by Calculated Risk on 4/05/2018 08:49:00 AM

Thursday, April 05, 2018

Trade Deficit at $57.6 Billion in February

From the Department of Commerce reported:

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis announced today that the goods and services deficit was $57.6 billion in February, up $0.9 billion from $56.7 billion in January, revised. ... February exports were $204.4 billion, $3.5 billion more than January exports. February imports were $262.0 billion, $4.4 billion more than January imports.

Click on graph for larger image.

Click on graph for larger image.Both exports and imports increased in February.

Exports are 24% above the pre-recession peak and up 7% compared to February 2017; imports are 13% above the pre-recession peak, and up 11% compared to February 2017.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $54.61 in February, down slightly from $54.76 in January, and up from $45.25 in February 2017.

The petroleum deficit increased over the last two months, and this is the main reason the overall trade deficit increased in January and February.

The trade deficit with China increased to $29.3 billion in February, from $23.0 billion in February 2017. The trade deficit with China was boosted by the timing of the Chinese New Year this year.

Weekly Initial Unemployment Claims increase to 242,000

by Calculated Risk on 4/05/2018 08:33:00 AM

The DOL reported:

In the week ending March 31, the advance figure for seasonally adjusted initial claims was 242,000, an increase of 24,000 from the previous week's revised level. The previous week's level was revised up by 3,000 from 215,000 to 218,000. The 4-week moving average was 228,250, an increase of 3,000 from the previous week's revised average. The previous week's average was revised up by 750 from 224,500 to 225,250.The previous week was revised up.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 228,250.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, April 04, 2018

Thursday: Unemployment Claims, Trade Deficit

by Calculated Risk on 4/04/2018 06:40:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Still Solid Despite Warning Signs

Mortgage rates were sideways to slightly lower today, depending on the lender. ... If nothing changes about underlying markets by tomorrow morning, most lenders will likely be slightly worse off. Of course, "worse" is a relative term, because today's rates are in line with 2-month lows. On the other hand, the overall range has been very narrow over that 2-month time frame. [30YR FIXED - 4.5%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 226 thousand initial claims, up from 215 thousand the previous week.

• Also at 8:30 AM, Trade Balance report for February from the Census Bureau. The consensus is for the U.S. trade deficit to be at $56.8 billion in February from $56.8 billion in January.

U.S. Heavy Truck Sales up Year-over-year in March

by Calculated Risk on 4/04/2018 03:28:00 PM

The following graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the March 2018 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR). Then sales increased more than 2 1/2 times, and hit 480 thousand SAAR in June 2015.

Heavy truck sales declined again - probably mostly due to the weakness in the oil sector - and bottomed at 364 thousand SAAR in October 2016.

Click on graph for larger image.

With the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 455 thousand SAAR in March, down from 475 thousand in February, and up from 391 thousand in March 2017.

Annual Vehicle Sales: On Pace to be Unchanged in 2018

by Calculated Risk on 4/04/2018 12:17:00 PM

Through March, light vehicle sales are on pace to be unchanged in 2018 compared to 2017.

This would still make 2018 tied with 2017 for the fourth best year on record after 2016, 2015, and 2000.

My guess is vehicle sales will finish the year with sales lower than in 2017. A small decline in sales this year isn't a concern - I think sales will move mostly sideways at near record levels (however there is concern about the impact of tariffs).

As I noted last year, this means the economic boost from increasing auto sales is over (from the bottom in 2009, auto sales boosted growth every year through 2016).

Click on graph for larger image.

This graph shows annual light vehicle sales since 1976. Source: BEA.

Sales for 2018 are estimated at the pace of the first three months.

ISM Non-Manufacturing Index decreased to 58.8% in March

by Calculated Risk on 4/04/2018 10:03:00 AM

The March ISM Non-manufacturing index was at 58.8%, down from 59.5% in February. The employment index increased in March to 56.6%, from 55.0%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: March 2018 Non-Manufacturing ISM Report On Business®

conomic activity in the non-manufacturing sector grew in March for the 98th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 58.8 percent, which is 0.7 percentage point lower than the February reading of 59.5 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index decreased to 60.6 percent, 2.2 percentage points lower than the February reading of 62.8 percent, reflecting growth for the 104th consecutive month, at a slower rate in March. The New Orders Index registered 59.5 percent, 5.3 percentage points lower than the reading of 64.8 percent in February. The Employment Index increased 1.6 percentage points in March to 56.6 percent from the February reading of 55 percent. The Prices Index increased by 0.5 percentage point from the February reading of 61 percent to 61.5 percent, indicating that prices increased in March for the 25th consecutive month. According to the NMI®, 15 non-manufacturing industries reported growth. Despite the slight dip in the NMI® composite index, the non-manufacturing sector enjoyed another month of strong growth in March. The cooling off of the New Orders Index possibly prevented an even stronger reading for the NMI® composite index. The majority of respondents remain positive about business conditions."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slightly slower expansion in March than in February.

ADP: Private Employment increased 241,000 in March

by Calculated Risk on 4/04/2018 08:20:00 AM

Private sector employment increased by 241,000 jobs from February to March according to the March ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 180,000 private sector jobs added in the ADP report.

...

“We saw impressive momentum in the first quarter of 2018 with more jobs added per month on average than in 2017,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Midsized businesses added nearly half of all jobs this month, the best growth this segment has seen since the fall of 2014. The manufacturing industry also performed well, with its strongest increase in more than three years.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is rip-roaring. Monthly job growth remains firmly over 200,000, double the pace of labor force growth. The tight labor market continues to tighten.”

The BLS report for March will be released Friday, and the consensus is for 167,000 non-farm payroll jobs added in March.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 4/04/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 30, 2018.

... The Refinance Index decreased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 5 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged at 4.69 percent, with points remaining unchanged at 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 5% year-over-year.

Tuesday, April 03, 2018

Wednesday: ADP Employment, ISM non-Mfg Index

by Calculated Risk on 4/03/2018 09:07:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for March. This report is for private payrolls only (no government). The consensus is for 180,000 payroll jobs added in March, down from 235,000 added in February.

• At 10:00 AM, the ISM non-Manufacturing Index for March. The consensus is for index to decrease to 59.0 from 59.5 in February.

Fed: Q4 2017 Household Debt Service Ratio Increasing from Very Low Level

by Calculated Risk on 4/03/2018 06:57:00 PM

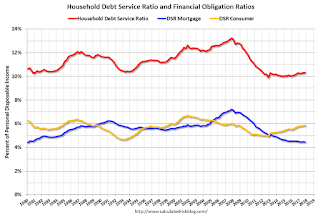

The Fed's Household Debt Service ratio through Q4 2017 was released on today: Household Debt Service and Financial Obligations Ratios. I used to track this quarterly back in 2005 and 2006 to point out that households were taking on excessive financial obligations.

These ratios show the percent of disposable personal income (DPI) dedicated to debt service (DSR) and financial obligations (FOR) for households. Note: The Fed changed the release in Q3 2013.

The household Debt Service Ratio (DSR) is the ratio of total required household debt payments to total disposable income.This data has limited value in terms of absolute numbers, but is useful in looking at trends. Here is a discussion from the Fed:

The DSR is divided into two parts. The Mortgage DSR is total quarterly required mortgage payments divided by total quarterly disposable personal income. The Consumer DSR is total quarterly scheduled consumer debt payments divided by total quarterly disposable personal income. The Mortgage DSR and the Consumer DSR sum to the DSR.

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only an approximation of the debt service ratio faced by households. Nonetheless, this approximation is useful to the extent that, by using the same method and data series over time, it generates a time series that captures the important changes in the household debt service burden.

Click on graph for larger image.

Click on graph for larger image.The graph shows the Total Debt Service Ratio (DSR), and the DSR for mortgages (blue) and consumer debt (yellow).

The overall Debt Service Ratio increased slightly in Q4, and has been moving up slowly from the recent record low. Note: The financial obligation ratio (FOR) also increased slightly in Q4.

The DSR for mortgages (blue) are near the low for the last 38 years. This ratio increased rapidly during the housing bubble, and continued to increase until 2007. With falling interest rates, and less mortgage debt (mostly due to foreclosures), the mortgage ratio has declined significantly.

The consumer debt DSR (yellow) has been increasing for the last five years.

This data suggests aggregate household cash flow has improved significantly since the great recession, but has started to decline slightly recently.