by Calculated Risk on 10/09/2017 05:30:00 PM

Monday, October 09, 2017

Duy: "On Track For a December Rate Hike"

From Tim Duy at Fed Watch: On Track For a December Rate Hike

The headline figure on nonfarm payrolls report came in well below already withered expectations, but the disappointment was more than compensated for in the details of both the establishment and household survey. The Fed is looking for data that allows them to overlook the weak inflation data. This was just that sort of data.

...

An unemployment rate at 4.2% will rattle Fed officials already worried about pushing too far below full employment under the current projections. This will go a long way toward offsetting their nagging worries about low inflation.

...

The data calendar is a bit slower this week. Look for the JOLTS report (Wednesday), inflation indicator reports PPI (Thursday) and CPI (Friday), and readings on the demand side of the economy from retail sales and business inventories (both on Friday).

In addition, we have plenty of Fed speakers, including regional Presidents Kashkari (Tuesday), Evans (Wednesday), Bostic (Thursday), and Rosengren and Kaplan (Friday). I don’t think we will see anything new from these speakers regarding monetary policy. Federal Reserve Governor Jerome Powell speaks Thursday (keynote address on emerging markets) and Friday (“Are Rules Made to be Broken? Discretion and Monetary Policy,” an event for which I foolishly forgot to make an effort to attend). Neither speech will likely give direct policy guidance, but with Powell rumored to be a contender for the top spot at the Fed, they will offer additional opportunity to explore his thinking.

Bottom Line: December rate hike still a go; low unemployment outweighs low inflation for now. That will change next year if job growth slows further and unemployment stabilizes.

Update: Framing Lumber Prices Up 20% Year-over-year

by Calculated Risk on 10/09/2017 12:11:00 PM

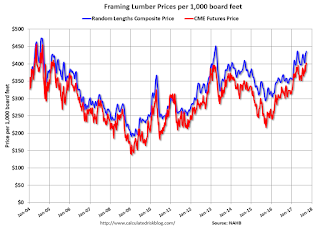

Here is another update on framing lumber prices. Early in 2013 lumber prices came close to the housing bubble highs - and prices are once again near the bubble highs.

The price increases in early 2013 were due to a surge in demand (more housing starts) and supply constraints (framing lumber suppliers were working to bring more capacity online).

Prices didn't increase as much early in 2014 (more supply, smaller "surge" in demand).

In 2015, even with the pickup in U.S. housing starts, prices were down year-over-year. Note: Multifamily starts do not use as much lumber as single family starts, and there was a surge in multi-family starts. This decline in 2015 was also probably related to weakness in China.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through early Sept 2017 (via NAHB), and 2) CME framing futures.

Prices in 2017 are up solidly year-over-year and might approach or exceed the housing bubble highs in the Spring of 2018.

Right now Random Lengths prices are up 22% from a year ago, and CME futures are up about 19% year-over-year.

There is a seasonal pattern for lumber prices. Prices frequently peak around May, and bottom around October or November - although there is quite a bit of seasonal variability.

Oil Rigs "Steady as she goes"

by Calculated Risk on 10/09/2017 10:02:00 AM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on Oct 6, 2017:

• The US oil rig count is largely stable

• Total US oil rigs were down 2 to 748

• Horizontal oil rigs were down 1 to 641

...

• Overall, the rig count looks like it’s moving sideways.

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Leading Index for Commercial Real Estate Declines in September

by Calculated Risk on 10/09/2017 08:11:00 AM

Note: This index is possibly a leading indicator for new non-residential Commercial Real Estate (CRE) investment, except manufacturing.

From Dodge Data Analytics: Dodge Momentum Index Declines In September

The Dodge Momentum Index fell in September, moving 8.4% lower to 116.4 (2000=100) from the revised August reading of 127.1. The Momentum Index is a monthly measure of the first (or initial) report for nonresidential building projects in planning, which have been shown to lead construction spending for nonresidential buildings by a full year. Both components of the Momentum Index declined in September. The institutional building component fell 11.5% from August, while the commercial building component fell 6.1%. While the overall Momentum Index has lost ground for four consecutive months, this should not be seen, in and of itself, as a predictor of a turn in building markets. Prior to the previous peak of the Momentum Index in January 2008 it had suffered similar significant declines, only to rebound and post strong gains in subsequent months in line with overall economic growth. Similarly, the Momentum Index posted healthy gains from late-2016 through early 2017. Economic growth remains solid, and building market fundamentals are supportive of further growth in construction activity.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Dodge Momentum Index since 2002. The index was at 116.4 in September, down from 127.1 in August.

The index is down 4.6% year-over-year.

According to Dodge, this index leads "construction spending for nonresidential buildings by a full year". This suggests some softness in CRE spending next year.

Sunday, October 08, 2017

Sunday Night Futures

by Calculated Risk on 10/08/2017 08:30:00 PM

Weekend:

• Schedule for Week of Oct 8, 2017

• The Record Job Streak: A couple of Comments

Monday:

• Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $49.42 per barrel and Brent at $55.62 per barrel. A year ago, WTI was at $50, and Brent was at $51 - so oil prices are unchanged to up 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.47 per gallon - up sharply in September due to Hurricane Harvey, but now declining back towards pre-hurricane levels - a year ago prices were at $2.26 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

The Record Job Streak: A couple of Comments

by Calculated Risk on 10/08/2017 08:09:00 AM

On Friday, the BLS reported that the U.S. economy lost 33,000 nonfarm payroll jobs in September (the decline was mostly related to the impact of the hurricanes).

This negative headline jobs report followed a record 83 consecutive months of positive jobs reports.

A couple of comments:

1) If we adjust for the 2010 Census hiring and firing (data here) the streak of consecutive positive jobs reports was actually 90 months long. It makes sense to adjust for the Census hiring and firing since that was preplanned and unrelated to the business cycle.

This graph shows the monthly change in payroll jobs, ex-Census (meaning the impact of the decennial Census temporary hires and layoffs is removed - mostly in 2010 - to show the underlying payroll changes).

The previous longest streak was 48 months ending in 1990. If we adjust for the 1990 Decennial Census, that streak was actually 45 months - making the streak ending in 2007 at 46 months the second longest.

2) There is a reasonable chance that the recent streak isn't over - and that the September jobs data will be revised up.

In September 2005 - following Hurricane Katrina - the BLS reported 35,000 jobs lost in September. This was revised up to only 8,000 jobs lost in the October report, and revised up again to a gain of 17,000 in the November report. After annual revisions, the gain in September, following Katrina, is now reported as 67,000.

If something similar happens, the streak would still be alive!

Saturday, October 07, 2017

Schedule for Week of Oct 8, 2017

by Calculated Risk on 10/07/2017 08:09:00 AM

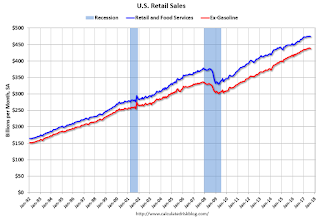

The key economic reports this week are September retail sales and the Consumer Price Index (CPI).

Columbus Day Holiday: Banks will be closed in observance of Columbus Day. The stock market will be open. No economic releases are scheduled.

6:00 AM ET: NFIB Small Business Optimism Index for September.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in July to 6.170 million from 6.116 in June. This was the highest number of job openings since this series started in December 2000.

The number of job openings (yellow) were up 3% year-over-year, and Quits were up 4% year-over-year.

2:00 PM: FOMC Minutes, Meeting of September 19 - 20, 2017

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 252 thousand initial claims, down from 260 thousand the previous week.

8:30 AM: The Producer Price Index for September from the BLS. The consensus is a 0.4% increase in PPI, and a 0.2% increase in core PPI.

8:30 AM: The Consumer Price Index for September from the BLS. The consensus is for a 0.6% increase in CPI, and a 0.2% increase in core CPI.

8:30 AM ET: Retail sales for September be released. The consensus is for a 1.9% increase in retail sales.

8:30 AM ET: Retail sales for September be released. The consensus is for a 1.9% increase in retail sales.This graph shows retail sales since 1992 through August 2017.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for August. The consensus is for a 0.6% increase in inventories.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for October). The consensus is for a reading of 95.5, up from 95.1 in September.

At 9:00 AM ET, Speech by Fed Chair Janet Yellen, The Economy and Monetary Policy, At the 32nd Annual G30 International Banking Seminar, Washington, D.C

Friday, October 06, 2017

AAR: Rail Carloads decreased, Intermodal Increased, in September

by Calculated Risk on 10/06/2017 05:15:00 PM

From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission.

Total U.S. rail carloads were down 2.3% (24,106 carloads) in September 2017 from September 2016, their third straight monthly decline following eight straight monthly gains. Those eight months of gains usually involved double-digit percentage gains in carloads of coal, but over the past couple of months, comparisons to last year have become much more difficult for coal. In September, in fact, coal carloads were down compared with last year, their first decline in 10 months. ... Intermodal had a good September: the last two weeks of September were the two top intermodal weeks in history for U.S. and Canadian railroads. U.S. intermodal volume in September was up 3.8% (39,482 units) over last September; for the first nine months, intermodal was up 3.5% (348,784 units) in 2017 over 2016.

Click on graph for larger image.

Click on graph for larger image.This graph from the Rail Time Indicators report shows U.S. average weekly rail carloads (NSA). Dark blue is 2017.

Rail carloads have been weak over the last decade due to the decline in coal shipments.

U.S. railroads originated 1,044,563 carloads in September 2017, down 24,106 carloads, or 2.3%, from September 2016. Average weekly carloads of 261,141 in September 2017 were the fewest for September since sometime prior to 1988, when our data begin. September was the third straight year-over-year monthly decline in total carloads following eight straight increases.

The second graph is for intermodal traffic (using intermodal or shipping containers):

The second graph is for intermodal traffic (using intermodal or shipping containers):September 2017 was a solid intermodal month for U.S. railroads. Volume was 1,080,444 containers and trailers, up 3.8%, or 39,482 units, over September 2016. Average weekly volume in September 2017 was 270,111 units, the second most (behind 2015) for September in history. Hurricanes helped prevent a record from being set this year. As it is, the last two weeks in September were the top two intermodal weeks in history for U.S. railroads.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 10/06/2017 03:15:00 PM

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (dark blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (dark red) took office.

There was a recession towards the end of President G.H.W. Bush (light purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just eight months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (dark red), 9,041,000 under President Carter (dashed green), 1,510,000 under President G.H.W. Bush (light purple), and 11,756,000 under President Obama (dark blue).

During the first eight months of Mr. Trump's term, the economy has added 1,092,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs). However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first eight months of Mr. Trump's term, the economy has added 26,000 public sector jobs.

After eight months of Mr. Trump's presidency, the economy has added 1,189,000 jobs, about 549,000 behind the projection.

Las Vegas Real Estate in September: Sales up Slightly YoY, Inventory down Sharply

by Calculated Risk on 10/06/2017 12:55:00 PM

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Local Home Prices Keep Climbing, While Sales Stabilize in September, GLVAR Housing Statistics for September 2017

The Greater Las Vegas Association of REALTORS® (GLVAR) reported today that local home prices continued to rise while home sales stabilized in September.1) Overall sales were up about 1% year-over-year.

...

By the end of September, GLVAR reported 4,969 single-family homes listed for sale without any sort of offer. That’s down 33.1 percent from one year ago. For condos and townhomes, the 680 properties listed without offers in September represented a 41.4 percent drop from one year ago.

The total number of existing local homes, condos and townhomes sold during September was 3,571, up from 3,541 in September 2016. Compared to one year ago, sales were down 0.4 percent for homes, but up 7.0 percent for condos and townhomes.

According to GLVAR, total sales so far in 2017 continue to outpace 2016, when 41,720 total properties were sold in Southern Nevada. At this rate, GLVAR statistics show that 2017 is on pace to be the best year for local home sales since at least 2012.

...

In recent years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in September, when 2.9 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That’s down from 4.6 percent of all sales in September 2016. Another 2.3 percent of all September sales were bank-owned, down from 6.0 percent one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago.

3) Fewer distressed sales.