by Calculated Risk on 10/18/2017 06:20:00 PM

Wednesday, October 18, 2017

Thursday: Unemployment Claims, Philly Fed Mfg

Black Knight is expected to release their "First Look" mortgage delinquency data for September tomorrow morning. The Black Knight data includes mortgages 30 days or more delinquent (as opposed to the Fannie and Freddie data that is for serious delinquent loans). Since this includes short term delinquencies, I expect a sharp increase in mortgage delinquencies due to the hurricanes. It will take longer for the impact of the hurricanes to show up in the Fannie and Freddie data.

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, down from 243 thousand the previous week.

• Also at 8:30 AM, the Philly Fed manufacturing survey for October. The consensus is for a reading of 20.2, down from 23.8.

Fed's Beige Book: "Modest to moderate"expansion, Labor markets "Tight"

by Calculated Risk on 10/18/2017 02:06:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Minneapolis based on information collected on or before October 6, 2017"

Reports from all 12 Federal Reserve Districts indicated that economic activity increased in September through early October, with the pace of growth split between modest and moderate. The Richmond, Atlanta, and Dallas Districts reported major disruptions from Hurricanes Harvey and Irma in some areas and sectors, including transportation, energy, and agriculture. Manufacturing activity and nonfinancial services expanded modestly to moderately in most Districts. Retail spending rose slowly, while vehicle sales and tourism increased in most Districts. Residential construction continued to increase, and growth in commercial construction was up slightly on balance. Low home inventory levels continued to constrain residential sales in many areas, while nonresidential real estate activity increased slightly overall. Loan demand was generally stable to modestly higher. Growth in the energy sector eased slightly. Agricultural conditions were mixed; while some regions were reporting better-than-expected harvests, low commodity prices continued to weigh down farm incomes.

...

Employment growth was modest on balance, with most Districts reporting flat to moderate increases. Labor markets were widely described as tight. Many Districts noted that employers were having difficulty finding qualified workers, particularly in construction, transportation, skilled manufacturing, and some health care and service positions. These shortages were also restraining business growth. Firms in several Districts reported that scarcity of labor, particularly related to construction, would be exacerbated by hurricane recovery efforts. Despite widespread labor tightness, the majority of Districts reported only modest to moderate wage pressures. However, some Districts reported stronger wage pressures in certain sectors, including transportation and construction. Growing use of sign-on bonuses, overtime, and other nonwage efforts to attract and retain workers were also reported.

emphasis added

Comments on September Housing Starts

by Calculated Risk on 10/18/2017 12:15:00 PM

Earlier: Housing Starts decreased to 1.127 Million Annual Rate in September

The housing starts report released this morning showed starts were down 0.8% in September compared to August (August was revised up slightly), and starts were up 6.1% year-over-year compared to September 2016. This was below the consensus forecast, but some of the weakness was in the south - probably due to hurricane Harvey.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were up 6.1% in September 2017 compared to September 2016 (an easy comparison), and starts are up only 3.1% year-to-date.

The comparisons in Q4 will be more difficult.

Note that single family starts are up 9.1% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess was starts would increase around 3% to 7% in 2017.

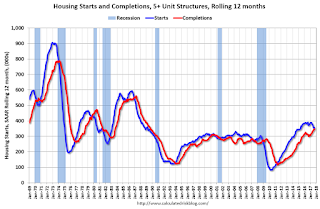

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - but completions have almost caught up to starts (more deliveries).

Completions lag starts by about 12 months.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts peaked in June 2015 (at 510 thousand SAAR).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few years of increasing single family starts and completions.

AIA: Architecture Billings Index "Backslides Slightly" in September

by Calculated Risk on 10/18/2017 10:46:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Architecture Billings Index Backslides Slightly

After seven months of steady growth in the demand for design services, the Architecture Billings Index (ABI) paused in September. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the September ABI score was 49.1, down from a score of 53.7 in the previous month. This score reflects a slight decrease in design services provided by U.S. architecture firms (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.0, down from a reading of 62.5 the previous month, while the new design contracts index eased somewhat from 54.2 to 52.9.

“We’ve seen unexpectedly strong numbers in design activity for most of 2017, so the pause in September should be viewed in that context” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “Project inquiries and new design contracts remain healthy, and the continued strength in most sectors and regions indicates stability industry-wide.”

...

• Regional averages: Northeast (56.9), South (54.0), Midwest (50.4), West (48.8)

• Sector index breakdown: commercial / industrial (54.0), mixed practice (52.2), multi-family residential (51.0), institutional (51.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.1 in September, down from 53.7 in August. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 10 of the last 12 months, suggesting a further increase in CRE investment in 2017 and into 2018.

Housing Starts decreased to 1.127 Million Annual Rate in September

by Calculated Risk on 10/18/2017 08:40:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in September were at a seasonally adjusted annual rate of 1,127,000. This is 4.7 percent below the revised August estimate of 1,183,000, but is 6.1 percent above the September 2016 rate of 1,062,000. Single-family housing starts in September were at a rate of 829,000; this is 4.6 percent below the revised August figure of 869,000. The September rate for units in buildings with five units or more was 286,000.

Building Permits:

Privately-owned housing units authorized by building permits in September were at a seasonally adjusted annual rate of 1,215,000. This is 4.5 percent below the revised August rate of 1,272,000 and is 4.3 percent below the September 2016 rate of 1,270,000. Single-family authorizations in September were at a rate of 819,000; this is 2.4 percent above the revised August figure of 800,000. Authorizations of units in buildings with five units or more were at a rate of 360,000 in September.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in September compared to August. However Multi-family starts are up slightly year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving down recently.

Single-family starts (blue) decreased in September, and are up 5.9% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in September were below expectations. Starts for July and August were revised slightly.

Starts in the south were down year-over-year (hurricane Harvey). I'll have more later ...

MBA: Mortgage Applications Increase in Latest Weekly Survey

by Calculated Risk on 10/18/2017 07:00:00 AM

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 3.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending October 13, 2017. This week’s results included an adjustment for the Columbus Day holiday.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 4 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 9 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) decreased to 4.14 percent from 4.16 percent, with points remaining unchanged at 0.44 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 9% year-over-year.

Tuesday, October 17, 2017

Wednesday: Housing Starts, Beige Book

by Calculated Risk on 10/17/2017 06:27:00 PM

Back in 2014, I wrote this ...

For amusement: Years ago, whenever there was a market sell-off, my friend Tak Hallus (Stephen Robinett) would shout at his TV tuned to CNBC "Bring out the bears!".Now the market is up about 80% since his 2012 prediction. I mention Faber - not because of his forecasting record - but because of his racist comments today (he will no longer be on CNBC).

This was because CNBC would usually bring on the bears whenever there was a sell-off, and bulls whenever the market rallied.

Today was no exception with Marc Faber on CNBC:

"This year, for sure—maybe from a higher diving board—the S&P will drop 20 percent," Faber said, adding: "I think, rather, 30 percent"And Faber from August 8, 2013:

Faber expect to see stocks end the year "maybe 20 percent [lower], maybe more!"And from October 24, 2012:

"I believe globally we are faced with slowing economies and disappointing corporate profits, and I will not be surprised to see the Dow Jones, the S&P, the major indices, down from the recent highs by say, 20 percent," Faber said...Since the market is up 30% since his 2012 prediction, shouldn't he be expecting a 50% decline now?

I guess CNBC has an opening for a permabear!

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Housing Starts for September. The consensus is for 1.170 million SAAR, down from the August rate of 1.180 million.

• During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

Lawler: Early Read on Existing Home Sales in September

by Calculated Risk on 10/17/2017 01:21:00 PM

From housing economist Tom Lawler:

Based on publicly-available state and local realtor/MLS reports from across the country released through today, I predict that US existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 5.38 million in September, up 0.6% from August’s estimated pace but down 1.6% from last September’s seasonally adjusted pace. Unadjusted sales should show a larger YOY decline, reflecting the lower business day count this September compared to last September. Hurricane Irma has a sizable impact on home sales in Florida, where I estimate sales were down by over 20% YOY. Surprisingly, however, residential sales in Houston were up 3.4% YOY, apparently reflecting the partial “spillover” in hurricane-related delayed closings in August (Harvey hit Houston in the latter part of August). For the combined August/September period home sales in Houston were down 12.5% from the comparable period of last year.

On the inventory front, local realtor/MLS data suggest that the NAR’s estimate of the number of existing homes for sale at the end of September will be about 1.88 million, unchanged from August’s preliminary estimate and down 7.4% from a year earlier.

Finally, realtor/MLS data suggest that the NAR’s estimate of the median existing SF home sales price last month was up 6.0% from last September.

CR Note: Existing home sales for September are scheduled to be released this Friday. The consensus is for sales of 5.30 million SAAR.

NAHB: Builder Confidence increased to 68 in October

by Calculated Risk on 10/17/2017 10:06:00 AM

The National Association of Home Builders (NAHB) reported the housing market index (HMI) was at 68 in October, up from 64 in September. Any number above 50 indicates that more builders view sales conditions as good than poor.

From NAHB: Builder Confidence Rises Four Points in October

Builder confidence in the market for newly-built single-family homes rose four points to a level of 68 in October on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI). This was the highest reading since May.

“This month’s report shows that home builders are rebounding from the initial shock of the hurricanes,” said NAHB Chairman Granger MacDonald, a home builder and developer from Kerrville, Texas. “However, builders need to be mindful of long-term repercussions from the storms, such as intensified material price increases and labor shortages.”

“It is encouraging to see builder confidence return to the high 60s levels we saw in the spring and summer,” said NAHB Chief Economist Robert Dietz. “With a tight inventory of existing homes and promising growth in household formation, we can expect the new home market continue to strengthen at a modest rate in the months ahead.”

...

All three HMI components posted gains in October. The component gauging current sales conditions rose five points to 75 and the index charting sales expectations in the next six months increased five points to 78. Meanwhile, the component measuring buyer traffic ticked up a single point to 48.

Looking at the three-month moving averages for regional HMI scores, the South rose two points to 68 and the Northeast rose one point to 50. Both the West and Midwest remained unchanged at 77 and 63, respectively.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph show the NAHB index since Jan 1985.

This was above the consensus forecast, and a strong reading.

Industrial Production Increased 0.3% in September

by Calculated Risk on 10/17/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.3 percent in September. The rates of change for July and August were notably revised; the current estimate for July, a decrease of 0.1 percent, was 0.5 percentage point lower than previously reported, while the estimate for August, a decrease of 0.7 percent, was 0.2 percentage point higher than before. The estimates for manufacturing, mining, and utilities were each revised lower in July. The continued effects of Hurricane Harvey and, to a lesser degree, the effects of Hurricane Irma combined to hold down the growth in total production in September by 1/4 percentage point.[1] For the third quarter as a whole, industrial production fell 1.5 percent at an annual rate; excluding the effects of the hurricanes, the index would have risen at least 1/2 percent. Manufacturing output edged up 0.1 percent in September but fell 2.2 percent at an annual rate in the third quarter. The indexes for mining and utilities in September rose 0.4 percent and 1.5 percent, respectively. At 104.6 percent of its 2012 average, total industrial production in September was 1.6 percent above its year-earlier level. Capacity utilization for the industrial sector increased 0.2 percentage point in September to 76.0 percent, a rate that is 3.9 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.4 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.0% is 3.9% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in September to 104.6. This is 20.1% above the recession low, and close to the pre-recession peak.

The hurricanes are still impacting this data.