by Calculated Risk on 6/06/2017 08:00:00 AM

Tuesday, June 06, 2017

Las Vegas Real Estate in May: Sales up 28% YoY, Inventory down Sharply

This is a key distressed market to follow since Las Vegas saw the largest price decline, following the housing bubble, of any of the Case-Shiller composite 20 cities.

The Greater Las Vegas Association of Realtors reported Despite housing shortage, local home prices and sales keep rising, GLVAR Housing Statistics for May 2017

Despite a shrinking housing supply, the Greater Las Vegas Association of REALTORS® (GLVAR) reported today that local home prices and sales continued to rise.1) Overall sales were up 28% year-over-year.

...

At the current sales pace, GLVAR President David J. Tina said Southern Nevada now has less a two-month supply of existing homes available for sale. A six-month supply is considered to be a balanced market.

...

... The total number of existing local homes, condos and townhomes sold in May was 4,297, up from 3,349 in May 2016. Compared to one year ago, sales were up 24.8 percent for homes and up 11.4 percent for condos and townhomes.

According to GLVAR, total sales to date in 2017 are 17,963, which includes all homes, condos, townhomes and other residential properties sold through GLVAR’s MLS. These sales continue to outpace 2016, when 41,720 total properties were sold in Southern Nevada. That was more than the 38,577 properties sold during 2015. It was also more total sales than in 2014, but fewer than each year from 2009 through 2013.

...

By the end of May, GLVAR reported 4,972 single-family homes listed for sale without any sort of offer. That’s down 32.4 percent from one year ago. For condos and townhomes, the 630 properties listed without offers in May represented a 71.8 percent drop from one year ago.

For several years, GLVAR has been reporting fewer distressed sales and more traditional home sales, where lenders are not controlling the transaction. That trend continued in May, when 3.1 percent of all local sales were short sales – which occur when lenders allow borrowers to sell a home for less than what they owe on the mortgage. That compares to 4.5 percent of all sales in May 2016. Another 3.7 percent of all May sales were bank-owned, down from 6.1 percent one year ago.

emphasis added

2) Active inventory (single-family and condos) is down sharply from a year ago (A very sharp decline in condo inventory).

3) Fewer distressed sales.

Monday, June 05, 2017

Tuesday: Job Openings

by Calculated Risk on 6/05/2017 06:18:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Just Off 7-Month Lows

Mortgage rates were modestly higher today after hitting the lowest levels since early November at the end of last week. Along with mid-April, this is the second time rates have been in this territory in more than 7 months. Most prospective borrowers will see very little--if any difference between Friday's rate quotes and today's [30 Year fixed at 4.0%].Tuesday:

...

With rates being driven by financial markets and with investors generally on edge ahead of Thursday's congressional testimony from former FBI Director Comey, it makes sense to Friday's momentum to ebb to some extent. Thursday should remain a focal point for volatility this week.

emphasis added

• At 10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. Jobs openings increased in March to 5.743 million from 5.682 million in February. The number of job openings were down 2% year-over-year, and Quits were up 6% year-over-year.

Hotels: Hotel Occupancy up Year-over-Year

by Calculated Risk on 6/05/2017 03:07:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 27 May

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 21-27 May 2017, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In comparison with the week of 22-28 May 2016, the industry recorded the following:

• Occupancy: +0.5% to 70.3%

• Average daily rate (ADR): +2.5% to US$127.47

• Revenue per available room (RevPAR): +3.1% to US$89.67

emphasis added

The red line is for 2017, dashed is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).

The red line is for 2017, dashed is 2015 (best year on record), blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels).For hotels, occupancy will increase further during the summer travel season.

Data Source: STR, Courtesy of HotelNewsNow.com

Black Knight Mortgage Monitor: "Q1 2017 Originations Fall 34 Percent, Led By 45 Percent Drop in Refinance Lending"

by Calculated Risk on 6/05/2017 11:33:00 AM

Black Knight Financial Services (BKFS) released their Mortgage Monitor report for April today. According to BKFS, 4.08% of mortgages were delinquent in April, down from 4.24% in April 2016. BKFS also reported that 0.85% of mortgages were in the foreclosure process, down from 1.17% a year ago.

This gives a total of 4.93% delinquent or in foreclosure.

Press Release: Black Knight’s Mortgage Monitor: Q1 2017 Originations Fall 34 Percent, Led By 45 Percent Drop in Refinance Lending; Despite Recent Rate Softening, Home Affordability Remains Near Post-Recession Low

Today, the Data & Analytics division of Black Knight Financial Services, Inc. released its latest Mortgage Monitor Report, based on data as of the end of April 2017. This month, Black Knight looked at Q1 2017 purchase and refinance originations, finding significant quarterly declines in volume among both. As Black Knight Data & Analytics Executive Vice President Ben Graboske explained, the declines are rooted in the upward interest rate shift seen in Q4 2016.

“Overall, first lien mortgage originations fell by 34 percent in the first quarter of 2017,” said Graboske. “As expected, the decline was most pronounced in the refinance market, which saw a 45 percent decline from Q4 2016 and were down 20 percent from last year. They also made up a smaller share of overall originations than in the past; just 45 percent of total Q1 originations were refinances vs. 54 percent in Q4 2016. Purchase originations were also down 21 percent from Q4 2016, although the first quarter is historically the calendar-year low for such lending. Purchase lending was up year-over-year, but the three percent annual growth is a marked decline from Q4 2016’s 12 percent, and marks the slowest growth rate Black Knight has observed in more than three years – going back to Q4 2013. At that point in time, interest rates had risen abruptly – very similarly to what we saw at the end of 2016 – and originations slowed considerably. The same dynamic is at work here.

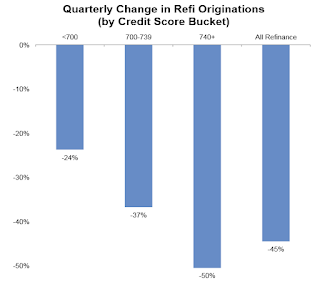

“Likewise, refinance lending among higher-credit-score borrowers, who have largely driven the refinance market these past several years, saw a quarterly decline of 50 percent. As we’ve seen in the past, these borrowers tend to strike quickly and often when interest rate incentives are present, but tend to hold back when the conditions are less favorable. At the other end of the credit spectrum, lower credit borrowers – those with credit scores below 700 – only saw refinance volumes decrease by 24 percent. Again, we saw a similar phenomenon when rates rose in late 2013/early 2014. This is worth noting as we monitor the future performance of 2017 originations. Not only are refinances -- which generally tend to outperform purchase mortgages -- making up a smaller share of the market, but there’s also been a net lowering of average credit scores as well. The average Q1 2017 refinance credit score was 742, down from 751 in Q4 2016, and the lowest average credit score since Q3 2014. Both of these factors could have a dampening factor on mortgage performance, holistically speaking.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from Black Knight shows the refinance volume by credit score.

From Black Knight:

• Higher credit score borrowers (740 and up) saw the greatest decline in refinance activity, with origination volumes declining by 50 percent

• At the other end of the spectrum, refinance lending to lower credit borrowers – those with credit scores below 700 – decreased by 24 percent

• A similar phenomenon was observed in late 2013/early 2014 when interest rates had also risen abruptly, in a very similar fashion to what was observed at the end of 2016

This graph from Black Knight shows the change in refinance origination by credit score.

This graph from Black Knight shows the change in refinance origination by credit score. From Black Knight:

• Refinances – which generally tend to outperform purchase mortgages – are making up a smaller share of the market, accounting for 45 percent of total Q1 originations vs. 54 percent in Q4 2016There is much more in the mortgage monitor.

• There’s been a net lowering of average credit scores as well, with the average Q1 refinance credit score coming in at 742, down from 751 in Q4 2016, and the lowest average credit score since Q3 2014

• Both of these factors could have a dampening factor on mortgage performance holistically speaking and are worth noting as we monitor future performance of 2017 originations

ISM Non-Manufacturing Index decreased to 56.9% in May

by Calculated Risk on 6/05/2017 10:05:00 AM

The April ISM Non-manufacturing index was at 56.9%, down from 57.5% in April. The employment index increased in May to 57.8%, from 51.4%. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management:May 2017 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in May for the 89th consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM® Report On Business®.

The report was issued today by Anthony Nieves, CPSM, C.P.M., A.P.P., CFPM, Chair of the Institute for Supply Management® (ISM®) Non-Manufacturing Business Survey Committee: "The NMI® registered 56.9 percent, which is 0.6 percentage point lower than the April reading of 57.5 percent. This represents continued growth in the non-manufacturing sector at a slightly slower rate. The Non-Manufacturing Business Activity Index decreased to 60.7 percent, 1.7 percentage points lower than the April reading of 62.4 percent, reflecting growth for the 94th consecutive month, at a slower rate in May. The New Orders Index registered 57.7 percent, 5.5 percentage points lower than the reading of 63.2 percent in April. The Employment Index increased 6.4 percentage points in May to 57.8 percent from the April reading of 51.4 percent. The Prices Index decreased 8.4 percentage points from the April reading of 57.6 percent to 49.2 percent, indicating prices decreased in May for the first time after 13 consecutive months of increasing. According to the NMI®, 17 non-manufacturing industries reported growth. Although the non-manufacturing sector’s growth rate dipped in May, the sector continues to reflect strength, buoyed by the strong rate of growth in the Employment Index. The majority of respondents’ comments continue to indicate optimism about business conditions and the overall economy."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This suggests slightly slower expansion in May than in April.

Sunday, June 04, 2017

Sunday Night Futures

by Calculated Risk on 6/04/2017 07:04:00 PM

Weekend:

• Schedule for Week of June 4, 2017

Monday:

• At 10:00 AM ET, the ISM non-Manufacturing Index for May. The consensus is for index to decrease to 57.0 from 57.5 in April.

• Also at 10:00 AM, The Fed will release the monthly Labor Market Conditions Index (LMCI).

From CNBC: Pre-Market Data and Bloomberg futures: S&P and DOW futures are down slightly (fair value).

Oil prices were down over the last week with WTI futures at $47.75 per barrel and Brent at $49.95 per barrel. A year ago, WTI was at $49, and Brent was at $49 - so oil prices are mostly unchanged year-over-year.

Here is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are at $2.37 per gallon - a year ago prices were at $2.37 per gallon - so gasoline prices are unchanged year-over-year.

Saturday, June 03, 2017

Schedule for Week of June 4, 2017

by Calculated Risk on 6/03/2017 08:11:00 AM

This will be a light week for economic data.

On Thursday, the ECB meets and former FBI director James Comey is schedule to testify before the Senate intelligence committee.

10:00 AM: the ISM non-Manufacturing Index for May. The consensus is for index to decrease to 57.0 from 57.5 in April.

10:00 AM ET: The Fed will release the monthly Labor Market Conditions Index (LMCI).

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for April from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings increased in March to 5.743 million from 5.682 million in February.

The number of job openings (yellow) were down 2% year-over-year, and Quits were up 6% year-over-year.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

3:00 PM: Consumer credit from the Federal Reserve. The consensus is for a $17.0 billion increase in credit.

8:30 AM ET: The initial weekly unemployment claims report will be released. The consensus is for 241 thousand initial claims, down from 248 thousand the previous week.

10:00 AM: The Q1 Quarterly Services Report from the Census Bureau.

12:00 PM: Q1 Flow of Funds Accounts of the United States from the Federal Reserve.

No major economic releases scheduled.

Friday, June 02, 2017

Oil: "A middling week for rig additions"

by Calculated Risk on 6/02/2017 05:32:00 PM

A few comments from Steven Kopits of Princeton Energy Advisors LLC on June 2, 2017:

• A middling week for rig additions

• Total US oil rigs were up 11 to 733

• US horizontal oil rigs added 7 to 633

• Rig additions may still have been affected by logistics considerations associated with the Memorial Day weekend

Click on graph for larger image.

Click on graph for larger image.CR note: This graph shows the US horizontal rig count by basin.

Graph and comments Courtesy of Steven Kopits of Princeton Energy Advisors LLC.

Public and Private Sector Payroll Jobs: Carter, Reagan, Bush, Clinton, Bush, Obama, Trump

by Calculated Risk on 6/02/2017 02:11:00 PM

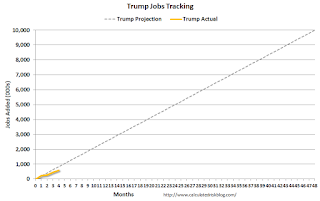

Here is another update of tracking employment during Presidential terms. We frequently use Presidential terms as time markers - we could use Speaker of the House, or any other marker.

NOTE: Several readers have asked if I could add a lag to these graphs (obviously a new President has zero impact on employment for the month they are elected). But that would open a debate on the proper length of the lag, so I'll just stick to the beginning of each term.

Important: There are many differences between these periods. Overall employment was smaller in the '80s, however the participation rate was increasing in the '80s (younger population and women joining the labor force), and the participation rate is generally declining now. But these graphs give an overview of employment changes.

The first graph shows the change in private sector payroll jobs from when each president took office until the end of their term(s). Presidents Carter and George H.W. Bush only served one term.

Mr. G.W. Bush (red) took office following the bursting of the stock market bubble, and left during the bursting of the housing bubble. Mr. Obama (blue) took office during the financial crisis and great recession. There was also a significant recession in the early '80s right after Mr. Reagan (yellow) took office.

There was a recession towards the end of President G.H.W. Bush (purple) term, and Mr Clinton (light blue) served for eight years without a recession.

The first graph is for private employment only.

Mr. Trump is in Orange (just four months).

The employment recovery during Mr. G.W. Bush's (red) first term was sluggish, and private employment was down 811,000 jobs at the end of his first term. At the end of Mr. Bush's second term, private employment was collapsing, and there were net 396,000 private sector jobs lost during Mr. Bush's two terms.

Private sector employment increased slightly under President G.H.W. Bush (purple), with 1,510,000 private sector jobs added.

Private sector employment increased by 20,966,000 under President Clinton (light blue), by 14,717,000 under President Reagan (yellow), and 9,041,000 under President Carter (dashed green).

There were only 1,937,000 more private sector jobs at the end of Mr. Obama's first term. At the end of his second term, there were 11,756,000 more private sector jobs than when Mr. Obama initially took office.

During the first four months of Mr. Trump's term, the economy has added 601,000 private sector jobs.

The public sector grew during Mr. Carter's term (up 1,304,000), during Mr. Reagan's terms (up 1,414,000), during Mr. G.H.W. Bush's term (up 1,127,000), during Mr. Clinton's terms (up 1,934,000), and during Mr. G.W. Bush's terms (up 1,744,000 jobs).

However the public sector declined significantly while Mr. Obama was in office (down 268,000 jobs).

During the first four months of Mr. Trump's term, the economy has lost 7,000 public sector jobs.

After four months of Mr. Trump's presidency, the economy has added 594,000 jobs, about 240,000 behind the projection.

Trade Deficit at $47.6 Billion in April

by Calculated Risk on 6/02/2017 11:59:00 AM

From the Department of Commerce reported:

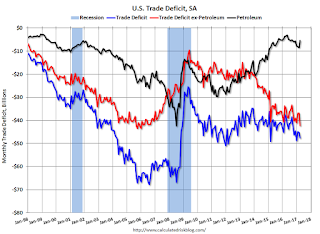

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis, through the Department of Commerce, announced today that the goods and services deficit was $47.6 billion in April, up $2.3 billion from $45.3 billion in March, revised. April exports were $191.0 billion, $0.5 billion less than March exports. April imports were $238.6 billion, $1.9 billion more than March imports.

Click on graph for larger image.

Click on graph for larger image.Imports increased and exports decreased in April.

Exports are 15% above the pre-recession peak and up 5% compared to April 2016; imports are 3% above the pre-recession peak, and up 8% compared to April 2016.

In general, trade has been picking up.

The second graph shows the U.S. trade deficit, with and without petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.Oil imports averaged $45.40 in April, down from $46.26 in March, and up from $29.53 in April 2016. The petroleum deficit had been declining for years - and is the major reason the overall deficit has mostly moved sideways since early 2012.

The trade deficit with China increased to $27.6 billion in April, from $24.3 billion in April 2016.