by Calculated Risk on 4/21/2018 08:11:00 AM

Saturday, April 21, 2018

Schedule for Week of Apr 22, 2018

The key economic reports this week are the advance estimate of Q1 GDP, March new and existing home sales, and Case-Shiller house prices.

8:30 AM ET: Chicago Fed National Activity Index for March. This is a composite index of other data.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.28 million SAAR, down from 5.54 million in February.

10:00 AM: Existing Home Sales for March from the National Association of Realtors (NAR). The consensus is for 5.28 million SAAR, down from 5.54 million in February.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler estimates the NAR will reports sales of 5.51 million SAAR for March.

9:00 AM ET: S&P/Case-Shiller House Price Index for February.

9:00 AM ET: S&P/Case-Shiller House Price Index for February.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the January 2018 report (the Composite 20 was started in January 2000).

The consensus is for a 6.2% year-over-year increase in the Comp 20 index for February.

9:00 AM: FHFA House Price Index for February 2018. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: New Home Sales for March from the Census Bureau.

10:00 AM: New Home Sales for March from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the February sales rate.

The consensus is for 630 thousand SAAR, up from 618 thousand in February.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for April.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 232 thousand the previous week.

8:30 AM: Durable Goods Orders for March from the Census Bureau. The consensus is for a 1.7% increase in durable goods orders.

10:00 AM: the Q1 2018 Housing Vacancies and Homeownership from the Census Bureau.

11:00 AM: the Kansas City Fed manufacturing survey for March.

8:30 AM: Gross Domestic Product, 1st quarter 2018 (Advance estimate). The consensus is that real GDP increased 2.0% annualized in Q1, down from 2.9% in Q4.

10:00 AM: University of Michigan's Consumer sentiment index (Final for April). The consensus is for a reading of 98.0, up from 97.8..

Friday, April 20, 2018

Oil Rigs "Middling rig adds"

by Calculated Risk on 4/20/2018 05:41:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Apr 20, 2018:

• Total US oil rigs were up, +5 to 820

• Horizontal oil rigs were up,+6 at 723

...

• Almost all the action was back in the Permian, +9 horizontal oil rigs

• The breakeven oil price to add rigs appears to have crept up from around $48 WTI late last year, to about $56 WTI now.

• The Brent spread remains above $5 / barrel

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Four Q1 GDP Forecasts: Around 2%

by Calculated Risk on 4/20/2018 01:57:00 PM

The advance Q1 GDP report will be released next Friday, April 27th. The consensus is for real GDP growth of 2.1% on a seasonally adjusted annual rate (SAAR) basis.

Here are four Q1 GDP forecast.

From Merrill Lynch:

We expect real GDP growth to slow to 1.7% qoq saar in the advance 1Q report [April 20 estimate].From Nomura:

We expect the first reading of Q1 real GDP growth to come in at 1.6% q-o-q saar [April 20 estimate]And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 2.0 percent on April 17, up from 1.9 percent on April 16. [April 17 estimate]From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.9% for 2018:Q1 and 3.0% for 2018:Q2. [April 20 estimate]CR Note: It looks like another quarter around 2% or so, although there might still be some residual seasonality in the first quarter.

Existing Home Sales: Lawler vs. the Consensus

by Calculated Risk on 4/20/2018 11:59:00 AM

Housing economist Tom Lawler has been sending me his predictions of what the NAR will report for 8 years. The table below shows the consensus for each month, Lawler's predictions, and the NAR's initial reported level of sales.

Lawler hasn't always been closer than the consensus, but usually when there has been a fairly large spread between Lawler's estimate and the "consensus", Lawler has been closer.

NOTE: There have been times when Lawler "missed", but then he pointed out an apparent error in the NAR data - and the subsequent revision corrected that error. As an example, see: The “Curious Case” of Existing Home Sales in the South in April

The early consensus is that the NAR will report sales of 5.55 million. However, housing economist Tom Lawler estimates the NAR will report sales of 5.51 million on a seasonally adjusted annual rate (SAAR) basis.

The consensus is pretty close to Lawler's estimate for March. Note: The NAR is scheduled to report March Existing Home Sales on Monday, April 23rd at 10:00 AM ET.

Over the last eight years, the consensus average miss was 145 thousand, and Lawler's average miss was 69 thousand.

| Existing Home Sales, Forecasts and NAR Report millions, seasonally adjusted annual rate basis (SAAR) | |||

|---|---|---|---|

| Month | Consensus | Lawler | NAR reported1 |

| May-10 | 6.20 | 5.83 | 5.66 |

| Jun-10 | 5.30 | 5.30 | 5.37 |

| Jul-10 | 4.66 | 3.95 | 3.83 |

| Aug-10 | 4.10 | 4.10 | 4.13 |

| Sep-10 | 4.30 | 4.50 | 4.53 |

| Oct-10 | 4.50 | 4.46 | 4.43 |

| Nov-10 | 4.85 | 4.61 | 4.68 |

| Dec-10 | 4.90 | 5.13 | 5.28 |

| Jan-11 | 5.20 | 5.17 | 5.36 |

| Feb-11 | 5.15 | 5.00 | 4.88 |

| Mar-11 | 5.00 | 5.08 | 5.10 |

| Apr-11 | 5.20 | 5.15 | 5.05 |

| May-11 | 4.75 | 4.80 | 4.81 |

| Jun-11 | 4.90 | 4.71 | 4.77 |

| Jul-11 | 4.92 | 4.69 | 4.67 |

| Aug-11 | 4.75 | 4.92 | 5.03 |

| Sep-11 | 4.93 | 4.83 | 4.91 |

| Oct-11 | 4.80 | 4.86 | 4.97 |

| Nov-11 | 5.08 | 4.40 | 4.42 |

| Dec-11 | 4.60 | 4.64 | 4.61 |

| Jan-12 | 4.69 | 4.66 | 4.57 |

| Feb-12 | 4.61 | 4.63 | 4.59 |

| Mar-12 | 4.62 | 4.59 | 4.48 |

| Apr-12 | 4.66 | 4.53 | 4.62 |

| May-12 | 4.57 | 4.66 | 4.55 |

| Jun-12 | 4.65 | 4.56 | 4.37 |

| Jul-12 | 4.50 | 4.47 | 4.47 |

| Aug-12 | 4.55 | 4.87 | 4.82 |

| Sep-12 | 4.75 | 4.70 | 4.75 |

| Oct-12 | 4.74 | 4.84 | 4.79 |

| Nov-12 | 4.90 | 5.10 | 5.04 |

| Dec-12 | 5.10 | 4.97 | 4.94 |

| Jan-13 | 4.90 | 4.94 | 4.92 |

| Feb-13 | 5.01 | 4.87 | 4.98 |

| Mar-13 | 5.03 | 4.89 | 4.92 |

| Apr-13 | 4.92 | 5.03 | 4.97 |

| May-13 | 5.00 | 5.20 | 5.18 |

| Jun-13 | 5.27 | 4.99 | 5.08 |

| Jul-13 | 5.13 | 5.33 | 5.39 |

| Aug-13 | 5.25 | 5.35 | 5.48 |

| Sep-13 | 5.30 | 5.26 | 5.29 |

| Oct-13 | 5.13 | 5.08 | 5.12 |

| Nov-13 | 5.02 | 4.98 | 4.90 |

| Dec-13 | 4.90 | 4.96 | 4.87 |

| Jan-14 | 4.70 | 4.67 | 4.62 |

| Feb-14 | 4.64 | 4.60 | 4.60 |

| Mar-14 | 4.56 | 4.64 | 4.59 |

| Apr-14 | 4.67 | 4.70 | 4.65 |

| May-14 | 4.75 | 4.81 | 4.89 |

| Jun-14 | 4.99 | 4.96 | 5.04 |

| Jul-14 | 5.00 | 5.09 | 5.15 |

| Aug-14 | 5.18 | 5.12 | 5.05 |

| Sep-14 | 5.09 | 5.14 | 5.17 |

| Oct-14 | 5.15 | 5.28 | 5.26 |

| Nov-14 | 5.20 | 4.90 | 4.93 |

| Dec-14 | 5.05 | 5.15 | 5.04 |

| Jan-15 | 5.00 | 4.90 | 4.82 |

| Feb-15 | 4.94 | 4.87 | 4.88 |

| Mar-15 | 5.04 | 5.18 | 5.19 |

| Apr-15 | 5.22 | 5.20 | 5.04 |

| May-15 | 5.25 | 5.29 | 5.35 |

| Jun-15 | 5.40 | 5.45 | 5.49 |

| Jul-15 | 5.41 | 5.64 | 5.59 |

| Aug-15 | 5.50 | 5.54 | 5.31 |

| Sep-15 | 5.35 | 5.56 | 5.55 |

| Oct-15 | 5.41 | 5.33 | 5.36 |

| Nov-15 | 5.32 | 4.97 | 4.76 |

| Dec-15 | 5.19 | 5.36 | 5.46 |

| Jan-16 | 5.32 | 5.36 | 5.47 |

| Feb-16 | 5.30 | 5.20 | 5.08 |

| Mar-16 | 5.27 | 5.27 | 5.33 |

| Apr-16 | 5.40 | 5.44 | 5.45 |

| May-16 | 5.64 | 5.55 | 5.53 |

| Jun-16 | 5.48 | 5.62 | 5.57 |

| Jul-16 | 5.52 | 5.41 | 5.39 |

| Aug-16 | 5.44 | 5.49 | 5.33 |

| Sep-16 | 5.35 | 5.55 | 5.47 |

| Oct-16 | 5.44 | 5.47 | 5.60 |

| Nov-16 | 5.54 | 5.60 | 5.61 |

| Dec-16 | 5.54 | 5.55 | 5.49 |

| Jan-17 | 5.55 | 5.60 | 5.69 |

| Feb-17 | 5.55 | 5.41 | 5.48 |

| Mar-17 | 5.61 | 5.74 | 5.71 |

| Apr-17 | 5.67 | 5.56 | 5.57 |

| May-17 | 5.55 | 5.65 | 5.62 |

| Jun-17 | 5.58 | 5.59 | 5.52 |

| Jul-17 | 5.57 | 5.38 | 5.44 |

| Aug-17 | 5.48 | 5.39 | 5.35 |

| Sep-17 | 5.30 | 5.38 | 5.39 |

| Oct-17 | 5.30 | 5.60 | 5.48 |

| Nov-17 | 5.52 | 5.77 | 5.81 |

| Dec-17 | 5.75 | 5.66 | 5.57 |

| Jan-18 | 5.65 | 5.48 | 5.38 |

| Feb-18 | 5.42 | 5.44 | 5.54 |

| Mar-18 | 5.28 | 5.51 | --- |

| 1NAR initially reported before revisions. | |||

BLS: Unemployment Rates Lower in 4 states in March; Kentucky and Maine at New Series Lows

by Calculated Risk on 4/20/2018 10:12:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Unemployment rates were lower in March in 4 states, higher in 1 state, and stable in 45 states and the District of Columbia, the U.S. Bureau of Labor Statistics reported today. Seventeen states had jobless rate decreases from a year earlier and 33 states and the District had little or no change. The national unemployment rate was unchanged from February at 4.1 percent but was 0.4 percentage point lower than in March 2017.Thirteen states have reached new all time lows since the end of the 2007 recession. These thirteen states are: Alabama, Arkansas, California, Colorado, Hawaii, Kentucky, Maine, Mississippi, North Dakota, Oregon, Tennessee, Texas and Wisconsin.

...

Hawaii had the lowest unemployment rate in March, 2.1 percent. The rates in Kentucky (4.0 percent) and Maine (2.7 percent) set new series lows. (All state series begin in 1976.) Alaska had the highest jobless rate, 7.3 percent.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the number of states (and D.C.) with unemployment rates at or above certain levels since January 2006. At the worst of the employment recession, there were 11 states with an unemployment rate at or above 11% (red).

Currently only one state, Alaska, has an unemployment rate at or above 7% (light blue); And only Alaska is above 6% (dark blue).

Thursday, April 19, 2018

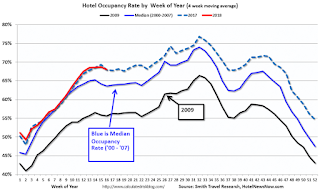

Hotels: Occupancy Rate Up Year-over-Year, Record Q1

by Calculated Risk on 4/19/2018 07:37:00 PM

From HotelNewsNow.com: STR: US hotels set Q1 performance record

The U.S. hotel industry reported record-breaking performance during the first quarter of 2018, according to data from STR.And from HotelNewsNow.com: STR: US hotel results for week ending 14 April

Compared with Q1 2017:

• Occupancy: +0.9% to 61.6%

• Average daily rate (ADR): +2.5% to US$127.37

• Revenue per available room (RevPAR): +3.5% to US$78.46

“The absolute levels for each of the three key performance metrics were the highest STR has ever benchmarked for a Q1,” said Bobby Bowers, STR’s senior VP of operations. “Supply (more than 460 million room nights available) and demand (more than 285 million room nights sold) also reached record levels for a Q1, but demand grew at a much higher rate (+3.0% vs. +2.0%).”

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 8-14 April 2018, according to data from STR. In comparison with the week of 9-15 April 2017, the industry recorded the following:The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

• Occupancy: +6.1% to 68.1%

• Average daily rate (ADR): +5.8% to US$130.57

• Revenue per available room (RevPAR): +12.2% to US$88.95

STR analysts note performance growth was boosted by a favorable comparison with the week of Easter in 2017.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate, to date, is slightly ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Lawler: Early Read on Existing Home Sales in March

by Calculated Risk on 4/19/2018 02:21:00 PM

From housing economist Tom Lawler: Early Read on Existing Home Sales in March

Based on publicly-available local realtor/MLS reports from across the country released through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.51 million in March, down 0.5% from February’s preliminary pace and down 2.8% from last March’s seasonally adjusted pace. Unadjusted sales should show a larger YOY decline, reflecting this March’s lower business day count relative to last March’s.

Local realtor/MLS data indicate that the inventory of existing homes for sale in March was down from a year ago but that the YOY decline in March was less than that in February, and I project that the NAR’s estimate of the number of existing homes for sale at the end of March was 1.67 million, up 5.0% from February’s preliminary estimate and down 7.2% from last March.

Finally, local realtor/MLS data suggest the median US existing single-family home sales price last month was up about 7.1% from last March. Note, however, that of late the NAR’s median existing home sales prices have shown lower YOY gains than local realtor/MLS data would have suggested, for reasons that are not clear.

CR Note: Existing home sales for March are scheduled to be released by the NAR on Monday.

Black Knight: National Mortgage Delinquency Rate Decreased in March

by Calculated Risk on 4/19/2018 10:41:00 AM

From Black Knight: Black Knight’s First Look: Hurricane Impact Lingers, Drives Up Foreclosure Starts as Moratoria Lift; National Delinquencies Fall to 12-Month Low

• Seasonal effects and continued hurricane-related improvements contributed to a 13 percent decline in the national delinquency rate in MarchAccording to Black Knight's First Look report for March, the percent of loans delinquent decreased 13.2% in March compared to February, but increased 3.1% year-over-year.

• Nationally, there was a decline of 65,000 in serious delinquencies (90 or more days past due but not yet in foreclosure)

• Serious delinquencies attributable to Hurricanes Harvey and Irma saw a reduction of 19,500 loans

• However, as the hurricane impact shifts away from delinquencies, foreclosure starts rose by 12 percent

• More than two-thirds of that increase came from hurricane-affected areas of Texas and Florida

• Overall, active foreclosure inventory continues to improve, falling another 10,000 loans in March to its lowest level since late 2006

• Despite interest rates remaining above 4.4 percent, prepayment activity in March increased by 22 percent from February’s 4-year low

The percent of loans in the foreclosure process decreased 3.2% in March and were down 29.3% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 3.73% in March, down from 4.30% in February.

The percent of loans in the foreclosure process decreased in March to 0.63%.

The number of delinquent properties, but not in foreclosure, is up 81,000 properties year-over-year, and the number of properties in the foreclosure process is down 127,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Mar 2018 | Feb 2018 | Mar 2017 | Mar 2016 | |

| Delinquent | 3.73% | 4.30% | 3.62% | 4.08% |

| In Foreclosure | 0.63% | 0.65% | 0.88% | 1.25% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 1,912,000 | 2,198,000 | 1,831,000 | 2,062,000 |

| Number of properties in foreclosure pre-sale inventory: | 321,000 | 331,000 | 448,000 | 631,000 |

| Total Properties | 2,232,000 | 2,528,000 | 2,279,000 | 2,693,000 |

Philly Fed Manufacturing Survey Showed "Continued Growth" in April

by Calculated Risk on 4/19/2018 09:30:00 AM

From the Philly Fed: April 2018 Manufacturing Business Outlook Survey

Results from the April Manufacturing Business Outlook Survey suggest continued growth for the region’s manufacturing sector. Although the survey’s indexes for general activity and employment improved slightly, the indexes for new orders and shipments moderated. The firms also reported higher prices for both inputs and their own manufactured goods this month. The survey’s future indexes, measuring expectations for the next six months, reflected continued optimism.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The diffusion index for current general activity edged 1 point higher, from 22.3 in March to 23.2 this month ... The firms continued to report overall increases in employment. Over 31 percent of the responding firms reported increases in employment, while 4 percent reported decreases this month. The current employment index edged 2 points higher to 27.1, its highest reading in six months. The firms also reported a longer average workweek this month: The current average workweek index increased 9 points.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through April), and five Fed surveys are averaged (blue, through March) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through March (right axis).

This suggests the ISM manufacturing index will show solid expansion again in April, but perhaps lower than in March.

Weekly Initial Unemployment Claims decrease to 232,000

by Calculated Risk on 4/19/2018 08:33:00 AM

The DOL reported:

In the week ending April 14, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 1,000 from the previous week's unrevised level of 233,000. The 4-week moving average was 231,250, an increase of 1,250 from the previous week's unrevised average of 230,000.The previous week was unrevised.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 231,250.

This was slightly higher than the consensus forecast. The low level of claims suggest relatively few layoffs.