by Calculated Risk on 5/24/2018 10:09:00 AM

Thursday, May 24, 2018

NAR: "Existing-Home Sales Slide 2.5 Percent in April"

From the NAR: Existing-Home Sales Slide 2.5 Percent in April

After moving upward for two straight months, existing-home sales retreated in April on both a monthly and annualized basis, according to the National Association of Realtors®. All four major regions saw no gain in sales activity last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, decreased 2.5 percent to a seasonally adjusted annual rate of 5.46 million in April from 5.60 million in March. With last month’s decline, sales are now 1.4 percent below a year ago and have fallen year-over-year for two straight months.

...

Total housing inventory at the end of April increased 9.8 percent to 1.80 million existing homes available for sale, but is still 6.3 percent lower than a year ago (1.92 million) and has fallen year-over-year for 35 consecutive months. Unsold inventory is at a 4.0-month supply at the current sales pace (4.2 months a year ago).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in April (5.46 million SAAR) were 2.5% lower than last month, and were 1.4% below the April 2017 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.80 million in April from 1.67 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

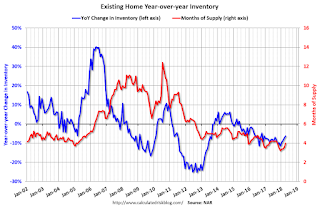

According to the NAR, inventory increased to 1.80 million in April from 1.67 million in March. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 6.3% year-over-year in April compared to April 2017.

Inventory decreased 6.3% year-over-year in April compared to April 2017. Months of supply was at 4.0 months in April.

Sales were below the consensus view. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

Weekly Initial Unemployment Claims increase to 234,000

by Calculated Risk on 5/24/2018 08:33:00 AM

The DOL reported:

In the week ending May 19, the advance figure for seasonally adjusted initial claims was 234,000, an increase of 11,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 222,000 to 223,000. The 4-week moving average was 219,750, an increase of 6,250 from the previous week's revised average. The previous week's average was revised up by 250 from 213,250 to 213,500.The previous week was revised up.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 219,750.

This was higher than the consensus forecast. The low level of claims suggest few layoffs.

Wednesday, May 23, 2018

Thursday: Unemployment Claims, Existing Home Sales

by Calculated Risk on 5/23/2018 08:31:00 PM

Thursday:

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 220 thousand initial claims, down from 222 thousand the previous week.

• At 9:00 AM: FHFA House Price Index for March 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 10:00 AM: Existing Home Sales for April from the National Association of Realtors (NAR). The consensus is for 5.60 million SAAR, unchanged from 5.60 million in March. Housing economist Tom Lawler estimates the NAR will reports sales of 5.48 million SAAR for April.

• At 11:00 AM: the Kansas City Fed manufacturing survey for May.

Philly Fed: State Coincident Indexes increased in 45 states in April

by Calculated Risk on 5/23/2018 06:31:00 PM

From the Philly Fed:

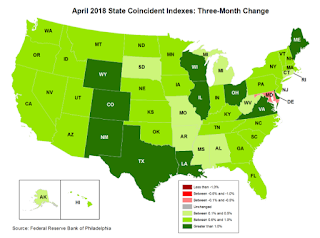

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for April 2018. Over the past three months, the indexes increased in 49 states and decreased in one, for a three-month diffusion index of 96. In the past month, the indexes increased in 45 states, decreased in one, and remained stable in four, for a one-month diffusion index of 88.Note: These are coincident indexes constructed from state employment data. An explanation from the Philly Fed:

emphasis added

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

Click on map for larger image.

Click on map for larger image.Here is a map of the three month change in the Philly Fed state coincident indicators. This map was all red during the worst of the recession, and all or mostly green during most of the recent expansion.

Once again, the map is almost all green on a three month basis.

Source: Philly Fed.

Note: For complaints about red / green issues, please contact the Philly Fed.

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).

And here is a graph is of the number of states with one month increasing activity according to the Philly Fed. This graph includes states with minor increases (the Philly Fed lists as unchanged).In April, 48 states had increasing activity (including minor increases).

The downturn in 2015 and 2016, in the number of states increasing, was mostly related to the decline in oil prices.

Black Knight: National Mortgage Delinquency Rate Decreased in April, Foreclosure Inventory Lowest since August 2006

by Calculated Risk on 5/23/2018 02:38:00 PM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Buck Upward Seasonal Trend in April, Fall to Second Lowest Point in 12 Years

• Historically, mortgage delinquencies have risen 85 percent of the time in April; this month they declined 1.6 percent – about equal to the size of their average usual increaseAccording to Black Knight's First Look report for April, the percent of loans delinquent decreased 1.6% in April compared to March, and decreased 10.2% year-over-year.

• April’s improvement halted a seven-month trend of annual increases in the national delinquency rate

• Areas impacted by Hurricanes Harvey and Irma led April’s delinquency improvement, but slight declines were seen in non-affected areas as well

• Over 90,000 seriously delinquent mortgages (90 or more days past due) attributed to the 2017 hurricane season remain in affected areas of Texas, Florida and Georgia

• The number of mortgages in active foreclosure hit its lowest point since August 2006

The percent of loans in the foreclosure process decreased 2.3% in April and were down 28.4% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.67% in April, down from 3.73% in March.

The percent of loans in the foreclosure process decreased in April to 0.61%.

The number of delinquent properties, but not in foreclosure, is down 187,000 properties year-over-year, and the number of properties in the foreclosure process is down 119,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Apr 2018 | Mar 2018 | Apr 2017 | Apr 2016 | |

| Delinquent | 3.67% | 3.73% | 4.08% | 4.24% |

| In Foreclosure | 0.61% | 0.63% | 0.85% | 1.17% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,885,000 | 1,912,000 | 2,072,000 | 2,146,000 |

| Number of properties in foreclosure pre-sale inventory: | 314,000 | 321,000 | 433,000 | 820,000 |

| Total Properties | 2,199,000 | 2,232,000 | 2,505,000 | 2,741,000 |

FOMC Minutes: "A temporary period of inflation modestly above 2 percent would be consistent with inflation objective"

by Calculated Risk on 5/23/2018 02:14:00 PM

Still on pace for 3 or 4 rate hikes in 2018. Some excerpts:

From the Fed: Minutes of the Federal Open Market Committee, May 1-2, 2018:

With regard to the medium-term outlook for monetary policy, all participants reaffirmed that adjustments to the path for the policy rate would depend on their assessments of the evolution of the economic outlook and risks to the outlook relative to the Committee's statutory objectives. Participants generally agreed with the assessment that continuing to raise the target range for the federal funds rate gradually would likely be appropriate if the economy evolves about as expected. These participants commented that this gradual approach was most likely to be conducive to maintaining strong labor market conditions and achieving the symmetric 2 percent inflation objective on a sustained basis without resulting in conditions that would eventually require an abrupt policy tightening. A few participants commented that recent news on inflation, against a background of continued prospects for a solid pace of economic growth, supported the view that inflation on a 12-month basis would likely move slightly above the Committee's 2 percent objective for a time. It was also noted that a temporary period of inflation modestly above 2 percent would be consistent with the Committee's symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective.

emphasis added

A few Comments on April New Home Sales

by Calculated Risk on 5/23/2018 11:59:00 AM

New home sales for April were reported at 662,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months were revised down.

Sales in April were up 11.6% year-over-year compared to April 2017, however, this was a fairly easy comparison.

Earlier: New Home Sales decrease to 662,000 Annual Rate in April.

This graph shows new home sales for 2017 and 2018 by month (Seasonally Adjusted Annual Rate).

Sales are up 7.2% through April compared to the same period in 2017. Decent growth so far, and the next four months will also be an easy comparison to 2017.

This is on track to be close to my forecast for 2018 of 650 thousand new home sales for the year; an increase of about 6% over 2017. There are downside risks to that forecast, such as higher mortgage rates, higher costs (labor and material), and possible policy errors.

AIA: "Architecture Firm Billings Strengthen in April"

by Calculated Risk on 5/23/2018 11:11:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Firm Billings Strengthen in April

The American Institute of Architects (AIA) is reporting today that architecture firm billings rose for the seventh consecutive month, with the pace of growth in April increasing modestly from March.

Overall, the AIA’s Architecture Billings Index (ABI) score for April was 52.0 (any score over 50 is billings growth), which indicates the business environment continues to be healthy for architecture firms despite continued labor shortages, growing inflation in building materials costs and rising interest rates. The ABI also revealed that business conditions remained strong at firms located in the West, while billings softened slightly at Midwest firms.

“While there was slower growth in April for new project work coming into architecture firms, business conditions have remained healthy for the first four months of the year,” said AIA Chief Economist Kermit Baker, Hon. AIA, PhD. “Although growth in regional design activity was concentrated at firms in the sunbelt, there was balanced growth so far this year across all major construction sectors.”

...

• Regional averages: West (55.1), Midwest (49.6), South (51.8), Northeast (50.3)

• Sector index breakdown: multi-family residential (50.7), institutional (52.0), commercial/industrial (52.7), mixed practice (50.6)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.0 in April, up from 51.0 in March. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 11 of the last 12 months, suggesting a further increase in CRE investment in 2018.

New Home Sales decrease to 662,000 Annual Rate in April

by Calculated Risk on 5/23/2018 10:16:00 AM

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 662 thousand.

The previous three months were revised down, combined.

"Sales of new single-family houses in April 2018 were at a seasonally adjusted annual rate of 662,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 1.5 percent below the revised March rate of 672,000, but is 11.6 percent above the April 2017 estimate of 593,000."

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in April to 5.4 months from 5.3 months in March.

The months of supply increased in April to 5.4 months from 5.3 months in March. The all time record was 12.1 months of supply in January 2009.

This is in the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of April was 300,000. This represents a supply of 5.4 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In April 2018 (red column), 64 thousand new homes were sold (NSA). Last year, 56 thousand homes were sold in April.

The all time high for April was 116 thousand in 2005, and the all time low for April was 30 thousand in 2011.

This was below expectations of 677,000 sales SAAR, and the previous months were revised down. I'll have more later today.

MBA: Mortgage Applications Decrease in Latest Weekly Survey, Refi Index lowest since December 2000

by Calculated Risk on 5/23/2018 07:00:00 AM

From the MBA: Mortgage Rates Increase, Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 18, 2018.

... The Refinance Index decreased 4 percent from the previous week to its lowest level since December 2000. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.77 percent from 4.78 percent, with points remaining unchanged at 0.50 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.