by Calculated Risk on 1/31/2018 08:08:00 PM

Wednesday, January 31, 2018

Thursday: Unemployment Claims, ISM Mfg Index, Construction Spending, Vehicle Sales

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 235 thousand initial claims, up from 233 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for January. The consensus is for the ISM to decrease to 58.7. The PMI was at 59.7% in December, the employment index was at 57.0%, and the new orders index was at 69.4%.

• Also at 10:00 AM, Construction Spending for December. The consensus is for a 0.5% increase in construction spending.

• All day, Light vehicle sales for January. The consensus is for light vehicle sales to be 17.3 million SAAR in January, down from 17.8 million in December (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate increased in December due to Hurricanes

by Calculated Risk on 1/31/2018 04:52:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate increased to 1.24% in December, up from 1.12% in November. The serious delinquency rate is up from 1.20% in December 2016.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

By vintage, for loans made in 2004 or earlier (4% of portfolio), 3.28% are seriously delinquent. For loans made in 2005 through 2008 (6% of portfolio), 6.55% are seriously delinquent, For recent loans, originated in 2009 through 2017 (90% of portfolio), only 0.53% are seriously delinquent. So Fannie is still working through poor performing loans from the bubble years.

This increase in the delinquency rate was due to the hurricanes - no worries about the overall market - and we might see a further increase over the next month or so (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline to 0.5 to 0.7 percent or so to a cycle bottom.

Note: Freddie Mac reported earlier.

FOMC Statement: No Change in Policy

by Calculated Risk on 1/31/2018 02:02:00 PM

Information received since the Federal Open Market Committee met in December indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Gains in employment, household spending, and business fixed investment have been solid, and the unemployment rate has stayed low. On a 12-month basis, both overall inflation and inflation for items other than food and energy have continued to run below 2 percent. Market-based measures of inflation compensation have increased in recent months but remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee expects that, with further gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will remain strong. Inflation on a 12‑month basis is expected to move up this year and to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to maintain the target range for the federal funds rate at 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant further gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

Voting for the FOMC monetary policy action were Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Thomas I. Barkin; Raphael W. Bostic; Lael Brainard; Loretta J. Mester; Jerome H. Powell; Randal K. Quarles; and John C. Williams.

emphasis added

NAR: Pending Home Sales Index Increased 0.5% in December, Up 0.5% Year-over-year

by Calculated Risk on 1/31/2018 10:05:00 AM

From the NAR: Pending Home Sales Tick Up 0.5 Percent in December

Pending home sales were up slightly in December for the third consecutive month, according to the National Association of Realtors®. In 2018, existing-home sales and price growth are forecast to moderate, primarily because of the new tax law's expected impact in high-cost housing markets.This was close to expectations of a 0.4% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in January and February.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, moved higher 0.5 percent to 110.1 in December from an upwardly revised 109.6 in November. With last month's modest increase, the index is now 0.5 percent above a year ago.

...

The PHSI in the Northeast dipped 5.1 percent to 93.9 in December, and is now 2.7 percent below a year ago. In the Midwest the index decreased 0.3 percent to 105.0 in December, but is still 0.3 percent higher than December 2016.

Pending home sales in the South grew 2.6 percent to an index of 126.9 in December and are now 4.0 percent higher than last December. The index in the West rose 1.5 percent in December to 101.7, but is still 3.1 percent below a year ago.

emphasis added

ADP: Private Employment increased 234,000 in January

by Calculated Risk on 1/31/2018 08:19:00 AM

Private sector employment increased by 234,000 jobs from December to January according to the January ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was above the consensus forecast for 195,000 private sector jobs added in the ADP report.

...

“We’ve kicked off the year with another month of unyielding job gains,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Service providers were firing on all cylinders, posting their strongest gain in more than a year. We also saw robust hiring from midsize and large companies, while job growth in smaller firms slowed slightly.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market juggernaut marches on. Given the strong January job gain, 2018 is on track to be the eighth consecutive year in which the economy creates over 2 million jobs. If it falls short, it is likely because businesses can’t find workers to fill all the open job positions.”

The BLS report for January will be released Friday, and the consensus is for 176,000 non-farm payroll jobs added in January.

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 1/31/2018 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 26, 2018.

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to its highest level since March 2017, 4.41 percent, from 4.36 percent, with points increasing to 0.56 from 0.54 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

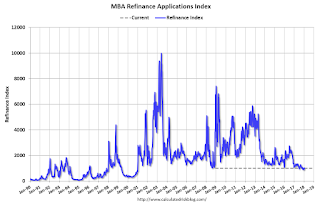

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, January 30, 2018

Wednesday: FOMC Annoucement, ADP Employment, Pending Home Sales, Chicago PMI

by Calculated Risk on 1/30/2018 07:46:00 PM

From Merrill Lynch on FOMC announcement:

The FOMC meeting on 31 January is likely to send a modestly hawkish signal, as FOMC officials become more convinced of the shift from the disinflation of 2017 and emphasize the momentum in the real economy. The FOMC will only have the statement to communicate updated views, as there is no press conference or Summary of Economic Projections (SEP). This will mark Janet Yellen's last FOMC meeting as Chair.Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for January. This report is for private payrolls only (no government). The consensus is for 195,000 payroll jobs added in January, down from 250,000 added in December.

• At 9:45 AM, Chicago Purchasing Managers Index for January. The consensus is for a reading of 64.0, down from 67.6 in December.

• At 10:00 AM, Pending Home Sales Index for December. The consensus is for a 0.4% increase in the index.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to announce no change to policy at this meeting.

Update: A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 1/30/2018 05:24:00 PM

CR Note: This is a repeat of earlier posts with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see former Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

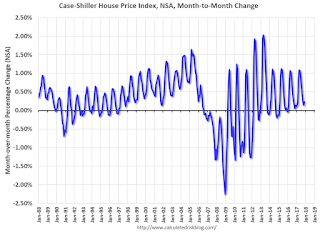

This graph shows the month-to-month change in the NSA Case-Shiller National index since 1987 (through November 2017). The seasonal pattern was smaller back in the '90s and early '00s, and increased once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Freddie Mac: Mortgage Serious Delinquency Rate Increased Sharply in December due to Hurricanes

by Calculated Risk on 1/30/2018 01:57:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate in December was 1.08%, up sharply from 0.95% in November. Freddie's rate is up from 1.00% in December 2016.

Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

This increase in the delinquency rate was due to the hurricanes - no worries about the overall market - and we might see a further increase over the next month or so (These are serious delinquencies, so it takes three months late to be counted).

After the hurricane bump, maybe the rate will decline to a cycle bottom in the 0.5% to 0.8% range..

Note: Fannie Mae will report for December soon.

Real House Prices and Price-to-Rent Ratio in November

by Calculated Risk on 1/30/2018 12:57:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 6.2% year-over-year in November

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 6.4% above the previous bubble peak. However, in real terms, the National index (SA) is still about 11.6% below the bubble peak (and historically there has been an upward slope to real house prices).

The year-over-year increase in prices is mostly moving sideways now around 6%. In November, the index was up 6.2% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $282,000 today adjusted for inflation (41%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to February 2006 levels.

Real House Prices

In real terms, the National index is back to September 2004 levels, and the Composite 20 index is back to April 2004.

In real terms, house prices are back to 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to December 2003 levels, and the Composite 20 index is back to October 2003 levels.

In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio has been increasing slowly.