by Calculated Risk on 12/14/2017 08:36:00 AM

Thursday, December 14, 2017

Weekly Initial Unemployment Claims decrease to 225,000

The DOL reported:

n the week ending December 9, the advance figure for seasonally adjusted initial claims was 225,000, a decrease of 11,000 from the previous week's unrevised level of 236,000. The 4-week moving average was 234,750, a decrease of 6,750 from the previous week's unrevised average of 241,500.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. The claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 234,750.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, December 13, 2017

Thursday: Retail Sales, Unemployment Claims

by Calculated Risk on 12/13/2017 06:35:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Quickly Lower After Inflation Data and Fed

Mortgage rates fell fairly quickly this afternoon following the Federal Reserves updated economic projections. [30YR FIXED - 4.0%]. ... rates had long since adjusted to today's rate hike--so much so that the hike itself was a non-event. Again, it was the update economic projections that helped rates move lower this afternoon. Fed Chair Yellen's press conference played a major role as well.Thursday:

Even before the Fed news came out, a weaker reading on an important inflation report helped bond markets get into positive territory on the day. The net effect of the Fed and the economic data was a moderately quick move back to last week's low rates.

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 236 thousand the previous week.

• Also at 8:30 AM, Retail sales for November be released. The consensus is for a 0.3% increase in retail sales.

• At 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for October. The consensus is for a 0.1% decrease in inventories.

FOMC Projections and Press Conference Link

by Calculated Risk on 12/13/2017 02:10:00 PM

Statement here.

Yellen press conference video here.

On the projections, projections for GDP in 2017 are near the top of the September range.

| GDP projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Change in Real GDP1 | 2017 | 2018 | 2019 | 2020 |

| Dec 2017 | 2.4 to 2.5 | 2.2 to 2.6 | 1.9 to 2.3 | 1.7 to 2.0 |

| Sept 2017 | 2.2 to 2.5 | 2.0 to 2.3 | 1.7 to 2.1 | 1.6 to 2.0 |

| June 2017 | 2.1 to 2.2 | 1.8 to 2.2 | 1.8 to 2.0 | --- |

The unemployment rate was at 4.1% in October and November, so the unemployment rate projection for Q4 2017 was revised down. The unemployment rate for 2018 and 2019 were also revised down too.

| Unemployment projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Unemployment Rate2 | 2017 | 2018 | 2019 | 2020 |

| Dec 2017 | 4.1 | 3.7 to 4.0 | 3.6 to 4.0 | 3.6 to 4.2 |

| Sept 2017 | 4.2 to 4.3 | 4.0 to 4.2 | 3.9 to 4.4 | 4.0 to 4.5 |

| June 2017 | 4.2 to 4.3 | 4.0 to 4.3 | 4.1 to 4.4 | --- |

As of October, PCE inflation was up 1.6% from October 2016. Based on recent readings, PCE inflation was revised up slightly for Q4 2017, and down for 2018.

| Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| PCE Inflation1 | 2017 | 2018 | 2019 | 2020 |

| Dec 2017 | 1.6 to 1.7 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

| Sept 2017 | 1.5 to 1.6 | 1.8 to 2.0 | 2.0 | 2.0 to 2.1 |

| June 2017 | 1.6 to 1.7 | 1.8 to 2.0 | 2.0 to 2.1 | --- |

PCE core inflation was up 1.4% in October year-over-year. Core PCE inflation was unchanged for Q4 2017, and revised down for 2018.

| Core Inflation projections of Federal Reserve Governors and Reserve Bank presidents | ||||

|---|---|---|---|---|

| Core Inflation1 | 2017 | 2018 | 2019 | 2020 |

| Dec 2017 | 1.5 | 1.7 to 1.9 | 2.0 | 2.0 to 2.1 |

| Sept 2017 | 1.5 to 1.6 | 1.8 to 2.0 | 2.0 | 2.0 to 2.1 |

| June 2017 | 1.6 to 1.7 | 1.8 to 2.0 | 2.0 to 2.1 | --- |

FOMC Statement: 25bps Rate Hike

by Calculated Risk on 12/13/2017 02:01:00 PM

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Averaging through hurricane-related fluctuations, job gains have been solid, and the unemployment rate declined further. Household spending has been expanding at a moderate rate, and growth in business fixed investment has picked up in recent quarters. On a 12-month basis, both overall inflation and inflation for items other than food and energy have declined this year and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Hurricane-related disruptions and rebuilding have affected economic activity, employment, and inflation in recent months but have not materially altered the outlook for the national economy. Consequently, the Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will remain strong. Inflation on a 12‑month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee's 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

Voting for the FOMC monetary policy action were Janet L. Yellen, Chair; William C. Dudley, Vice Chairman; Lael Brainard; Patrick Harker; Robert S. Kaplan; Jerome H. Powell; and Randal K. Quarles. Voting against the action were Charles L. Evans and Neel Kashkari, who preferred at this meeting to maintain the existing target range for the federal funds rate.

emphasis added

Key Measures Show Inflation Mostly Below Fed's Target

by Calculated Risk on 12/13/2017 11:14:00 AM

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.7% annualized rate) in November. The 16% trimmed-mean Consumer Price Index also rose 0.2% (2.4% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for November here. Motor fuel increased 131% annualized in November.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.4% (4.7% annualized rate) in November. The CPI less food and energy rose 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.3%, the trimmed-mean CPI rose 1.8%, and the CPI less food and energy rose 1.7%. Core PCE is for October and increased 1.4% year-over-year.

On a monthly basis, median CPI was at 2.7% annualized, trimmed-mean CPI was at 2.4% annualized, and core CPI was at 1.4% annualized.

Using these measures, inflation picked up a little year-over-year in November. However, overall, these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

BLS: CPI increased 0.4% in November, Core CPI increased 0.1%

by Calculated Risk on 12/13/2017 08:38:00 AM

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in November on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index rose 2.2 percent.I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI. This was at the consensus forecast of a 0.4% increase for CPI, and below the forecast of a 0.1% increase in core CPI.

...

The index for all items less food and energy increased 0.1 percent in November. ... The all items index rose 2.2 percent for the 12 months ending November. The index for all items less food and energy rose 1.7 percent, a slight decline from the 1.8-percent increase for the period ending October.

emphasis added

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 12/13/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 8, 2017.

... The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 10 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.20 percent from 4.19 percent, with points decreasing to 0.39 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 10% year-over-year.

Tuesday, December 12, 2017

Wednesday: FOMC Announcement, CPI

by Calculated Risk on 12/12/2017 06:53:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, The Consumer Price Index for November from the BLS. The consensus is for a 0.4% increase in CPI, and a 0.2% increase in core CPI.

• At 2:00 PM, FOMC Meeting Announcement. The FOMC is expected to increase the Fed Funds rate 25 bps at this meeting.

• Also at 2:00 PM, FOMC Forecasts This will include the Federal Open Market Committee (FOMC) participants' projections of the appropriate target federal funds rate along with the quarterly economic projections.

• At 2:30 PM, Fed Chair Janet Yellen holds a press briefing following the FOMC announcement.

LA area Port Traffic Surges in November

by Calculated Risk on 12/12/2017 03:45:00 PM

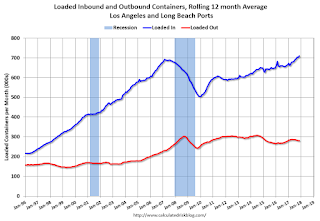

Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

From the Port of Long Beach: Port Surges Past 2016 Cargo Volume

With just under one month left in 2017, the Port of Long Beach has already exceeded the cargo total for all of last year, and will handle more than 7 million containers for only the fourth time in its 106-year history....From the Port of Los Angeles: Port of Los Angeles Sets New Record for Highest Monthly Container Volumes

“U.S. consumers are confident and the economy has been strong,” said Long Beach Harbor Commission President Lou Anne Bynum. “Retailers have been stocking goods as a result and we are nearing cargo levels we have not seen since before the 2008 recession.”

The Port of Los Angeles moved 924,225 Twenty-Foot Equivalent Units (TEUs) in November, the most containerized monthly cargo the Port has processed during its 110-year history. The previous record of 877,564 TEUs was set in November 2016.The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Eleven months through 2017, volumes are up 6.3 percent compared to last year’s record-breaking 8.8 million TEUs.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 0.9% compared to the rolling 12 months ending in October. Outbound traffic was up 0.2% compared to the rolling 12 months ending in October.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. Trade has been strong - especially inbound - and setting record volumes most months recently. This suggests the retailers are optimistic about the Christmas Holiday shopping season.

In general imports have been increasing, and exports are mostly moving sideways to slightly down recently.

Mortgage Equity Withdrawal slightly positive in Q3

by Calculated Risk on 12/12/2017 12:24:00 PM

Note: This is not Mortgage Equity Withdrawal (MEW) data from the Fed. The last MEW data from Fed economist Dr. Kennedy was for Q4 2008.

The following data is calculated from the Fed's Flow of Funds data (released yesterday) and the BEA supplement data on single family structure investment. This is an aggregate number, and is a combination of homeowners extracting equity - hence the name "MEW" - and normal principal payments and debt cancellation (modifications, short sales, and foreclosures).

For Q3 2017, the Net Equity Extraction was a positive $33 billion, or a positive 0.9% of Disposable Personal Income (DPI) .

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, using the Flow of Funds (and BEA data) compared to the Kennedy-Greenspan method.

Note: This data is impacted by debt cancellation and foreclosures, but much less than a few years ago.

MEW has been positive for 6 consecutive quarters, and 8 of the last 9 quarters. With a slower rate of debt cancellation, MEW will likely be mostly positive going forward.

The Fed's Flow of Funds report showed that the amount of mortgage debt outstanding increased by $85 billion in Q3.

The Flow of Funds report also showed that Mortgage debt has declined by $0.7 trillion since the peak. This decline is mostly because of debt cancellation per foreclosures and short sales, and some from modifications. There has also been some reduction in mortgage debt as homeowners paid down their mortgages so they could refinance.

For reference:

Dr. James Kennedy also has a simple method for calculating equity extraction: "A Simple Method for Estimating Gross Equity Extracted from Housing Wealth". Here is a companion spread sheet (the above uses my simple method).

For those interested in the last Kennedy data included in the graph, the spreadsheet from the Fed is available here.