by Calculated Risk on 5/27/2018 08:12:00 AM

Sunday, May 27, 2018

May 2018: Unofficial Problem Bank list; Which Bank is the "Mystery" Problem Bank?

Note: Surferdude808 compiles an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 2018.

Here are the monthly changes and a few comments from surferdude808:

Update on the Unofficial Problem Bank List for May 2018. The list had a net decline of two insured institutions to 92 banks after three additions and five removals. After the net changes to the list and updating asset with 2018Q1 figures, aggregate assets declined during the month by $911 million to $18.0 billion. A year ago, the list held 140 institutions with assets of $34.2 billion.CR Note: When the unofficial weekly was list was first published on August 7, 2009 it had 389 institutions. The list peaked at just over 1,000 institutions in 2011. Now there are only 92 banks on the unofficial list (the FDIC reported 92 banks on the official problem bank list at the end of 2017).

Actions were terminated against HomeStar Bank and Financial Services, Manteno, IL ($359 million); Freedom Bank of Oklahoma, Tulsa, OK ($156 million); and Superior Bank, Hazelwood, MO ($29 million). Finding their way off the list through merger were Indus American Bank, Edison, NJ ($231 million) and Wawel Bank, Wallington, NJ ($73 million).

Additions this month were Maryland Financial Bank, Towson, MD ($66 million); Sunrise Bank Dakota, Onida, SD ($65 million); and The First National Bank of Sedan, Sedan, KS ($64 million).

Name and location changes made this month include Saigon National Bank (Cert #57974), Westminster, CA with a name change to California International Bank, N.A. and a headquarters move to Rosemead, CA; First State Bank (Cert #9502), Danville, VA with a name change to Movement Bank; Covenant Bank (Cert #34460), Leeds, AL with a name change to Millennial Bank; California Business Bank (Cert #58037), Los Angeles, CA with a headquarters move to Irvine, CA; and BNB Hana Bank, National Association (Cert #26790), Fort Lee, NJ with a name change to KEB Hana Bank USA, National Association.

This week the FDIC released their official Problem Bank figures for the end of the first quarter of 2018, with their list holding 92 institutions with assets of $56.4 billion. At the end of the fourth quarter of 2017, the FDIC reported the 95 institutions with assets of $13.9 billion were on the official Problem Bank List. So if we understand the FDIC correctly, over the past 90 days, the official Problem Bank List has declined by three institutions but aggregate assets increased by a whopping $42.5 billion.

During the press conference this week and its press release, the FDIC highlighted the decline in the number of problem banks being the lowest since the first quarter of 2008, but there was no mention of the significant jump in problem bank assets. In the question and answer section of the press conference, an intrepid reporter asked FDIC Chairman Gruenberg about the increase. In response, Chairman Gruenberg, consistent with normal protocol, said he would not comment about the condition of an open institution.

Given that the FDIC does not disclose the contents of its official Problem Bank List, we are left to ponder what large-sized institution they added. Because of the small change in the number of banks on the list, our first guess is that a single institution with assets in the $40 billion to $46 billion range was added to the list. We have scoured all available information sources such as the enforcement action search engines of the Federal Reserve, FDIC, and OCC and SEC disclosures of publicly traded bank/bank holding companies without finding any recent safety & soundness actions issued against banks with asset sizes in the $40 billion to $46 billion range. There are six institutions with assets in this range, with five being controlled by a parent company whose stock is publicly traded. Obviously, receiving an enforcement action that should be issued to a bank that is on the Problem Bank List, is worthy of an 8-K disclosure. There is only one institution in that asset range, without an ultimate domestic parent, which would not have to disclose issuance of an enforcement action. We will continue to monitor the banking regulator websites and other information sources. Ideally, this mystery is solved by our next update.

The FDIC's official problem bank list is comprised of banks with a CAMELS rating of 4 or 5, and the list is not made public (just the number of banks and assets every quarter). Note: Bank CAMELS ratings are also not made public.

CAMELS is the FDIC rating system, and stands for Capital adequacy, Asset quality, Management, Earnings, Liquidity and Sensitivity to market risk. The scale is from 1 to 5, with 1 being the strongest.

As a substitute for the CAMELS ratings, surferdude808 is using publicly announced formal enforcement actions, and also media reports and company announcements that suggest to us an enforcement action is likely, to compile a list of possible problem banks in the public interest.

Saturday, May 26, 2018

Schedule for Week of May 27, 2018

by Calculated Risk on 5/26/2018 08:12:00 AM

The key reports this week are the May employment report on Friday, and the second estimate of Q1 GDP on Wednesday.

Other key indicators include Personal Income and Outlays for April, the May ISM manufacturing index, and May auto sales.

All US markets will be closed in observance of Memorial Day.

9:00 AM ET: S&P/Case-Shiller House Price Index for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for March.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2018 report (the Composite 20 was started in January 2000).

The consensus is for a 6.4% year-over-year increase in the Comp 20 index for March.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for May. This is the last of the regional Fed surveys for May.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:15 AM: The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 186,000 payroll jobs added in May, down from 204,000 added in April.

8:30 AM: Gross Domestic Product, 1st quarter 2018 (Second estimate). The consensus is that real GDP increased 2.2% annualized in Q1, down from the advance estimate of 2.3% in Q1.

2:00 PM: the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 224 thousand initial claims, down from 234 thousand the previous week.

8:30 AM: Personal Income and Outlays for April. The consensus is for a 0.3% increase in personal income, and for a 0.3% increase in personal spending. And for the Core PCE price index to increase 0.1%.

9:45 AM: Chicago Purchasing Managers Index for May. The consensus is for a reading of 58.1, up from 57.6 in April.

10:00 AM: Pending Home Sales Index for April. The consensus is for a 0.7% increase in the index.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April.

8:30 AM: Employment Report for May. The consensus is for an increase of 185,000 non-farm payroll jobs added in May, up from the 164,000 non-farm payroll jobs added in April. The consensus is for the unemployment rate to be unchanged at 3.9%.

This graph shows the year-over-year change in total non-farm employment since 1968.

In April the year-over-year change was 2.280 million jobs.

A key will be the change in wages.

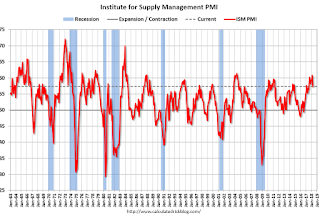

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April.

10:00 AM: ISM Manufacturing Index for May. The consensus is for the ISM to be at 58.4, up from 57.3 in April.Here is a long term graph of the ISM manufacturing index.

The PMI was at 57.3% in April, the employment index was at 54.2%, and the new orders index was at 61.2%.

10:00 AM: Construction Spending for April. The consensus is for a 0.8% increase in construction spending.

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for May. The consensus is for light vehicle sales to be 17.1 million SAAR in May, down from 17.2 million in April (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the April sales rate.

Friday, May 25, 2018

Oil Rigs: "Big rig add reversing last week"

by Calculated Risk on 5/25/2018 06:19:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on May 25, 2018:

• Total US oil rigs were up 15 to 859

• Horizontal oil rigs added 9 to 755

...

• The gains this week were largely a catch-up on last week’s flat numbers

• Oil prices moved down sharply on Friday as traders sold their positions heading into the Memorial Day weekend and on news OPEC may add volumes

• We do not believe OPEC will add material volumes

• The Brent spread advanced to $8.65 and the futures curve remains in pronounced backwardation, suggesting demand remains robust

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: "US Deaths Jumped in 2017"

by Calculated Risk on 5/25/2018 03:16:00 PM

From housing economist Tom Lawler: US Deaths Jumped in 2017

Provisional estimates from the National Center for Health Statistics (NCHS) indicate that the number of US deaths increased sharply last year, both in absolute terms and adjusted for age. According to the NCHS’ “mortality dashboard”, the “crude” US death rate (deaths per 100,000 of population) averaged 866.2 in 2017, up from 839.3 in 2016. The NCHS’ “age-adjusted” death rate (which adjusts for the changing age distribution of the population) for 2017 was 733.6, up from 728.8 in 2017 and the highest age-adjusted death rate since 2011. These data suggest that the total number of US deaths last year was around 2.821 million, compared to 2.744 million in 2016.

While data on deaths by age (or full-year deaths by cause) are not yet available, these data suggest that the recent alarming trend of significantly higher death rates among teenagers and non-elderly adults (shown in the table below) continued last year.

| US Death Rates (deaths per 100,000 population), Total and Selected Age Groups (NCHS) | ||||||||

|---|---|---|---|---|---|---|---|---|

| 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | |

| All Ages | 866.2 | 839.3 | 844.0 | 823.7 | 821.5 | 810.2 | 807.3 | 799.5 |

| <1 | 587.0 | 589.6 | 588.0 | 594.7 | 599.3 | 600.1 | 623.4 | |

| 1-4 | 25.2 | 24.9 | 24.0 | 25.5 | 26.3 | 26.3 | 26.5 | |

| 5-14 | 13.4 | 13.2 | 12.7 | 13.0 | 12.6 | 13.2 | 12.9 | |

| 15-24 | 74.9 | 69.5 | 65.5 | 64.8 | 66.4 | 67.7 | 67.7 | |

| 25-34 | 129.0 | 116.7 | 108.4 | 106.1 | 105.4 | 104.7 | 102.9 | |

| 35-44 | 192.2 | 180.1 | 175.2 | 172.0 | 170.7 | 172.0 | 170.5 | |

| 45-54 | 405.5 | 404.0 | 404.8 | 406.1 | 405.4 | 409.8 | 407.1 | |

| 55-64 | 883.8 | 875.3 | 870.3 | 860.0 | 854.2 | 849.4 | 851.9 | |

| 65-74 | 1788.6 | 1796.8 | 1786.3 | 1802.1 | 1802.5 | 1846.2 | 1875.1 | |

| 75-84 | 4474.8 | 4579.2 | 4564.2 | 4648.1 | 4674.5 | 4753.0 | 4790.2 | |

| 85+ | 13392.1 | 13673.9 | 13407.9 | 13660.4 | 13678.6 | 13779.3 | 13934.3 | |

| Age Adjusted | 733.6 | 728.8 | 733.1 | 724.6 | 731.9 | 732.8 | 741.3 | 747.0 |

What is especially striking about this table is the substantial increase in death rates for the 15-44 year old age groups from 2014 to 2016.

While full-year provisional estimates of deaths by cause are not yet available, here are some death rates by selected causes for the four-quarters ending in the second quarter.

| Death Rate (per 100,000 population) by Selected Cause | |||

|---|---|---|---|

| Four Quarter Period Ended: | Drug Overdose | Firearm Injury | Suicide |

| Q2/2017 | 21.0 | 14.1 | 11.6 |

| Q2/2016 | 17.8 | 13.8 | 12.2 |

With respect to drug overdose deaths, the “trending” quarterly data suggest that drug overdose deaths in 2017 were probably around 70,000. Here is a table showing recent history

| Drug Overdose Deaths by Selected Age Groups, NCHS | ||||||||

|---|---|---|---|---|---|---|---|---|

| 15-24 | 25-34 | 35-44 | 45-54 | 55-64 | 65+ | Total | ||

| 2012 | 3,518 | 8,508 | 8,948 | 11,895 | 6,423 | 2,094 | 41,386 | |

| 2013 | 3,664 | 8,947 | 9,320 | 12,045 | 7,551 | 2,344 | 43,871 | |

| 2014 | 3,798 | 10,055 | 10,134 | 12,263 | 8,122 | 2,568 | 46,940 | |

| 2015 | 4,235 | 11,880 | 11,505 | 12,974 | 8,901 | 2,760 | 52,255 | |

| 2016 | 5,376 | 15,443 | 14,183 | 14,771 | 10,632 | 3,075 | 63,480 | |

| 2017 | 70,0001 | |||||||

| 1estimate | ||||||||

For folks who rely on Census population projections to forecast other variables such as labor force growth, household growth, etc., these recent death statistics suggest that they should not do so. The latest Census long-term population projections not only did not reflect the increased death rates for certain age groups from 2014 to 2016, but also assumed that death rates for most age groups would decline from the assumed rates for 2017. E.g., here is a table showing the projected deaths in the Census population projections (released earlier this year) for the year ended 6/30/2017 compared to the NCHS data for deaths for calendar year 2016.

| Age Group | Census 2017 Projections 7/1/15-6/30/17 | NCHS 2016 (Calendar Year) | Difference |

|---|---|---|---|

| <1 | 39,741 | 23,161 | 16,580 |

| 1-4 | 8,482 | 4,045 | 4,437 |

| 5-9 | 2,422 | 2,490 | -68 |

| 10-14 | 2,883 | 3,013 | -130 |

| 15-24 | 23,543 | 32,575 | -9,032 |

| 25-34 | 43,981 | 57,616 | -13,635 |

| 35-44 | 62,599 | 77,792 | -15,193 |

| 45=54 | 151,976 | 173,516 | -21,540 |

| 55-64 | 330,420 | 366,445 | -36,025 |

| 65-74 | 493,422 | 512,080 | -18,658 |

| 75-84 | 619,610 | 636,916 | -17,306 |

| >85 | 909,723 | 854,462 | 55,261 |

| N/A | 137 | -137 | |

| Total | 2,688,802 | 2,744,248 | -55,446 |

Note that the latest Census population projections were dramatically too high for infant deaths (they made a mistake) and too high for the very elderly, but way too low for the 15-84 year old groups.

Here is another table comparing the death assumptions in the latest Census population projection to NCHS data.

| Census 2017 Projections 12 month period ended 6/30 | NCHS Calendar Year | |

|---|---|---|

| 2016 | 2,744,248 | |

| 2017 | 2,688,802 | 2,821,379* |

| 2018 | 2,717,297 | |

| 2019 | 2,744,661 | |

| 2020 | 2,772,160 |

If death rates by age were to move back down to 2016 levels from 2018 to 2020, then deaths from 2018 to 2020 would cumulatively be about 260,000 higher than those in the Census’ latest projection. However, deaths of 15-84 year olds would be whopping 496,000 higher over this three year period than what is shown in the Census’ latest projections, while deaths of 85 year olds and older would be about 180,000 fewer. These are actually fairly large number.

Net, the latest provisional data on US deaths is bad news from a societal perspective. They also indicate that the latest Census population projections are of limited usefulness, and analysts relying on population projection to forecast other key variables must actually produce their own population projections based on reasonable assessments of population growth’s key drivers – births, deaths, and net international migration – the latter of which is an even thornier issue, which I won’t touch on today.

Sometime in the near future I will produce updated population projections by age incorporating the recently release “Vintage 2017” estimates, more realistic death assumptions, and different scenarios for net international migration.

Q2 GDP Forecasts

by Calculated Risk on 5/25/2018 11:18:00 AM

From Merrill Lynch:

On balance, today's data added a tenth to 2Q GDP tracking, to 3.5% qoq saar [May 25 estimate].From Goldman Sachs:

emphasis added

[W]e are lowering our Q2 GDP tracking estimate by one tenth to +3.4% (qoq ar). [May 24 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2018 is 4.0 percent on May 25, down from 4.1 percent on May 16. [May 25 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 3.0% for 2018:Q2. [May 25 estimate]CR Note: These early estimates suggest real annualized GDP in the 3% to 4% in Q2.

Fed Chair Powell: "Financial Stability and Central Bank Transparency"

by Calculated Risk on 5/25/2018 09:30:00 AM

An excerpt from Fed Chair Jerome Powell's comments at "350 years of Central Banking: The Past, the Present and the Future," in Stockholm, Sweden: Financial Stability and Central Bank Transparency

The post-crisis framework remains novel and unfamiliar. Some of these new policies, such as stress testing and resolution planning, are inherently complex and challenging for all involved. As a result, transparency and accountability around financial stability tools present particular challenges. We will continue to strive to find better ways to enhance transparency around our approach to preserving financial stability. Efforts to engage with the public‑‑including consumer groups, academics, and the financial sector‑‑are likely to lead to improved policies. Moreover, ongoing dialogue will work to enhance public trust, as well as our ability to adapt to new threats as they emerge.

There is every reason to expect that technology and communications will continue to rapidly evolve, and to affect the financial system and financial stability in ways that we cannot fully anticipate. While future innovations may well improve the delivery of financial services and make the system stronger, they may also contain the seeds of potential future systemic vulnerabilities. We will need to keep up with the pace of innovation, which will doubtless require changes to our approach to financial stability. As we consider such changes, it will remain critically important to provide transparency and accountability. By doing so, we strengthen the foundation of democratic legitimacy that enables central banks to serve the needs of our citizens, in the long and proud tradition of the Riksbank.

Thursday, May 24, 2018

Friday: Durable Goods

by Calculated Risk on 5/24/2018 08:43:00 PM

Friday:

• At 8:30 AM, Durable Goods Orders for April from the Census Bureau. The consensus is for a 1.3% decrease in durable goods orders.

• At 9:20 AM, Panel Discussion, Fed Chair Jerome Powell, Financial Stability and Central Bank Transparency, At the Sveriges Riksbank Conference: 350 Years of Central Banking--The Past, The Present and The Future, Stockholm, Sweden

• At 10:00 AM, University of Michigan's Consumer sentiment index (Final for May). The consensus is for a reading of 99.0, up from 98.8.

Housing Inventory Tracking

by Calculated Risk on 5/24/2018 03:59:00 PM

Update: Watching existing home "for sale" inventory is very helpful. As an example, the increase in inventory in late 2005 helped me call the top for housing.

And the decrease in inventory eventually helped me correctly call the bottom for house prices in early 2012, see: The Housing Bottom is Here.

And in 2015, it appeared the inventory build in several markets was ending, and that boosted price increases.

I don't have a crystal ball, but watching inventory helps understand the housing market.

Here is a table from housing economist Tom Lawler showing the year-over-year (YoY) change for National inventory from the NAR, and the YoY change for California from the CAR.

It appears the YoY declines are slowing nationally, and inventory has started to increase YoY in California.

| YOY % Change, Existing SF Homes for Sale | ||

|---|---|---|

| NAR (National) | CAR (California) | |

| Sep-17 | -8.4% | -11.2% |

| Oct-17 | -10.4% | -11.5% |

| Nov-17 | -9.7% | -11.5% |

| Dec-17 | -11.5% | -12.0% |

| Jan-18 | -9.5% | -6.6% |

| Feb-18 | -8.6% | -1.3% |

| Mar-18 | -7.2% | -1.0% |

| Apr-18 | -6.3% | 1.9% |

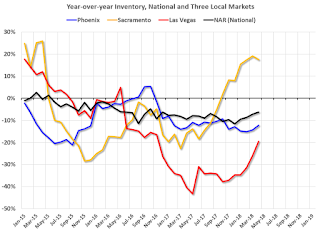

The graph below shows the year-over-year change for non-contingent inventory in Las Vegas, Phoenix and Sacramento (through April), and also total existing home inventory as reported by the NAR (also through April 2018).

Click on graph for larger image.

Click on graph for larger image.This shows the year-over-year change in inventory for Phoenix, Sacramento, and Las Vegas. The black line if the year-over-year change in inventory as reported by the NAR.

Note that inventory in Sacramento was up 18% year-over-year in April (inventory was still very low), and has increased year-over-year for seven consecutive months.

Also note that inventory is still down in Las Vegas (red), but the YoY decline has been getting smaller.

Inventory is a key for the housing market, and I will be watching inventory for the impact of the new tax law and higher mortgage rates on housing. Currently I expect national inventory to be up YoY by the end of 2018 (but still be low).

A Few Comments on April Existing Home Sales

by Calculated Risk on 5/24/2018 01:08:00 PM

Earlier: NAR: "Existing-Home Sales Slide 2.5 Percent in April"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus. See: Lawler: Early Read on Existing Home Sales in April.

2) Inventory is still very low and falling year-over-year (YoY) with inventory down 6.3% year-over-year in March). This was the 35th consecutive month with a year-over-year decline in inventory, however the YoY declines have been getting smaller. And some areas of the country are now reporting YoY increases in inventory.

More inventory would probably mean smaller price increases, and less inventory somewhat larger price increases.

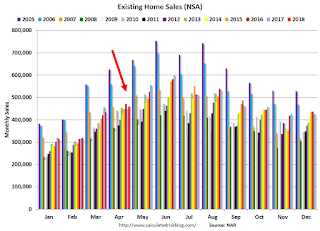

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in April (460,000, red column) were above sales in April 2017 (447,000, NSA).

Sales NSA through April are down about 1% from the same period in 2017.

This is a small decline - and it is too early to tell if there is an impact from higher interest rates and / or the changes to the tax law on home sales.

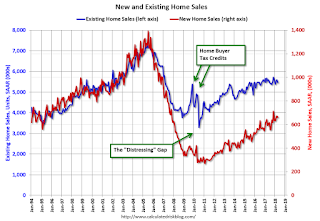

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Kansas City Fed: Regional Manufacturing Activity "Continued to Expand Rapidly" in May

by Calculated Risk on 5/24/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Continued to Expand Rapidly

The Federal Reserve Bank of Kansas City released the May Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity continued to expand at a rapid pace, and optimism remained high for future activity.So far all of the regional Fed surveys have shown strong growth in May.

“Our composite index rose to another record high in May, with continued optimism for future growth,” said Wilkerson. “Prices indexes were stable but remained at high levels.”

...

The month-over-month composite index was 29 in May, up from readings of 26 in April and 17 in March. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity increased at both durable and nondurable goods plants, particularly at nondurable plants producing chemicals and food. Most month-over-month indexes continued to rise. The production index jumped from 33 to 41, and the shipments, new orders, and new orders for exports indexes also moved higher. In contrast, the order backlog and employment indexes eased somewhat. The raw materials inventory index edged up from 17 to 19, and the finished goods inventory index also increased.

emphasis added