by Calculated Risk on 5/31/2017 07:29:00 PM

Wednesday, May 31, 2017

Thursday: Unemployment Claims, ADP Employment, ISM Mfg, Construction Spending, Auto Sales

Thursday:

• At 8:15 AM ET, The ADP Employment Report for May. This report is for private payrolls only (no government). The consensus is for 170,000 payroll jobs added in May, down from 177,000 added in April.

• At 8:30 AM, The initial weekly unemployment claims report will be released. The consensus is for 239 thousand initial claims, up from 234 thousand the previous week.

• At 10:00 AM, ISM Manufacturing Index for May. The consensus is for the ISM to be at 54.6, down from 54.8 in April. The employment index was at 52.0% in April, and the new orders index was at 54.8%.

• Also at 10:00 AM, Construction Spending for April. The consensus is for a 0.5% increase in construction spending.

• All day: Light vehicle sales for May. The consensus is for light vehicle sales to be at 16.9 million SAAR in May, mostly unchanged from 16.9 million in April (Seasonally Adjusted Annual Rate).

Fannie Mae: Mortgage Serious Delinquency rate declined in April, Lowest since January 2008

by Calculated Risk on 5/31/2017 04:29:00 PM

Fannie Mae reported that the Single-Family Serious Delinquency rate declined to 1.07% in April, from 1.12% in March. The serious delinquency rate is down from 1.40% in April 2016.

This is the lowest serious delinquency rate since January 2008.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59%.

Although the rate is declining, the "normal" serious delinquency rate is under 1%.

The Fannie Mae serious delinquency rate has fallen 0.33 percentage points over the last year, and at that rate of improvement, the serious delinquency rate will not be below 1% until this Summer.

Note: Freddie Mac reported earlier.

Fed's Beige Book: Modest to Moderate expansion, Labor markets "Tighten"

by Calculated Risk on 5/31/2017 02:08:00 PM

Fed's Beige Book "This report was prepared at the Federal Reserve Bank of Philadelphia based on information collected on or before May 22, 2017."

Most of the twelve Federal Reserve Districts reported that their economies continued to expand at a modest or moderate pace from early April through late May. Boston and Chicago signaled that growth in their Districts had slowed somewhat to a modest pace since the prior Beige Book period, while New York indicated that activity had flattened out. Consumer spending softened with many Districts noting little or no change in nonauto retail sales, while auto sales have edged down from last year's record highs in several Districts; tourism activity has continued to keep pace with the general economy. Meanwhile, the majority of Districts continued to report moderate growth in manufacturing activity and in most nonfinancial service sectors. Construction of new homes and nonresidential structures also continued to grow at modest to moderate rates, as did sales of existing homes; nonresidential leasing picked up a bit. Lending volume trends tended to mirror (and support) the general activity of the economy. Agricultural conditions remained mixed with some regions negatively affected by unusually wet weather. Most energy sectors tended to modestly improve. A majority of Districts reported that firms expressed positive near-term outlooks; however, optimism waned somewhat in a few Districts.And a few excerpts on real estate:

...

Labor markets continued to tighten, with most Districts citing shortages across a broadening range of occupations and regions. Despite supply constraints impeding the ability of firms to attract and retain qualified workers, most Districts reported that employment continued to grow at a modest to moderate pace. Similarly, most firms across the Districts noted little change to the recent trend of modest to moderate wage growth, although many firms reported offering higher wages to attract workers where shortages were most severe.

emphasis added

New York: Housing markets across the District have been mixed but, on balance, steady since the last report. New York City's rental market has remained mostly steady, though increased landlord concessions have further lowered effective rents and spurred some pickup in leasing, especially at the high end. In contrast, rents continued to rise across northern New Jersey, the Lower Hudson Valley, southwestern Connecticut and upstate New York.

The sales market for homes has strengthened in northern New Jersey and across upstate New York but has been essentially flat in New York City...

San Franciso: Real estate market activity continued to grow at a strong pace, but activity varied by region. Residential construction activity remained strong in urban centers but slowed to a moderate pace in some rural regions, due in part to especially wet ground conditions in areas of the Mountain West. Permits for single and multi-family units edged up, but contacts noted that construction was somewhat hampered by shortages of available land in some areas. Supply shortages and strong demand continued to fuel rapid home price growth in most parts of the District; contacts in urban centers reported that bids routinely came in significantly above the asking prices. Demand for commercial real estate loans in California remained strong.

Updated: Chicago PMI Increases in May

by Calculated Risk on 5/31/2017 11:15:00 AM

Earlier, the Chicago PMI was reported at 55.2. That has now been corrected to 59.4. This was above the consensus forecast.

Here is the updated report on the Chicago PMI: May Chicago Business Barometer at 59.4 vs 58.3 in April

The MNI Chicago Business Barometer increased to 59.4 in May from 58.3 in April, the highest level since November 2014.

...

“May’s rise in the MNI Chicago Business Barometer provides a further boost to the business environment. Rising pressure on backlogs and delivery times accompanied with higher production levels suggests firms’ expectations of a busy summer,” said Shaily Mittal, senior economist at MNI Indicators.

emphasis added

NAR: Pending Home Sales Index decreased 1.3% in April, down 3.3% year-over-year

by Calculated Risk on 5/31/2017 10:05:00 AM

From the NAR: Pending Home Sales Scale Back 1.3 Percent in April

Pending home sales in April slumped for the second consecutive month and were down year-over-year nationally and in all four major regions, according to the National Association of Realtors®. Only the West saw an increase in contract signings last month.This was below expectations of a 0.5% increase for this index. Note: Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in May and June.

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 1.3 percent to 109.8 in April from a downwardly revised 111.3 in March. After last month's decline, the index is now 3.3 percent below a year ago, which is the first year-over-year decline since last December and the largest since June 2014 (7.1 percent).

...

The PHSI in the Northeast decreased 1.7 percent to 97.2 in April, and is now 0.6 percent below a year ago. In the Midwest the index fell 4.7 percent to 104.4 in April, and is now 6.1 percent lower than April 2016.

Pending home sales in the South declined 2.7 percent to an index of 125.9 in April and are now 2.3 percent below last April. The index in the West jumped 5.8 percent in April to 100.0, but is still 4.2 percent below a year ago.

emphasis added

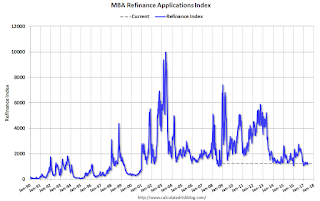

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 5/31/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 3.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending May 26, 2017.

... The Refinance Index decreased 6 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 3 percent compared with the previous week and was 7 percent higher than the same week one year ago. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) remained unchanged at 4.17 percent, with points decreasing to 0.32 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Refinance activity will not increase significantly unless rates fall sharply.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the increase in mortgage rates late last year, purchase activity is still up 7% year-over-year.

Tuesday, May 30, 2017

Wednesday: Chicago PMI, Pending Home Sales, Beige Book

by Calculated Risk on 5/30/2017 07:21:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Sideways Near Long-Term Lows

Mortgage rates remained relatively unchanged again today. This continues the sideways trend leading into Memorial Day weekend. As the current week progresses, we can expect to see volatility increase thanks to the presence of more significant economic data.Wednesday:

For what it's worth, being "sideways" at current levels [30 year fixed at 4.0%] wouldn't be anything to complain about. Only a handful of days since the presidential election have seen rates any lower.

emphasis added

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 9:45 AM, Chicago Purchasing Managers Index for May. The consensus is for a reading of 57.5, down from 58.3 in April.

• At 10:00 AM, Pending Home Sales Index for April. The consensus is for a 0.5% increase in the index.

• At 2:00 PM, the Federal Reserve Beige Book, an informal review by the Federal Reserve Banks of current economic conditions in their Districts.

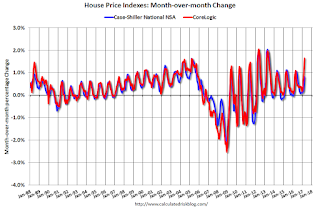

A few comments on the Seasonal Pattern for House Prices

by Calculated Risk on 5/30/2017 03:25:00 PM

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

This graph shows the month-to-month change in the CoreLogic (through March 2017) and NSA Case-Shiller National index since 1987 (through March 2017). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The swings in the seasonal factors has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels.

However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.

Dallas Fed: "Texas Manufacturing Expansion Picks Up Pace" in May

by Calculated Risk on 5/30/2017 12:29:00 PM

From the Dallas Fed: Texas Manufacturing Expansion Picks Up Pace

Texas factory activity increased at a faster pace in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, moved up eight points to 23.3, reaching its highest level since April 2014.This was the last of the regional Fed surveys for May.

Other measures of current manufacturing activity also rose to levels not seen since mid-2014. The new orders index pushed up to 18.1, and the growth rate of orders index rose to 12.3, marking its fifth consecutive positive reading. The capacity utilization index moved up to 19.4, with roughly a third of firms noting increased utilization. The shipments index surged 15 points to 24.7, reaching a level not seen in nearly 10 years.

Perceptions of broader business conditions improved again in May. The general business activity index held fairly steady at 17.2, and the company outlook index rose five points to 20.2.

Labor market measures indicated continued employment gains and markedly longer workweeks this month. The employment index came in at 8.3, posting a fifth positive reading in a row. Eighteen percent of firms noted net hiring, compared with 10 percent noting net layoffs. The hours worked index shot up 10 points to 15.7, its highest reading in six years.

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through May), and five Fed surveys are averaged (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

It seems likely the ISM manufacturing index will be mostly unchanged or decline slightly in May, but still show solid expansion (to be released on Thursday).

Real House Prices and Price-to-Rent Ratio in March

by Calculated Risk on 5/30/2017 10:22:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.8% year-over-year in March

It has been more than ten years since the bubble peak. In the Case-Shiller release this morning, the seasonally adjusted National Index (SA), was reported as being 2.4% above the previous bubble peak. However, in real terms, the National index (SA) is still about 13.8% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now just over 5%. In March, the index was up 5.8% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $278,000 today adjusted for inflation (39%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is at a new peak, and the Case-Shiller Composite 20 Index (SA) is back to October 2005 levels, and the CoreLogic index (NSA) is back to October 2005.

Real House Prices

In real terms, the National index is back to May 2004 levels, the Composite 20 index is back to March 2004, and the CoreLogic index back to March 2004.

In real terms, house prices are back to early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to November 2003 levels, the Composite 20 index is back to September 2003 levels, and the CoreLogic index is back to August 2003.

In real terms, prices are back to early 2004 levels, and the price-to-rent ratio is back to 2003 - and the price-to-rent ratio maybe moving a little more sideways now.