by Calculated Risk on 3/14/2018 08:33:00 PM

Wednesday, March 14, 2018

Thursday: Unemployment Claims, NY Fed Mfg, Philly Fed Mfg, Homebuilder Confidence

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, down from 231 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for March. The consensus is for a reading of 23.3, down from 25.8.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for March. The consensus is for a reading of 14.6, up from 13.1.

• At 10:00 AM, The March NAHB homebuilder survey. The consensus is for a reading of 72, unchanged from 72 in February. Any number above 50 indicates that more builders view sales conditions as good than poor.

"Mortgage Rates Match 2-Week Lows"

by Calculated Risk on 3/14/2018 04:41:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Match 2-Week Lows

Mortgage rates fell again today as several economic updates painted a slightly gloomier picture. In general, weaker economic data coincides with lower rates. First up were Retail Sales numbers, which moved into negative territory in February. Analysts expected a modest improvement. Later in the morning, several widely-followed sources of GDP tracking adjusted Q1 estimates significantly lower. For instance, the Federal Reserve Bank of Atlanta keeps a running tally of where GDP would come out today given the incoming data. Today's reading fell to 1.9% from 2.5% last week.Here is a table from Mortgage News Daily:

...

The average borrower is likely to see the same interest rate at the top of the page (i.e. same NOTE rate) but with slightly lower upfront costs today (i.e. lower EFFECTIVE rate). With these gains, the average lender has inched down to the same rates seen on March 1st. [30YR FIXED - 4.5-4.625%]

emphasis added

Atlanta Fed: GDPNow declines to 1.9% for Q1

by Calculated Risk on 3/14/2018 11:15:00 AM

From the Atlanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2018 is 1.9 percent on March 14, down from 2.5 percent on March 9. After yesterday's Consumer Price Index release from the U.S. Bureau of Labor Statistics and this morning's retail sales report from the U.S. Census Bureau, the nowcast of first-quarter real personal consumption expenditures growth fell from 2.2 percent to 1.4 percent.

Retail Sales decreased 0.1% in February

by Calculated Risk on 3/14/2018 08:37:00 AM

On a monthly basis, retail sales decreased 0.1 percent from January to February (seasonally adjusted), and sales were up 4.0 percent from February 2017.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for February 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $492.0 billion, a decrease of 0.1 percent from the previous month, but 4.0 percent above February 2017. ... The December 2017 to January 2018 percent change was revised from down 0.3 percent to down 0.1 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were unchanged in February.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 3.9% on a YoY basis.The increase in February was well below expectations, however sales in January were revised up (although sales in December were revised down). A disappointing report.

MBA: Purchase Mortgage Applications Increase, Refinance Applications Decrease in Latest Weekly Survey

by Calculated Risk on 3/14/2018 07:00:00 AM

From the MBA: Purchase Apps Up, Refis Down in Latest MBA Weekly Survey

Mortgage applications increased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 9, 2018.

... The Refinance Index decreased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 5 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since January 2014, 4.69 percent, from 4.65 percent, with points decreasing to 0.45 from 0.58 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

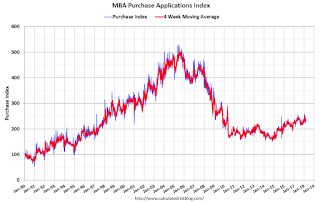

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, March 13, 2018

Wednesday: Retail Sales, PPI

by Calculated Risk on 3/13/2018 08:39:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Retail sales for February will be released. The consensus is for a 0.4% increase in retail sales.

• Also at 8:30 AM, The Producer Price Index for February from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for January. The consensus is for a 0.5% increase in inventories.

LA area Port Traffic Increases YoY in February

by Calculated Risk on 3/13/2018 05:04:00 PM

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

On a rolling 12 month basis, inbound traffic was up 2.1% compared to the rolling 12 months ending in January. Outbound traffic was down 0.4% compared to the rolling 12 months ending in January.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Note: The Chinese New Year boosted inbound traffic in February, and will slow inbound traffic in March this year.

Trade has been strong - especially inbound - and setting record volumes most months recently.

In general imports have been increasing, and exports are mostly moving sideways recently.

Larry Kudlow is usually wrong

by Calculated Risk on 3/13/2018 01:29:00 PM

With all the discussion that Larry Kudlow might be named the new director of the White House's National Economic Council, I've been asked to repost a post I wrote in 2016 "Larry Kudlow is usually wrong". On Kudlow, see from Bloomberg: Trump Says Kudlow Has ‘Very Good Chance’ at Taking Cohn’s Job and CNN Trump tells people he is selecting Larry Kudlow to replace Gary Cohn

Most of the following is a repeat of the 2016 post ...

Larry Kudlow is usually wrong and frequently absurd, as an example, in June 2005 Kudlow wrote "The Housing Bears are Wrong Again" (link has been replaced) and called me (or people like me) "bubbleheads".

Homebuilders led the stock parade this week with a fantastic 11 percent gain. This is a group that hedge funds and bubbleheads love to hate. All the bond bears have been dead wrong in predicting sky-high mortgage rates. So have all the bubbleheads who expect housing-price crashes in Las Vegas or Naples, Florida, to bring down the consumer, the rest of the economy, and the entire stock market.I guess I was one of those "bubbleheads"!

In December 2007, he wrote: Bush Boom Continues

There’s no recession coming. The pessimistas were wrong. It’s not going to happen. At a bare minimum, we are looking at Goldilocks 2.0. (And that’s a minimum). Goldilocks is alive and well. The Bush boom is alive and well. It’s finishing up its sixth consecutive year with more to come. Yes, it’s still the greatest story never told.Note the date of the article. The recession started in December 2007!

Note: At the beginning of 2007 I predicted a recession would start that year - made it by one month. It seems I'm always on the opposite side from Kudlow of each forecast - and one of us has been consistently wrong.

In 2014, Kudlow claimed: "I've always believed the 1990s were Ronald Reagan's third term."

In that piece, Kudlow was rewriting his own history. Near the beginning of Clinton's first term, Kudlow was arguing Clinton's policies would take the economy into a deep recession or even depression. Kudlow was wrong then (I remember because I was on the other side of that debate), so he can't claim he "always believed" now. Nonsense.

Also in 2007, right before the crash during President George W. Bush's 2nd term, Kudlow wrote: A Stock Market Vote of Confidence for Bush:

"I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. And today's stock market message is an unmistakable vote of confidence for the president."Well, maybe Kudlow had a point ... about President Obama!

Now Larry Kudlow might be the new director of the White House's National Economic Council. Oh my.

Key Measures Show Inflation About the Same Year-over-year in February as in January

by Calculated Risk on 3/13/2018 11:11:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (1.9% annualized rate) in February. The 16% trimmed-mean Consumer Price Index rose 0.1% (1.2% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for February here. Motor fuel was down in February.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.2% (1.8% annualized rate) in February. The CPI less food and energy rose 0.2% (2.2% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.4%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.8%. Core PCE is for January and increased 1.5% year-over-year.

On a monthly basis, median CPI was at 1.9% annualized, trimmed-mean CPI was at 1.2% annualized, and core CPI was at 2.2% annualized.

Using these measures, inflation was about the same year-over-year in February as in January. Overall, these measures are close, but still mostly below, the Fed's 2% target (Median CPI is slightly above).

Small Business Optimism Index Increased in February, "Difficulty of finding qualified workers" is Top Problem

by Calculated Risk on 3/13/2018 09:06:00 AM

From the National Federation of Independent Business (NFIB): February 2018 Report: Small Business Optimism Index

Small business owners are showing unprecedented confidence in the economy as the optimism index continues at record high numbers, rising to 107.6 in February, according to the NFIB Small Business Economic Trends Survey, released today. The historically high numbers include a jump in small business owners increasing capital outlays and raising compensation.

Job creation remained solid in the small business sector as owners reported a seasonally adjusted average employment change per firm of 0.22 workers, a strong showing and a repeat of last month. ... Fifty-two percent reported hiring or trying to hire (down 3 points), but 47 percent (90 percent of those hiring or trying to hire) reported few or no qualified applicants for the positions they were trying to fill. Twenty-two percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (unchanged), exceeding the percentage citing taxes or the cost of regulation.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index increased to 107.6 in February.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem.

Now the difficulty of finding qualified workers is the top problem.