by Calculated Risk on 9/27/2017 10:05:00 AM

Wednesday, September 27, 2017

NAR: Pending Home Sales Index decreased 2.6% in August, down 2.6% year-over-year

From the NAR: Pending Home Sales Fall 2.6 Percent in August; 2017 Forecast Downgraded

Pending home sales sank in August for the fifth time in six months, and slower activity in the areas hit hard by Hurricanes Harvey and Irma will likely pull existing sales for the year below the pace set in 2016, according to the National Association of Realtors®.This was below expectations of a 0.1% decrease for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in September and October.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, retreated 2.6 percent to 106.3 in August from 109.1 in July. The index is now at its lowest reading since January 2016 (106.1), is 2.6 percent below a year ago, and has fallen on an annual basis in four of the past five months.

...

The PHSI in the Northeast fell 4.4 percent to 93.4 in August, and is now 4.1 percent below a year ago. In the Midwest the index decreased 1.5 percent to 101.8 in August, and is now 3.2 percent lower than August 2016.

Pending home sales in the South retreated 3.5 percent to an index of 118.8 in August and are now 1.7 percent below last August. The index in the West declined 1.0 percent in August to 101.3, and is 2.4 percent below a year ago.

emphasis added

MBA: Mortgage Applications Decrease Slightly in Latest Weekly Survey

by Calculated Risk on 9/27/2017 07:00:00 AM

From the MBA: Mortgage Applications Slightly Decrease in Latest MBA Weekly Surve

Mortgage applications decreased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 22, 2017.

... The Refinance Index decreased 4 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 4 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.04 percent from 4.03 percent, with points remaining unchanged at 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not pick up significantly unless mortgage rates fall well below 4%.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. According to the MBA, purchase activity is up 4% year-over-year.

Tuesday, September 26, 2017

Wednesday: Durable Goods, Pending Home Sales

by Calculated Risk on 9/26/2017 07:59:00 PM

Wednesday:

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:30 AM, Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

• At 10:00 AM, Pending Home Sales Index for August. The consensus is for a 0.1% decrease in the index.

Real House Prices and Price-to-Rent Ratio in July

by Calculated Risk on 9/26/2017 03:50:00 PM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.9% year-over-year in July

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 3.8% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.3% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now in the 5% to 6% range. In July, the index was up 5.9% YoY.

Usually people graph nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to November 2005 levels.

Real House Prices

In real terms, the National index is back to August 2004 levels, and the Composite 20 index is back to March 2004.

In real terms, house prices are back to early-to-mid 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, and the Composite 20 index is back to August 2003 levels.

In real terms, prices are back to early-to-mid 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Yellen: "Inflation, Uncertainty, and Monetary Policy"

by Calculated Risk on 9/26/2017 12:50:00 PM

From Fed Chair Janet Yellen: Inflation, Uncertainty, and Monetary Policy. Excerpts:

Today I will discuss uncertainty and monetary policy, particularly as it relates to recent inflation developments. Because changes in interest rates influence economic activity and inflation with a substantial lag, the Federal Open Market Committee (FOMC) sets monetary policy with an eye to its effects on the outlook for the economy. But the outlook is subject to considerable uncertainty from multiple sources, and dealing with these uncertainties is an important feature of policymaking. Key among current uncertainties are the forces driving inflation, which has remained low in recent years despite substantial improvement in labor market conditions. As I will discuss, this low inflation likely reflects factors whose influence should fade over time. But as I will also discuss, many uncertainties attend this assessment, and downward pressures on inflation could prove to be unexpectedly persistent. My colleagues and I may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective, or even the fundamental forces driving inflation. In interpreting incoming data, we will need to stay alert to these possibilities and, in light of incoming information, adjust our views about inflation, the overall economy, and the stance of monetary policy best suited to promoting maximum employment and price stability.Yellen still thinks inflation will pick up, and that the FOMC is on the correct course.

...

To conclude, standard empirical analyses support the FOMC's outlook that, with gradual adjustments in monetary policy, inflation will stabilize at around the FOMC's 2 percent objective over the next few years, accompanied by some further strengthening in labor market conditions. But the outlook is uncertain, reflecting, among other things, the inherent imprecision in our estimates of labor utilization, inflation expectations, and other factors. As a result, we will need to carefully monitor the incoming data and, as warranted, adjust our assessments of the outlook and the appropriate stance of monetary policy. But in making these adjustments, our longer-run objectives will remain unchanged--to promote maximum employment and 2 percent inflation.

emphasis added

A few Comments on August New Home Sales

by Calculated Risk on 9/26/2017 11:30:00 AM

New home sales for August were reported at 560,000 on a seasonally adjusted annual rate basis (SAAR). This was below the consensus forecast, and the three previous months combined were revised down. However there was probably some negative impact from hurricane Harvey (not clear the size of the impact).

Sales were down 1.2% year-over-year in August.

Earlier: New Home Sales decrease to 560,000 Annual Rate in August.

This graph shows new home sales for 2016 and 2017 by month (Seasonally Adjusted Annual Rate). Sales were down 1.2% year-over-year in August.

For the first eight months of 2017, new home sales are up 7.5% compared to the same period in 2016.

This was a solid year-over-year increase through August.

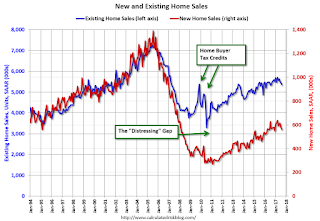

And here is another update to the "distressing gap" graph that I first started posting a number of years ago to show the emerging gap caused by distressed sales. Now I'm looking for the gap to close over the next several years.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The gap has persisted even though distressed sales are down significantly, since new home builders focused on more expensive homes.

I expect existing home sales to move more sideways, and I expect this gap to slowly close, mostly from an increase in new home sales.

However, this assumes that the builders will offer some smaller, less expensive homes. If not, then the gap will persist.

This ratio was fairly stable from 1994 through 2006, and then the flood of distressed sales kept the number of existing home sales elevated and depressed new home sales. (Note: This ratio was fairly stable back to the early '70s, but I only have annual data for the earlier years).

In general the ratio has been trending down since the housing bust, and this ratio will probably continue to trend down over the next several years.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

Reis: Apartment Vacancy Rate increased in Q3 to 4.5%

by Calculated Risk on 9/26/2017 10:37:00 AM

Reis reported that the apartment vacancy rate was at 4.5% in Q3 2017, up from 4.4% in Q2, and up from 4.1% in Q3 2016. This is the highest vacancy rate since Q4 2012 (although the increase has been small). The vacancy rate peaked at 8.0% at the end of 2009.

From Reis:

The apartment market continued to withstand the pressure from added supply in the third quarter as the national vacancy rate increased only 10 basis points to 4.5% in the quarter. With so much construction underway, vacancy rates were thought to grow higher. More importantly, asking rents increased 1.0% in the third quarter, while effective rents grew 0.9%.

...

Total inventory is still expected to increase significantly in 2017 and 2018; however, construction in the third quarter, 47,271 units, was again lower than expected. That said, this number should be revised once things get settled in Florida and Houston – two areas that have seen significant construction this year.

At 4.5%, the national vacancy rate increased 10 basis points from 4.4% in the second quarter. One year ago, the vacancy rate was 4.1%. Occupancy growth, or net absorption, was 31,352 units, lower than new supply. This pushed the vacancy rate up in the quarter.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the apartment vacancy rate starting in 1980. (Annual rate before 1999, quarterly starting in 1999). Note: Reis is just for large cities.

The vacancy rate had been mostly moving sideways for the last few years. However it appears the vacancy rate has bottomed and is starting to increase. With more supply coming on line later this year and next - and less favorable demographics - the vacancy rate will probably continue to increase slowly.

Apartment vacancy data courtesy of Reis.

New Home Sales decrease to 560,000 Annual Rate in August

by Calculated Risk on 9/26/2017 10:15:00 AM

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 560 thousand.

The previous three months combined were revised down.

"Sales of new single-family houses in August 2017 were at a seasonally adjusted annual rate of 560,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.4 percent below the revised July rate of 580,000 and is 1.2 percent below the August 2016 estimate of 567,000. "

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in August to 6.1 months from 5.7 month in July.

The months of supply increased in August to 6.1 months from 5.7 month in July. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of August was 284,000. This represents a supply of 6.1 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2017 (red column), 45 thousand new homes were sold (NSA). Last year, 46 thousand homes were sold in August.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in 2010.

This was below expectations of 583,000 sales SAAR, and the previous months were revised down. I'll have more later today.

Case-Shiller: National House Price Index increased 5.9% year-over-year in July

by Calculated Risk on 9/26/2017 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P Corelogic Case-Shiller National Home Price Index Continues to Rise

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.9% annual gain in July, up from 5.8% the previous month. The 10-City Composite annual increase came in at 5.2%, up from 4.9% the previous month. The 20-City Composite posted a 5.8% year-over-year gain, up from 5.6% the previous month.

Seattle, Portland, and Las Vegas reported the highest year-over-year gains among the 20 cities. In July, Seattle led the way with a 13.5% year-over-year price increase, followed by Portland with a 7.6% increase, and Las Vegas with a 7.4% increase. Twelve cities reported greater price increases in the year ending July 2017 versus the year ending June 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.7% in July. The 10-City and 20-City Composites reported increases of 0.8% and 0.7% respectively in July. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase. The 10-City Composite posted a 0.4% month-over-month increase. The 20-City Composite posted a 0.3% monthover-month increase. All 20 cities reported increases in July before seasonal adjustment; after seasonal adjustment, 17 cities saw prices rise.

“Home prices over the past year rose at a 5.9% annual rate,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Consumers, through home buying and other spending, are the driving force in the current economic expansion. While the gains in home prices in recent months have been in the Pacific Northwest, the leadership continues to shift among regions and cities across the country. Dallas and Denver are also experiencing rapid price growth. Las Vegas, one of the hardest hit cities in the housing collapse, saw the third fastest increase in the year through July 2017.

“While home prices continue to rise, other housing indicators may be leveling off. Sales of both new and existing homes have slipped since last March. The Builders Sentiment Index published by the National Association of Home Builders also leveled off after March. Automobiles are the second largest consumer purchase most people make after houses. Auto sales peaked last November and have been flat to slightly lower since. The housing market will face two contradicting challenges during the rest of 2017 and into 2018. First, rebuilding following hurricanes across Texas, Florida and other parts of the south will lead to further supply pressures. Second, the Fed’s recent move to shrink its balance sheet could push mortgage rates upward.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 6.3% from the peak, and up 0.4% in July (SA).

The Composite 20 index is off 3.5% from the peak, and up 0.35% (SA) in July.

The National index is 3.8% above the bubble peak (SA), and up 0.5% (SA) in July. The National index is up 40.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.2% compared to June 2016. The Composite 20 SA is up 5.8% year-over-year.

The National index SA is up 5.9% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, September 25, 2017

Tuesday: New Home Sales, Case-Shiller House Prices, Yellen Speech and More

by Calculated Risk on 9/25/2017 06:17:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rate Resilience Continues

Mortgage rates held their ground yet again, and are finally starting to look resilient after a relatively sharp move higher over the past 2 weeks. This was true even before mid-day headlines put additional downward pressure on rates. ... Some lenders responded to the bond market improvements by adjusting today's rate sheets. Other lenders maintained the same rates from the morning and thus will be more likely to offer better pricing tomorrow, assuming minimal bond market movement overnight. [30YR FIXED - 3.875-4.0%]Tuesday:

• At 9:00 AM ET: S&P/Case-Shiller House Price Index for July. The consensus is for a 5.9% year-over-year increase in the Comp 20 index for July.

• At Early: Reis Q3 2017 Apartment Survey of rents and vacancy rates.

• At 10:00 AM ET: New Home Sales for August from the Census Bureau. The consensus is for 583 thousand SAAR, unchanged from 571 thousand in July.

• At 10:00 AM: Richmond Fed Survey of Manufacturing Activity for September.

• At 12:45 PM: Speech by Fed Chair Janet Yellen, Inflation, Uncertainty, and Monetary Policy, 59th NABE Annual Meeting, Cleveland, Ohio