by Calculated Risk on 2/28/2018 08:19:00 PM

Wednesday, February 28, 2018

Thursday: Unemployment Claims, Personal Income and Outlays, ISM Mfg, Construction Spending, Vehicle Sales, Fed Chair Powell

Plenty of data on Thursday:

• At 8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 222 thousand the previous week.

• Also at 8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.3%.

• At 10:00 AM, ISM Manufacturing Index for February. The consensus is for the ISM to be at 58.6, down from 59.1 in January. The ISM manufacturing index indicated expansion in December. The PMI was at 59.1% in January, the employment index was at 54.2%, and the new orders index was at 65.4%.

• Also at 10:00 AM, Construction Spending for January. The consensus is for a 0.3% increase in construction spending.

• Also at 10:00 AM, Fed Chair Jerome Powell Testimony, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking Committee, Washington, D.C

• All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 17.2 million SAAR in February, up from 17.1 million in January (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate decreased slightly in January

by Calculated Risk on 2/28/2018 04:10:00 PM

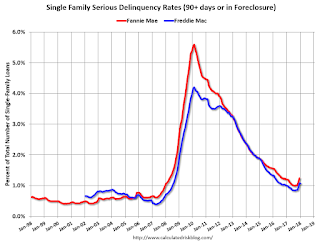

Fannie Mae reported that the Single-Family Serious Delinquency rate decreased to 1.23% in January, down from 1.24% in December. The serious delinquency rate is up from 1.20% in January 2017.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (3% of portfolio), 3.31% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 6.54% are seriously delinquent, For recent loans, originated in 2009 through 2017 (91% of portfolio), only 0.54% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

Earlier: Chicago PMI Declines in February, Still Solid

by Calculated Risk on 2/28/2018 12:22:00 PM

From the Chicago PMI: February Chicago Business Barometer Declines to 61.9

The MNI Chicago Business Barometer fell 3.8 points to 61.9 in February, down from 65.7 in January, to the lowest level since August 2017.This was well below the consensus forecast of 65.0, but still a solid reading.

Business activity continued to expand in February, although at a softer pace than in January. All five of the Barometer components receded on the month, but despite a second straight monthly fall, the Barometer was still up 8% on last February and above the 2017 average of 60.8.

...

“Disruptive weather conditions this month and large promotions at the back-end of last year appear to have weighed on demand and output in February, but despite the Barometer’s broad-based decline activity remains upbeat,” said Jamie Satchi, Economist at MNI Indicators.

“That said, a large proportion of firms are anxious about the cost of input materials, and warn they could pass on these higher costs to consumers if inflationary pressures do not abate,” he added.

emphasis added

NAR: Pending Home Sales Index Decreased 4.7% in January, Down 3.8% Year-over-year

by Calculated Risk on 2/28/2018 10:06:00 AM

From the NAR: Pending Home Sales Stumble 4.7 Percent in January

After seeing a modest three-month rise in activity, pending home sales cooled considerably in January to their lowest level in over three years, according to the National Association of Realtors®. All major regions experienced monthly and annual declines in contract signings last month.This was well below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in February and March.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, fell 4.7 percent to 104.6 in January from a downwardly revised 109.8 in December 2017. After last month’s retreat, the index is now 3.8 percent below a year ago and at its lowest level since October 2014 (104.1).

...

The PHSI in the Northeast dropped 9.0 percent to 87.0 in January, and is now 12.1 percent below a year ago. In the Midwest the index fell 6.6 percent to 98.2 in January, and is now 4.1 percent lower than January 2017.

Pending home sales in the South declined 3.9 percent to an index of 121.9 in January, and are now 1.1 percent lower than last January. The index in the West decreased 1.2 percent in January to 97.9, and is 2.5 percent below a year ago.

emphasis added

Q4 GDP Revised down to 2.5% Annual Rate

by Calculated Risk on 2/28/2018 08:34:00 AM

From the BEA: Gross Domestic Product: Fourth Quarter and Annual 2017 (Second Estimate)

Real gross domestic product (GDP) increased at an annual rate of 2.5 percent in the fourth quarter of 2017, according to the "second" estimate released by the Bureau of Economic Analysis. In the third quarter, real GDP increased 3.2 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was unrevised at 3.8%. Residential investment was revised up from 11.6% to 13.0%. Most revisions were small. This was at the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.6 percent. With this second estimate for the fourth quarter, the general picture of economic growth remains the same.

emphasis added

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 2/28/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 2.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 23, 2018. This week’s results include an adjustment for the Washington's Birthday (Presidents’ Day) holiday.

... The Refinance Index decreased 1 percent from the previous week. The seasonally adjusted Purchase Index increased 6 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 3 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) remained unchanged from last week at 4.64 percent, with points increasing to 0.63 from 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall 50 bps or more from the recent level.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase index According to the MBA, purchase activity is up 3% year-over-year.

Tuesday, February 27, 2018

Wednesday: GDP, Pending Home Sales, Chicago PMI

by Calculated Risk on 2/27/2018 07:35:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Gross Domestic Product, 4th quarter 2017 (Second estimate). The consensus is that real GDP increased 2.5% annualized in Q4, down from the advance estimate of 2.6%.

• 9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 65.0, down from 65.7 in January.

• At 10:00 AM, Pending Home Sales Index for January. The consensus is for a 0.5% increase in the index.

Freddie Mac: Mortgage Serious Delinquency Rate Decreased Slightly in January

by Calculated Risk on 2/27/2018 04:47:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in January was 1.07%, down from 1.08% in December. Freddie's rate is up from 0.99% in January 2017.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The recent increase in the delinquency rate was due to the hurricanes - no worries about the overall market (These are serious delinquencies, so it took three months late to be counted).

After the hurricane bump, maybe the rate will decline to a cycle bottom in the 0.5% to 0.8% range.

Note: Fannie Mae will report for January soon.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 2/27/2018 03:20:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

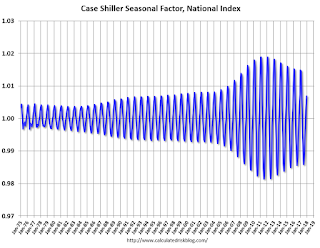

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

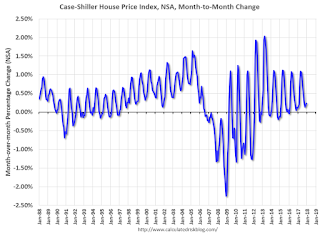

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through November 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Real House Prices and Price-to-Rent Ratio in December

by Calculated Risk on 2/27/2018 12:50:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.3% year-over-year in December

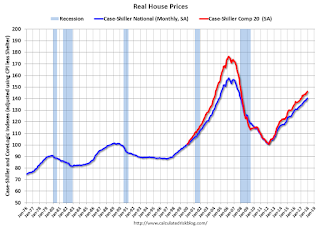

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 7.0% above the previous bubble peak. However, in real terms, the National index (SA) is still about 11.1% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In December, the index was up 6.3% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $282,000 today adjusted for inflation (41%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to March 2006 levels (and will probably be at a new high soon).

Real House Prices

In real terms, the National index is back to November 2004 levels, and the Composite 20 index is back to April 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 2000 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to January 2004 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to late 2003, early 2004 - and the price-to-rent ratio has been increasing slowly.