by Calculated Risk on 12/07/2017 09:51:00 AM

Thursday, December 07, 2017

CoreLogic: "2.5 million Homes still in negative equity" at end of Q3 2017

From CoreLogic: CoreLogic Reports Homeowner Equity Increased by Almost $871 Billion in Q3 2017

CoreLogic® ... today released its Q3 2017 home equity analysis which shows that U.S. homeowners with mortgages (roughly 63 percent of all homeowners*) have collectively seen their equity increase 11.8 percent year over year, representing a gain of $870.6 billion since Q3 2016.

Additionally, homeowners gained an average of $14,888 in home equity between Q3 2016 and Q3 2017. Western states led the increase, while no state experienced a decrease. Washington homeowners gaining an average of approximately $40,000 in home equity and California homeowners gaining an average of approximately $37,000 in home equity.

On a quarter-over-quarter basis, from Q2 2017 to Q3 2017, the total number of mortgaged homes in negative equity decreased 9 percent to 2.5 million homes, or 4.9 percent of all mortgaged properties. Year over year, negative equity decreased 22 percent from 3.2 million homes, or 6.3 percent of all mortgaged properties, from Q3 2016 to Q3 2017.

“Homeowner equity increased by almost $871 billion over the last 12 months, the largest increase in more than three years,” said Dr. Frank Nothaft, chief economist for CoreLogic. “This increase is primarily a reflection of rising home prices, which drives up home values, leading to an increase in home equity positions and supporting consumer spending.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the distribution of home equity in Q3 2017 compared to Q2 2017.

For reference, about five years ago, in Q3 2012, almost 10% of residential properties had 25% or more negative equity.

A year ago, in Q3 2016, there were 3.2 million properties with negative equity - now there are 2.5 million. A significant change.

Weekly Initial Unemployment Claims decrease to 236,000

by Calculated Risk on 12/07/2017 08:37:00 AM

The DOL reported:

In the week ending December 2, the advance figure for seasonally adjusted initial claims was 236,000, a decrease of 2,000 from the previous week's unrevised level of 238,000. The 4-week moving average was 241,500, a decrease of 750 from the previous week's unrevised average of 242,250.The previous week was unrevised.

Claims taking procedures continue to be disrupted in the Virgin Islands. Claims taking process in Puerto Rico has still not returned to normal.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,500.

This was lower than the consensus forecast. The low level of claims suggest relatively few layoffs.

Wednesday, December 06, 2017

Thursday: Unemployment Claims, Q3 Flow of Funds

by Calculated Risk on 12/06/2017 07:28:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 238 thousand the previous week.

• At 10:00 AM, The Q3 Quarterly Services Report from the Census Bureau.

• At 12:00 PM, Q3 Flow of Funds Accounts of the United States from the Federal Reserve.

• At 3:00 PM, Consumer Credit from the Federal Reserve. The consensus is for consumer credit to increase $17.0 billion in October.

2018 Housing Forecasts

by Calculated Risk on 12/06/2017 01:07:00 PM

Towards the end of each year I collect some housing forecasts for the following year. This is an update (I'll gather several more).

First a review of the previous five years ...

Here is a summary of forecasts for 2017. It is early (just nine months), but in 2017, new home sales will probably be around 615 thousand, and total housing starts will be around 1.200 to 1.210 million. Brad Hunter (HomeAdvisor) appears very close on New Home sales, and Merrill Lynch and NAR appear close on starts.

Here is a summary of forecasts for 2016. In 2016, new home sales will probably be around 565 thousand, and total housing starts will be around 1.175 million. Fannie Mae and Merrill Lynch were very close on New Home sales, and MetroStudy was close on starts.

Here is a summary of forecasts for 2015. In 2015, new home sales were 501 thousand, and total housing starts were 1.112 million. Zillow, CoreLogic, and the MBA were right on with New Home sales, and CoreLogic, MetroStudy, MBA and Zillow were all correct on starts.

Here is a summary of forecasts for 2014. In 2014, new home sales were 437 thousand, and total housing starts were 1.003 million. No one was close on New Home sales (all way too optimistic), and Michelle Meyer (Merrill Lynch) and Fannie Mae were the closest on housing starts (about 10% too high). In 2014, many analysts underestimated the impact of higher mortgage rates and higher new home prices on new home sales and starts.

Here is a summary of forecasts for 2013. In 2013, new home sales were 429 thousand, and total housing starts were 925 thousand. Barclays was the closest on New Home sales followed by David Crowe (NAHB). Fannie Mae and the NAHB were the closest on housing starts.

The table below shows several forecasts for 2018:

From Fannie Mae: Housing Forecast: November 2017

From Freddie Mac: November 2017 Economic & Housing Market Forecas

From NAHB: NAHB’s housing and economic forecast

From NAR: Economic & Housing Outlook

Note: For comparison, new home sales in 2017 will probably be around 615 thousand, and total housing starts around 1.205 million.

| Housing Forecasts for 2018 | ||||

|---|---|---|---|---|

| New Home Sales (000s) | Single Family Starts (000s) | Total Starts (000s) | House Prices1 | |

| CoreLogic | 4.2%6 | |||

| Fannie Mae | 651 | 905 | 1,250 | 5.1%2 |

| Freddie Mac | 1,300 | 5.7%2 | ||

| HomeAdvisor5 | 653 | 981 | 1,320 | 4.0% |

| NAHB | 656 | 911 | 1,255 | |

| NAR | 700 | 5.0%3 | ||

| Zillow | 3.0%4 | |||

| *** Still to come. 1Case-Shiller unless indicated otherwise 2FHFA Purchase-Only Index 3NAR Median Prices 4Zillow Home Prices 5Brad Hunter, chief economist, formerly of MetroStudy 6CoreLogic Index |

||||

Las Vegas Real Estate in November: Sales up Slightly YoY, Inventory down 33%

by Calculated Risk on 12/06/2017 10:41:00 AM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local Home Prices Take Cue from Winter Weather, But Still Well Up from 2016; GLVAR Housing Statistics for November 2017

The Greater Las Vegas Association of REALTORS® (GLVAR) reported today that local home prices continued to cool down heading into the holidays, though home prices and sales are still up from one year ago.1) Overall sales were up slightly year-over-year.

...

By the end of November, GLVAR reported 4,538 single-family homes listed for sale without any sort of offer. That’s down 33.1 percent from one year ago. For condos and townhomes, the 735 properties listed without offers in November represented a 29.1 percent drop from one year ago.

The total number of existing local homes, condos and townhomes sold during November was 3,202, a slight increase from November 2016. Compared to one year ago, sales were unchanged for homes and up 5.2 percent for condos and townhomes.

According to GLVAR, home sales so far in 2017 continue to run about 10 percent ahead of the pace from 2016, when 41,720 total properties were sold in Southern Nevada. At this rate, GLVAR statistics show that 2017 is on pace to be the best year for local home sales since at least 2012.

...

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. Tina said foreclosures and short sales now make up such a small share of the local housing market that “they’ve really become a non-issue.” For instance, he said short sales and foreclosures combined accounted for fewer than 5 percent of all existing home sales during November, compared to 10.5 percent of all sales one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago.

3) Fewer distressed sales.

ADP: Private Employment increased 190,000 in November

by Calculated Risk on 12/06/2017 08:23:00 AM

Private sector employment increased by 190,000 jobs from October to November according to the November ADP National Employment Report®. ... The report, which is derived from ADP’s actual payroll data, measures the change in total nonfarm private employment each month on a seasonally-adjusted basis.This was slightly below the consensus forecast for 192,000 private sector jobs added in the ADP report.

...

“The labor market continues to grow at a solid pace,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. “Notably, manufacturing added the most jobs the industry has seen all year. As the labor market continues to tighten and wages increase it will become increasingly difficult for employers to attract and retain skilled talent.”

Mark Zandi, chief economist of Moody’s Analytics, said, “The job market is red hot, with broad-based job gains across industries and company sizes. The only soft spots are in industries being disrupted by technology, brick-and-mortar retailing being the best example. There is a mounting threat that the job market will overheat next year."

The BLS report for November will be released Friday, and the consensus is for 185,000 non-farm payroll jobs added in November.

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 12/06/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 1, 2017. The prior week’s results included an adjustment for the Thanksgiving holiday.

... The Refinance Index increased 9 percent from the previous week. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 38 percent compared with the previous week and was 8 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.19 percent from 4.20 percent, with points increasing to 0.40 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 8% year-over-year.

Tuesday, December 05, 2017

Wednesday: ADP Employment

by Calculated Risk on 12/05/2017 06:07:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, The ADP Employment Report for November. This report is for private payrolls only (no government). The consensus is for 192,000 payroll jobs added in November, down from 235,000 added in October.

November Employment Revisions

by Calculated Risk on 12/05/2017 03:41:00 PM

Every month, prior to writing my employment preview, I like to look at revisions for that month in prior years.

Here is a table of revisions for November since 2005. Note that most of the revisions have been up. This doesn't mean that the November 2017 revision will be up, but it does seem likely. Although, in recent years, the revisions have been more evenly split between up and down.

The fairly large upward revision in 2005 was related to the hurricanes that year.

| November Employment Report (000s) | |||

|---|---|---|---|

| Year | Initial | Revised | Revision |

| 2005 | 215 | 341 | 126 |

| 2006 | 132 | 209 | 77 |

| 2007 | 94 | 114 | 20 |

| 2008 | -533 | -766 | -233 |

| 2009 | -11 | -2 | 9 |

| 2010 | 39 | 119 | 80 |

| 2011 | 120 | 141 | 21 |

| 2012 | 146 | 132 | -14 |

| 2013 | 203 | 258 | 55 |

| 2014 | 321 | 312 | -9 |

| 2015 | 211 | 272 | 61 |

| 2016 | 178 | 164 | -14 |

Note: In 2008, the BLS significantly under reported job losses. That wasn't surprising since the initial models the BLS used missed turning points (something I wrote about in 2007). The BLS has since improved this model.

ISM Non-Manufacturing Index decreased to 57.4% in November

by Calculated Risk on 12/05/2017 10:05:00 AM

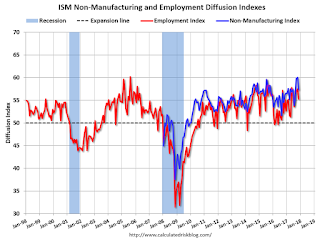

The November ISM Non-manufacturing index was at 57.4%, down from 60.1% in October. The employment index decreased in November to 55.3%, from 57.5%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: November 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in November for the 95th consecutive month, say the nation’s purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 57.4 percent, which is 2.7 percentage points lower than the October reading of 60.1 percent. This represents continued growth in the non-manufacturing sector at a slower rate. The Non-Manufacturing Business Activity Index decreased to 61.4 percent, 0.8 percentage point lower than the October reading of 62.2 percent, reflecting growth for the 100th consecutive month, at a slightly slower rate in November. The New Orders Index registered 58.7 percent, 4.1 percentage points lower than the reading of 62.8 percent in October. The Employment Index decreased 2.2 percentage points in November to 55.3 percent from the October reading of 57.5 percent. The Prices Index decreased by 2 percentage points from the October reading of 62.7 percent to 60.7 percent, indicating prices increased in November for the sixth consecutive month. According to the NMI®, 16 non-manufacturing industries reported growth. The rate of growth has lessened in the non-manufacturing sector after two very strong months of growth. Comments from the survey respondents indicate that the economy and sector will continue to grow for the remainder of the year."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slower expansion in November than in October.