by Calculated Risk on 2/24/2018 08:11:00 AM

Saturday, February 24, 2018

Schedule for Week of Feb 25, 2018

The key economic reports this week are the second estimate of Q4 GDP, January new home sales, February auto sales, and the December Case-Shiller house price index.

For manufacturing, the February ISM manufacturing index, and the February Richmond Fed and Dallas Fed manufacturing surveys will be released this week.

Also, the new Fed Chair, Jerome Powell, will deliver the Semiannual Monetary Policy Report to the Congress.

8:30 AM ET: Chicago Fed National Activity Index for January. This is a composite index of other data.

10:00 AM: New Home Sales for January from the Census Bureau.

10:00 AM: New Home Sales for January from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the December sales rate.

The consensus is for 600 thousand SAAR, down from 625 thousand in December.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for February.

8:30 ET AM: Durable Goods Orders for January from the Census Bureau. The consensus is for a 0.2% decrease in durable goods orders.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.

9:00 AM ET: S&P/Case-Shiller House Price Index for December.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the October 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 6.3% year-over-year increase in the Comp 20 index for December.

9:00 AM: FHFA House Price Index for December 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

10:00 AM: Fed Chair Jerome Powell Testimony, Semiannual Monetary Policy Report to the Congress, Before the House Financial Services Committee, Washington, D.C.

10:00 AM ET: Richmond Fed Survey of Manufacturing Activity for February. This is the last of the regional surveys for February.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Gross Domestic Product, 4th quarter 2017 (Second estimate). The consensus is that real GDP increased 2.5% annualized in Q4, down from the advance estimate of 2.6%.

9:45 AM: Chicago Purchasing Managers Index for February. The consensus is for a reading of 65.0, down from 65.7 in January.

10:00 AM: Pending Home Sales Index for January. The consensus is for a 0.5% increase in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 230 thousand initial claims, up from 222 thousand the previous week.

8:30 AM: Personal Income and Outlays for January. The consensus is for a 0.3% increase in personal income, and for a 0.2% increase in personal spending. And for the Core PCE price index to increase 0.3%.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 58.6, down from 59.1 in January.

10:00 AM: ISM Manufacturing Index for February. The consensus is for the ISM to be at 58.6, down from 59.1 in January.Here is a long term graph of the ISM manufacturing index.

The ISM manufacturing index indicated expansion in December. The PMI was at 59.1% in January, the employment index was at 54.2%, and the new orders index was at 65.4%.

10:00 AM: Construction Spending for January. The consensus is for a 0.3% increase in construction spending.

10:00 AM: Fed Chair Jerome Powell Testimony, Semiannual Monetary Policy Report to the Congress, Before the Senate Banking Committee, Washington, D.C

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 17.2 million SAAR in February, up from 17.1 million in January (Seasonally Adjusted Annual Rate).

All day: Light vehicle sales for February. The consensus is for light vehicle sales to be 17.2 million SAAR in February, up from 17.1 million in January (Seasonally Adjusted Annual Rate).This graph shows light vehicle sales since the BEA started keeping data in 1967. The dashed line is the January sales rate.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for February). The consensus is for a reading of 99.5, down from 99.9 in January.

Friday, February 23, 2018

Oil Rigs "Oil rig counts take a breather"

by Calculated Risk on 2/23/2018 07:05:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Feb 23, 2018:

• Total US oil rigs took an anticipated breather this week, +1 to 799

• Horizontal oil rigs were up, +1 to 697

...

• The oil price continues to recover

• If rig count additions continue on our forecast trajectory, expect this to weigh on sentiment during March, particularly if supply gains surprise to the upside

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Lawler: "Census: Population Growth Slowed Slightly in 2017: Immigration Uncertainty Clouds Outlook"

by Calculated Risk on 2/23/2018 03:58:00 PM

From housing economist Tom Lawler: Census: Population Growth Slowed Slightly in 2017: Immigration Uncertainty Clouds Outlook

At the end of last year the Census Bureau released its estimate of the US population for July 1, 2017 and its updated estimates for previous years (the so-called “Vintage 2017” estimates). As of July 1, 2017 Census estimated that the US resident population totaled 325,719,178, up 2,313,062 (or 0.71%) from the upwardly-revised estimate for July 1, 2016. The estimated population increase for 2017 was slightly lower than the 2,366,096 estimated gain in 2016, reflecting slightly lower estimated births, slightly higher estimated deaths, and slightly lower net international migration. Revised population estimates for previous years mainly reflected revised estimates of net international migration, which were driven by an updated methodology for estimating foreign-born emigration and net native-born migration. Below is a table comparing Vintage 2017 population estimates compared to the Vintage 2015 and the Vintage 2016 estimates. The Vintage “estimates” for the subsequent year reflect near-term projections for each Vintage.

| Estimated US Resident Population | |||

|---|---|---|---|

| Vintage 2015 | Vintage 2016 | Vintage 2017 | |

| 7/1/2010 | 309,346,863 | 309,348,193 | 309,339,421 |

| 7/1/2011 | 311,718,857 | 311,663,358 | 311,644,280 |

| 7/1/2012 | 314,102,623 | 313,998,379 | 313,993,272 |

| 7/1/2013 | 316,427,395 | 316,204,908 | 316,234,505 |

| 7/1/2014 | 318,907,401 | 318,563,456 | 318,622,525 |

| 7/1/2015 | 321,418,820 | 320,896,618 | 321,039,839 |

| 7/1/2016 | 323,889,854 | 323,127,513 | 323,405,935 |

| 7/1/2017 | 325,344,115 | 325,719,178 | |

| 7/1/2018 | 328,033,240 | ||

While Census had originally planned to release updated long-term population projections in December (the last long-term population projections report was released at the end of 2014 with “Vintage 2013” as a starting point), “senior officials” delayed the updated population release until sometime in March. Many analysts use these population projections to project such things as labor force growth, household growth, etc. Unfortunately, the Census population projections from 2014 are woefully out of date. Amazingly, however, some analysts still use these old projections. E.g., in October of last year the Bureau of Labor Statistics produced updated labor force projections over the next decade based on the outdated Census population projections. Since, as discussed later, the Census 2014 population projections significantly overstated not just actual population growth but likely population growth over the next few years, projection of key economic variables based on these outdated population forecasts are of little use to anyone.

Below is a table showing the US resident population projections from the Census 2014 projections compared to the Vintage 2017 estimates.

| Vintage 2017 | Census 2014 Projections | Difference | |

|---|---|---|---|

| 7/1/2014 | 318,622,525 | 318,748,017 | -125,492 |

| 7/1/2015 | 321,039,839 | 321,368,864 | -329,025 |

| 7/1/2016 | 323,405,935 | 323,995,528 | -589,593 |

| 7/1/2017 | 325,719,178 | 326,625,791 | -906,613 |

| 7/1/2018 | 328,033,240 | 329,256,465 | -1,223,225 |

As the table indicates, the Census 2014 population projection for 2017 were 906,613 higher than the latest 2017 estimate, and the projection for 2018 was 1,223,225 above the latest short-term forecast.

For 2017, here is a breakdown of the 2014 projections’ “component of change” assumptions for 2014 through 2017 compared to the Vintage 2017’s estimates.

| Cumulative Components of Change from 7/1/2013 to 7/1/2017 | |||

|---|---|---|---|

| Vintage 2017 | Census 2014 Projections | Difference | |

| Births | 15,864,285 | 16,050,287 | -186,002 |

| Deaths | 10,755,028 | 10,532,454 | 222,574 |

| Net International Migration | 4,375,416 | 4,979,119 | -603,703 |

| Components of Change | 9,484,673 | 10,496,952 | -1,012,279 |

| 7/1/2013 Starting Point | 316,234,505 | 316,128,839 | 105,666 |

| 7/1/2017 Population | 325,719,178 | 326,625,791 | -906,613 |

As the table indicates, over the 2014 through 2017 period births were lower, deaths were higher, and net international migration was significantly lower (according to the latest estimates) than the assumptions made in the Census 2014 population projections.

While Census has not yet released the Vintage 2017 population estimates by detailed age (these estimates probably won’t be available until June), the 7/1/2017 estimate of the US resident “adult” (18+) population is 252,063,800, or 778,438 below the projection for that date from the Census 2014 population projection report.

For the 2014 to 2017 period (using “actual” labor force participation rates), US labor force growth was about 0.1% per year lower than would have been the case if the Census 2014 population projections had been accurate. Over than same period my “best guess” is that US household growth over than period was about 118,000 lower than would have been the case if the Census 2014 population projections had been accurate. I use the term “best guess” because there are no reliable estimates of the number of US households for that period. (The so-called “household estimate conundrum.”)

The gap between Census 2014 population projections and likely “actual” population counts will almost certainly widen over the next few years, partly because of higher death rates but mainly because the Census 2014 assumptions on net international migration over the next few years seem way too high given the current political climate. As the chart below shows, the Census 2014 population projections assumed that net international immigration would be substantially higher over the 2018-2020 period than was the case over the past several years. Given the current political climate, such an assumption seems very unrealistic.

Click on graph for larger image.

Click on graph for larger image.On the immigration assumption front, my “gut” tells me that a major reason Census officials delayed the release of new long-term population projections is that it is far from clear how to assess what immigration numbers are likely to look like under an Administration that has expressed its support for legislation that would sharply reduce immigration. It also is a sensitive political topic, and it seems doubtful that Census officials would want to put out “official” government projections that showed rising net immigration numbers. I’m guessing that when Census finally releases its updated population projections, it will show different immigration scenarios, as they did in the 2012 population projection release, but I also believe that its “base’ or “middle net international migration scenario will show considerable lower numbers than those in the 2014 projections.

For analysts wishing to make economic projections that are dependent on population projections, there a few choices: (1) forego making any projections until Census releases its updated population forecasts, which is tentatively scheduled for release sometime next month; (2) make their own population projections based on their own assumptions about births, deaths, and (especially) net international migration; or (3) (NOT RECOMMENDED) continue the use the outdated Census 2014 population projections because, well, er, they are the last officially released projections!

When the Census’ new long-term population projections are released (again, probably next month), there are a few things analysts should take into account before using them as inputs to other economic/demographic variables. First, of course, analysts should look closely at the underlying assumptions in the projections, and make an assessment of whether they are “reasonable” (with special attention to the assumptions on net international migration). Second, it is highly likely that the “starting point” for Census’ updated population projections will be the “Vintage 2016” population estimate for July 1, 2016. As noted in the table on page one, the population estimate for this date was revised upward at the end of last year by 278,782. As such, rigorous analysts will need to adjust the Census projections to reflect these updated estimates, and may also want to adjust the Census projections to reflect their own views of the key components of change (again, especially with respect to net international migration).

Net, of course, the updated long-term Census population projections released (probably) next month are likely to show SUBSTANTIALLY slower projected population growth than the Census 2014 projections, and folks who only use “official” Census population projections to forecast such things as labor force growth and household formations will show substantially slower growth in these variables from their previous forecasts.

House Prices: NAR Median Prices vs Case-Shiller Index

by Calculated Risk on 2/23/2018 12:05:00 PM

During the housing bubble and subsequent bust, I noted that the median house price could be distorted by the mix of houses sold. I preferred to use the repeat sales indexes from the FHFA, Case-Shiller and Corelogic (and others).

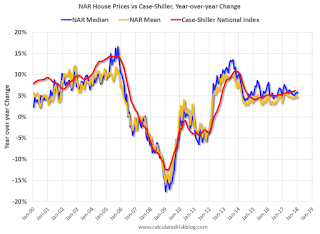

Now that most of the distortion from the bubble is behind us, I thought I'd take a look at the median (and mean) house price data for existing home sales from the NAR, compared to the Case-Shiller National index.

The first graph show the NAR existing home sales median and mean prices since 1999 (Not Seasonally Adjusted), compared to Case-Shiller (Seasonally Adjusted).

The median and mean house prices showed less of an increase in prices during the bubble (this was the distortion I discussed back in 2005 and 2006).

Now it appears the median and mean prices are pretty much tracking the Case-Shiller index.

The second graph show the same data on a year-over-year basis.

The Case-Shiller National Index was up 6.2% in November.

The NAR median price was up 5.8% in January, and the mean price was up 4.7%.

I still prefer the repeat sales indexes, but I think the NAR prices are also useful.

The third graph shows the NAR existing home median prices, the Census Bureau's new home median prices, and the Case-Shiller national index.

Compared to the bubble peak, the NAR median price is up 4.4%, the Case-Shiller index is up 6.4%, however new home median prices are up 27.5%!

Black Knight: National Mortgage Delinquency Rate decreased in January

by Calculated Risk on 2/23/2018 08:30:00 AM

From Black Knight: Black Knight’s First Look: Mortgage Delinquencies Decline Sharply in January; Hurricanes’ Lingering Impact on Performance Continues

• Calendar-driven effects and fewer hurricane-related delinquencies resulted in a 210,000-loan decline in the number of past-due mortgagesAccording to Black Knight's First Look report for January, the percent of loans delinquent decreased 8.6% in January compared to December, and increased 1.3% year-over-year.

• Despite an 8.6 percent monthly decline, delinquencies remain 1.3 percent above last year’s levels

• 146,000 loans remain delinquent as a result of Hurricanes Harvey and Irma, 132,000 of which are seriously delinquent (90 or more days past due)

• An early look at January data on the mortgage market in Puerto Rico shows an additional 57,000 loans still delinquent as a result of Hurricane Maria, with 49,000 seriously delinquent

• The population of loans in active foreclosure rose 6,000 month-over-month, marking only the second monthly rise in more than five years

The percent of loans in the foreclosure process increased 1.8% in January and were down 30% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.31% in January, down from 4.71% in December.

The percent of loans in the foreclosure process increased slightly in January to 0.66%.

The number of delinquent properties, but not in foreclosure, is up 40,000 properties year-over-year, and the number of properties in the foreclosure process is down 144,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2018 | Dec 2017 | Jan 2017 | Jan 2016 | |

| Delinquent | 4.31% | 4.71% | 4.25% | 5.09% |

| In Foreclosure | 0.66% | 0.65% | 0.94% | 1.30% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,202,000 | 2,412,000 | 2,162,000 | 2,575,000 |

| Number of properties in foreclosure pre-sale inventory: | 337,000 | 331,000 | 481,000 | 659,000 |

| Total Properties | 2,539,000 | 2,743,000 | 2,643,000 | 3,234,000 |

Thursday, February 22, 2018

Duy's Fed Watch: "Fedspeak Reiterates Gradual Path"

by Calculated Risk on 2/22/2018 06:20:00 PM

From Professor Tim Duy at Fed Watch: Fedspeak Reiterates Gradual Path

Fed speakers continue to reiterate that policy remains on a gradual path of tightening. So far, the inflation data and brightening economy has more emboldened their commitment to gradual rate hikes than a faster pace of hikes. What about fiscal policy? That train has left the station, but central bankers don’t seem too concerned – yet.

...

If the Fed wants to see what happens if you run the economy hot, best to give it a try in a low inflation, well-anchored inflation expectations environment. If the economy overheats and sends inflation to 3 percent, it wouldn’t be something the Fed couldn’t control. I am willing to endorse that experiment.

...

Bottom Line: Fed speakers continue to show no urgency to accelerate the pace of rate hikes despite firming inflation data and budget-busting fiscal stimulus. Also, keep an eye out for the possibility that Trump’s appointees reveal themselves to be doves in hawks’ clothing.

Hotels: Solid Start for Occupancy Rate in 2018

by Calculated Risk on 2/22/2018 01:52:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 17 February

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 11-17 February 2018, according to data from STR.Note: Houston is no longer reporting a large year-over-year increase in occupancy, so it appears the impact of the hurricanes is fading.

In comparison with the week of 12-18 February 2017, the industry recorded the following:

• Occupancy: +1.2% to 62.9%

• Average daily rate (ADR): +3.2% to US$128.75

• Revenue per available room (RevPAR): +4.4% to US$80.99

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

Click on graph for larger image.The red line is for 2018, dash light blue is 2017 (record year due to hurricanes), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

Currently the occupancy rate is second overall, to date (just behind 2006) - and ahead of the record year in 2017 (2017 finished strong due to the impact of the hurricanes).

Data Source: STR, Courtesy of HotelNewsNow.com

Kansas City Fed: Regional Manufacturing Activity "Continued Solid Growth" in February

by Calculated Risk on 2/22/2018 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Posted Continued Solid Growth

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that the Tenth District manufacturing survey posted continued solid growth, and expectations for future activity increased moderately.So far all of the regional Fed surveys have been solid in February, and most have been above the January levels (most indexes suggest faster growth in February than in January).

“February was another good month for factories in our region,” said Wilkerson. “A rising number of firms reported higher input and selling prices.”

...

The month-over-month composite index was 17 in February, higher than 16 in January and 13 in December (Tables 1 & 2, Chart 1). The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Factory activity grew at both durable and non-durable goods plants, particularly for metals, machinery, and plastics products. Most month-over-month indexes also increased. The shipments, new orders, and employment indexes all rose moderately. The order backlog index fell from 20 to 13, and the new orders for exports index also eased somewhat. The raw materials inventory index decreased from 15 to 8, while the finished goods inventory index was basically unchanged.

Most year-over-year factory indexes were higher in February. The composite index rose from 35 to 38, and the production, shipments, new orders, and order backlog indexes also increased. The employment index climbed from 31 to 39, and the capital expenditures index inched slightly higher. The raw materials inventory index fell from 38 to 23, while the finished goods inventory index increased slightly.

emphasis added

Weekly Initial Unemployment Claims decrease to 222,000

by Calculated Risk on 2/22/2018 08:33:00 AM

The DOL reported:

In the week ending February 17, the advance figure for seasonally adjusted initial claims was 222,000, a decrease of 7,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 230,000 to 229,000. The 4-week moving average was 226,000, a decrease of 2,250 from the previous week's revised average. The previous week's average was revised down by 250 from 228,500 to 228,250.The previous week was revised down.

Claims taking procedures in Puerto Rico and in the Virgin Islands have still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 226,000.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, February 21, 2018

Thursday: Unemployment Claims

by Calculated Risk on 2/21/2018 08:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Hit New 4-Year Highs

Mortgage rates continued higher today following the release of the Minutes from the Federal Reserve's (aka "The Fed") most recent policy meeting. The Fed was slightly more upbeat than markets expected, saying that most members agreed that a stronger economy increased the likelihood of further rate hikes. ... Unfortunately, today that meant rates moved to their highest levels in more than 4 years. For what it's worth, today's rates are only microscopically higher than last week's highs. [30YR FIXED - 4.625%]Thursday:

emphasis added

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 229 thousand initial claims, up from 221 thousand the previous week.

• At 11:00 AM, the Kansas City Fed manufacturing survey for February.