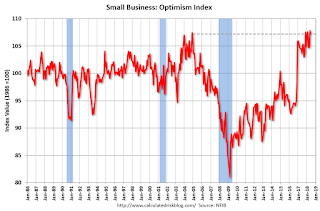

The Small Business Optimism Index posted its sixth highest reading in survey history for the month of June, at 107.2, down 0.6 from May.

..

Reports of employment gains remain strong among small businesses. Owners reported adding a net 0.19 workers per firm on average, virtually unchanged from May

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 107.2 in June.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.

Monday, July 09, 2018

Tuesday: Job Openings

by Calculated Risk on 7/09/2018 06:59:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Edge Slightly Higher

Mortgage rates were modestly higher today amid exceptionally quiet market conditions. In general, the bond market (which underlies mortgage rates) has been sideways and fairly lifeless since the end of June. [30YR FIXED - 4.625% - 4.75%]Tuesday:

emphasis added

• At 6:00 AM ET, NFIB Small Business Optimism Index for June.

• At 10:00 AM, Job Openings and Labor Turnover Survey for May from the BLS. Job openings increased in April to 6.698 million from 6.633 million in March.

U.S. Heavy Truck Sales up Year-over-year in June

by Calculated Risk on 7/09/2018 02:09:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the June 2018 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 364 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 475 thousand SAAR in June, up from 452 thousand in May, and up from 416 thousand in June 2017.

Annual Vehicle Sales: On Pace to increase slightly in 2018

by Calculated Risk on 7/09/2018 01:28:00 PM

The BEA released their estimate of June vehicle sales. The BEA estimated sales of 17.38 million SAAR in June 2018 (Seasonally Adjusted Annual Rate), up 3.2% from the May sales rate, and up 4.7% from June 2017.

Through June, light vehicle sales are on pace to be up slightly in 2018 compared to 2017.

This would make 2018 the fourth best year on record after 2016, 2015, and 2000.

My guess is vehicle sales will finish the year with sales lower than in 2017. A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels.

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated based on the pace of sales during the first six months.

Black Knight Mortgage Monitor for May

by Calculated Risk on 7/09/2018 09:17:00 AM

Black Knight released their Mortgage Monitor report for May today. According to Black Knight, 3.64% of mortgages were delinquent in May, down from 3.79% in May 2017. Black Knight also reported that 0.59% of mortgages were in the foreclosure process, down from 0.83% a year ago.

This gives a total of 4.23% delinquent or in foreclosure.

Press Release: Black Knight’s May 2018 Mortgage Monitor

Today, the Data & Analytics division of Black Knight, Inc.released its latest Mortgage Monitor Report, based on data as of the end of May 2018. This month, the company looks again at tappable equity, or the share of equity available for homeowners with mortgages to borrow against before reaching a maximum total combined loan-to-value (LTV) ratio of 80 percent. Despite the record-setting growth in such equity seen in the first quarter of 2018, homeowners are withdrawing equity at a lower rate than in the past. As Ben Graboske, executive vice president of Black Knight’s Data & Analytics division explained, although total equity withdrawn by dollar amount has increased slightly since the same time last year, the rate of growth pales in comparison to that of tappable equity.

“In Q1 2018, homeowners with mortgages withdrew $63 billion in equity via cash-out refinances or HELOCs,” said Graboske. “That represents a slight one percent increase from the same time last year, despite the fact that the amount of equity available for homeowners to borrow against increased by 16 percent over the same time period. Collectively, American homeowners now have $5.8 trillion in tappable equity available, yet only 1.17 percent of that total was withdrawn in the first quarter of the year. That’s the lowest quarterly share in four years, and the second lowest since the housing recovery began six years ago. Somewhat surprisingly, even though rising first-lien interest rates normally produce an increase in HELOC lending, the volume of equity withdrawn via lines of credit dropped to a two-year low as well.

“One driving factor in the decline of HELOC equity utilization is likely the increasing spread between first-lien mortgage interest rates – which are tied most closely to 10-year Treasury yields – and those of HELOCs – which are more closely tied to the federal funds rate. As of late last year, the difference between a HELOC rate and a first-lien rate had widened to 1.5 percent, the widest spread we’ve seen since we began comparing the two rates 10 years ago. The distance between the two has closed somewhat in Q2 as 30-year mortgage rates have been on the rise, which does suggest the market remains ripe for relatively low-risk HELOC lending expansion. Still, increasing costs in the form of higher interest rates do appear to have impacted homeowners’ borrowing decisions in Q1 2018. We should also remember that the Federal Reserve raised its target interest rate again at its June meeting, which will likely further increase the standard interest rate on HELOCs in Q3 2018. Black Knight will continue to monitor the situation moving forward.”

The data also showed that tappable equity increased by more than $380 billion in Q1 2018, the largest single-quarter growth since Black Knight began tracking the metric in 2005. On an annual basis, total tappable equity increased $820 billion, a 16.5 percent increase over the prior 12 months. The $5.8 trillion in total available tappable equity is 16 percent higher than the peak seen during the pre-recession peak in 2006. Nearly 80 percent of the nation’s tappable equity is held by homeowners with first-lien interest rates at or below 4.5 percent, with 60 percent of the total being held by those with current rates below 4.0 percent. The average mortgage holder gained $14,700 in tappable equity over the past year and has $113,900 in total available equity to borrow against.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the number of active foreclosure since 2000.

From Black Knight:

• The number of active foreclosures has declined from 2.3M at the peak in December 2010 to just 303k remaining today

• At the current rate of improvement (-29% Y/Y), the national foreclosure rate is on pace to ‘normalize’ (to the 2000-2005 average) within the next three months

• The number of outstanding foreclosures is on track to normalize in September 2018

• Given the various factors noted on the previous page, we may see foreclosure volumes dip even further

• Holding today's rate of improvement steady, both foreclosure rates and active foreclosure inventory would fall to the lowest level this century within the next 18 months

The second graph shows Black Knight's estimate of "Tappable Equity":

• Tappable equity increased by $820B (+16.5%) over the past 12 monthsThere is much more in the mortgage monitor.

• A total of $5.8T in tappable equity now held by U.S. homeowners with mortgages represents the highest volume ever recorded, and 16% above the mid-2006 peak

• Tappable equity grew by >$380B (+7%) in Q1 2018 alone, marking the largest single quarter growth volume of lendable equity since Black Knight began tracking it in 2005

...

• A large driver has been rising home prices, which rose + 2.5% in just the first 3 months of 2018, about +$6,900 for the median-priced home

• Additionally, declining current combined LTVs (CLTV) – now 52% on average, the lowest ever recorded by Black Knight – mean that the majority of home price gains are immediately eligible to be tapped

Oil Rigs: "A rebound after last week's fall"

by Calculated Risk on 7/09/2018 08:56:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on July 6, 2018:

• Rig counts recovered after last week’s lousy numbers

• Total oil rigs are up, +5 to 863

• Horizontal oil rigs rebounded, +6 to 771

...

• The big movers this week were the Cana Woodford, -6; and Other US, +7. Expect some reversal of these numbers next week.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Sunday, July 08, 2018

Sunday Night Futures

by Calculated Risk on 7/08/2018 06:39:00 PM

Weekend:

• Schedule for Week of July 8, 2018

Monday:

• At 3:00 PM ET, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $12.4 billion in May.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 4, and DOW futures are up 45 (fair value).

Oil prices were mixed over the last week with WTI futures at $73.96 per barrel and Brent at $77.29 per barrel. A year ago, WTI was at $44, and Brent was at $47 - so oil prices are up about 65% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.86 per gallon. A year ago prices were at $2.26 per gallon - so gasoline prices are up 60 cents per gallon year-over-year.

Public and Private Sector Payroll Jobs During Presidential Terms

by Calculated Risk on 7/08/2018 11:39:00 AM

By request, here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, Fed Chair, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

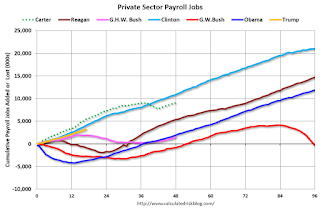

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just 17 months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 804,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 391,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,964,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,509,000 under President G.H.W. Bush (light purple), and 11,907,000 under President Obama (dark blue).

During the first 17 months of Mr. Trump's term, the economy has added 3,188,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 266,000 jobs).

During the first 17 months of Mr. Trump's term, the economy has added 28,000 public sector jobs.

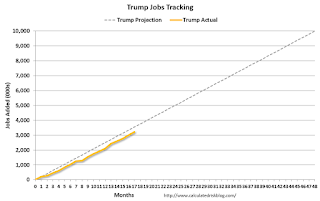

After 17 months of Mr. Trump's presidency, the economy has added 3,216,000 jobs, about 326,000 behind the projection.