by Calculated Risk on 8/17/2017 07:22:00 PM

Thursday, August 17, 2017

Mortgage Rates Fall below 4%, Lowest since November 2016

From Matthew Graham at Mortgage News Daily: Trump Administration Drama Pushing Rates Even Lower

Mortgage rates fell yesterday in response to a tweet about Trump disbanding his councils of CEOs. Twitter was in play again today. This time around it was Gary Cohn, Trump's economic advisor. Rather, it was rumors of Cohn's departure that sent financial markets into a tail-spin. Terror attacks in Spain may have played a supporting role. The net effect was heavy losses for stocks and solid gains for bonds. When bonds improve, rates fall.

Mortgage lenders continue to be slow to pass along the gains in bond markets in general, but they're certainly passing them along. Multiple lenders issued positive reprices in the afternoon as bond markets rallied. Conventional 30yr fixed rates are increasingly being quoted at 3.875% as opposed to 4.0% on top tier scenarios. On average, rates are the lowest since November 2017--something we've been able to say for the 2nd straight day, and several times over the past few weeks.

Hotels: Occupancy Rate up Year-over-Year

by Calculated Risk on 8/17/2017 02:16:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 12 August

The U.S. hotel industry reported mostly positive year-over-year results in the three key performance metrics during the week of 6-12 August 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 7-13 August 2016, the industry recorded the following:

• Occupancy: +0.7% to 73.6%

• Average daily rate (ADR): +1.5% to US$128.39

• Revenue per available room (RevPAR): +2.2% to US$94.46

emphasis added

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dash light blue is 2016, dashed orange is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).Currently the occupancy rate is tracking close to last year, and behind the record year in 2015.

Seasonally, the occupancy rate has peaked and will decline into the Fall.

Data Source: STR, Courtesy of HotelNewsNow.com

Earlier: Philly Fed Manufacturing Survey "region continued to advance" in August

by Calculated Risk on 8/17/2017 10:36:00 AM

Earlier from the Philly Fed: August 2017 Manufacturing Business Outlook Survey

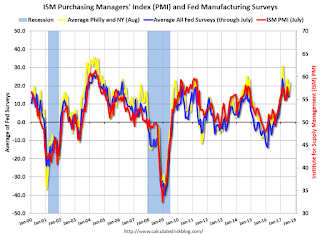

Manufacturing conditions in the region continued to advance in August, according to firms responding to this month’s Manufacturing Business Outlook Survey. The diffusion index for general activity fell slightly but continued to reflect growth. There was a notable improvement in the new orders and shipments indexes, and overall employment expansion continued among the reporting firms. The survey’s indexes of future activity indicate that firms expect a continuation of growth in the region’s manufacturing sector over the next six months.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, fell slightly from 19.5 in July to 18.9 in August. The index has been positive for 13 consecutive months ... The survey’s indicators for labor market conditions suggest modest growth in employment. The percentage of firms reporting increases in employment (15 percent) was greater than the percentage reporting decreases (5 percent). The employment index held near steady at 10.1. Firms also reported overall increases in average work hours in August, and the workweek index was positive for the 10th consecutive month.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through August), and five Fed surveys are averaged (blue, through July) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through July (right axis).

This suggests the ISM manufacturing index will show somewhat faster, and solid expansion in August.

Industrial Production Increased 0.2% in July

by Calculated Risk on 8/17/2017 09:23:00 AM

From the Fed: Industrial production and Capacity Utilization

Industrial production rose 0.2 percent in July following an increase of 0.4 percent in June. In July, manufacturing output edged down 0.1 percent; the production of motor vehicles and parts fell substantially, but that decrease was mostly offset by a net gain of 0.2 percent for other manufacturing industries. Following a six-month string of increases beginning in September 2016, factory output was little changed, on net, between February and July. The indexes for mining and utilities in July rose 0.5 percent and 1.6 percent, respectively. At 105.5 percent of its 2012 average, total industrial production was 2.2 percent above its year-earlier level. Capacity utilization for the industrial sector was unchanged in July at 76.7 percent, a rate that is 3.2 percentage points below its long-run (1972–2016) average.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows Capacity Utilization. This series is up 9.9 percentage points from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 76.7% is 3.2% below the average from 1972 to 2015 and below the pre-recession level of 80.8% in December 2007.

Note: y-axis doesn't start at zero to better show the change.

The second graph shows industrial production since 1967.

The second graph shows industrial production since 1967.Industrial production increased in July to 105.5. This is 21.1% above the recession low, and above the pre-recession peak.

The increase was slightly below expectations.

Weekly Initial Unemployment Claims decrease to 232,000

by Calculated Risk on 8/17/2017 08:32:00 AM

The DOL reported:

In the week ending August 12, the advance figure for seasonally adjusted initial claims was 232,000, a decrease of 12,000 from the previous week's unrevised level of 244,000. The 4-week moving average was 240,500, a decrease of 500 from the previous week's unrevised average of 241,000The previous week was unrevised.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 240,500.

This was lower than the consensus forecast.

The low level of claims suggests relatively few layoffs.

Wednesday, August 16, 2017

Thursday: Unemployment Claims, Industrial Production, Philly Fed Mfg

by Calculated Risk on 8/16/2017 07:33:00 PM

Personal Note: Sometimes we must not remain silent. I found Mr. Trump's comments on Saturday disgraceful. His comments on Monday were more appropriate, and better late than never. However Mr. Trump's comments yesterday were despicable. Unfortunately, this isn't a surprise. Here is what I wrote last May: Off-Topic: A Comment on Litmus Test Moments

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 241 thousand initial claims, down from 244 thousand the previous week.

• Also at 8:30 AM, Philly Fed manufacturing survey for August. The consensus is for a reading of 17.0, down from 19.5.

• At 9:15 AM, The Fed will release Industrial Production and Capacity Utilization for July. The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 76.7%.

NY Fed: "Household Borrowing Grows Modestly; Credit Card Delinquencies Rise"

by Calculated Risk on 8/16/2017 02:53:00 PM

From the NY Fed: Household Borrowing Grows Modestly; Credit Card Delinquencies Rise

The CMD’s latest Quarterly Report on Household Debt and Credit reveals that total household debt rose by $114 billion (0.9 percent) to $12.84 trillion in the second quarter of 2017. There were modest increases in mortgage, auto, and credit card debt (increasing by 0.7 percent, 2 percent, and 2.6 percent respectively), no change to student loan debt, and a decline in home equity lines of credit (which fell by 0.9 percent). Flows of credit card balances into both early and serious delinquencies climbed for the third straight quarter—a trend not seen since 2009.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q2. Household debt previously peaked in 2008, and bottomed in Q2 2013.

From the NY Fed:

Aggregate household debt balances increased in the second quarter of 2017, for the 12th consecutive quarter, and are now $164 billion higher than the previous (2008Q3) peak of $12.68 trillion. As of June 30, 2017, total household indebtedness was $12.84 trillion, a $114 billion (0.9%) increase from the first quarter of 2017. Overall household debt is now 15.1% above the 2013Q2 trough.

Mortgage balances, the largest component of household debt, increased again during the first quarter. Mortgage balances shown on consumer credit reports on June 30 stood at $8.69 trillion, an increase of $64 billion from the first quarter of 2017. Balances on home equity lines of credit (HELOC) were roughly flat, and now stand at $452 billion. Non-housing balances were up in the second quarter. Auto loans grew by $23 billion and credit card balances increased by $20 billion, while student loan balances were roughly flat.

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate was mostly unchanged in Q2. From the NY Fed:

Aggregate delinquency rates were flat in the second quarter of 2017. As of June 30, 4.8% of outstanding debt was in some stage of delinquency. Of the $612 billion of debt that is delinquent, $411 billion is seriously delinquent (at least 90 days late or “severely derogatory”). Early delinquency flows deteriorated somewhat in the second quarter from a year ago, although they have improved markedly since the recession. Student loans, auto loans, and mortgages all saw modest increases in their early delinquency flows, while delinquency flows on credit card balances ticked up notably in the second quarter.There is much more in the report.

FOMC Minutes: Balance Sheet Normalization "Relatively soon"

by Calculated Risk on 8/16/2017 02:10:00 PM

From the Fed: Minutes of the Federal Open Market Committee, July 25-26, 2017. Excerpts:

Participants also discussed the appropriate time to implement the plan for reducing the Federal Reserve's securities holdings that was announced in June in the Committee's postmeeting statement and its Addendum to the Policy Normalization Principles and Plans. Participants generally agreed that, in light of their current assessment of economic conditions and the outlook, it was appropriate to signal that implementation of the program likely would begin relatively soon, absent significant adverse developments in the economy or in financial markets. Many noted that the program was expected to contribute only modestly to the reduction in policy accommodation. Several reiterated that, once the program was under way, further adjustments to the stance of monetary policy in response to economic developments would be centered on changes in the target range for the federal funds rate. Although several participants were prepared to announce a starting date for the program at the current meeting, most preferred to defer that decision until an upcoming meeting while accumulating additional information on the economic outlook and developments potentially affecting financial markets.

...

Participants discussed the softness in inflation in recent months. Many participants noted that much of the recent decline in inflation had probably reflected idiosyncratic factors. Nonetheless, PCE price inflation on a 12‑month basis would likely continue to be held down over the second half of the year by the effects of those factors, and the monthly readings might be depressed by possible residual seasonality in measured PCE inflation. Still, most participants indicated that they expected inflation to pick up over the next couple of years from its current low level and to stabilize around the Committee's 2 percent objective over the medium term. Many participants, however, saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside. Participants agreed that a fall in longer-term inflation expectations would be undesirable, but they differed in their assessments of whether inflation expectations were well anchored. One participant pointed to the stability of a number of measures of inflation expectations in recent months, but a few others suggested that continuing low inflation expectations may have been a factor putting downward pressure on inflation or that inflation expectations might need to be bolstered in order to ensure their consistency with the Committee's longer-term inflation objective.

emphasis added

Comments on July Housing Starts

by Calculated Risk on 8/16/2017 10:44:00 AM

Earlier: Housing Starts decreased to 1.155 Million Annual Rate in July

The housing starts report released this morning showed starts were down 4.8% in July compared to June, and were down 5.6% year-over-year compared to July 2016. This was a weak report and was below the consensus forecast.

Note that multi-family starts are volatile month-to-month, and has seen wild swings over the last year.

This first graph shows the month to month comparison between 2016 (blue) and 2017 (red).

Starts were down 4.8% in July 2017 compared to July 2016, and starts are up only 2.4% year-to-date.

Note that single family starts are up 8.6% year-to-date, and the weakness (as expected) has been in multi-family starts.

My guess is starts will increase around 3% to 7% in 2017.

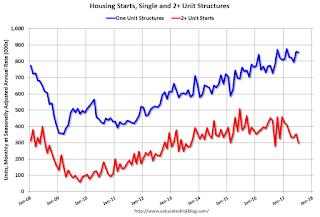

Below is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

The rolling 12 month total for starts (blue line) increased steadily over the last few years - but has turned down recently. Completions (red line) have lagged behind - but completions have been catching up (more deliveries).

Completions lag starts by about 12 months.

As I've been noting for a couple of years, the growth in multi-family starts is behind us - multi-family starts probably peaked in June 2015 (at 510 thousand SAAR).

Note the exceptionally low level of single family starts and completions. The "wide bottom" was what I was forecasting following the recession, and now I expect a few years of increasing single family starts and completions.

Housing Starts decreased to 1.155 Million Annual Rate in July

by Calculated Risk on 8/16/2017 08:38:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in July were at a seasonally adjusted annual rate of 1,155,000. This is 4.8 percent below the revised June estimate of 1,213,000 and is 5.6 percent below the July 2016 rate of 1,223,000. Single-family housing starts in July were at a rate of 856,000; this is 0.5 percent below the revised June figure of 860,000. The July rate for units in buildings with five units or more was 287,000.

Building Permits:

Privately-owned housing units authorized by building permits in July were at a seasonally adjusted annual rate of 1,223,000. This is 4.1 percent below the revised June rate of 1,275,000, but is 4.1 percent above the July 2016 rate of 1,175,000. Single-family authorizations in July were at a rate of 811,000; this is unchanged from the revised June figure of 811,000. Authorizations of units in buildings with five units or more were at a rate of 377,000 in July.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Multi-family starts (red, 2+ units) decreased in July compared to June. Multi-family starts are down 35% year-over-year.

Multi-family is volatile month-to-month, but has been mostly moving sideways over the last few years.

Single-family starts (blue) increased in July, and are up 10.9% year-over-year.

The second graph shows total and single unit starts since 1968.

The second graph shows total and single unit starts since 1968. The second graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering (but still historically low),

Total housing starts in July were below expectations, however starts for May and June combined were revised up slightly. I'll have more later ...