by Calculated Risk on 6/20/2018 07:00:00 AM

Wednesday, June 20, 2018

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 15, 2018.

... The Refinance Index increased 6 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.83 percent, with points decreasing to 0.48 from 0.53 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

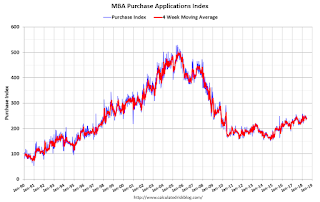

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, June 19, 2018

Wednesday: Existing Home Sales

by Calculated Risk on 6/19/2018 07:54:00 PM

Wednesday:

• At 7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:30 AM: Panel Discussion, Fed Chair Jerome Powell, Monetary Policy at a Time of Uncertainty and Tight Labor Markets, At the ECB Forum on Central Banking, Linhó Sintra, Portugal

• At 10:00 AM: Existing Home Sales for May from the National Association of Realtors (NAR). The consensus is for 5.56 million SAAR, up from 5.46 million in April. Housing economist Tom Lawler estimates the NAR will reports sales of 5.47 million SAAR for May and that inventory will be down 5.1% year-over-year.

• At During the day: The AIA's Architecture Billings Index for May (a leading indicator for commercial real estate).

Existing Home Inventory: Up 8.3% Year-over-year in California

by Calculated Risk on 6/19/2018 04:37:00 PM

It appears inventory has bottomed in some areas. The CAR reported today: California median home price sets new record as home sales dial back, C.A.R. reports

The number of statewide active listings improved for the second consecutive month, increasing 8.3 percent from the previous year.Here is some data from the NAR and CAR (ht Tom Lawler)

…

“As we predicted last month, California’s statewide median home price broke the previous pre-recession peak set in May 2007 and hit another high as tight supply conditions continued to pour fuel on the price appreciation fire,” said C.A.R. Senior Vice President and Chief Economist Leslie Appleton-Young. “With inventory starting to show signs of improvement, however, home price appreciation could decelerate in the second half of the year, especially since further rate increases are expected to hamper homebuyers’ affordability and limit how much they are willing to pay for their new home.”

emphasis added

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

| May-18 | --- | 8.3% |

Existing Home Sales: Take the Under for May

by Calculated Risk on 6/19/2018 02:08:00 PM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8+ years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initially reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

As an example, last month, for April 2018, the consensus was for sales of 5.60 million on a seasonally adjusted annual rate (SAAR) basis. Lawler estimated 5.48 million, and the NAR reported 5.46 million (the consensus missed by 140 thousand compared to 20 thousand for Lawler).

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

For May 2018, the consensus is that the NAR will report sales of 5.56 million SAAR. However, housing economist Tom Lawler estimates the NAR will report sales of 5.47 million.

Lawler's estimate is a little below the consensus, so I'd take the under for May. Note: The NAR is scheduled to report May Existing Home Sales tomorrow Wednesday, June 20th at 10:00 AM ET.

Over the last eight years, the consensus average miss was 147 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | 5.60 |

| Apr-18 | 5.60 | 5.48 | 5.46 |

| May-18 | 5.56 | 5.47 | --- |

| 1NAR initially reported before revisions. | |||

Comments on May Housing Starts

by Calculated Risk on 6/19/2018 11:10:00 AM

Earlier: Housing Starts increased to 1.350 Million Annual Rate in May

The housing starts report released this morning showed starts were up 5.0% in May compared to April, and starts were up 20.3% year-over-year compared to April 2017.

Both multi-family and single family starts were up solidly year-over-year.

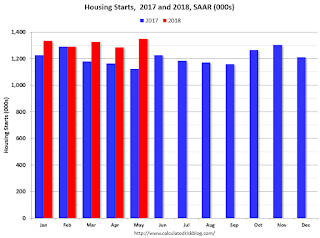

This first graph shows the month to month comparison for total starts between 2017 (blue) and 2018 (red).

Starts were up 20.3% in May compared to May 2017.

Note that starts in March, April and May of 2017 were weaker than other months, so this was a solid increase, but also a fairly easy comparison.

Through five months, starts are up 11.0% year-to-date compared to the same period in 2017.

Single family starts were up 18.3% year-over-year, and up 3.9% compared to April 2018.

Multi-family starts (including 2 units) were up 25.1% year-over-year, and up 7.5% compared to April 2018 (multi-family is volatile month-to-month).

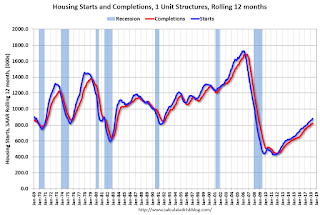

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily for several years following the great recession - but has turned down recently. Completions (red line) had lagged behind - however completions have caught up to starts (more deliveries).

It is likely that both starts and completions, on rolling 12 months basis, will now move mostly sideways.

As I've been noting for a few years, the significantly growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few more years of increasing single family starts and completions.

Housing Starts increased to 1.350 Million Annual Rate in May

by Calculated Risk on 6/19/2018 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,350,000. This is 5.0 percent above the revised April estimate of 1,286,000 and is 20.3 percent above the May 2017 rate of 1,122,000. Single-family housing starts in May were at a rate of 936,000; this is 3.9 percent above the revised April figure of 901,000. The May rate for units in buildings with five units or more was 404,000.

Building Permits:

Privately-owned housing units authorized by building permits in May were at a seasonally adjusted annual rate of 1,301,000. This is 4.6 percent below the revised April rate of 1,364,000, but is 8.0 percent above the May 2017 rate of 1,205,000. Single-family authorizations in May were at a rate of 844,000; this is 2.2 percent below the revised April figure of 863,000. Authorizations of units in buildings with five units or more were at a rate of 421,000 in May.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) increased in May compared to April. Also Multi-family starts were up 25% year-over-year in May.

Multi-family is volatile month-to-month, and has been mostly moving sideways the last few years.

Single-family starts (blue) increased in May, and were up 18% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically fairly low).

Total housing starts in May were above expectations, however starts for March and April were revised down slightly (Combined).

I'll have more later ...

Monday, June 18, 2018

Tuesday: Housing Starts

by Calculated Risk on 6/18/2018 06:46:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Little-Changed to Begin Quiet Week

Mortgage rates were sideways to slightly higher today, depending on the lender. The underlying bond market (which dictates rates) was exceptionally quiet. On the heels of last week's important events and without much on the calendar this week, markets may take a couple days to relax.Tuesday:

To put that in context, rates have been holding somewhat steady just below long-term highs. [30YR FIXED - 4.625%]

emphasis added

• At 8:30 AM: Housing Starts for May. The consensus is for 1.309 million SAAR, up from 1.287 million SAAR in April.

Lawler: Early Read on Existing Home Sales in May

by Calculated Risk on 6/18/2018 03:13:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in May

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.47 million in May, little changed from April’s preliminary pace and down 2.3% from last May’s seasonally adjusted pace.

Local realtor/MLS data, as well as tracking sources, indicate that while the inventory of existing homes for sale in May was down from a year ago, the YOY decline in May was less than that in April. I project that the NAR’s estimate of the number of existing homes for sale at the end of May will be 1.87 million, up 3.9% from April’s preliminary estimate and down 5.1% from last May.

Finally, local realtor/MLS data suggest the median US existing single-family home sales price last month was up about 6.3% from last May. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: Existing home sales for May are scheduled to be released by the NAR on Wednesday, June 20th. The consensus is the NAR will report sales of 5.56 Million SAAR.

Phoenix Real Estate in May: Sales up 3%, Active Inventory down 16% YoY

by Calculated Risk on 6/18/2018 01:02:00 PM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports ("Stats Report", table below):

1) Overall sales in May were up 2.8% year-over-year.

2) Active inventory is down 15.5% year-over-year. In some cities, it appears the inventory decline might be ending, but not yet in Phoenix.

This is the nineteenth consecutive month with a YoY decrease in inventory.

| May Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||

|---|---|---|---|---|

| Sales | YoY Change | Active Inventory | YoY Change | |

| 12-May | 8,435 | --- | 12,932 | --- |

| 13-May | 8,754 | 3.8% | 15,517 | 20.0% |

| 14-May | 7,659 | -12.5% | 26,245 | 69.1% |

| 15-May | 8,319 | 8.6% | 21,569 | -17.8% |

| 16-May | 8,676 | 4.3% | 18,975 | -12.0% |

| 17-May | 9,641 | 11.1% | 18,688 | -1.5% |

| 18-May | 9,913 | 2.8% | 15,795 | -15.5% |

NAHB: Builder Confidence Decreases to 68 in June

by Calculated Risk on 6/18/2018 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in June, down from 70 in May. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Slips Two Points as Lumber Prices Soar

Builder confidence in the market for newly built single-family homes fell two points to 68 in June on the NAHB/Wells Fargo Housing Market Index (HMI). The decline was due in large part to sharply elevated lumber prices, although sentiment remains on solid footing.

“Builders are optimistic about housing market conditions as consumer demand continues to grow,” said NAHB Chairman Randy Noel. “However, builders are increasingly concerned that tariffs placed on Canadian lumber and other imported products are hurting housing affordability. Record-high lumber prices have added nearly $9,000 to the price of a new single-family home since January 2017.”

“Improved economic growth, continued job creation and solid housing demand should spur additional single-family construction in the months ahead,” said NAHB Chief Economist Robert Dietz. “However, builders do need access to lumber and other construction materials at reasonable costs in order to provide homes at competitive price points, particularly for the entry-level market where inventory is most needed.”

...

All three HMI indexes inched down a single point in June. The index measuring current sales conditions fell to 75, the component gauging expectations in the next six months dropped to 76, and the metric charting buyer traffic edged down to 50.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose two points to 57 while the West and Midwest remained unchanged at 76 and 65, respectively. The South fell one point to 71.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was below the consensus forecast, but still a solid reading.