by Calculated Risk on 8/15/2017 08:40:00 AM

Tuesday, August 15, 2017

Retail Sales increased 0.6% in July

On a monthly basis, retail sales increased 0.6 percent from June to July (seasonally adjusted), and sales were up 4.2 percent from July 2016.

From the Census Bureau report:

Advance estimates of U.S. retail and food services sales for July 2017, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $478.9 billion, an increase of 0.6 percent from the previous month, and 4.2 percent above July 2016. ... The May 2017 to June 2017 percent change was revised from down 0.2 percent to up 0.3 percent

Click on graph for larger image.

Click on graph for larger image.This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were up 0.7% in July.

The second graph shows the year-over-year change in retail sales and food service (ex-gasoline) since 1993.

Retail and Food service sales, ex-gasoline, increased by 4.3% on a YoY basis.

Retail and Food service sales, ex-gasoline, increased by 4.3% on a YoY basis.The increase in July was above expectations, and sales in May and June were revised up. A solid report.

Note: Amazon Prime day boosted retail sales in July.

Monday, August 14, 2017

Tuesday: Retail Sales, Empire State Mfg, Homebuilder Survey

by Calculated Risk on 8/14/2017 06:47:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Up Slightly From Long-Term Lows

Mortgage rates rose moderately today as weekend news headlines suggested some measure of de-escalation of nuclear tensions between the US and North Korea. To be sure, the news wasn't resoundingly conciliatory, but investors took solace in it nonetheless.Tuesday:

...

In the afternoon, comments from NY Fed President Dudley (one of the 3 most important voices at the Fed) kept pressure on rates, which seemed willing to recover in the late morning hours. Dudley affirmed investors' assumptions about upcoming Fed policy changes. Because these changes are net-negative for bond markets, they put upward pressure on rates. [30YR FIXED - 4.00%]

• At 8:30 AM ET, Retail sales for July will be released. The consensus is for a 0.3% increase in retail sales.

• Also at 8:30 AM, The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 10.0, up from 9.8.

• At 10:00 AM, The August NAHB homebuilder survey. The consensus is for a reading of 65, up from 64 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

• Also at 10:00 AM, Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.4% increase in inventories.

LA area Port Traffic increased in July

by Calculated Risk on 8/14/2017 12:55:00 PM

From the Port of Long Beach: Port of Long Beach Sees Busiest Month Ever

Surging cargo volume in July set a record for the best month in the Port of Long Beach’s 106-year history, surpassing the previous high mark set in August 2015 for the number of containers moved across its docks.Container traffic gives us an idea about the volume of goods being exported and imported - and usually some hints about the trade report since LA area ports handle about 40% of the nation's container port traffic.

With total volume of 720,312 twenty-foot-equivalent units (TEUs) in July, cargo traffic has increased for five consecutive months in Long Beach, and in six of the first seven months of 2017. Volume is up 6.4 percent for the calendar year compared to 2016.

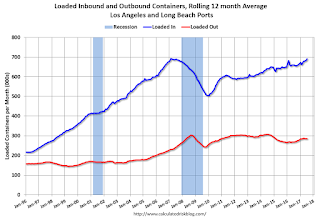

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.On a rolling 12 month basis, inbound traffic was up 1.2% compared to the rolling 12 months ending in June. Outbound traffic was up 0.2% compared to the rolling 12 months ending in June.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year.

Usually imports peak in the July to October period as retailers import goods for the Christmas holiday, and then decline sharply and bottom in February or March depending on the timing of the Chinese New Year. In general imports have been increasing, and exports are moving sideways.

Phoenix Real Estate in July: Sales up 3%, Inventory down 9% YoY

by Calculated Risk on 8/14/2017 09:28:00 AM

This is a key housing market to follow since Phoenix saw a large bubble / bust followed by strong investor buying.

The Arizona Regional Multiple Listing Service (ARMLS) reports (table below):

1) Overall sales in July were up 3.0% year-over-year.

2) Active inventory is now down 8.9% year-over-year.

More inventory (a theme in most of 2014) - and less investor buying - suggested price increases would slow sharply in 2014. And prices increases did slow in 2014, only increasing 2.4% according to Case-Shiller.

In 2015, with falling inventory, prices increased a little faster. Prices were up 6.3% in 2015 according to Case-Shiller.

With flat inventory in 2016, prices were up 4.8%.

This is the ninth consecutive month with a YoY decrease in inventory, and prices are rising a little faster this year (2.5% through May or 6.2% annual rate).

| July Residential Sales and Inventory, Greater Phoenix Area, ARMLS | ||||||

|---|---|---|---|---|---|---|

| Sales | YoY Change Sales | Cash Sales | Percent Cash | Active Inventory | YoY Change Inventory | |

| Jul-08 | 5,9741 | --- | --- | --- | 54,5272 | --- |

| Jul-09 | 9,095 | 52.2% | 3,269 | 35.9% | 38,024 | ---2 |

| Jul-10 | 7,101 | -21.9% | 2,901 | 40.9% | 42,887 | 12.8% |

| Jul-11 | 8,397 | 18.3% | 3,779 | 45.0% | 27,663 | -35.5% |

| Jul-12 | 7,152 | -14.8% | 3,214 | 44.9% | 20,384 | -26.3% |

| Jul-13 | 8,214 | 14.8% | 2,944 | 35.8% | 20,049 | -1.6% |

| Jul-14 | 6,790 | -17.3% | 1,681 | 24.8% | 27,081 | 35.1% |

| Jul-15 | 7,915 | 16.6% | 1,731 | 21.9% | 22,940 | -15.3% |

| Jul-16 | 7,775 | -1.8% | 1,534 | 19.7% | 23,695 | 3.3% |

| Jul-17 | 8,010 | 3.0% | 1,541 | 19.2% | 21,590 | -8.9% |

| 1 July 2008 does not include manufactured homes, ~100 more 2 July 2008 Inventory includes pending | ||||||

Sunday, August 13, 2017

Sunday Night Futures

by Calculated Risk on 8/13/2017 07:45:00 PM

Weekend:

• Schedule for Week of Aug 13, 2017

• The Housing Bottom and Comparing Housing Recoveries

Monday:

• No major economic releases scheduled.

From CNBC: Pre-Market Data and Bloomberg futures: S&P 500 futures are up 7, and DOW futures are up 65 (fair value).

Oil prices were down over the last week with WTI futures at $48.84 per barrel and Brent at $52.09 per barrel. A year ago, WTI was at $46, and Brent was at $47 - so oil prices are up about 5% to 10% year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.34 per gallon - a year ago prices were at $2.13 per gallon - so gasoline prices are up 21 cents per gallon year-over-year.

The Housing Bottom and Comparing Housing Recoveries

by Calculated Risk on 8/13/2017 08:21:00 AM

In early 2012 I wrote The Housing Bottom is Here and Housing: The Two Bottoms, I pointed out there are usually two bottoms for housing: the first for new home sales, housing starts and residential investment, and the second bottom is for house prices.

For the bottom in activity, I presented a graph of Single family housing starts, New Home Sales, and Residential Investment (RI) as a percent of GDP.

When I posted that graph, the bottom wasn't obvious to everyone. Here is an update to that graph.

The arrows point to some of the earlier peaks and troughs for these three measures.

The purpose of this graph is to show that these three indicators generally reach peaks and troughs together. Note that Residential Investment is quarterly and single-family starts and new home sales are monthly.

For the most recent housing bust, the bottom was spread over a few years from 2009 into 2011. This was a long flat bottom - something a number of us predicted given the overhang of existing vacant housing units.

In 2012, I argued that the current housing recovery would continue to be sluggish relative to previous housing recoveries. I suggested there were several reasons for this. From my 2012 post:

First, the causes of this downturn were different than in most cycles. Usually housing down cycles are related to the Fed fighting inflation, and then housing comes back strongly when the Fed starts to ease again. But in this cycle, the housing downturn was the result of the bursting of the housing bubble and the financial crisis.That was correct, and the recovery continued to be sluggish.

As everyone now knows (or should know by now), recoveries following a financial crisis are sluggish. This is especially true for housing as all the excesses have to be worked down before the recovery will become robust. In some areas of the country, housing is starting to recover, and in other areas there are still a large number of excess vacant houses (although the number is being reduced just about everywhere).

There are also a large number of houses in the foreclosure process, especially in certain states with a judicial foreclosure process (like New Jersey). This means there will be competition for homebuilders from foreclosures for an extended period in these areas.

Contrast this to a typical recovery were most areas recover at the same time.

There are other factors too. Employment gains are sluggish following a financial crisis, there is still quite a bit of consumer deleveraging ongoing, and lending standards are still tight (in a typical recovery, lending standards are loosened pretty quickly).

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.

This graph compares the current housing recovery (single family starts) to previous recoveries. The bottom is set to 100 for each housing cycle.For the first several years, the current recovery (red) under performed previous recoveries.

Note: This doesn't even consider the depth of the current cycle (the deepest decline in housing starts since the Census Bureau started collecting data).

In 2012 I wrote:

With excess inventory, more foreclosures (especially in certain states), more consumer deleveraging, and tight lending standards, I expect this recovery to remains sluggish. The good news is - barring a significant policy mistake - this housing recovery will probably continue for several years (last for more years than usual).The current recovery (red) started slowly, but is still ongoing!

Saturday, August 12, 2017

Schedule for Week of Aug 13, 2017

by Calculated Risk on 8/12/2017 08:11:00 AM

The key economic reports this week are July retail sales and Housing Starts.

For manufacturing, July industrial production, and the August New York and Philly Fed manufacturing surveys, will be released this week.

No major economic releases scheduled.

8:30 AM ET: Retail sales for July will be released. The consensus is for a 0.3% increase in retail sales.

8:30 AM ET: Retail sales for July will be released. The consensus is for a 0.3% increase in retail sales.This graph shows retail sales since 1992 through June 2017.

8:30 AM: The New York Fed Empire State manufacturing survey for August. The consensus is for a reading of 10.0, up from 9.8.

10:00 AM: Manufacturing and Trade: Inventories and Sales (business inventories) report for June. The consensus is for a 0.4% increase in inventories.

10:00 AM: The August NAHB homebuilder survey. The consensus is for a reading of 65, up from 64 in July. Any number above 50 indicates that more builders view sales conditions as good than poor.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

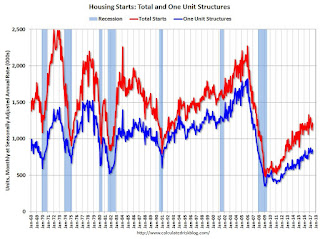

8:30 AM: Housing Starts for July. The consensus is for 1.225 million SAAR, up from the June rate of 1.215 million.

8:30 AM: Housing Starts for July. The consensus is for 1.225 million SAAR, up from the June rate of 1.215 million.This graph shows total and single unit starts since 1968.

The graph shows the huge collapse following the housing bubble, and then - after moving sideways for a couple of years - housing is now recovering.

2:00 PM: FOMC Minutes for the Meeting of 25 - 26, 2017

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 241 thousand initial claims, down from 244 thousand the previous week.

8:30 AM: the Philly Fed manufacturing survey for August. The consensus is for a reading of 17.0, down from 19.5.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.

9:15 AM: The Fed will release Industrial Production and Capacity Utilization for July.This graph shows industrial production since 1967.

The consensus is for a 0.3% increase in Industrial Production, and for Capacity Utilization to increase to 76.7%.

10:00 AM: University of Michigan's Consumer sentiment index (preliminary for August). The consensus is for a reading of 93.9, up from 93.4 in July.

10:00 AM: Regional and State Employment and Unemployment (Monthly) for July 2017

Friday, August 11, 2017

Q3 GDP Forecasts

by Calculated Risk on 8/11/2017 02:45:00 PM

From the Altanta Fed: GDPNow

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2017 is 3.5 percent on August 9, down from 3.7 percent on August 4.From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.0% for 2017:Q3. The effects of news from this week’s data releases were small, leaving the nowcast broadly unchanged.From Merrill Lynch:

3Q GDP tracking remained unchanged on net at 2.8%. 2Q tracking was bumped up a tenth to 2.5%, owing to better wholesale inventories data.CR Note: Looks like real GDP growth will probably be in the 2s again in Q3.

Key Measures Show Inflation mostly below 2% in July

by Calculated Risk on 8/11/2017 11:16:00 AM

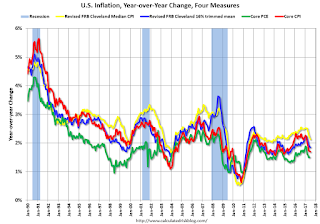

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% (2.0% annualized rate) in July. The 16% trimmed-mean Consumer Price Index also rose 0.2% (1.8% annualized rate) during the month. The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics' (BLS) monthly CPI report.Note: The Cleveland Fed released the median CPI details for July here. Motor fuel declined 14% in July annualized.

Earlier today, the BLS reported that the seasonally adjusted CPI for all urban consumers rose 0.1% (1.3% annualized rate) in July. The CPI less food and energy also rose 0.1% (1.4% annualized rate) on a seasonally adjusted basis.

Click on graph for larger image.

Click on graph for larger image.This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.1%, the trimmed-mean CPI rose 1.9%, and the CPI less food and energy rose 1.7%. Core PCE is for June and increased 1.5% year-over-year.

On a monthly basis, median CPI was at 2.0% annualized, trimmed-mean CPI was at 1.8% annualized, and core CPI was at 1.4% annualized.

Using these measures, inflation was soft again in July. Overall these measures are mostly below the Fed's 2% target (Median CPI is slightly above).

Early Look at 2018 Cost-Of-Living Adjustments and Maximum Contribution Base

by Calculated Risk on 8/11/2017 09:31:00 AM

The BLS reported this morning:

The Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) increased 1.6 percent over the last 12 months to an index level of 238.617 (1982-84=100). For the month, the index decreased 0.1 percent prior to seasonal adjustment.CPI-W is the index that is used to calculate the Cost-Of-Living Adjustments (COLA). The calculation dates have changed over time (see Cost-of-Living Adjustments), but the current calculation uses the average CPI-W for the three months in Q3 (July, August, September) and compares to the average for the highest previous average of Q3 months. Note: this is not the headline CPI-U, and is not seasonally adjusted (NSA).

• In 2016, the Q3 average of CPI-W was 235.057.

The 2016 Q3 average was the highest Q3 average, so we only have to compare Q3 this year to last year. (Sometimes we have to look back two years).

Click on graph for larger image.

Click on graph for larger image.This graph shows CPI-W since January 2000. The red lines are the Q3 average of CPI-W for each year.

Note: The year labeled for the calculation, and the adjustment is effective for December of that year (received by beneficiaries in January of the following year).

CPI-W was up 1.6% year-over-year in July, and although this is early - we still need the data for August and September - it appears COLA will be positive this year, and will probably be around 1% to 2% this year.

Contribution and Benefit Base

The law prohibits an increase in the contribution and benefit base if COLA is not greater than zero. However if the there is even a small increase in COLA (seems likely this year), the contribution base will be adjusted using the National Average Wage Index.

From Social Security: Cost-of-Living Adjustment Must Be Greater Than Zero

... ... any amount that is directly dependent for its value on the COLA would not increase. For example, the maximum Supplemental Security Income (SSI) payment amounts would not increase if there were no COLA.The contribution base will be adjusted using the National Average Wage Index. This is based on a one year lag. The National Average Wage Index is not available for 2016 yet, but wages probably increased again in 2016. If wages increased the same as last year, then the contribution base next year will increase to around $131,500 from the current $127,200.

... if there were no COLA, section 230(a) of the Social Security Act prohibits an increase in the contribution and benefit base (Social Security's maximum taxable earnings), which normally increases with increases in the national average wage index. Similarly, the retirement test exempt amounts would not increase ...

Remember - this is an early look. What matters is average CPI-W for all three months in Q3 (July, August and September).