by Calculated Risk on 12/16/2017 08:13:00 AM

Saturday, December 16, 2017

Schedule for Week of December 17th

The key economic reports this week are November housing starts, new home sales and existing home sales. Other key reports include the third estimate of Q3 GDP, and Personal Income & Outlays for November.

For manufacturing, the December Philly Fed and Kansas City Fed manufacturing surveys will be released this week.

10:00 AM: The December NAHB homebuilder survey. The consensus is for a reading of 70, unchanged from 70 in November. Any number above 50 indicates that more builders view sales conditions as good than poor.

8:30 AM: Housing Starts for November. The consensus is for 1.240 million SAAR, down from the October rate of 1.290 million.

8:30 AM: Housing Starts for November. The consensus is for 1.240 million SAAR, down from the October rate of 1.290 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

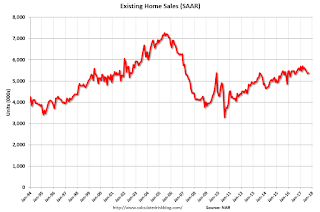

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.52 million SAAR, up from 5.48 million in October.

10:00 AM: Existing Home Sales for November from the National Association of Realtors (NAR). The consensus is for 5.52 million SAAR, up from 5.48 million in October.The graph shows existing home sales from 1994 through the report last month.

Housing economist Tom Lawler expects the NAR to report sales of 5.77 million SAAR for November.

During the day: The AIA's Architecture Billings Index for November (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for 234 thousand initial claims, up from 225 thousand the previous week.

8:30 AM: Gross Domestic Product, 3rd quarter 2017 (Third estimate). The consensus is that real GDP increased 3.3% annualized in Q3, unchanged from 3.3% in the second report.

8:30 AM: the Philly Fed manufacturing survey for December. The consensus is for a reading of 21.8, down from 22.7.

8:30 AM ET: Chicago Fed National Activity Index for November. This is a composite index of other data.

9:00 AM ET: FHFA House Price Index for October 2017. This was originally a GSE only repeat sales, however there is also an expanded index.

8:30 AM: Durable Goods Orders for November from the Census Bureau. The consensus is for a 2.0% increase in durable goods orders.

8:30 AM: Personal Income and Outlays for November. The consensus is for a 0.4% increase in personal income, and for a 0.5% increase in personal spending. And for the Core PCE price index to increase 0.1%.

10:00 AM ET: New Home Sales for November from the Census Bureau.

10:00 AM ET: New Home Sales for November from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the September sales rate.

The consensus is for 650 thousand SAAR, down from 685 thousand in October.

10:00 AM: University of Michigan's Consumer sentiment index (final for December). The consensus is for a reading of 97.0, up from the preliminary reading 96.8.

10:00 AM: State Employment and Unemployment (Monthly) for November 2017

11:00 AM: the Kansas City Fed manufacturing survey for December.

Friday, December 15, 2017

Lawler: Early Read on Existing Home Sales in November

by Calculated Risk on 12/15/2017 05:42:00 PM

A short note from housing economist Tom Lawler:

"Based on what I've seen so far, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.77 million in November."

CR Note: Existing home sales for November are scheduled to be released next Wednesday. The consensus is for sales of 5.53 million SAAR. Take the over on Wednesday!

Oil Rigs "The Calm before the Storm"

by Calculated Risk on 12/15/2017 02:50:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Dec 15, 2017:

• Rigs overall continue in recovery mode

• Total US oil rigs were down 4 to 747

• Horizontal oil rigs, however, were up 2 to 654

...

• Expect the rig count to surge upward in the next four weeks, with some weeks exceeding +10 horizontal oil rigs

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Q4 GDP Forecasts

by Calculated Risk on 12/15/2017 12:01:00 PM

From Merrill Lynch:

The strong retail sales data provided a 0.3pp boost to our 4Q GDP tracking estimate, bringing it up to 2.4%.From the Altanta Fed: GDPNow

emphasis added

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2017 is 3.3 percent on December 14, up from 2.9 percent on December 8. The forecast of fourth-quarter real consumer spending growth increased from 2.5 percent to 3.2 percent after [the] Consumer Price Index report from the U.S. Bureau of Labor Statistics and [the] retail sales release from the U.S. Census Bureau.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 4.0% for 2017:Q4 and 3.1% for 2018:Q1.CR Note: It looks likely that GDP will be over 3% again in Q4.

Industrial Production Increased 0.2% in November

by Calculated Risk on 12/15/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production moved up 0.2 percent in November after posting an upwardly revised increase of 1.2 percent in October. Manufacturing production also rose 0.2 percent in November, its third consecutive monthly gain. The output of utilities dropped 1.9 percent. The index for mining increased 2.0 percent, as oil and gas extraction returned to normal levels after being held down in October by Hurricane Nate. Excluding the post-hurricane rebound in oil and gas extraction, total industrial production would have been unchanged in November. Total industrial production was 106.4 percent of its 2012 average in November and was 3.4 percent above its year-earlier level. Capacity utilization for the industrial sector was 77.1 percent in November, a rate that is 2.8 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 10.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 77.1% is 2.8% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in November to 106.4. This is 22.2% above the recession low, and 1% above the pre-recession peak.

NY Fed: Manufacturing Activity grew at a "solid clip" in December

by Calculated Risk on 12/15/2017 08:39:00 AM

From the NY Fed: Empire State Manufacturing Survey

Business activity continued to grow at a solid clip in New York State, according to firms responding to the December 2017 Empire State Manufacturing Survey. The headline general business conditions index, at 18.0, remained close to last month’s level. The new orders index and the shipments index both showed sustained strong gains, with the former holding steady at 19.5 and the latter edging up to 22.4. ...This was at the consensus forecast of a reading of 18.0.

...

Labor market indicators pointed to a small increase in employment but no change in hours worked. ...

The index for future business conditions fell three points to 46.6. After advancing to its highest level in several years last month, the index for future new orders declined thirteen points to 41.1. The index for future number of employees rose eight points to 29.0, its highest level in nearly a year, and the capital expenditures index climbed nine points to 34.1, a multiyear high.

emphasis added

Thursday, December 14, 2017

Friday: Industrial Production, NY Fed Mfg Survey

by Calculated Risk on 12/14/2017 07:28:00 PM

From Merrill Lynch:

The strong retail sales data provided a 0.3pp boost to our 4Q GDP tracking estimate, bringing it up to 2.4%.Friday:

• At 8:30 AM ET, The New York Fed Empire State manufacturing survey for December. The consensus is for a reading of 18.0, down from 19.4.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for November. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 77.2%.

It Never Rains in California

by Calculated Risk on 12/14/2017 03:29:00 PM

After enduring a five year drought, California finally had a decent rainy season last year. But this season is off to a very slow start.

Here are a few resources to track the rain and snow.

These tables show the snowpack in the North, Central and South Sierra. Currently the snowpack is about 29% of normal for this date in the North, 41% of normal in the Central Sierra, and 38% of normal in the Southern Sierra. A slow start to the season.

And here are some plots comparing the current and previous years to the average, a very dry year ('14-'15) and a wet year ('82-'83). This winter is tracking the drought years.

And for Los Angeles, here is a historical table of annual rainfall. After one year of significantly above average rainfall, this year is below normal (and there is no rain in sight - just smoke from the fires).

It is very early in the season, but this is a weak start.

Hotel Occupancy Rate Increased Year-over-Year, 2017 will be Record Occupancy Year

by Calculated Risk on 12/14/2017 12:01:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 9 December

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 3-9 December 2017, according to data from STR.Note: The hurricanes continue to drive demand in Texas and Florida, especially in Houston.

In comparison with the week of 4-10 December 2016, the industry recorded the following:

• Occupancy: +2.7% to 60.7%

• Average daily rate (ADR): +4.0% to US$125.07

• Revenue per available room (RevPAR): +6.8% to US$75.97

Among the Top 25 Markets, Miami/Hialeah, Florida, reported the largest increase in RevPAR (+83.0% to US$234.96), due primarily to the largest lift in ADR (+57.4% to US$272.55). While hosting Art Basel, the market experienced the second-highest rise in occupancy (+16.3% to 86.2%).

Houston, Texas, saw the largest increase in occupancy (+17.5% to 73.5%), which produced double-digit growth in RevPAR (+22.6% to US$81.63).

emphasis added

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of the record year in 2015. The hurricanes will push the annual occupancy rate to a new record in 2017.

Data Source: STR, Courtesy of HotelNewsNow.com

Retail Sales increased 0.8% in November

by Calculated Risk on 12/14/2017 08:53:00 AM

On a monthly basis, retail sales increased 0.8 percent from October to November (seasonally adjusted), and sales were up 5.8 percent from November 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for November 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $492.7 billion, an increase of 0.8 percent from the previous month, and 5.8 percent above November 2016 ... The September 2017 to October 2017 percent change was revised from up 0.2 percent to up 0.5 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.6% in November.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 5.0% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 5.0% on a YoY basis.The increase in November was well above expectations, and sales in September and October were revised up. A solid report.