by Calculated Risk on 3/29/2018 08:34:00 AM

Thursday, March 29, 2018

Weekly Initial Unemployment Claims decrease to 215,000

The DOL reported:

In the week ending March 24, the advance figure for seasonally adjusted initial claims was 215,000, a decrease of 12,000 from the previous week's revised level. This is the lowest level for initial claims since January 27, 1973 when it was 214,000. The previous week's level was revised down by 2,000 from 229,000 to 227,000. The 4-week moving average was 224,500, a decrease of 500 from the previous week's revised average. The previous week's average was revised up by 1,250 from 223,750 to 225,000.The previous week was revised down.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 224,500.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, March 28, 2018

Thursday: Personal Income and Outlays, Unemployment Claims, Chicago PMI and More

by Calculated Risk on 3/28/2018 08:12:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 228 thousand initial claims, down from 229 thousand the previous week.

• Also at 8:30 AM, Personal Income and Outlays for February. The consensus is for a 0.4% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for March. The consensus is for a reading of 63.2, up from 61.9 in February.

• During the Day, Reis Q1 2018 Office Survey of rents and vacancy rates.

• At 10:00 AM, University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 102.0, unchanged from 102.0 in February.

Zillow Case-Shiller Forecast: More Solid House Price Gains in February

by Calculated Risk on 3/28/2018 04:07:00 PM

The Case-Shiller house price indexes for January were released yesterday. Zillow forecasts Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close.

From Aaron Terrazas at Zillow: January Case-Shiller Results and February Forecast: Prelude to Home Buying Season Already Hot

The continuing inventory pinch helped boost the U.S. national Case Shiller index 6.2 percent in January from a year earlier, down from a 6.3 percent gain in December. Case-Shiller’s 10-City Composite rose 6 percent, while the 20-City Composite climbed 6.4 percent year-over-year.The Zillow forecast is for the year-over-year change for the Case-Shiller National index to be slightly less in February than in January.

...

Spring home shopping season will be in full swing soon, and with it we can expect the usual seasonal bump of would-be home buyers competing over a shrinking pool of homes. But in a twist, this year’s buyers may be competing against some buyers who have been unsuccessful in recent months.

Increasingly, the traditional seasonal boundaries around home shopping season – which generally heats up in early spring and cools off by late summer, in time for back-to-school season – are becoming less pronounced.

Limited supply, fierce competition and rising prices are forcing many buyers to stay on the market longer in hopes of finding the right home at the right price. More inventory is really the only cure for those pressures right now, especially for people at the entry-level end of the market, but it has proven frustratingly slow in coming.

...

Right now, the market can barely absorb what current demand there is. It remains to be seen how it adapts to even more buyers, and presumably less inventory, in the months to come.

Zillow predicts the February S&P/Case-Shiller U.S. national index, released April 24, will climb 6 percent year-over year.

Reis: Apartment Vacancy Rate increased in Q1 to 4.7%

by Calculated Risk on 3/28/2018 12:25:00 PM

Reis reported that the apartment vacancy rate was at 4.7% in Q1 2018, up from 4.6% in Q4, and up from 4.3% in Q1 2017. This is the highest vacancy rate since Q3 2012. The vacancy rate peaked at 8.0% at the end of 2009, and bottomed at 4.1% in 2016.

From Reis:

Continuing on its upward path, the apartment vacancy rate increased to 4.7% from 4.6% at year-end 2017 and 4.3% in the first quarter of 2017. The vacancy rate has increased 60 basis points from a low of 4.1% in Q3 2016.

The national average asking rent increased 0.9% in the first quarter while effective rents, which net out landlord concessions, increased 0.8%. At $1,382 (market) and $1,318 (effective) per unit, the average rents have increased 4.4% and 3.9%, respectively, from the first quarter of 2017.

Net absorption was 27,875 units, well below the average quarterly absorption of 2017 of 44,707 units. Construction was also low at 39,917 units, trailing the 2017 quarterly average of 58,824 units. We caution that the first quarter tends to see the lowest activity, but this was particularly low given the construction pipeline.

...

Although many metros are expected to see considerably higher levels of completions in 2018 – including Dallas, New York, Los Angeles, Denver and Atlanta – the expected increase in vacancy is not expected to exceed 2.5% in any market as job growth is expected to remain healthy in most metros fueling the demand for apartments.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. However, the vacancy rate has bottomed and is starting to increase. With more supply coming on line - and less favorable demographics - the vacancy rate will probably continue to increase in 2018.

Apartment vacancy data courtesy of Reis.

NAR: Pending Home Sales Index Increased 3.1% in February, Down 4.1% Year-over-year

by Calculated Risk on 3/28/2018 10:04:00 AM

From the NAR: Pending Home Sales Reverse Course in February, Rise 3.1 Percent

Pending home sales snapped back in much of the country in February, but weakening affordability and not enough inventory on the market restricted overall activity compared to a year ago, according to the National Association of Realtors®.This was above expectations of a 2.7% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in March and April.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, grew 3.1 percent to 107.5 in February from a downwardly revised 104.3 in January. Even with last month’s increase in activity, the index is 4.1 percent below a year ago.

...

The PHSI in the Northeast surged 10.3 percent to 96.0 in February, but is still 5.1 percent below a year ago. In the Midwest the index inched forward 0.7 percent to 98.9 in February, but is 9.5 percent lower than February 2017.

Pending home sales in the South rose 3.0 percent to an index of 125.7 in February, but are 1.5 percent lower than last February. The index in the West climbed 0.4 percent in February to 96.9, but is 2.2 percent below a year ago.

emphasis added

Q4 GDP Revised up to 2.9% Annual Rate

by Calculated Risk on 3/28/2018 08:38:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter and Annual 2017 (Third Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2017, according to the "third" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.Here is a Comparison of Third and Second Estimates. PCE growth was up to 4.0% from 3.8%. Residential investment was revised down from 13.0% to 2.8%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "second" estimate issued last month. In the second estimate, the increase in real GDP was 2.5 percent. With this third estimate for the fourth quarter, the general picture of economic growth remains the same; personal consumption expenditures (PCE) and private inventory investment were revised up.

emphasis added

MBA: Purchase Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 3/28/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 23, 2018.

... The Refinance Index increased 7 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 8 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.69 percent from 4.68 percent, with points decreasing to 0.43 from 0.46 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 8% year-over-year.

Tuesday, March 27, 2018

Wednesday: GDP, Pending Home Sales

by Calculated Risk on 3/27/2018 07:42:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 4th quarter 2017 (Third estimate). The consensus is that real GDP increased 2.3% annualized in Q4, unchanged from the second estimate of 2.3%.

• At 10:00 AM, Pending Home Sales Index for February. The consensus is for a 2.7% increase in the index.

• During the Day, Reis Q1 2018 Apartment Survey of rents and vacancy rates.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased Slightly in February

by Calculated Risk on 3/27/2018 04:49:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in February was 1.06%, down from 1.07% in January. Freddie's rate is up from 0.98% in February 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to a cycle bottom in the 0.5% to 0.8% range.

Note: Fannie Mae will report for February soon.

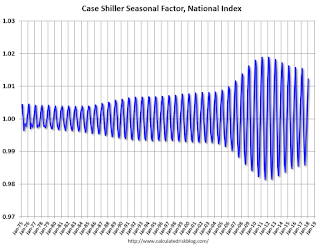

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 3/27/2018 04:41:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through January 2018). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.