by Calculated Risk on 1/11/2018 08:22:00 PM

Thursday, January 11, 2018

Friday: Retail Sales, CPI

Friday:

• At 8:30 AM ET: Retail sales for December will be released. The consensus is for a 0.5% increase in retail sales.

• Also at 8:30 AM: The Consumer Price Index for December from the BLS. The consensus is for a 0.1% increase in CPI, and a 0.2% increase in core CPI.

• At 10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for November. The consensus is for a 0.3% increase in inventories.

Oil Prices Higher, Up 19% Year-over-year

by Calculated Risk on 1/11/2018 01:40:00 PM

From Bloomberg: Crude Oil Prices Are Up 49%, and It’s Not All Thanks to OPEC

The bottom line: A 49 percent surge in benchmark North American crude futures since late June, putting prices at a three-year high.

...

"We expect inventories are going to build this year -- slightly,” said Michael Cohen, Barclays Head of Oil Markets Research, in an interview on Bloomberg TV. "You’re going to see a bunch of new crude supply coming on to the market this year from the U.S. So all in all, on a balanced basis, we don’t see the kind of shortage to bring us to $80 for a sustainable basis."

Click on graph for larger image

Click on graph for larger imageThe first graph shows WTI and Brent spot oil prices from the EIA. (Prices today added).

According to Bloomberg, WTI is at $64.29 per barrel today, and Brent is at $69.66.

Prices really collapsed at the end of 2014 - and then rebounded a little - and then collapsed again at the end of 2015 and in early 2016.

Now, with the global economy stronger and less domestic production, oil prices are rising.

The second graph shows the year-over-year change in WTI based on data from the EIA.

The second graph shows the year-over-year change in WTI based on data from the EIA.Six times since 1987, oil prices have increased 100% or more YoY. And several times prices have almost fallen in half YoY.

Currently WTI is up about 19% year-over-year.

Sacramento Housing in December: Sales down 8% YoY, Active Inventory up 8% YoY

by Calculated Risk on 1/11/2018 11:34:00 AM

Note: I'm going to retire the graph below. The purpose was to see when the market shifted from distressed sales to more conventional sales. For several years, not much changed. But in 2012 and 2013, we saw some significant changes with a dramatic shift from distressed sales to more normal equity sales. Now almost all of the sales are conventional equity sales.

Note: The Sacramento Association of REALTORS® started breaking out REOs in May 2008, and short sales in June 2009.

In December, total sales were down 8.0% from December 2016, and conventional equity sales were down 3.8% compared to the same month last year.

In December, 2.9% of all resales were distressed sales. This was up from 2.3% last month, and down from 4.8% in December 2016.

Sacramento Realtor Press Release: 2017 closes with less sales, less inventory, higher sales price

December recorded 1,408 closed escrows, a .9% increase from November(1,396 sales) and an 8% decrease from last year (1,530 sales).Here are the statistics.

...

Active Listing Inventory decreased, dropping 28.9% from 2,216 to 1,575. The Months of Inventory also decreased, dropping 31.3% from 1.6 Months to 1.1. A year ago the Months of inventory was 1 and Active Listing Inventory stood at 1,458 listings (7.4% below the current figure).

emphasis added

Click on graph for larger image.

Click on graph for larger image. This graph shows the percent of REO sales, short sales and conventional sales.

There has been a sharp increase in conventional (equity) sales that started in 2012 (blue) as the percentage of distressed sales declined sharply.

Active Listing Inventory for single family homes increased 8.0% year-over-year (YoY) in November. This is the third consecutive month with a YoY inventory increase, following 29 consecutive months with a YoY decrease in inventory in Sacramento.

Cash buyers accounted for 12.9% of all sales - this has been generally declining (frequently investors).

Summary: This data suggests a normal market with few distressed sales, and less investor buying - but with limited inventory. Keep an eye on inventory - this might be a change in trend.

Weekly Initial Unemployment Claims increase to 261,000

by Calculated Risk on 1/11/2018 09:20:00 AM

The DOL reported:

In the week ending January 6, the advance figure for seasonally adjusted initial claims was 261,000, an increase of 11,000 from the previous week's unrevised level of 250,000. The 4-week moving average was 250,750, an increase of 9,000 from the previous week's unrevised average of 241,750.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 250,750.

This was higher than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, January 10, 2018

Thursday: Unemployment Claims, PPI

by Calculated Risk on 1/10/2018 07:32:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 245 thousand initial claims, down from 250 thousand the previous week.

• Also at 8:30 AM, The Producer Price Index for December from the BLS. The consensus is a 0.2% increase in PPI, and a 0.2% increase in core PPI.

Kansas City Fed on Housing: "Pent-Up Demand and Continuing Price Increases"

by Calculated Risk on 1/10/2018 03:35:00 PM

From Jordan Rappaport, Senior Economist at the Kansas City Fed: Pent-Up Demand and Continuing Price Increases: The Outlook for Housing in 2018 An excerpt on inventory:

The low rate of residential construction has been contributing to the tight supply of existing homes listed for sale. New construction provides liquidity to local housing markets, where households are often both buyers and sellers. With fewer new homes from which to choose, many homeowners considering upgrading have instead chosen to remain in their current homes and so have not listed them for sale. As a result, the number of existing homes for sale has decreased as well, dissuading other homeowners from upgrading and further dampening sales listings. This “vicious circle” has limited the efficacy of rising sales prices in eliciting more listings. Since early 2015, the number of single-family homes listed for sale has steadily declined (Chart 2, blue line). Correspondingly, the ratio of listed homes to monthly sales, also known as “months supply,” fell to 3.8 in November, its lowest value since 1982, the earliest date for which data are available (green line).

Click on graph for larger image.

Limited new construction and sales listings of low-end single-family homes have similarly dissuaded many younger households from leaving their apartments to purchase homes, thereby depressing the number of vacant apartments available for potential new households.There is much more in the Fed article.

CR Note: Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we have seen a surge in home improvement spending, and this is also limiting supply.

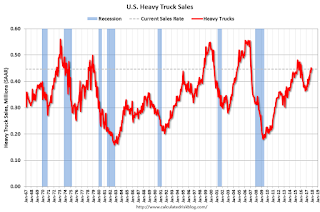

U.S. Heavy Truck Sales up Year-over-year in 2017

by Calculated Risk on 1/10/2018 12:18:00 PM

Heavy truck sales increased 3% in 2017 compared to 2016, and heavy truck sales were up 18% year-over-year in December.

First, here is a table of heavy truck sales since 2000 (source: BEA).

Note that sales peaked during the housing bubble, and really collapsed during the great recession. The decline in 2016 was probably related to oil prices.

| Heavy Truck Sales (000s) | |

|---|---|

| Year | Sales |

| 2000 | 461.9 |

| 2001 | 350.1 |

| 2002 | 322.4 |

| 2003 | 328.4 |

| 2004 | 431.6 |

| 2005 | 496.5 |

| 2006 | 544.4 |

| 2007 | 371.1 |

| 2008 | 298.5 |

| 2009 | 199.8 |

| 2010 | 217.6 |

| 2011 | 306.6 |

| 2012 | 346.3 |

| 2013 | 352.6 |

| 2014 | 407.7 |

| 2015 | 449.3 |

| 2016 | 401.0 |

| 2017 | 412.5 |

Click on graph for larger image.

This graph shows heavy truck sales since 1967 using data from the BEA. The dashed line is the December 2017 seasonally adjusted annual sales rate (SAAR).

Heavy truck sales really collapsed during the great recession, falling to a low of 181 thousand in April and May 2009, on a seasonally adjusted annual rate basis (SAAR).

Truck sales softened with the decline in oil prices, however with the increase in oil prices over the last year, heavy truck sales increased too.

Heavy truck sales were at 447 thousand SAAR in December 2017, down slightly from 451 thousand in November, and up from 379 thousand in December 2016. With solid construction and rising oil prices, heavy truck sales will probably increase in 2018.

Update: The Inland Empire Bust and Recovery

by Calculated Risk on 1/10/2018 10:09:00 AM

Way back in 2006 I disagreed with some analysts on the outlook for the Inland Empire in California. I wrote:

As the housing bubble unwinds, housing related employment will fall; and fall dramatically in areas like the Inland Empire. The more an area is dependent on housing, the larger the negative impact on the local economy will be.And sure enough, the economies of housing dependent areas like the Inland Empire were devastated during the housing bust. The good news is the Inland Empire is expanding solidly now.

So I think some pundits have it backwards: Instead of a strong local economy keeping housing afloat, I think the bursting housing bubble will significantly impact housing dependent local economies.

Click on graph for larger image.

Click on graph for larger image.This graph shows the unemployment rate for the Inland Empire (using MSA: Riverside, San Bernardino, Ontario), and also the number of construction jobs as a percent of total employment.

The unemployment rate is falling, and is down to 4.1% (down from 14.4% in 2010). And construction employment is up from the lows (as a percent of total employment), but still well below the bubble years.

So the unemployment rate has fallen to a record low, but the economy isn't as heavily depending on construction. Overall the Inland Empire economy is in much better shape today.

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..

The second graph shows the number of construction jobs as a percent of total employment for the Inland Empire, all of California, and the entire U.S..Clearly the Inland Empire is more dependent on construction than most areas. Construction has picked up as a percent of total employment, but the economy in California and the U.S. is not as dependent on construction as during the bubble years.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 1/10/2018 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 8.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 5, 2018. This week’s results included an adjustment for the New Year’s holiday. Results for the previous week ending 12/29/17 were revised.

... The Refinance Index increased 11 percent from the previous week. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index increased 44 percent compared with the previous week and was 1 percent lower than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) increased to 4.23 percent from 4.22 percent, with points decreasing to 0.35 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is down 1% year-over-year.

Tuesday, January 09, 2018

Earlier: Small Business Optimism Index Declines in December

by Calculated Risk on 1/09/2018 06:40:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

Earlier from the National Federation of Independent Business (NFIB): Average Monthly Optimism Sets All-Time Record in 2017

The Index of Small Business Optimism lost 2.6 points in December, falling to 104.9, still one of the strongest readings in the 45-year history of the NFIB surveys. The highest reading of 108.0 was reached in July 1983, only slightly above November’s 107.5. The lowest reading of 79.7 occurred in April 1980. Two of the 10 Index components posted a gain, five declined, and three were unchanged. The decline left the Index historically strong and maintained a string of exceptional readings that started the day after the 2016 election results were announced. Following the election announcement, the Index rose from 95.0 (a below average reading) for October and pre-election November, to 102.0 in the November weeks after the election, and then to 105.0 in January. This surge in optimism has led to 2017 achieving the highest yearly average Index reading in the survey’s history. The average monthly Index for 2017 was 104.8. The previous record was 104.6, set in 2004.

Job creation was slow in the small-business sector as owners reported a seasonally adjusted average employment change per firm of 0.01 workers. Clearly, a lack of “qualified” workers is impeding the growth in employment. ... Nineteen percent of owners cited the difficulty of finding qualified workers as their Single Most Important Business Problem (up 1 point), second only to taxes. This is the top ranked problem for those in construction (30 percent) and manufacturing (27 percent).

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the small business optimism index since 1986.

The index decreased to 104.9 in December.

Note: Usually small business owners complain about taxes and regulations. However, during the recession, "poor sales" was the top problem. Now labor shortages are moving to the top.