by Calculated Risk on 9/26/2017 10:15:00 AM

Tuesday, September 26, 2017

New Home Sales decrease to 560,000 Annual Rate in August

The Census Bureau reports New Home Sales in August were at a seasonally adjusted annual rate (SAAR) of 560 thousand.

The previous three months combined were revised down.

"Sales of new single-family houses in August 2017 were at a seasonally adjusted annual rate of 560,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 3.4 percent below the revised July rate of 580,000 and is 1.2 percent below the August 2016 estimate of 567,000. "

emphasis added

Click on graph for larger image.

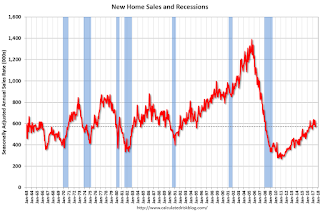

Click on graph for larger image.The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Even with the increase in sales over the last several years, new home sales are still somewhat low historically.

The second graph shows New Home Months of Supply.

The months of supply increased in August to 6.1 months from 5.7 month in July.

The months of supply increased in August to 6.1 months from 5.7 month in July. The all time record was 12.1 months of supply in January 2009.

This is at the top of the normal range (less than 6 months supply is normal).

"The seasonally-adjusted estimate of new houses for sale at the end of August was 284,000. This represents a supply of 6.1 months at the current sales rate."

On inventory, according to the Census Bureau:

On inventory, according to the Census Bureau: "A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

The third graph shows the three categories of inventory starting in 1973.

The inventory of completed homes for sale is still low, and the combined total of completed and under construction is also low.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).In August 2017 (red column), 45 thousand new homes were sold (NSA). Last year, 46 thousand homes were sold in August.

The all time high for August was 110 thousand in 2005, and the all time low for August was 23 thousand in 2010.

This was below expectations of 583,000 sales SAAR, and the previous months were revised down. I'll have more later today.

Case-Shiller: National House Price Index increased 5.9% year-over-year in July

by Calculated Risk on 9/26/2017 09:13:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July ("July" is a 3 month average of May, June and July prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P Corelogic Case-Shiller National Home Price Index Continues to Rise

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 5.9% annual gain in July, up from 5.8% the previous month. The 10-City Composite annual increase came in at 5.2%, up from 4.9% the previous month. The 20-City Composite posted a 5.8% year-over-year gain, up from 5.6% the previous month.

Seattle, Portland, and Las Vegas reported the highest year-over-year gains among the 20 cities. In July, Seattle led the way with a 13.5% year-over-year price increase, followed by Portland with a 7.6% increase, and Las Vegas with a 7.4% increase. Twelve cities reported greater price increases in the year ending July 2017 versus the year ending June 2017.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.7% in July. The 10-City and 20-City Composites reported increases of 0.8% and 0.7% respectively in July. After seasonal adjustment, the National Index recorded a 0.5% month-over-month increase. The 10-City Composite posted a 0.4% month-over-month increase. The 20-City Composite posted a 0.3% monthover-month increase. All 20 cities reported increases in July before seasonal adjustment; after seasonal adjustment, 17 cities saw prices rise.

“Home prices over the past year rose at a 5.9% annual rate,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “Consumers, through home buying and other spending, are the driving force in the current economic expansion. While the gains in home prices in recent months have been in the Pacific Northwest, the leadership continues to shift among regions and cities across the country. Dallas and Denver are also experiencing rapid price growth. Las Vegas, one of the hardest hit cities in the housing collapse, saw the third fastest increase in the year through July 2017.

“While home prices continue to rise, other housing indicators may be leveling off. Sales of both new and existing homes have slipped since last March. The Builders Sentiment Index published by the National Association of Home Builders also leveled off after March. Automobiles are the second largest consumer purchase most people make after houses. Auto sales peaked last November and have been flat to slightly lower since. The housing market will face two contradicting challenges during the rest of 2017 and into 2018. First, rebuilding following hurricanes across Texas, Florida and other parts of the south will lead to further supply pressures. Second, the Fed’s recent move to shrink its balance sheet could push mortgage rates upward.”

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 6.3% from the peak, and up 0.4% in July (SA).

The Composite 20 index is off 3.5% from the peak, and up 0.35% (SA) in July.

The National index is 3.8% above the bubble peak (SA), and up 0.5% (SA) in July. The National index is up 40.3% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 5.2% compared to June 2016. The Composite 20 SA is up 5.8% year-over-year.

The National index SA is up 5.9% year-over-year.

Note: According to the data, prices increased in 17 of 20 cities month-over-month seasonally adjusted.

I'll have more later.

Monday, September 25, 2017

Tuesday: New Home Sales, Case-Shiller House Prices, Yellen Speech and More

by Calculated Risk on 9/25/2017 06:17:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rate Resilience Continues

Mortgage rates held their ground yet again, and are finally starting to look resilient after a relatively sharp move higher over the past 2 weeks. This was true even before mid-day headlines put additional downward pressure on rates. ... Some lenders responded to the bond market improvements by adjusting today's rate sheets. Other lenders maintained the same rates from the morning and thus will be more likely to offer better pricing tomorrow, assuming minimal bond market movement overnight. [30YR FIXED - 3.875-4.0%]Tuesday:

• At 9:00 AM ET: S&P/Case-Shiller House Price Index for July. The consensus is for a 5.9% year-over-year increase in the Comp 20 index for July.

• At Early: Reis Q3 2017 Apartment Survey of rents and vacancy rates.

• At 10:00 AM ET: New Home Sales for August from the Census Bureau. The consensus is for 583 thousand SAAR, unchanged from 571 thousand in July.

• At 10:00 AM: Richmond Fed Survey of Manufacturing Activity for September.

• At 12:45 PM: Speech by Fed Chair Janet Yellen, Inflation, Uncertainty, and Monetary Policy, 59th NABE Annual Meeting, Cleveland, Ohio

Duy: "Has The Fed Abandoned Its Reaction Function?"

by Calculated Risk on 9/25/2017 01:44:00 PM

From economist Tim Duy at FedWatch: Has The Fed Abandoned Its Reaction Function?

The immediate policy outcomes of the FOMC meeting were largely as expected. Central bankers left interest rates unchanged while announcing that the reduction of the balance sheet will begin in October as earlier outlined in June. The real action was in the Summary of Economic Projections. Policymakers continue to anticipate one more rate hike this year and three next. This policy stance looks inconsistent with the downward revisions to projections of inflation and the neutral rate; under the Fed’s earlier reaction function, the combination of the two would drive down rate projections. Arguably, policy is thus no longer as data dependent as the Fed would like us to believe. That or the reaction function has changed.

...

The economic forecasts were somewhat confounding. Policymakers edged up their growth forecasts, but still anticipate that unemployment will end the year at 4.3%.

The unemployment forecast for the next two years edged down 0.1 percentage point, but this relative stability is somewhat confusing given that growth is expected to exceed potential growth until 2020 (remember, the Fed believes that labor force participation is more likely to fall than rise, so strong growth should induce downward pressure on unemployment).

...

Bottom line: the Fed is strongly committed to rate hikes. The[y] don’t appear to be following their earlier reaction function; policy feels path dependent at the moment. Indeed, given the Fed’s expectation of low inflation and volatile and possibly weak data due to the hurricanes, it is difficult to see what stops the Fed from hiking in December.

Dallas Fed: "Growth in Texas Manufacturing Activity Holds Steady" in September

by Calculated Risk on 9/25/2017 10:44:00 AM

From the Dallas Fed: Growth in Texas Manufacturing Activity Holds Steady

Texas factory activity continued to increase in September, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, edged down to 19.5 from 20.3 in August, indicating output grew at about the same pace as last month.The regional reports released so far for September have been solid.

Other measures of current manufacturing activity also indicated continued growth. The new orders index increased and the growth rate of orders index ticked down but stayed positive, coming in at 18.6 and 9.7, respectively. The capacity utilization index edged up four points to 15.8, while the shipments index jumped nine points to 27.4.

Perceptions of broader business conditions improved in September. The general business activity index increased to 21.3, its highest reading in seven months. The company outlook index posted its 13th consecutive positive reading, jumping nine points to 25.6.

Labor market measures suggested faster employment growth and longer workweeks this month. The employment index came in at 16.3, its highest level since April 2014. Twenty-eight percent of firms noted net hiring, compared with 11 percent noting net layoffs. The hours worked index rose four points to 18.4.

emphasis added

Black Knight: House Price Index up 0.5% in July, Up 6.2% year-over-year

by Calculated Risk on 9/25/2017 09:30:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: Monthly Rate of Appreciation Slows as U.S. Home Prices Gain 0.5 Percent in July, Year-Over-Year Growth Steady at 6.2 Percent

• The rate of growth in year-over-year price appreciation stabilized in July after accelerating throughout every month of 2017The year-over-year increase in this index has been about the same for the last year (in the 5% and 6% range).

• After hitting a high of 1.3 percent in March 2017, the rate of monthly appreciation has steadily slowed over subsequent months

• July marks 63 consecutive months of annual home price appreciation

• Of the 20 largest states, only Virginia saw home prices pull back, with a 0.2 percent month-over-month decline from June

Note that house prices are above the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for July will be released tomorrow.

Chicago Fed "Index points to slower economic growth in August"

by Calculated Risk on 9/25/2017 08:38:00 AM

From the Chicago Fed: Index points to slower economic growth in August

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) moved down to –0.31 in August from +0.03 in July. Two of the four broad categories of indicators that make up the index decreased from July, and two of the four categories made negative contributions to the index in August. The index’s three-month moving average, CFNAI-MA3, decreased to –0.04 in August from a neutral reading in July.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was close to the historical trend in August (using the three-month average).

According to the Chicago Fed:

The index is a weighted average of 85 indicators of growth in national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

...

A zero value for the monthly index has been associated with the national economy expanding at its historical trend (average) rate of growth; negative values with below-average growth (in standard deviation units); and positive values with above-average growth.

Sunday, September 24, 2017

Sunday Night Futures

by Calculated Risk on 9/24/2017 08:50:00 PM

Weekend:

• Schedule for Week of Sept 24, 2017

Monday:

• At 8:30 AM ET, Chicago Fed National Activity Index for August. This is a composite index of other data.

• At 10:30 AM, Dallas Fed Survey of Manufacturing Activity for September.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 are up 3, and DOW futures are up 35 (fair value).

Oil prices were up over the last week with WTI futures at $50.60 per barrel and Brent at $56.83 per barrel. A year ago, WTI was at $45, and Brent was at $47 - so oil prices are up 10% to 20% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.55 per gallon - up sharply due to Hurricane Harvey, but now declining - a year ago prices were at $2.20 per gallon - so gasoline prices are up 35 cents per gallon year-over-year.

Hotel Occupancy Rate just Behind Record Year

by Calculated Risk on 9/24/2017 11:00:00 AM

From HotelNewsNow.com: STR: US hotel results for week ending 16 September

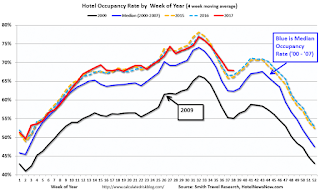

The U.S. hotel industry reported positive year-over-year results in the three key performance metrics during the week of 10-16 September 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 11-17 September 2016, the industry recorded the following:

• Occupancy: +0.5% to 72.2%

• Average daily rate (ADR): +1.4% to US$131.50

• Revenue per available room (RevPAR): +1.8% to US$94.97

Among the Top 25 Markets, Houston, Texas, reported the largest year-over-year increases in occupancy (+43.3% to 87.8%) and RevPAR (+58.6% to US$103.24). Amid recovery from Hurricane Harvey, Houston also posted an ADR increase of 10.7% to US$117.63.

Tampa/St. Petersburg, Florida, posted the second-highest lift in occupancy (+13.8% to 70.3%), that coupled with the highest increase in ADR (+14.1% to US$119.06), led the second-largest jump in RevPAR (+29.9% to US$83.75).

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate, to date, is ahead of last year, and just behind the record year in 2015. The hurricanes might push the annual occupancy rate to a new record.

Seasonally, the occupancy rate will increase into the Fall business travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Saturday, September 23, 2017

Schedule for Week of Sept 24, 2017

by Calculated Risk on 9/23/2017 08:09:00 AM

The key economic report this week is New Home sales for August on Tuesday.

Other key indicators include the third estimate of Q2 GDP, and July Case-Shiller house prices.

8:30 AM ET: Chicago Fed National Activity Index for August. This is a composite index of other data.

10:30 AM: Dallas Fed Survey of Manufacturing Activity for September.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.

9:00 AM ET: S&P/Case-Shiller House Price Index for July.This graph shows the nominal seasonally adjusted National Index, Composite 10 and Composite 20 indexes through the June 2017 report (the Composite 20 was started in January 2000).

The consensus is for a 5.9% year-over-year increase in the Comp 20 index for July.

Early: Reis Q3 2017 Apartment Survey of rents and vacancy rates.

10:00 AM ET: New Home Sales for August from the Census Bureau.

10:00 AM ET: New Home Sales for August from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for 583 thousand SAAR, unchanged from 571 thousand in July.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for September.

12:45 PM: Speech by Fed Chair Janet Yellen, Inflation, Uncertainty, and Monetary Policy, 59th NABE Annual Meeting, Cleveland, Ohio

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

8:30 AM: Durable Goods Orders for August from the Census Bureau. The consensus is for a 1.5% increase in durable goods orders.

10:00 AM: Pending Home Sales Index for August. The consensus is for a 0.1% decrease in the index.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 270 thousand initial claims, up from 259 thousand the previous week.

8:30 AM: Gross Domestic Product, 2nd quarter 2017 (Third estimate). The consensus is that real GDP increased 3.1% annualized in Q2, up from second estimate of 3.0%.

11:00 AM: the Kansas City Fed manufacturing survey for September.

Early: Reis Q3 2017 Office Survey of rents and vacancy rates.

8:30 AM: Personal Income and Outlays for August. The consensus is for a 0.3% increase in personal income, and for a 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

9:45 AM: Chicago Purchasing Managers Index for September. The consensus is for a reading of 58.6, down from 58.9 in August.

10:00 AM: University of Michigan's Consumer sentiment index (final for September). The consensus is for a reading of 97.2, unchanged from the preliminary reading 97.6.